Updated July 7, 2023

What is the Marginal Cost of Capital?

The term “marginal cost of capital” refers to the incremental cost of financing that a business has to bear due to raising an additional dollar of funding.

The combined cost of equity, debt, and other forms of financing is determined by considering their respective weights in the portfolio. Businesses utilize this measure when deciding on a proposed capital structure.

Examples of Marginal Cost of Capital (With Excel Template)

Let us look at the following criteria to understand the concept of it.

Example #1

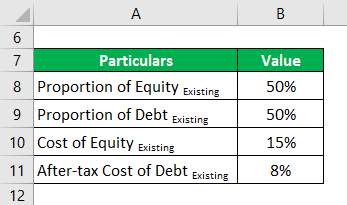

Let us take the example of ABC Inc., whose current capital structure of $50 million is a mix of 50% equity capital and 50% debt. The cost of equity is 15%, and the after-tax cost of debt is 8%. The company intends to expand its current business, which needs to raise funds worth another $25 million. The company has decided to raise capital similar to the existing capital structure as it suits its risk appetite and business objectives. Determine the current average cost of capital and the marginal cost of capital of the new capital, assuming that the specific cost of capital didn’t change.

Solution:

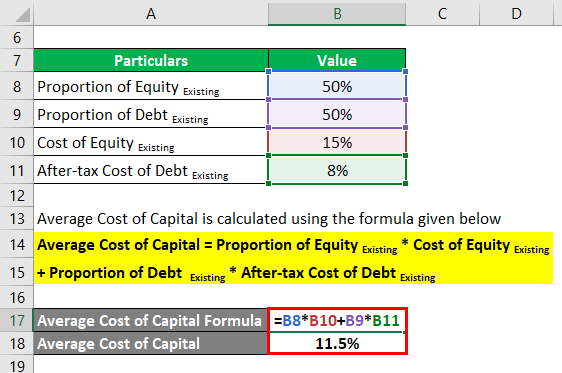

The formula to calculate average cost of capital is as below:

- Average Cost of Capital = 50% * 15% + 50% * 8%

- Average Cost of Capital = 11.5%

The marginal cost of capital will precisely equal the average cost of capital since there were no changes in the proportion and specific cost of capital for the new funding. Therefore, it will be 11.5%.

Example #2

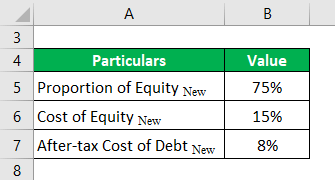

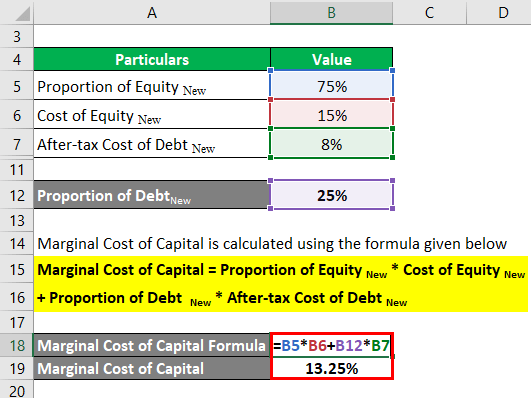

Let us take the above example and assume that the proportion of equity in the new funding is 75% while the specific cost of capital remains the same. Then, determine the marginal cost of capital in this revised case.

Solution:

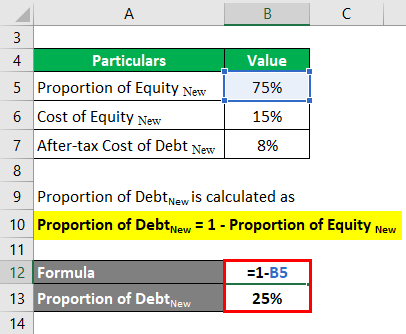

The calculation of the proportion of DebtNew is as below:

- Proportion of DebtNew = 1 – 75%

- Proportion of DebtNew = 25%

The cal

- Marginal Cost of Capital = 75% * 15% + 25% * 8%

- Marginal Cost of Capital = 13.25%

So, the increase in the proportion of equity capital increased the cost of capital from 11.5% to 13.25%.

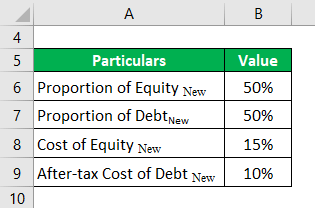

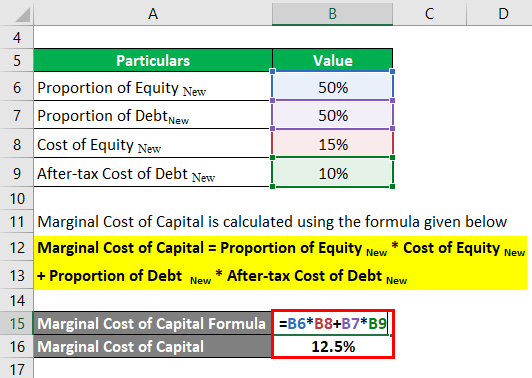

Example #3

Let us again take the above example and assume that the after-tax cost of debt has increased to 10% while the cost of equity and the proportion of equity and debt continues to remain the same as in Example 1. Determine the marginal cost of capital in this revised case.

Solution:

It is calculated using the formula given below

Marginal Cost of Capital = Proportion of Equity Existing * Cost of Equity Existing + Proportion of Debt Existing * After-tax Cost of Debt Existing

- Marginal Cost of Capital = 50% * 15% + 50% * 10%

- Marginal Cost of Capital = 12.5%

So, the increase in the after-tax cost of debt increased the cost of capital from 11.5% to 12.5%.

Uses of Marginal Cost of Capital

The following are the major uses:

- It can be used to estimate the breakpoint in the case of a fresh injection of investments. A breakpoint refers to the point until a company can continue to raise additional funds without an increase in it.

- Companies ensure this is less than the expected return on the proposed investments. Hence, it is used in making investment decisions.

- Analysts use this in addition to discounted cash flow models for asset valuation.

Why is it important?

This plays a role in asset valuation and financial analysis. The management also uses it while making critical capital budgeting decisions. Financial analysts usually compare this to the return on a project to evaluate its financing options and business viability. A good project typically has a higher spread between the marginal cost of capital and the expected return on investment.

Benefits

Some of the significant benefits are as follows:

- It helps monitor the change in the overall cost of capital due to the infusion of additional funds.

- Helps the management decide whether to go ahead with a project based on the financing options and the expected future cash flows.

- It helps decide the means of new funds and their respective proportions.

Disadvantages

Some of the major disadvantages are as follows:

- It tends to ignore the long-term implications of raising additional funds.

- The concept of this is not relevant for a new company.

Key Takeaways

Some of the key takeaways of the article are:

- This refers to incremental funding costs as businesses keep raising funds.

- This metric is critical as companies use it while making future capital structure decisions.

- Financial managers also use it to select the sources of funds and their respective proportions.

Conclusion

So, this concept is essential for businesses as it helps them decide on critical project funding. It can be the difference between the success and failure of a project.

Recommended Articles

This is a guide to the Marginal Cost of Capital. Here we discuss how to calculate it along with practical examples and downloadable excel templates. You may also look at the following articles to learn more –