Updated July 11, 2023

Definition of Limited Partnership

The term “limited partnership” refers to the type of legal structure in business in which two or more individuals join hands to form a partnership firm. A limited partnership engages in business activities similar to any other legal structure, with the partners, including at least one general and limited partner, actively sharing the profits.

The limited partner has limited liability only up to the extent of the capital invested in the partnership business. A limited partnership is also known as a silent partnership.

How Does Limited Partnership Work?

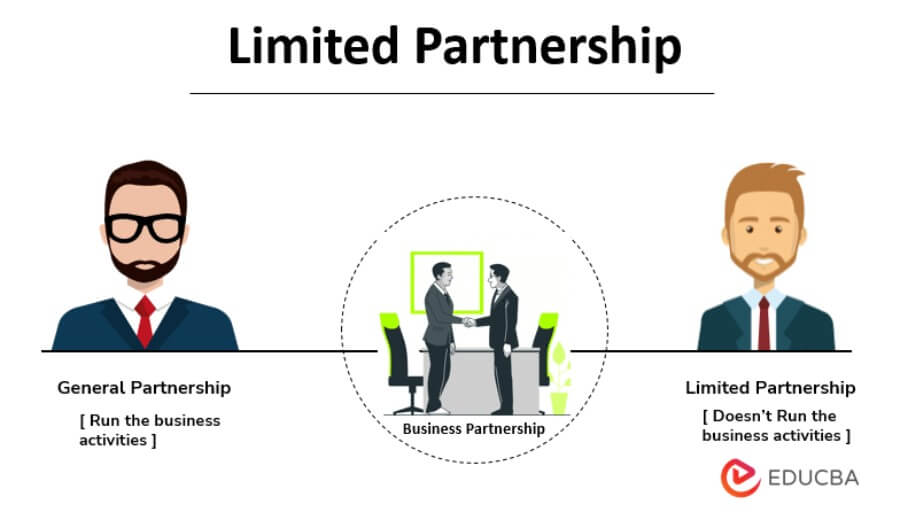

A limited partnership usually has two or more partners wherein each partner contributes to the business through capital, expertise, labor, etc. Consequently, the partners share the profit generated and the losses incurred by the firm based on their contribution to the business. A typical limited partnership business has two categories of partners – general and limited.

A general partner takes care of the firm’s routine activities and is fully liable for the firm’s debts and other business-related obligations. On the other hand, limited partners in a limited partnership business have a highly restricted role, as their name suggests. Therefore, they are commonly referred to as silent or passive investors.

Typically, the limited partners contribute capital to the business; based on that, they share the firm’s profits and losses. However, they don’t participate in the mundane management of the business like the general partners. They bear liability for the debts and other business-related obligations to the extent of their capital contribution to the business.

Example of Limited Partnership

Let us assume that John runs a Cloud Kitchen in California and has David as his partner. John is the general partner in this business with vast working experience in the food and beverage industry. In contrast, David is a limited partner with no working experience in this industry. David has invested capital of $10 million in John’s business, and the fund helps John pay his staff’s salary, purchase raw materials, and cover other business expenses. David, due to his capital contribution, receives a share in the profit but does not actively involve himself in the day-to-day business management

So, David earns a passive income from the restaurant business while John keeps him updated about the business’s financial position. Moreover, David’s investment risk is limited to the extent of his capital, i.e., $10 million. David will not bear any losses or business obligations beyond that value, which will be John’s liability. In short, David’s investment offers unlimited upside potential, while he faces limited downside risk to the extent of his investment in the business.

How to Form a Limited Partnership?

To form a firm, you must file a Certificate of Limited Partnership with the Secretary of State’s office. This certificate includes all basic information about your business.

After filing the Certificate of Limited Partnership, you and your partners should actively draft the partnership agreement. Although the agreement is not a legal requirement, it is a critical document, providing a blueprint of how you intend to run the business. In addition, the agreement clearly states each partner’s rights and responsibilities.

Benefits of Limited Partnership

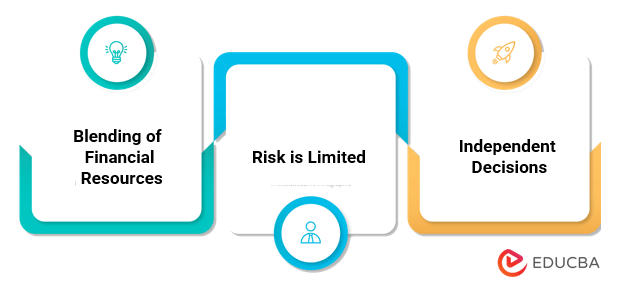

The following are some of the major benefits:

- This business structure results in the perfect blend of the financial resources of the limited partners and the skills & expertise of the general partners.

- Limited partners bear the downside risk limited to their investment in the business.

- As the limited partners don’t interfere with the day-to-day management of the business, the general partners can make their decisions independently without the limited partners’ influence.

- This business structure allows the partners to report their share of the profit and loss on their tax return, a simple pass-through tax filing.

Disadvantages of Limited Partnership

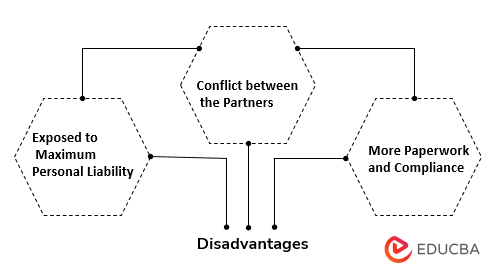

The following are some of the major disadvantages:

- The general partners bear maximum personal liability for debts and other business-related obligations.

- Conflict may arise between the partners due to the limited involvement of limited partners in decision-making.

- It is a much more demanding business structure than a general partnership, requiring more paperwork and compliance.

Key Takeaways

Some of the key takeaways of the article are:

- When two or more partners decide to conduct business together, they form a limited partnership firm. However, it is important to categorize the partners as either general partners or limited partners.

- The general partners take care of the business and bear unlimited liability for the debts and other business obligations. On the other hand, limited partners’ liabilities are only up to the amount invested in the business.

- The formation of limited partnerships is regulated by most US states requiring them to register with the Secretary of State.

Conclusion

So, it can be concluded that the structure of a limited partnership is best suited for people who want to start a business but don’t have the capital for the same. Such inspired entrepreneurs can involve their friends or family members as limited partners willing to invest money into the business but not participate. In this way, limited and general partners benefit through better returns on investment and fulfilling funding requirements.

Recommended Articles

This is a guide to Limited Partnership. Here we discuss the definition, working, examples, and formation of limited partnership along with its benefits and disadvantages. You may also have a look at the following articles to learn more –