Difference Between LLC vs Inc

These words seem confusing at first, but the abbreviations simply mean LLC as “Limited Liability Company “, and Inc or corp means a corporation in business.

Both are different in their ways. The way they manage, operate, and function. The main function of both is to protect the business from liability. For e.g., If a person wants to take the business on a larger scale from proprietorship, you will have to either do it LLP or Inc.

E.g., You started a business of shoes with a small retail shop at first. You are the only owner. Once you expand your shoe business, it goes from a sole proprietorship into a company that is recognized at the state level. At this point, your business and the owner of your business become two different entities. This means that if your shoe business gets sued or any legal issues occur, your assets (e.g., car, house) are not at stake. Only your investment in that business is at stake. When your shoe business expands to state-level legalities, get involved. This makes your shoe business into a legal business entity. This new business could be in any of the two ways:1)LLC or 2)Inc. Both these forms of business shield the owner from being personally liable in case of any legal issues or business debt.

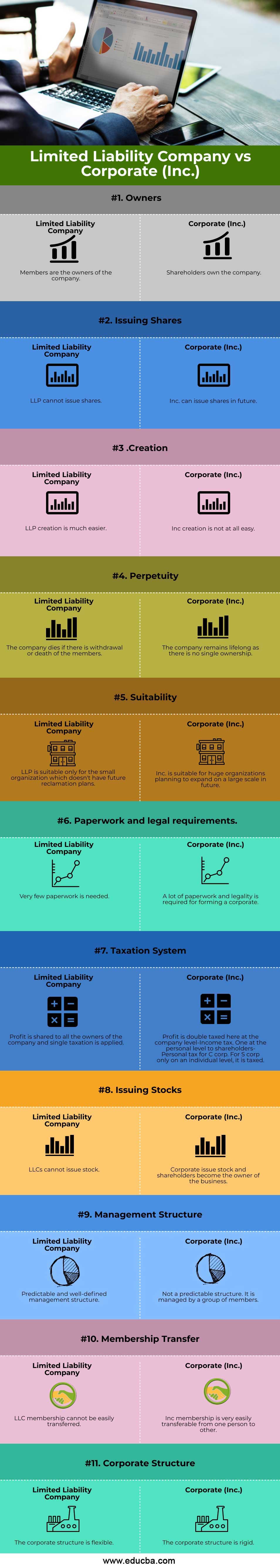

Head To Head Comparison Between LLC vs Inc(Infographics)

Below are the top 11 differences between LLC and Inc:

Key Differences Between LLC vs Inc

Let us discuss some of the major Difference Between LLC and Inc:

- The vision of the Limited Liability Company is very limited. The few owners are the members of the business in LLC. In Corp, all the shareholders are the members.

- The corporation is owned by a few individuals, whereas many shareholders own inc. LLCs owner has an interest in the company’s fixed asset as they have made a significant contribution to joining the business. This is not the case in Corporation.

- The creation of LLCs is much easier than a corporation. According to this LLC formation guide on GovDocFiling, LLCs are based on state law, so the process of forming and filing depends completely on state law. Some states allow filling to be done online, while some have other requirements. Most of the LLCs use ‘operating agreements’ in their formation process.

- The company dies if the owner of the business withdraws or dies in LLP. In corp, the company becomes perpetual as the shareholders and the owners keep on changing.

- LLP is more suitable for small businesses not having a huge plan of reclamation in the future. The corporation is suitable for huge scale businesses.

- Corporate must have an annual meeting that is properly recorded. They have to keep a record about shareholders and also pay some state fees. LLCs have to keep a record book, but it is the bare minimum compared to that of corporate. LLCs have to meet at least once a year. They do not have annual report requirements. This is good for small business who doesn’t want to invest time and money in it.

- Inc also has two types of corporations: C corporation and S corporation: The Corporation has to pay a dual tax on profit and dividends. S corporation just has to pay taxes on their income. This double taxation is usually treated as a big disadvantage. For an outside investor, LLC S is more preferable; however, if you want to retain more cash into the business for further expansion C Corp is more suitable. E.g. An LLC made a profit of Rs 300. It has two members as owners, and each has a 50 percent share in the company, so each of the owners is taxed on Rs 150 of income. If Corporation makes rs 300 profit, it is taxed on profit made by the company. Further taxed ion the dividends which are passed to the shareholders.

- Only Corporation has a right to issue stocks.

- In a corporation, ownership and control are two different aspects. Shareholders own the business but have very little right-Right to elect the board of members, vote, etc. Directors are responsible for policies in the company. In LLCs, the complete control is under the hands of the limited owners only.

- One or more people form lLCs as owners. While the corporation is formed by the corporate organization with the Board of Directors to oversee the business. The actual owners being the shareholders. So, the transfer of the membership becomes easy in the case of Inc as just buying and selling shares can change the owner of a business, whereas it is difficult in the case of LLCs.

- Corporate structure in the corporation is like Shareholders own the stock, Shareholders elect the Board of directors, Directors appoint officers, Officers run the business on behalf of shareholders. In the case of the LLP, the corporate structure is very simple as the magnitude of business is small and there are limited partners.

LLC vs Inc Comparison Table

Let us Discuss the Topmost Comparison Table between LLC vs Inc

| Basis of Comparision | Limited Liability Company | Corporate (Inc.) |

| Owners | Members are the owners of the company. | Shareholders own the company. |

| Issuing shares | LLC cannot issue shares. | Inc. can issue shares in the future. |

| Creation | LLC creation is much easier. | Inc creation is not at all easy. |

| Perpetuity | The company dies if there is withdrawal or death of the members. | The company remains lifelong as there is no single ownership. |

| Suitability | LLP is suitable only for the small organization which doesn’t have future reclamation plans. | Inc. is suitable for huge organizations planning to expand on a large scale in the future. |

| Paperwork and legal requirements. | Very little paperwork is needed. | A lot of paperwork and legality is required for forming a corporate. |

| Taxation system | Profit is shared with all the owners of the company, and single taxation is applied. | Profit is double taxed here at the company level-Income tax. One at the personal level to shareholders-Personal tax for C corp. For S corp only on an individual level, it is taxed. |

| Issuing stocks | LLCs cannot issue stock. | Corporate issue stock and shareholders become the owner of the business. |

| Management Structure | Predictable and well-defined management structure. | Not a predictable structure. A group of members manages it. |

| Membership transfer | LLC membership cannot be easily transferred. | Inc membership is very easily transferable from one person to another. |

| Corporate structure | The corporate structure is flexible. | The corporate structure is rigid. |

Conclusion

So, what is suitable for your business type? Both offer the same protection over liability, but It all depends upon your business type, short-term and long-term goals, workforce, tax consequences, and management structure.

Recommended Articles

This is a guide to LLC vs Inc. Here we have discussed the difference between LLC vs Inc along with the key differences with infographics and comparison table. You can also go through our other suggested articles to learn more –