Updated November 21, 2023

What is Machine Learning in Finance?

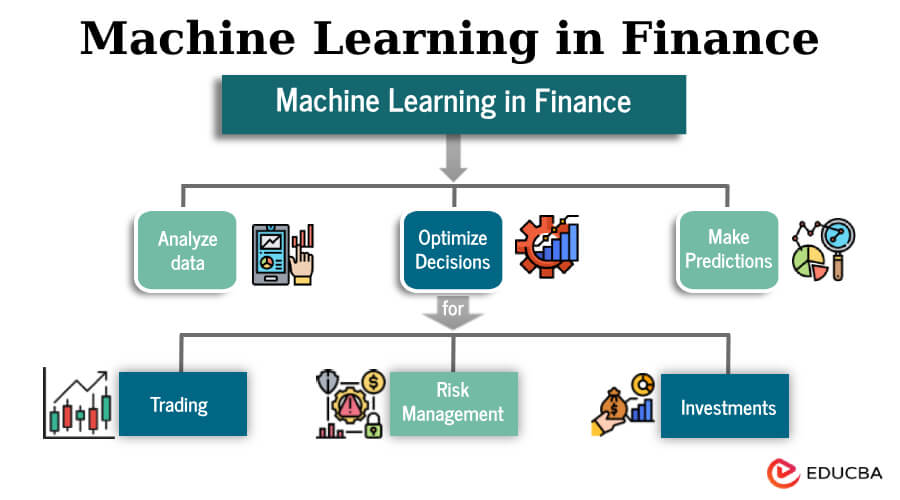

In finance, Machine Learning (ML) refers to using artificial intelligence (AI) techniques that allow systems to learn and improve without being explicitly programmed. In the finance industry, where vast amounts of data are generated daily, ML algorithms analyze this data to identify patterns, make predictions, and optimize decision-making processes. The primary objective is to use advanced computational methods to extract valuable insights, enhance efficiency, and improve various aspects of financial operations.

Table of Contents

- What is Machine Learning in Finance?

- Why Consider Machine Learning in Finance?

- Use Cases of Machine Learning in Finance

- How to use machine learning in finance to advance your career?

- Challenges and Opportunities

- Ethical Considerations

- Future Trends in Machine Learning for Finance

Why Consider Machine Learning in Finance?

Machine learning in finance offers unparalleled advantages by leveraging data-driven insights to enhance decision-making, automate processes, and mitigate risks. In a rapidly evolving financial landscape, where vast amounts of data are generated daily, machine learning algorithms can swiftly analyze and interpret complex information, identifying patterns and trends that may be invisible to traditional methods. This technology is pivotal in algorithmic trading, optimizing strategies, and executing trades quickly and precisely. Machine learning models provide more accurate credit scoring and risk management assessments, leading to improved lending decisions and better portfolio management.

Fraud detection benefits from the real-time analysis of transactional data, enabling swift identification of suspicious activities. Integrating machine learning in finance enhances efficiency and accuracy and enables financial institutions to adapt swiftly to market changes and regulatory requirements. Machine learning empowers the finance industry to make more informed, data-driven decisions, ultimately fostering innovation, reducing costs, and staying competitive in a dynamic global market.

