Updated July 24, 2023

Difference Between LLC vs Partnership

LLC is a limited liability company that can be formed with a minimum of one member. And for partnership, you need to find a partner with a similar vision or goal. And if you don’t want a partner or no one is available, then forming an LLC would be the right option. Understanding the difference between an LLC and a partnership can help you choose your business’s right structure. If you want to own your business, a limited liability company may offer you the most versatile tax treatment option. Limited Liability Company was first founded in the United States. Most of the states accept it very slowly. A limited liability company is a composed entity formed by the combination of a corporation’s limited liability and the partnership’s tax advantages. But now, it is the most usable entity for businesses.

What is LLC (Limited Liability Companies)?

An LLC is a corporate structure where holders are not responsible for company debts or liabilities. In LL, where liability is limited, it is provided to the business owners. A limited Liability Company is a discrete or individual and definite legal entity, meaning it can get a tax recognition number, create a bank account, and do its own business under its name. Limited Liability Companies can also have foreign entities and individuals as owners. Limited Liability Company is created by the filing of the organization of organization with the state office’s personal assistant. Limited Liability Company has members instead of shareholders, managers, directors, and officers.

What is Partnership?

A partnership is an action or process where the group known as business partners all agree to one business plan, and their mutual interests are the same. A partnership is formed by multiple co-owners or partners who do business together. Partners can have different shares of ownership or have the same shares. And according to their shares, they distribute profits and losses among them. The partnership cannot have another business entity as an owner or a partner. Three categories of partnership are a general partnership (GP), a Limited partnership (LP), Limited liability partnership (LLP). There are nine characteristics of a partnership sharing of profits, nature of liability, the existence of an agreement, business, agency relationship, membership, a combination of ownership and control, non-transferability of returns, and firm enrollment.

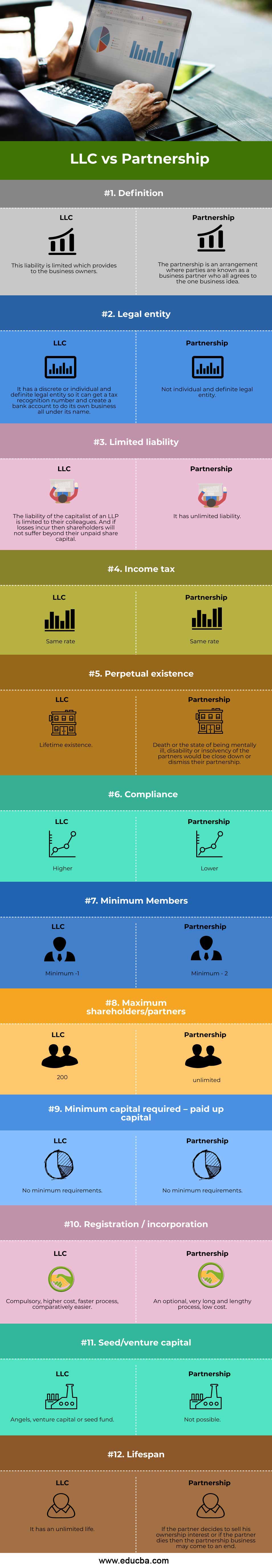

Head To Head Comparison Between LLC vs Partnership (Infographics)

Below are the top 12 differences between LLC (limited liability company) vs Partnership

Key Differences Between LLC vs Partnership

Let us look at the key differences between LLC (limited liability company) vs Partnership as below:

- When two or more people enter the business simultaneously with the same goals, they form a partnership. They don’t have to do any paperwork. And comparably, in limited liability companies, the business holder must record formal articles of organization; it is called a certificate of organization.

- The key difference between a Limited Liability Company and a partnership is that LLC has a separate legal entity from its owner. A partnership firm has no discrete or individual legal entity from its partners.

- An LLP requires a minimum of two or more partners. Each partner holds management responsibilities based on their investment levels. However, only the responsible partners will be liable if things go wrong. It is specified in the partnership agreement how to divide profits and losses among the partners.

- On the other hand, LLCs can have a single owner. However, no limit exists on the number of members an LLC can have. Unlike an LLP, the members of an LLC have varied management roles. LLC distributes the profits and losses as per each member’s ownership percentage. Small business owners mostly prefer LLCs.

- To form an LLP and LLC in Florida, the partner(s) must do an organizational filing at the Florida Division of Corporations. An LLC must pay $125 as registration fees and an annual fee of $138.75. Whereas LLPs have to pay $500 annually.

- The liability of partners is limited to contribution in the case of a Limited Liability Company, and the liability of partners is unlimited in the case of a partnership.

- When you want to work on a new company or your partner wants, understanding the difference between a limited liability company and a partnership can help you choose the proper arrangement for your business.

- The administration structure of a limited liability company is firmer than the partnership.

LLC vs Partnership Comparison Table

Let’s discuss the top comparison between LLC (limited liability company) vs Partnership.

|

Basis of Comparison |

Limited Liability Companies |

Partnership |

| Definition | This liability is limited which provides to the business owners. | A partnership is an arrangement where parties are known as business partners who all agree to one business idea. |

| Legal Entity | It has a discrete or individual and definite legal entity, so it can get a tax recognition number and create a bank account to do its own business, all under its name. | Not an individual and definite legal entity. |

| Limited Liability | The liability of the capitalist of an LLP is limited to their colleagues. And if losses are incurred, shareholders will not suffer beyond their unpaid share capital. | It has unlimited liability. |

| Income Tax | Same rate | Same rate |

| Perpetual Existence | Lifetime existence | Death or the state of being mentally ill, disability, or insolvency of the partners would be close down or dismissed their partnership. |

| Compliance | Higher | Lower |

| Minimum Members | Minimum -1

|

Minimum – 2 |

| Maximum Shareholders / Partners | 200 | unlimited |

| Minimum Capital Required – Paid-up Capital | No minimum requirements. | No minimum requirements. |

| Registration / Incorporation | Compulsory, higher cost, faster process, comparatively easier. | An optional, very long, and lengthy process, low cost. |

| Seed/Venture Capital | Angels, venture capital, or seed fund. | Not possible. |

| Lifespan | It has an unlimited life. | If the partner decides to sell his ownership interest or if the partner dies, then the partnership business may come to an end. |

Conclusion

We have gone through major differences between the Limited Liability Company and the partnership. So what would be the right option, a Limited Liability Company or partnership? The partnership is the most flexible and beneficial business format because it transfers wealth to the owners. We can say that a partnership business and partners are legal. The partnership is the most mature and famous form of business. The partnership business’s success rate is higher than limited liability companies because more people have different talents and skills. But there are various people in partnership, so they must be loyal and faithful to each other.

If one or more partners are dishonest, the business must be dissolved. So partnership business is based on a fiduciary relationship. If you want to go with a partnership business, you need to know that there are several partnership firms. In partnership, the owners have equal rights and personal liability for the business. And in partnership, you need to find partners with the same goals and similar visions.

Recommended Articles

This is a guide to LLC vs Partnership. Here we discuss the LLC (limited liability company) vs Partnership key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –