Simplified Vehicle Financing for Business Owners

For many business owners, having reliable vehicles is essential for smooth operations. However, securing a commercial car loan can be challenging, especially if you do not have traditional financial documents like tax returns and payslips. This is where low documentation commercial car loans come in. These loans provide a flexible financing solution for sole traders, small business owners, and self-employed professionals with limited financial records.

All Nation Finance, a trusted finance broker in Western Australia, specializes in low doc commercial car loans to help businesses get the vehicles they need with minimal paperwork.

What is a Low Documentation Commercial Car Loan?

A low-doc commercial car loan helps business owners without full financial statements meet lender requirements. Instead of tax returns and payslips, these loans allow applicants to submit alternative financial documents such as:

- Bank statements (covering 3–6 months)

- Business Activity Statements (BAS)

- Accountant’s letter verifying income

These loans benefit self-employed individuals, freelancers, and small business owners with fluctuating incomes or who reinvest most of their earnings into their businesses.

Benefits of Low Documentation Commercial Car Loans

Choosing a low doc commercial car loan with All Nation Finance comes with several advantages:

- Easier and Faster Approvals: Traditional loans require a lot of paperwork. Low doc loans simplify the process, making it quicker and easier to get approved.

- Flexibility for Business Owners: A low-doc loan allows you to prove your earnings more easily if your business has seasonal income or irregular financial records.

- Preserve Cash Flow: Financing helps businesses manage cash flow while acquiring the necessary vehicles rather than paying for a vehicle upfront.

- Tax Benefits: Interest payments and depreciation may be tax-deductible, depending on how the vehicle is used for business. Consult a financial professional for more information.

- Wide Range of Vehicles: All Nation Finance can help finance various commercial vehicles, including:

- Work vans and trucks

- Utes and 4WDs for trade businesses

- Delivery and logistics vehicles

- Fleet cars for business use

Eligibility Criteria for a Low Doc Commercial Car Loan

To qualify for a low doc commercial car loan with All Nation Finance, you will generally need to provide:

- ABN (Australian Business Number): Must be active for at least 6 to 12 months.

- Bank Statements: Usually covering 3 to 6 months to demonstrate business revenue.

- Business Activity Statements (BAS): Often required to show consistent income.

- Accountant’s Letter: Some lenders accept a letter from your accountant verifying your income.

- Vehicle Details: Information about the purchased car, such as a dealer invoice or private sale agreement.

Why Choose All Nation Finance?

All Nation Finance is a trusted finance broker in Western Australia specializing in low doc commercial car loans. Here is why they stand out:

- Expert Knowledge of the WA Market: With years of experience in the Western Australian finance industry, All Nation Finance understands the unique challenges that local businesses face and offers customized solutions.

- Access to Wide Network of Lenders: Finance brokers collaborate with multiple lenders to obtain competitive interest rates and favorable loan terms, ensuring you receive the best deal available.

- Personalized Service: All Nation Finance takes the time to understand your business needs and financial situation, tailoring loan options that align with your goals.

- Fast Loan Processing: Time is crucial for businesses that need vehicles to maintain operations. All Nation Finance streamlines the application process, ensuring quick approvals and minimal delays.

- Flexible Loan Terms: Whether you are looking for a short-term or long-term loan, they offer a range of repayment options tailored to fit different business cash flow needs.

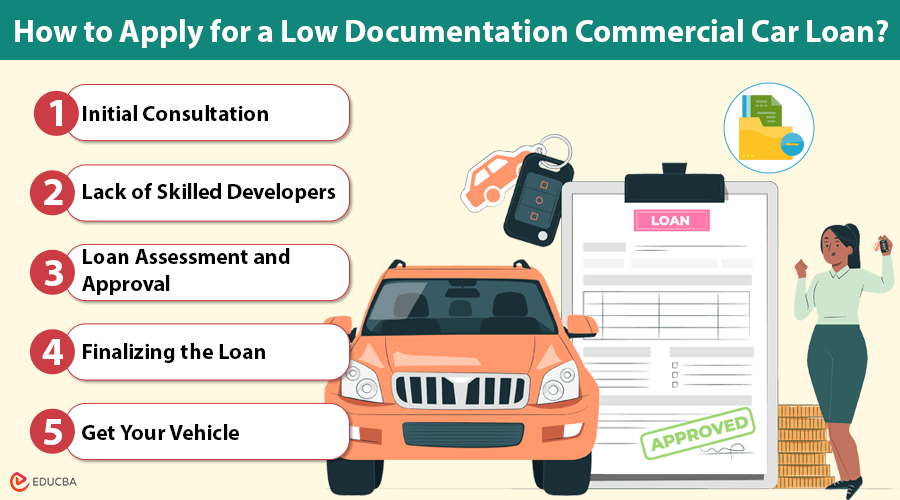

How to Apply for a Low Documentation Commercial Car Loan?

Applying for a low doc commercial car loan is straightforward. Here is how you can do it:

- Initial Consultation: Speak with an All Nation Finance loan expert to discuss your business needs, vehicle choice, and loan options.

- Submit Documentation: Provide the necessary paperwork, such as your ABN, bank statements, and vehicle details.

- Loan Assessment & Approval: The team reviews your application and matches you with the most suitable lender.

- Finalizing the Loan: Once your loan gets approved, All Nation Finance finalizes the paperwork and coordinates with the lender to release the funds for your vehicle purchase.

- Get Your Vehicle: Once you complete everything, you can take possession of your new commercial vehicle.

Things to Consider Before Applying

Before applying for a low doc car loan, keep these factors in mind:

- Interest Rates: Low doc loans often come with slightly higher interest rates to offset the reduced documentation requirements.

- Loan Terms: Select a loan term that aligns with your business’s cash flow.

- Deposit Requirements: Certain lenders may ask for a deposit, whereas others provide full 100% financing options.

- Business Stability: Lenders may prefer businesses operating for at least 12 months.

Final Thoughts

A low documentation commercial car loan is a great option for self-employed professionals and business owners in Western Australia who need vehicle financing without the burden of excessive paperwork. With All Nation Finance, the process is fast, simple, and tailored to meet your needs. Whether you are looking for a single work vehicle or an entire fleet, their team can help secure the best financing solution for your business. Ready to apply? Visit All Nation Finance and take the first step toward securing your next commercial vehicle!

Recommended Articles

We hope this guide on low documentation commercial car loans helps you easily navigate financing options. Check out these recommended articles for more insights on securing hassle-free vehicle loans for your business.