Use Cases of Machine Learning in Finance

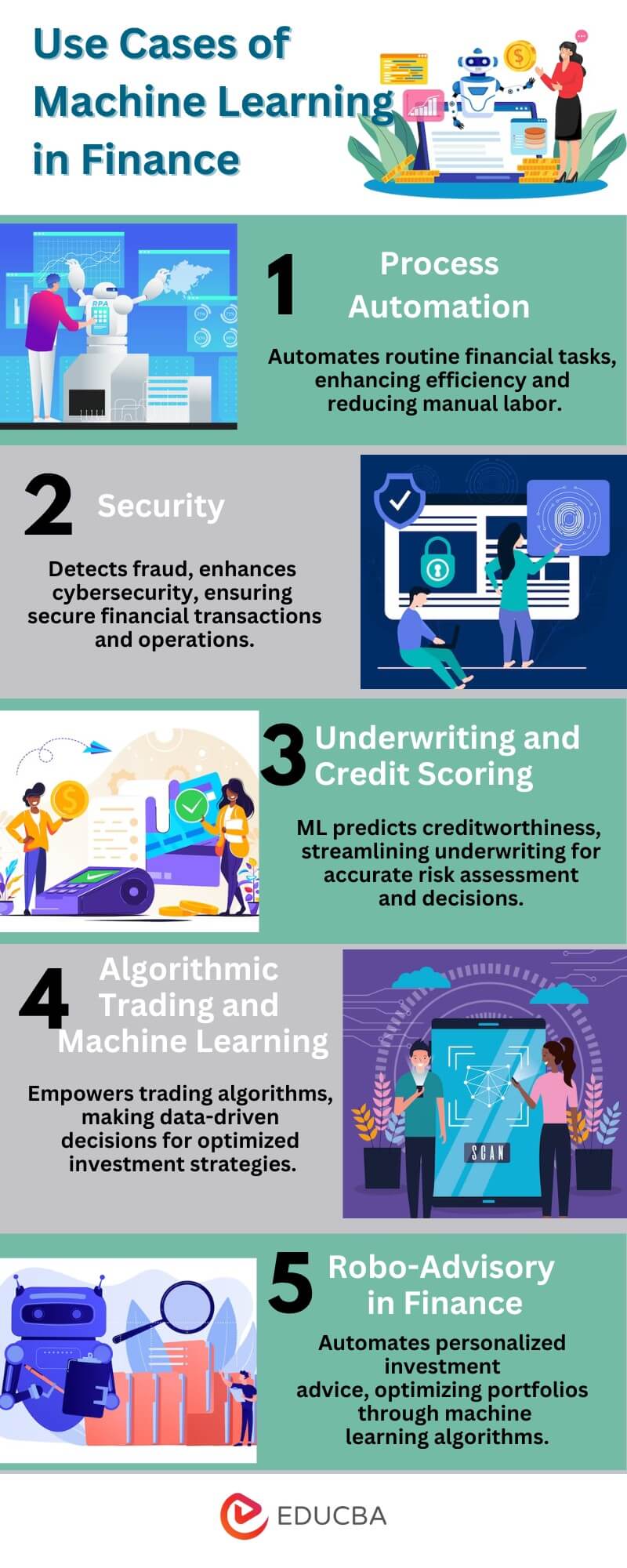

1. Process Automation

Process automation is a key application of machine learning in finance, revolutionizing traditional workflows and yielding significant benefits. Machine learning drives increased efficiency, cost optimization, and enhanced customer experiences by replacing manual tasks and automating repetitive processes. Below are specific use cases of automation in finance:

Chatbots:

- Purpose: Streamlining customer interactions and support.

- Example: Wells Fargo employs an AI-driven chatbot on Facebook Messenger, enhancing user engagement and assisting with password and account-related queries.

Call-Center Automation:

- Purpose: Automating routine tasks and responses in call center operations.

- Example: Implementing automated systems to handle customer inquiries, reducing response times, and improving overall efficiency.

Paperwork Automation:

- Purpose: Eliminating manual document processing through automated solutions.

- Example: JPMorgan Chase’s Contract Intelligence (COiN) platform utilizes Natural Language Processing to extract essential data from legal documents, significantly reducing review time and labor hours.

Gamification of Employee Training:

- Purpose: Enhancing training processes through interactive and engaging methods.

- Example: Introduction of gamified training modules to improve employee skills and knowledge dynamically and enjoyably.

Notable Examples of Process Automation in Banking:

- JPMorgan Chase: Leveraging machine learning, their COiN platform drastically reduces the time required to manually review commercial credit agreements, resulting in substantial labor-hour savings.

- BNY Mellon: Integration of process automation within their banking ecosystem generates annual savings of $300,000, bringing about diverse operational improvements.

- PrivatBank (Ukraine): Implementing chatbot assistants accelerates the resolution of customer queries and reduces reliance on human assistants across mobile and web platforms, enhancing overall service efficiency.

2. Security

Financial security threats are escalating with the surge in transactions, users, and third-party integrations. Machine learning emerges as a powerful tool for fraud detection, offering real-time monitoring and rapid response capabilities.

Example:

Banks leverage machine learning algorithms to scrutinize thousands of transaction parameters in real-time. Each user’s actions are analyzed, and the transaction’s characteristic fit for that specific user is assessed. This precise model detects fraudulent behavior promptly.

Response Mechanisms:

- Additional Verification: Upon identifying suspicious account activity, the system may prompt users for additional identification to validate the transaction.

