Updated July 7, 2023

What is Marginal Costing?

Marginal costing is an accounting measure determining the cost of producing additional output units. For example, a company produces 60 units of a product at $1.6 per unit for a total of $100. They receive an order of 90 units which the company makes for $140. In this case, the marginal cost for each additional unit becomes ($140-$100)/(90-60), which is $1.3 per unit.

In other words, it refers to the adjustments in total when producing one more unit of the product/service. It considers both fixed and variable costs for the process.

Key Highlights

- Marginal costing, in economic terms, describes how the changes in production quantity reflect production costs.

- The equation to calculate this metric is by dividing the difference in costs by the change in produced quantity.

- Its prominent characteristics are the determination of a firm’s profitability along with its profit-maximizing level of production, valuation of its stocks, and more.

- Although this measure helps businesses with budget planning and decision-making, cost segregation is one of its complex factors.

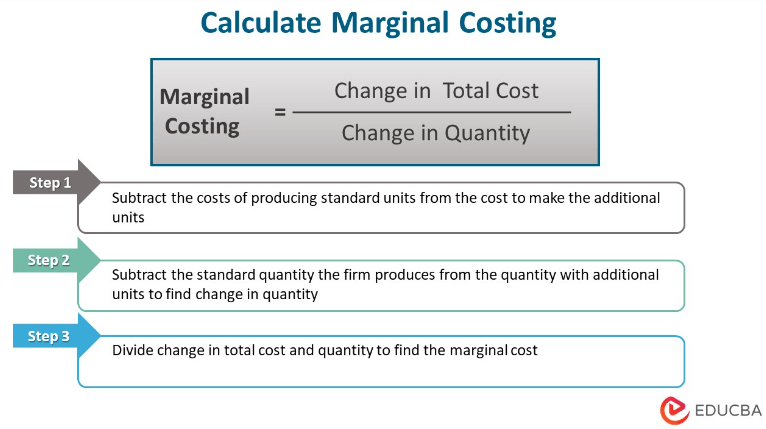

How to Calculate Marginal Costing Using Formula?

1. Determine the Quantity Change

- Initially, the company needs to ascertain the number of units they produce on a regular scale. It will be the number of standard units.

- In case of variation in the standard quantity, the company needs to record the number of units of production.

- Subtracting the original quantity the firm usually produces from the quantity value containing additional units gives the change in quantity.

- For example, a firm usually produces 100 units of a product. For custom orders, they make 160 units. Therefore, they had to build 60 additional units.

2. Determine the Cost Change

- Determine the total cost of production by summing the variable and fixed prices for a given units

- Fixed costs do not change throughout the evaluation period. Capital outlays (such as equipment), and rental fees are fixed costs

- Variable costs can change depending on the circumstances. Services, employee payroll, and raw materials are examples of variable costs

- After computing total costs for standard units of production and additional units, less the costs of producing standard units from the new price, including the additional units

- For example, a company produces its standard unit of products at $500. It costs the company $700 to make more than the standard unit. Therefore, the total cost will be $200.

3. Calculate the Marginal Costing

- Once you have the change in total cost and quantity, divide them to derive each additional unit’s marginal cost

- It is usually lower than the average unit cost, but it can also be equal.

Marginal Costing Example

Example #1:

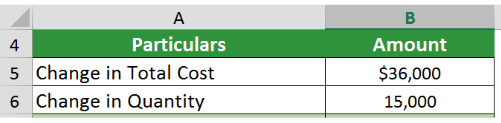

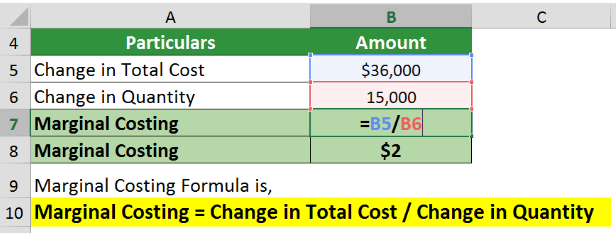

A manufacturing company’s product price is $2.5. After receiving a custom order, they record a change in their quantity and production costs as follows,

- Change in quantity = 15,000

- Change in total costs = $36,000

Calculate the marginal cost of each additional unit.

Given,

Implementing the formula,

The marginal cost for each extra unit is $2.

