What is Loan Servicing?

The term “loan servicing” refers to the administrative assistance required in the case of a loan right from the time of disbursal of the proceeds to the borrower until the full repayment of the loan by the borrower.

The various tasks falling under the purview of loan servicing include maintenance of the borrower’s escrow account, distribution of monthly statements, collection of monthly payments, maintenance of payment & balance records, payment of taxes & insurance, fund remittance to the lender, and follow up in case of any delinquencies.

Key Takeaways

Some of the key takeaways of the article are:

- Loan servicing refers to the functions previously performed by the banks and now by the third-party vendor’s considered specialists.

- This includes collecting monthly payments, paying taxes & insurance, maintaining records, and other tasks related to post-disbursement processing until the loan is paid off.

- It used to be a core function of the banks, but now it has become an industry.

- It allows the lenders to focus on their core function of new client acquisition and reduces their overhead costs.

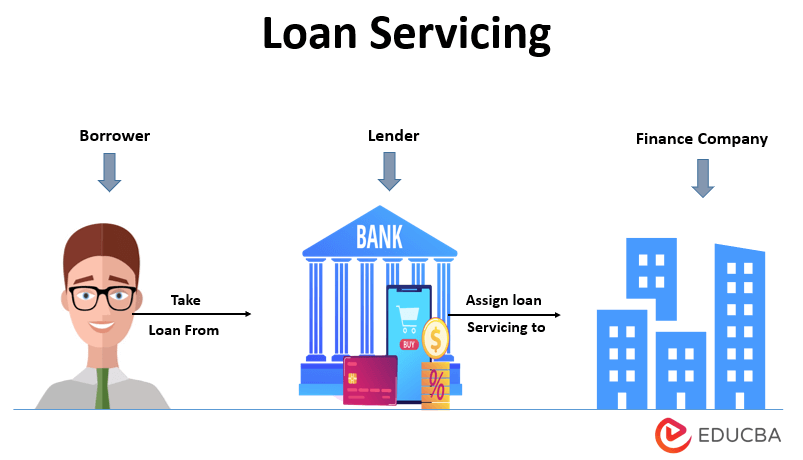

How Does Loan Servicing Work?

Now, let us understand how a loan service works in the real world. First, the loan servicer collects the scheduled payments from the borrower and passes them on to the different stakeholders (like investors, insurers, and tax authorities) using an escrow account. The loan servicer also protects the stakeholders’ interests by ensuring proper insurance coverage.

If the borrower falls behind on payments, the loan servicer works with the borrower and helps them get back on track. However, if that doesn’t happen, the loan servicer pursues a modification based on the borrower’s eligibility or explores other alternatives. For instance, in the case of a real estate mortgage, foreclosure is one of the viable options, and the loan servicer helps initiate the foreclosure process and manages it until the transaction is closed.

The loan servicer receives fees for the duties performed during the loan servicing process, including ensuring timely disbursal payments to the correct parties. If the borrower fails to make payments promptly, resulting in late fees, the loan servicer is again responsible for collecting the late fees.

Example of Loan Servicing

Let us look at an example to understand the concept. Sam recently purchased a new home on a mortgage with a loan servicer, with the house’s value at $200,000 and Sam making a $40,000 down payment, resulting in a mortgage loan of $160,000. The loan servicer charged 0.25% of each periodic loan payment as the servicing fee. To simplify, let’s assume that there is no interest charged, and Sam has to repay only the principal amount over the next 24 months, resulting in Sam making monthly payments of $6,667 (= $160,000 / 24). So, the loan servicer will retain a monthly fee of $16.7 (= 0.25% * $6,667) before passing on the remaining amount to the other stakeholders.

Loan Servicing Platform

Given the burden of maintaining a large volume of records of loans coupled with the borrower’s changing habits and expectations, the loan servicing industry has gradually become reliant on technology and software. Many lenders have shifted to loan servicing platforms to leverage technology and automate post-disbursement operations, such as collateral tracking, collections, etc. The platform also helps in managing customer requests and queries. These tools are usually available as an integrated part of loan management solutions. Most companies price these products on a per-user and per-month basis.

Why is it Important?

Traditionally, loan servicing was a core function of the banks. The banks used to handle the administrative aspects of the loan right after issuing the loan in the borrower’s name. However, the widespread efforts to securitize loans changed the nature of banking in general. Now, the banks primarily originate loans, then hand over the loan servicing part to a highly skilled third-party service provider. In this way, it has evolved into an industry that is an essential component of the loan life cycle and, more broadly, the banking system.

Benefits of Loan Servicing

The following are some of the significant benefits:

- Loan servicing allows banks or other lenders to focus on their core function of acquiring newer clients, which is a more profitable business.

- Since managing loans is the core competency of the loan servicers, they can get the job done at a lesser cost, reducing the overhead cost for the lenders.

- The borrowers can get faster responses leading to improvement in customer service.

- In the case of delinquent accounts, the loan servicers help follow up and recover the default money.

Conclusion

So, it can be seen that loan servicing has become a blessing for the banking industry as it has taken away a significant chunk of the administrative work associated with a loan. The loan servicers can efficiently execute the tasks as they develop their expertise by servicing multiple clients over the years. Overall, assigning tasks to people with the required core competency is best – administrative work by loan servicers and new client acquisition by banks.

Recommended Articles

This is a guide to Loan Servicing. Here we also discuss the definitions, working, example, platform, Why it is essential, and its benefits. You may also have a look at the following articles to learn more –