- Transaction Blocking: In cases with a high probability (e.g., 95%) of fraud, the system can instantly block the transaction, preventing real-time fraud rather than post-incident detection.

Financial Monitoring: Machine learning aids in detecting money laundering techniques like smurfing by training systems to identify patterns in large numbers of micropayments.

Network Security: Machine learning enhances network security by rapidly analyzing thousands of parameters in real-time, enabling cyber threats’ swift identification and isolation. This technology is anticipated to drive the most advanced cybersecurity networks soon.

Notable Fintech Examples:

Fintech giants, including Adyen, Payoneer, Paypal, Stripe, and Skrill, heavily invest in security machine learning to fortify their platforms against evolving threats.

3. Underwriting and credit scoring

Machine learning algorithms seamlessly integrate into the everyday underwriting tasks prevalent in finance and insurance, offering enhanced speed and accuracy.

- Training Process: Data scientists train models on extensive customer profiles, incorporating hundreds of data entries for each customer. A well-trained system can replicate underwriting and credit-scoring tasks in real-life scenarios, enabling faster and more precise decision-making.

- Scoring Engines: Sophisticated scoring engines, powered by machine learning, significantly augment the efficiency of human employees, streamlining underwriting processes.

- Data Sources: Banks and insurance companies tap into extensive historical consumer data for model training. Alternatively, they leverage datasets from large telecom or utility companies to enrich their training datasets.

Real-world Collaboration Example:

BBVA Bancomer and Destacame:

BBVA Bancomer collaborates with the alternative credit-scoring platform Destacame to enhance credit access in Latin America. Utilizing open APIs, Destacame accesses bill payment information from utility companies. By analyzing bill payment behavior, Destacame generates a credit score for customers, providing the bank with valuable insights to make informed lending decisions.

LendingClub:

- Objective: Enhance peer-to-peer lending decisions.

- Process: LendingClub utilizes machine learning to assess borrowers’ creditworthiness by analyzing a broad range of data, including credit history, income, and debt-to-income ratio.

ZestFinance:

- Objective: Improve credit decisions through machine learning.

- Process: ZestFinance employs machine learning models to analyze alternative data sources, enabling more accurate credit scoring for individuals with limited traditional credit histories.

Kreditech:

- Objective: Provide accessible credit scoring in emerging markets.

- Process: Kreditech leverages machine learning to analyze non-traditional data, such as social media activity and online behavior, to assess credit risk and make lending decisions.

4. Algorithmic Trading and Machine Learning

- Enhancing Decision-Making: In algorithmic trading, machine learning is pivotal in improving trading decisions. A mathematical model actively monitors real-time news and trade results, identifying patterns that influence stock prices. Based on these patterns, the system proactively decides whether to sell, hold, or buy stocks.

- Real-time Analysis: Machine learning algorithms can simultaneously analyze thousands of data sources in real-time feat beyond the capacity of human traders. This enables swift and informed decision-making.

- Market Advantage: Machine learning empowers human traders to gain a slight edge over the market average. In vast trading volumes, this marginal advantage often translates into substantial profits.

Example:

Quantitative Hedge Funds: Several quantitative hedge funds employ machine learning algorithms to analyze market data and execute trades swiftly. For instance, Renaissance Technologies utilizes advanced machine learning techniques to make data-driven investment decisions, showcasing the effectiveness of algorithmic trading in financial markets.

5. Robo-Advisory in Finance

Prominent Role in Finance: Robo-advisors have become integral in the financial landscape, primarily leveraging machine learning in two key areas within the advisory domain.

Portfolio Management:

- Functionality: An online wealth management service employing algorithms and statistics to allocate, manage, and optimize clients’ assets.

- Process: Users input their current financial assets and goals (e.g., saving a million dollars by age 50). The robo-advisor then strategically allocates assets across various investment opportunities, considering risk preferences and specified goals.

Financial Product Recommendations:

- Usage: Many online insurance services utilize robo-advisors to provide personalized insurance plan recommendations to users.

- Decision Factors: Customers opt for robo-advisors due to their lower fees and the appeal of receiving personalized and calibrated recommendations, often surpassing the offerings of personal financial advisors.

Example:

Wealthfront: Wealthfront, a leading robo-advisor, utilizes machine-learning algorithms for portfolio rebalancing and tax-loss harvesting. This example highlights how robo-advisors seamlessly integrate advanced technologies to optimize client portfolios and deliver personalized financial strategies.

How to use machine learning in finance to advance your career?

Using machine learning to further your career in finance entails learning the appropriate skills, obtaining hands-on experience, and staying up with the latest industry trends.

Here are some steps you can take to leverage machine learning in the finance sector and advance your career.

- Educational Background: Start with a foundation in finance or economics and pursue further education in machine learning and data science through certifications or degrees.

- Learn Machine Learning Tools and Libraries: Learn how to use well-known machine learning tools and packages, such as scikit-learn, TensorFlow, R, and Python. Develop proficiency in data visualization tools, as effective communication of results is crucial in a finance setting.

- Specialize in Financial Applications: Focus on machine learning applications relevant to finance, such as algorithmic trading, credit scoring, risk management, and fraud detection. Understand the unique challenges and data intricacies of the financial sector.

- Gain Practical Experience: Work on real-world projects to gain hands-on experience. This could include personal projects, contributions to open-source finance-related projects, or collaboration with industry professionals. Participate in online platforms like Kaggle to engage in data science competitions and solve real-world financial problems.

- Networking: Attend conferences, workshops, and networking events related to finance and machine learning. This helps in building a professional network and staying informed about industry trends. Engage with industry professionals through participation in social media networks, online forums, and discussion groups.

- Stay Informed on Industry Trends: Keep up with finance and machine learning advancements. Subscribe to industry publications, journals, and blogs to stay informed about the latest developments. Follow thought leaders, researchers, and practitioners in finance and machine learning.

- Earn Relevant Certifications: Obtain machine learning and data science certifications from recognized institutions. Certifications can demonstrate your skills and commitment to staying current in the field. Consider finance-specific certifications, such as the Chartered Financial Analyst (CFA), to complement your machine learning expertise.

- Build a Portfolio: Showcase your machine learning projects and their impact on finance in a portfolio. This offers verifiable proof of your abilities and achievements. Highlight any contributions to open-source projects or collaborations with industry professionals.

- Apply for Relevant Positions: Find job opportunities combining finance and machine learning. Positions such as quantitative analyst, data scientist in finance, or algorithmic trader may align with your skill set. Tailor your resume to emphasize your machine learning skills and their applications in finance.

Challenges and Opportunities

The following are some challenges and opportunities associated with implementing machine learning in finance:

Challenges

- Data Privacy and Security: Using sensitive financial data poses privacy and security issues. Ensuring compliance with data protection standards and against cyber attacks is critical.

- Model Explainability: Machine learning models often operate as “black boxes,” making it challenging to explain their decisions. The lack of transparency may hinder regulatory compliance and user trust.

- Overfitting and Bias: Overfitting to historical data and including bias in datasets can result in inaccurate predictions and reinforce existing discrepancies. These concerns must be addressed if models are to be fair and trustworthy.

- Integration with Legacy Systems: Financial institutions often operate on legacy systems, making the seamless integration of machine learning technologies challenging. Compatibility issues and resistance to change pose implementation obstacles.

Opportunities

- Improved Decision-Making: Machine learning enhances decision-making by analyzing vast datasets, identifying patterns, and making predictions. This leads to more informed and data-driven choices across various financial processes.

- Efficiency Gains and Cost Reduction: Automating operations like risk assessment, fraud detection, and customer service with machine learning improves operational efficiency while lowering costs and simplifying procedures.

- Innovation in Financial Products: Machine learning opens avenues for innovative financial products and services. Personalized recommendations, automated trading strategies, and dynamic risk management contribute to product diversification.

- Enhanced Customer Experience: Personalization through machine learning enables tailored financial services, improving customer satisfaction. Chatbots and virtual assistants provide real-time support, enhancing the overall customer experience.

- Regulatory Compliance: Despite challenges, machine learning offers tools for better regulatory compliance. Automated solutions can assist in meeting complex and evolving regulatory requirements in areas such as anti-money laundering and knowing your customers.

- Quantitative Analysis and Predictive Insights: Machine learning enables sophisticated quantitative analysis, providing deeper insights into market trends, customer behavior, and economic conditions. Predictive analytics aids in anticipating and responding to changes in the financial landscape.

Ethical Considerations

- Bias and Fairness: Ensure algorithms are free from biases that may disproportionately impact specific demographics. Regularly audit and adjust models to address any unintended biases.

- Transparency and Explainability: Prioritize the development of transparent models to enhance user trust. Provide clear explanations for model decisions, especially in financial contexts where accountability is paramount.

