Updated July 25, 2023

Difference Between Limited Partner vs General Partner

To form a new business entity, we have many options either to start it as a sole proprietorship, joint ventures, partnerships, private Limited Company (PVT), trust, estates, limited liability company (LLP). This depends on the requirement of the parties who want to start their business and in which circumstances they are. Here we will understand the partnership and its types. If multiple parties want to do business together, they entered into a legal agreement called a partnership agreement to form a partnership firm.

All the parties who form the partnership firm will be called as partners. The structure of the partnership agreement will depend on partners, decided mutually about their participation in the firm, and willingness to take liability. There are two major types of partners; General partners and limited partners. It is very important for the people who want to start a business and want to form a partnership firm; they need to understand the types of partners before starting it.

Who is a Limited Partner?

Under a limited partnership structure, there will be one or more limited or general partners. Under this form of partnership, at least one person needs to be a general partner. The abbreviation of the term-limited partners is LP. The limited partners are only responsible and accountable for debts that they have into the business. Limited partners have limited control; they have no control over the management but have limited involvement in the entity; they have more focus on return on the investment. The income of limited partners is the return on investment that has been predefined in the agreement. In limited partnerships, the partners need a legally binding partnership agreement.

Who is General Partner?

The general partners have unlimited liability associated with the financial matter of the entity; this means the general partner’s asset is also considered for settlement of the debt in case of insolvency of the entity. Therefore, we can say that the general partner is the owner of the partnership firm. A general partner can act on behalf of the entity, and general partners play an important role in the entity’s operations, management control, administration, and any kind of decision making for the entity, sometimes acts as a managing partner.

General partners have all the rights to participate in the management. The profits and losses in the general partnership will be shared based on the partnership agreement; they can also be paid by way of a management fee. A management fee means the percentage of the total amount of the fund’s capital. This percentage is fixed. The fee range could be between 1% to 2% annually of the capital committed. Some partnerships elect a company board to control and manage the entity.

Under this structure general partners have the option of making decisions and resolve the disagreements by voting with the majority rule, this can be called a dispute resolution process. No outside party can join the partnership without the full consent of existing partners or unless it is mentioned in the partnership agreement. Less paperwork requires in the partnership in compare to a limited liability partnership (LLP). They also have full control to manage the portfolio of the company.

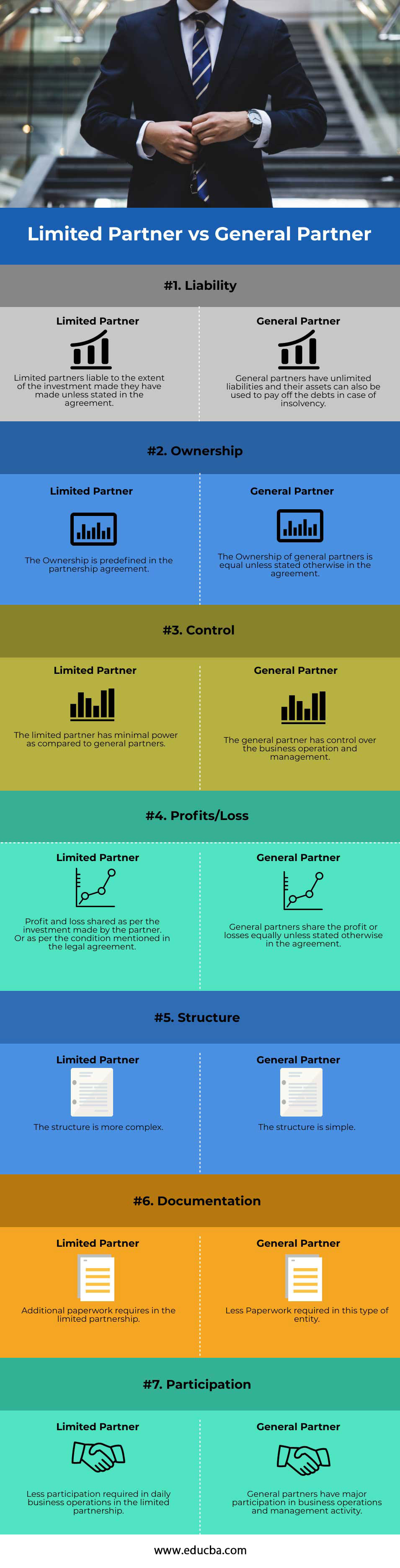

Head To Head Comparison Between Limited Partner vs General Partner (Infographics)

Below are the top 7 differences between Limited Partner vs General Partner

Key Differences Between Limited Partner vs General Partner

- The general partner’s assets can be used to recover the number of debts that need to pay by the entity in case of insolvency of the entity. In short partner’s asset can be used to pay off the debt in case of bankruptcy. Whereas the limited partners have limited liability in compare to general partners. A lawsuit can also be filed against general partners for the debts incurred by the entity. Limited partners have limited liability because they don’t have any such powers as general partners.

- Limited partners do not have full control over operations and management, in other words, they have limited or minimal control, while general partners have full control over the business operations, management and other decision-making for the entities.

- All the profits and losses are shared equally by the general partners, unless or stated otherwise mentioned in the agreement. The limited partners get the profit and losses share as per the amount invested by them or according to the term of the agreements. The management fee can also be paid to the general partners. This can vary from 1% – 2% of the capital committed.

- The complexity of the general partners’ structure is very less as compared to the limited partners’ structure.

- The general partner can be treated as the equal owner of the entity unless mentioned or stated in the agreement. The ownership of the limited partners has been predefined in the partnership agreement.

- The limited partners cannot make a decision or enter into the contract for the business, where general partners have all the rights to enter into the legal contract or any kind of deal on behalf of the entity.

Limited Partner vs General Partner Comparison Table

Let’s discuss the top comparison between Limited Partner vs General Partner:

| Basis of Comparison | Limited Partners | General Partners |

| Liability | Limited partners liable to the extent of the investment made they have made unless stated in the agreement. | General partners have unlimited liabilities and their assets can also be used to pay off the debts in case of insolvency. |

| Ownership | The Ownership is predefined in the partnership agreement. | The Ownership of general partners is equal unless stated otherwise in the agreement. |

| Control | The limited partner has minimal power as compared to general partners. | The general partner has control over the business operation and management. |

| Profits / Loss | Profit and loss shared as per the investment made by the partner. Or as per the condition mentioned in the legal agreement. |

General partners share the profit or losses equally unless stated otherwise in the agreement. |

| Structure | The structure is more complex | The structure is simple. |

| Documentation | Additional paperwork requires in the limited partnership. | Less Paperwork required in this type of entity. |

| Participation | Less participation required in daily business operations in the limited partnership. | General partners have major participation in business operations and management activities. |

Conclusion

As we saw both types of partners have their benefits. To start the business both the general partners and limited partners need to enter into legally binding contracts. In the case of insolvency, the personal assets of the general partners can be used to pay debts, whereas, with limited partners, not all personal assets can be used. The general partner has more control over the business as compared to limited partners. But general partners also have unlimited liability which is not in the case of the limited partnership.

Recommended Articles

This is a guide to Limited Partner vs General Partner. Here we have discussed the Limited Partner vs General Partner key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –