Updated July 21, 2023

Definition of Loan to Value Ratio

Loan to value ratio is a financial term used in the banking sector to represent the value of a loan against the value of the asset being offered a mortgage. The ratio is used only for mortgage-based loans. It will give an indication of whether the loan is risky or not. It also represents the extent of one’s own ownership and investment in the asset being financed.

The term “Loan to Value Ratio” refers to the financial ratio that allows the comparison of the size of the loan to the value of the asset purchased with the loan proceeds.

It is an important metric that helps in assessing the lending risk assumed by a lender by extending a loan to a borrower.

Typically, loans with higher LTV ratios are regarded as high-risk loans. Hence, if approved, these loans attract higher interest rates and may also require additional safety cushion in the form of mortgage insurance that the borrower has to purchase to offset the lending risk to some extent.

Key Takeaways

- Loan-to-value (LTV) ratio is used by lenders to assess lending risk and also determine the mortgage amount to be extended to the borrower based on the appraised value of the asset.

- Lenders usually offer loans at relatively lower interest rates if the LTV ratio is 80% or less. On the other hand, an LTV ratio of more than 80% attracts higher interest rates and additional requirements for insurance premiums.

- In the case of an underwater mortgage, the borrower may be deprived of the tax benefits associated with a loan.

How to Calculate LTV Ratio?

The calculation of the LTV ratio is fairly simple. So, let us have a look at how it can be calculated by following some easy steps mentioned below.

Step 1: Firstly, estimate the appraised value of the property to be funded. Typically, it is the selling price or the market value of the property. The lenders usually assign the task to a valuation team.

Step 2: Next, determine how much the borrower can fund in the purchase of the property. It is considered the down payment towards the purchase.

Step 3: Next, determine the mortgage amount based on the appraised value (step 1) of the property and the down payment (step 2) to be paid by the borrower. The mortgage amount is simply calculated by deducting the down payment from the appraised value.

Step 4: Finally, the LTV ratio of the loan is determined based on the mortgage amount and the appraised value of the property. Mathematically, it is derived by dividing the mortgage amount (step 3) by the appraised value (step 1).

Example of Loan to Value Ratio (With Excel Template)

Let us look at the following examples to understand the concept and calculation of the LTV ratio.

Example #1

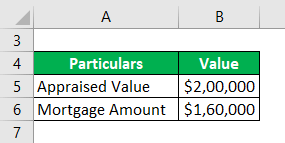

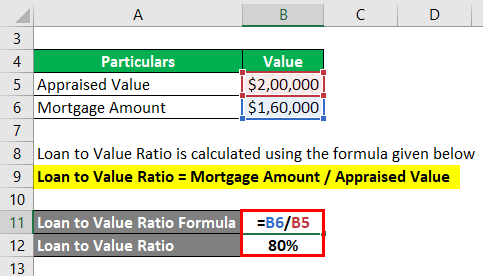

Let us take a simple example of John who has applied for a $160,000 car loan for purchasing a $200,000 brand new car. Determine the LTV ratio of the loan based on the given information.

Solution:

Loan to Value Ratio is calculated using the formula given below.

Loan to Value Ratio = Mortgage Amount / Appraised Value

- Loan to Value Ratio = $160,000 / $200,000

- Loan to Value Ratio = 80%

Therefore, the LTV ratio of the car loan is 80%.

Example #2

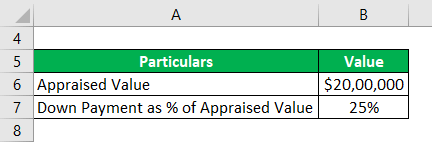

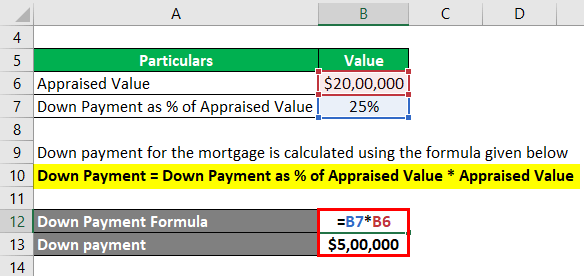

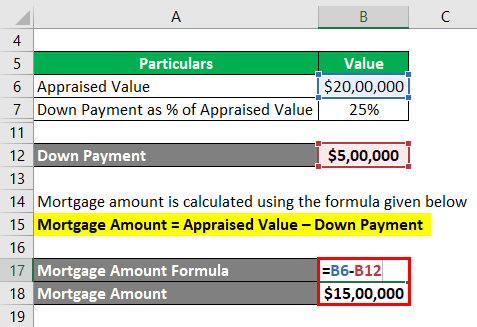

Let us take the example of David who is planning to purchase a 3-bedroom apartment in California for $2,000,000. He has approached a bank for a mortgage and the bank has asked for a 25% down payment. Determine the LTV ratio of the loan based on the given information.

