Updated August 9, 2023

Liquidity Trap Meaning

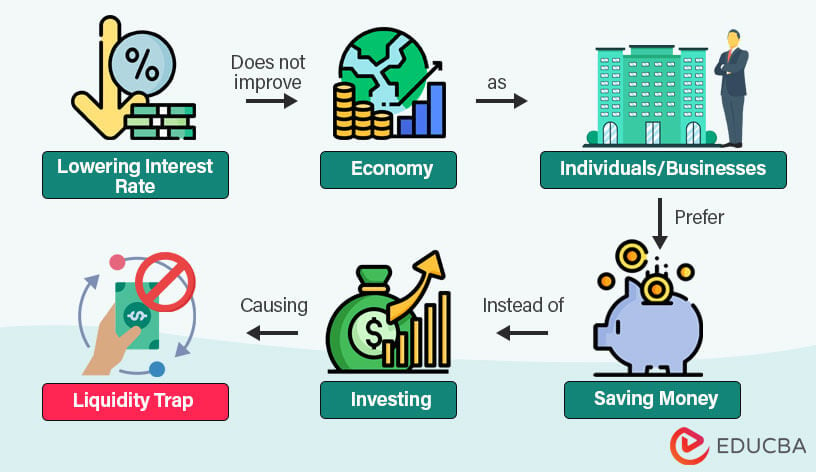

A liquidity trap is an economic situation that occurs when individuals and businesses choose to save money rather than invest even though the cost of borrowing (interest rates) is continuously low.

As a result, there is no active economic activity, and consumer spending and business investment stay low, leading to a more declining economic condition. Thus, increasing economic growth using conventional tools like monetary policies becomes difficult.

Table of Contents

Key Highlights

- A liquidity trap is a situation where low interest rates fail to encourage spending or investment due to possible risks, and individuals prefer safe assets or cash.

- The concept, introduced by economist John M. Keynes, gained prominence after the Great Depression.

- A few solutions to this situation include gradual interest rate adjustments, innovative fiscal policies, and international cooperation.

- Financial innovation and flexible policy-making are also crucial in responding effectively to liquidity traps and minimizing their disruptive effects.

How It Occurs? (with Example)

Here are some key points to understand how it works:

#1: Central Banks Lower Rates During Slowing Economy

During an economic slowdown, high inflation, or nearing recession, the government or the central banks use monetary policy to lower interest rates to get people to borrow and spend money.

#2: People Get Cautious and Start Saving More

The low-interest rates don’t help because businesses and consumers become more worried about the future, so they prioritize saving money instead of spending or investing due to uncertain times.

#3: Borrowing Stays Low & Economic Growth Remains Stagnant

Despite the lower interest rates, people and businesses don’t borrow much for spending or investing. Therefore, the economy doesn’t grow much due to less borrowing and spending.

#4: Central Banks Have a Problem as Deflation Risk Rises

As interest rates close to zero, central banks cannot continue using the same method to improve the economy. Continuous stagnation can lead to a decline in prices and wages, causing the economy to grow slowly for a long time or go into deflation.

Example

Let’s consider the liquidity trap occurring in country ABC.

1. Initial Economic Conditions

- Inflation Rate: 0.8%

- Interest Rate: 5.5%

- Actual GDP Growth Rate: 0% (stagnant economy)

- Potential GDP Growth Rate: 2.5%

2. Central Bank’s Response to Economic Stagnation

The central bank is concerned about the stagnant economy, so they decide to reduce the interest rate from 5.5% to 4%.

3. Limited Impact of Initial Interest Rate Cut

Consumers and businesses are cautious about their economic prospects despite the interest rate cut. Thus, borrowing and spending remain subdued, leading to minimal change in economic activity.

- Actual GDP Growth Rate: 0.5%

4. Additional Reduction in Interest Rates

In an attempt to further stimulate the economy, the central bank lowers the interest rate to 3%. However, the impact on borrowing and spending is still limited.

- Actual GDP Growth Rate: 1%

5. Further Interest Rate Reductions

As the economic situation worsens, the central bank continues to lower the interest rate in increments, first to 2%, then 1%, then 0.5%.

6. Entering a Liquidity Trap

Despite significant interest rate reductions, borrowing and spending show only marginal improvement. Consumers and businesses are reluctant to borrow and spend due to uncertain economic conditions, so the GDP growth rate remains around 1%.