Example #2:

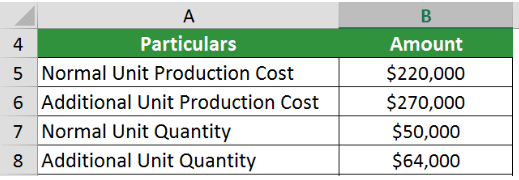

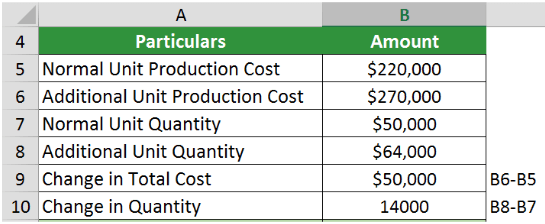

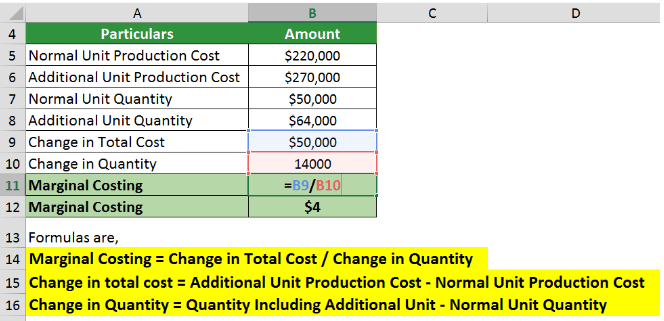

Company ABC produces 50,000 units every year at the cost of $220,000. In 2022, it produced additional units totaling 64,000 at $270,000. Calculate the additional unit’s marginal rate.

Given,

Calculating the change in the measures,

Implementing the formula,

Each additional unit’s marginal cost is $4.

Features & Characteristics of Marginal Costing

- It can determine the impact of variable costs on production volume

- The contribution of each product or department serves as the foundation for determining their profitability

- It can help with the pricing of products to elevate profit margins at minimal costs

- Values the stock of work in progress and finished products solely on variable costs

- It is a helpful technique that contributes to analyzing profits concerning cost and capacity. Additionally, it also splits semivariable costs into fixed and variable components

- It affects profit despite no change in the selling price. With an increase in production, the average cost falls, and the average & total profit rises.

Marginal Costing Assumptions

Following are the assumptions,

- Segregation between fixed and variable costs is attainable

- The cost to produce a unit is constant. However, this assumption is not always valid because sometimes there are variable costs such as materials and labor.

- The price to sell the product remains the same before and after the production of additional units

- The only metric that modifies the costs is the change in the quantity of the output.

Absorption Costing vs. Marginal Costing

| Absorption Costing | Marginal Costing |

| The products costs include both variable and fixed costs | The product costs only considers variable costs, while fixed costs are for the period |

| The allocation of the costs is for each unit of production | The cost allocation is separate for the base units and the additional units |

| It is on a per-batch basis, i.e., it considers all costs incurred for producing one more batch | It uses a per-unit basis, i.e., it considers the additional cost incurred for making one more unit |

| The overhead costs are considered and range from production and administration to costs for distribution. | It takes into account fixed and variable overhead costs. |

Advantages & Limitations

| Advantages | Limitations |

| It makes it easier to calculate the cost of sales, resulting in greater accuracy in profit calculation | It isn’t easy to separate costs into fixed and variable, as their distinction is only valid in the short term. |

| By excluding fixed costs, it eliminates difficulties in allocating, distributing, and absorbing overheads | It mitigates fixed overheads, but the issue persists in the case of variable overheads |

| The method of valuing shares becomes very simple | Excluding fixed costs leads to an underestimation of the share’s value |

| Companies manufacturing various products can prepare a comparative profitability statement which assists in informed product decisions | One cannot determine the price solely based on the contribution |

| It can help determine the price of your product/service to make a profit. | The sales function is given more weight over the production function. However, a business’s efficiency valuation should combine the sales and production functions. |

Marginal Costing Importance

- A clear division of costs into fixed and variable elements makes the flexible budget control system simple and effective, allowing for more practical cost control

- It aids in profit planning through the use of balance sheets and profit charts

- It is an effective tool for determining efficient sales, production policies, or pricing decisions, especially when the business is in a slump.

Frequently Asked Questions(FAQs)

Q1. What are the applications of marginal costing?

Answer: Marginal costing is a way for companies to determine whether it’s worth producing another product. It helps them budget, forecast, and assess their profit on each product to make product-related decisions.

Q2. What is marginal-cost pricing?

Answer: Marginal-cost pricing is a strategy where companies sell a product/service where the cost of an additional unit is meager. Firms apply this when they detect a decline in demand for a product. For example, if the marginal cost of a product is $5 and the original selling price is $10, the firm may move the selling price to $6 or $7. They believe lower profit is better than no product profit.

Q3. How is the marginal and average cost different?

Answer: The determination of the marginal cost is different from that of the average basket. The average cost divides the total price by the total produced units to determine the price per unit. On the other hand, marginal cost is a generalized cost per additional unit when creating one more element.

Q4. What is the short-run marginal cost?

Answer: It represents the cost change in terms of a graph. The graph in the short run is U-shaped, where the x-axis and y-axis represent the quantity and costs, respectively.

Recommended Articles

This article explains everything about Marginal Costing. Read the following articles to learn more,