Solution:

Down payment for the mortgage is calculated using the formula given below.

Down Payment = Down Payment as % of Appraised Value * Appraised Value

- Down Payment = 25% * $2,000,000

- Down Payment = $500,000

Mortgage amount is calculated using the formula given below.

Mortgage Amount = Appraised Value – Down Payment

- Mortgage Amount = $2,000,000 – $500,000

- Mortgage Amount = $1,500,000

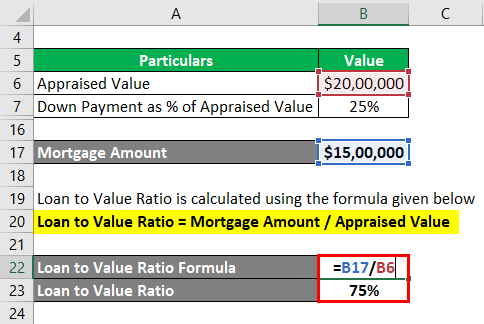

Loan to Value Ratio is calculated using the formula given below.

Loan to Value Ratio = Mortgage Amount / Appraised Value

- Loan to Value Ratio = $1,500,000 / $2,000,000

- Loan to Value Ratio = 75%

Therefore, the LTV ratio of the loan to be availed of by David is 75%.

Risk for LTV Ratio

Although the LTV ratio is a very useful metric for lenders, there are a few downsides that are applicable in the case of a high LTV ratio.

- The lenders may charge a relatively higher interest rate that will eventually increase the total amount to be paid by the borrower.

- The borrower may be required to purchase private mortgage insurance if the LTV ratio exceeds 80%.

- In case the LTV ratio exceeds 100% (known as an underwater mortgage) then the borrower may be deprived of the tax benefits of the loan.

Importance of Loan to Value Ratio

The ratio is of very importance to the lenders. It helps the lenders to determine the risk involved in the lending considering the value of the property. By analyzing this ratio, the lender would like to assure itself that they do not lend more than the actual value of the property (which is represented by mortgage value in the formula). Many banks and even some financial regulators may define the maximum ratio as an eligibility criterion for availing of a loan. The ratio forms the basis for a bank’s decision as to whether the loan can be approved or not. However, the bank will also consider other facts such as credit score, repayment history, and so on before approving the loan.

For banks, a lower ratio is always better and thus for a loan with a lower ratio, the chances for approval will be higher. Also, in case of a lower ratio the borrower can negotiate for other terms of the loan such as interest rates since due to the lower ratio, the loan is less risky. The ratio also represents one’s equity i.e. ownership in the asset and as such a lower ratio will represent that you have a greater amount of equity in the said asset. On the other hand, if the loan to value ratio for a loan is high, there are minimum chances of the loan getting approved since there is a greater amount of risk involved here. This is because there is less amount of equity contributed by the borrower and hence the chances of non-repayment are high!

Advantages

- It helps lenders to analyze the risk involved in granting mortgage-based loans to borrowers.

- The borrowers with a lower ratio enjoy beneficial rates of interest along with other benefits.

- The loan gets approved earlier and with ease if the ratio is on the lower side.

Disadvantages

- The ratio considers only the primary mortgage involved in the loan. But it does not take into account other considerations such as a secondary mortgage. It is for this reason that a combined loan to value ratio is considered to be more useful.

- As far as borrowers are concerned, the higher ratio will attract a higher rate of interest and also the chances of loan approval become complicated.

Conclusion

Thus, it is important to check the availability of funds with yourself, and based on that only you should apply for a loan. Based on your ratio, compare the rates being offered to you by various banks and proceed accordingly.

Recommended Articles

This is a guide to Loan to Value Ratio. Here we discuss how to calculate the Loan to Value Ratio along with practical examples and downloadable excel templates. You may also look at the following articles to learn more –