7. Zero Lower Bound (ZLB) & Confirmed Liquidity Trap

The central bank reaches a point where it cannot lower interest rates further due to the zero lower bound, and further rate cuts are not feasible. Country ABC is now in a liquidity trap. Despite extremely low interest rates, people prefer to hold onto cash rather than invest or spend.

- Interest Rate: 0.1%

- Actual GDP Growth Rate: 1.2%

8. Ineffectiveness of the Policies & Possible Solutions

The central bank’s attempts to stimulate economic growth through interest rate reductions have limited impact. In a liquidity trap, unconventional monetary policies like government spending and tax cuts may be necessary.

The government could increase public spending on infrastructure projects, provide financial incentives for businesses to invest, or implement targeted tax cuts to stimulate economic activity.

Real-World Examples

#1: COVID-19 Pandemic (2020s)

Problem and Impact:

With the sudden emergence of the COVID-19 pandemic in 2020, there were lockdowns and restrictions to contain the spread of the virus. Businesses closed, travel halted, and as a result, consumer spending sharply declined. There was a sudden economic slowdown and a decline in the global GDP by 3.4%.

Government Response and Challenges:

To address this crisis, governments worldwide took extraordinary measures. They provided financial aid to individuals and businesses to increase spending and protect jobs. Central banks lowered interest rates, purchased bonds, and initiated fiscal packages to fund projects that could create jobs and revive the economy.

Outcome and Ongoing Impacts:

Despite various efforts, many economies experienced slow recoveries. People were cautious about spending their money due to health concerns and uncertain economic prospects. The pandemic showed how difficult it is to promote spending during crises. It shows that policymakers need flexible and adaptable fiscal and monetary policies to tackle unexpected economic conditions effectively.

#2: Japan’s Lost Decade (1990s)

Problem and Impact:

During the 1990s, Japan encountered a major issue when the prices of houses and stocks experienced a sharp decline. Property values fell by approximately 60%, while stock prices dropped by around 80%.

Measures taken by Policymakers:

To solve this problem, Japan’s leaders took several steps. They invested in infrastructure projects, such as building roads, bridges, and other facilities, to create jobs and stimulate economic activity. They also drastically lowered interest rates, with short-term interest rates reaching zero. Moreover, they also adopted quantitative easing, an unconventional monetary policy where the central bank bought government bonds and other assets to increase money flow into the economy.

Outcome:

Despite these efforts, Japan’s economy did not recover as quickly as hoped. It revealed that encouraging people to spend and invest during uncertain times is challenging.

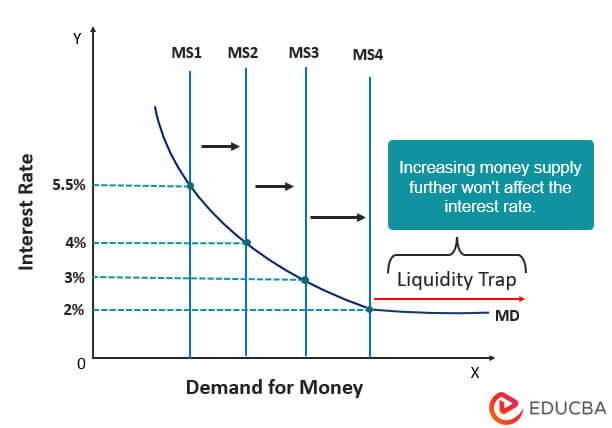

Liquidity Trap Diagram

Important Curves on the Graph

- MS (Money Supply): This is the total amount of money available in the economy, including physical money and money in bank accounts.

- MD (Money Demand): Money demand is how much money people want to keep for spending and saving.

- Interest Rate: This is the cost of borrowing money.

Explanation

To recover a declining economy, the central banks increase the money supply from MS1 to MS2. With increasing money supply, there is a drop in interest rates (from 5.5% to 4%). However, decreasing interest rates does not increase spending, and the demand for money (spending) further decreases. It is because individuals and businesses find that the returns they may earn on investing will be lower. They feel it is better to keep the money safe by saving rather than taking any additional loan or investing their cash.

When spending does not increase, the central bank increases the money supply again from MS2 to MS3, lowering the interest rate from 4% to 3%. However, there is still no increase in spending, and with continuous increase in the money supply, the interest rates keep falling until it reaches almost zero. Now, increasing the money supply won’t affect the interest rate as the interest rate can’t go any further below.

The point at which MS4 and MD intersect has an extremely low interest rate (2%). It represents the demand for cash that will be constant, however much money supply increases. This is the liquidity trap, where the government has done all it can to stimulate the economy by increasing the money supply, but people prefer to hold on to the cash/money.

Causes of Liquidity Trap

Some of the potential causes include:

- Extremely low-interest rates: Interest rates are near zero or close to their lower bound, making it difficult for central banks to reduce rates further.

- Ineffectiveness of monetary policy: Traditional monetary policy tools, like reducing interest rates, fail to stimulate borrowing and investment.

- Preference for holding cash: People and businesses become risk-averse and prefer to hold onto cash rather than invest or spend it.

Implications of Liquidity Trap

A liquidity trap can lead to the following:

- Ineffectiveness of monetary policy: Central banks’ efforts to stimulate the economy through interest rate cuts or quantitative easing become less effective, as interest rates are already near zero and additional liquidity does not lead to increased borrowing and spending.

- Policy challenges: Policymakers face difficulties combating the liquidity trap, often requiring unconventional measures to break free from its grip.

- Limited scope for economic expansion: Consumption and investment remains subdued, leading to slow economic growth and high unemployment rates.

- Deflationary pressures: There is a risk of deflation, as weak demand and low economic activity lead to falling prices.

- Stagnant interest rates: Interest rates may remain historically low for an extended period, making it difficult for savers to earn decent returns and encouraging riskier investments.

- Risk of secular stagnation: Persistent liquidity traps can contribute to long periods of slow growth and subdued economic activity, creating a risk of secular stagnation.

- Debt burdens: With low inflation and interest rates, debts become heavier for households and governments, potentially restricting future economic growth.

How to Avoid Liquidity Trap?

Some of the escape techniques from the liquidity trap include the following:

- Gradually Increase Interest Rates: Central banks should monitor the economy, communicate intentions clearly, and gradually raise interest rates if the economy improves to avoid disruptions.

- Encourage Spending through Price Stability: Encourage spending by maintaining stable prices and a predictable business environment to boost economic growth and confidence.

- Financial Innovations and Investment: Encourage financial innovation with effective risk management and promote financial education for informed investing decisions.

- Boost Government Spending and Cut Taxes: Governments should invest in productive infrastructure and projects for long-term economic benefits while implementing targeted tax cuts to boost consumer spending and business investment.

- Seek International Cooperation: Seek international cooperation to expand trade, open new markets, and address global economic challenges together.

Liquidity Trap Solutions

Here are some potential remedies to solve liquidity traps in an economy,

Expansionary Fiscal Policy

- Increase government spending on infrastructure, public services, and social programs.

- Create jobs and stimulate demand by injecting funds into the economy.

- Boost consumer confidence and encourage businesses to invest.

Quantitative Easing (QE)

- Central banks purchase financial assets from banks and financial institutions.

- Inject liquidity into the financial system to stimulate lending and investment.

- Lower long-term interest rates and support asset prices.

Helicopter Money

- Direct distribution of money to households by the government.

- Increase consumer spending and boost aggregate demand.

- Provide immediate relief and stimulate economic activity.

Structural Reforms

- Implement changes to improve the economy’s efficiency and productivity.

- Deregulate certain sectors to promote competition and innovation.

- Enhance the business environment and attract investments.

Inflation Targeting

- Central banks can set higher inflation targets to reduce real interest rates.

- Encourage borrowing and spending to combat deflationary pressures.

- Ensure price stability while supporting economic growth.

Frequently Asked Questions (FAQs)

Q1. What is a liquidity trap in trading?

Answer: A liquidity trap in trading is a situation that occurs when there is lower trading activity and limited participants in the market. You cannot buy or sell an asset without affecting its price. This lack of liquidity can lead to market inefficiencies. Thus, to manage risks, traders must adapt strategies and exercise patience.

Q2. Who created the liquidity trap?

Answer: John Maynard Keynes created the liquidity trap concept in his book “The General Theory of Employment, Interest, and Money,” published in 1936.

Q3. Is it common to fall into a Liquidity Trap?

Answer: Liquidity traps are relatively rare but can happen when interest rates are near zero. This makes using conventional monetary policy ineffective in stimulating economic growth. Therefore, policymakers need to be attentive and adaptive to avoid or address such situations.

Recommended Articles

We hope you found this EDUCBA information about Liquidity Trap useful. EDUCBA suggests the following articles for more information.