- Privacy Protection: Safeguard sensitive financial information and adhere to data protection regulations. Implement encryption and anonymization techniques to protect customer privacy.

- Informed Consent: Individuals whose data is used for training machine learning models should be given clear information about how their data will be used and for what purposes, and their informed consent should be obtained.

- Regulatory Compliance: Adhere to financial regulations and guidelines. Ensure that machine learning practices align with legal requirements, especially concerning anti-money laundering (AML), and know your customer (KYC) regulations.

- Security Measures: Implement robust cybersecurity procedures to guard against attacks or breaches. Financial organizations must prioritize the security of machine learning models and the data they manage.

- Mitigating Unintended Consequences: Anticipate and mitigate unintended consequences of machine learning applications. Regularly assess the social and economic impacts, taking corrective actions when necessary.

- Human Oversight: Maintain human oversight throughout the machine-learning process. Humans should interpret results, make critical decisions, and uphold ethical standards.

- Fairness in Credit Scoring: Address challenges related to fairness in credit scoring by avoiding discriminatory factors and ensuring that credit decisions are made based on relevant and non-discriminatory criteria.

- Continuous Monitoring and Auditing: Implement continuous monitoring and auditing of machine learning models to detect and rectify any ethical concerns that may arise over time. Regularly reassess models in real-world scenarios to ensure ongoing ethical behavior.

Future Trends in Machine Learning for Finance

- Explainable AI (XAI): Increasing demand for transparent models as regulatory bodies and stakeholders seek more precise insights into machine learning decisions.

- Reinforcement Learning: Growing adoption of reinforcement learning for dynamic decision-making in portfolio optimization and algorithmic trading areas.

- Quantum Machine Learning: Exploration of quantum computing applications to solve complex financial problems, providing exponential speedup for specific algorithms.

- Natural Language Processing (NLP): Advancements in NLP for sentiment analysis and processing unstructured data, aiding in market forecasting and customer interactions.

- Automated Machine Learning (AutoML): Rise of AutoML tools that automate the end-to-end machine learning pipeline, enabling non-experts to deploy models efficiently.

- Responsible AI Frameworks: Increasing emphasis on developing and adopting reliable AI frameworks to address ethical concerns, bias, and fairness in financial machine learning applications.

- Federated Learning: Emergence of federated learning to securely train models across decentralized devices, preserving data privacy in collaborative financial ecosystems.

- Robotic Process Automation (RPA): Integration of RPA with machine learning for enhanced process automation in financial institutions, streamlining routine tasks and reducing operational costs.

- Exponential Growth in Big Data: Continued growth in financial data volume and variety necessitating advanced machine learning techniques to extract valuable insights.

- Experiential AI: Evolution towards AI systems that learn from experience, adapting and improving over time in response to changing market dynamics and user behaviors.

Conclusion

Integrating machine learning into finance brings a transformative era of improved decision-making, greater efficiency, and innovative solutions. As we navigate the evolving landscape of financial technology, it is important to prioritize the ethical application of machine learning. The future holds even more advancements, including transparent AI, reinforcement learning, and quantum computing, shaping a landscape where responsible, data-driven insights empower financial professionals. The finance industry can unlock unprecedented opportunities by embracing these trends, ensuring its resilience and adaptability in an ever-changing global market.

FAQ’s

Q1. How does machine learning contribute to risk management in finance?

Answer: Machine learning models are employed in risk management to identify and assess various financial risks. These models analyze data to predict and mitigate potential risks proactively.

Q2. What ethical considerations are important in machine learning for finance?

Answer: Ethical considerations in financial machine learning include addressing bias, ensuring transparency, protecting privacy, and maintaining human oversight while complying with regulations and responsible data use.

Q3. What are the emerging trends in machine learning for finance?

Answer: Some emerging topics include explainable AI, reinforcement learning, quantum machine learning, natural language processing, and responsible AI frameworks. These trends reflect the field’s continual innovation and progress.

Q4. How can machine learning enhance customer service in finance?

Answer: Machine learning contributes to enhanced customer service through chatbots and virtual assistants. These AI-driven tools provide personalized assistance, answer queries, and improve customer experience.

Recommended Articles

We hope that this EDUCBA information on “Machine Learning in Finance” was beneficial to you. You can view EDUCBA’s recommended articles for more information,