Updated July 25, 2023

Difference Between Marginal vs Effective Tax Rate

The confusion between Marginal vs Effective Tax Rate is very common. Taxes are not necessarily paid on the entire income you earn but on the income after considering the different provisions. This is precisely the difference between marginal and effective tax rates.

Different countries follow different tax methods and there is also a difference in the tax brackets. Knowing the differences between these two rates is necessary for effective tax planning. The below table summarizes the difference between these rates.

What is the Marginal Tax Rate?

The marginal tax rate defines the tax individuals pay on each additional dollar of earned income, applying the rate corresponding to the next highest tax bracket as their income increases. From the taxpayer’s perspective, the tax paid on the income differs from the marginal tax rate.

What is an Effective Tax Rate?

The effective tax rate is the actual tax that is due based on your income and provisions. It is calculated as actual taxes divided by pre-tax income. The marginal and effective tax rate differential is because of the difference between the income on the financial statements and total taxable income while calculating tax returns.

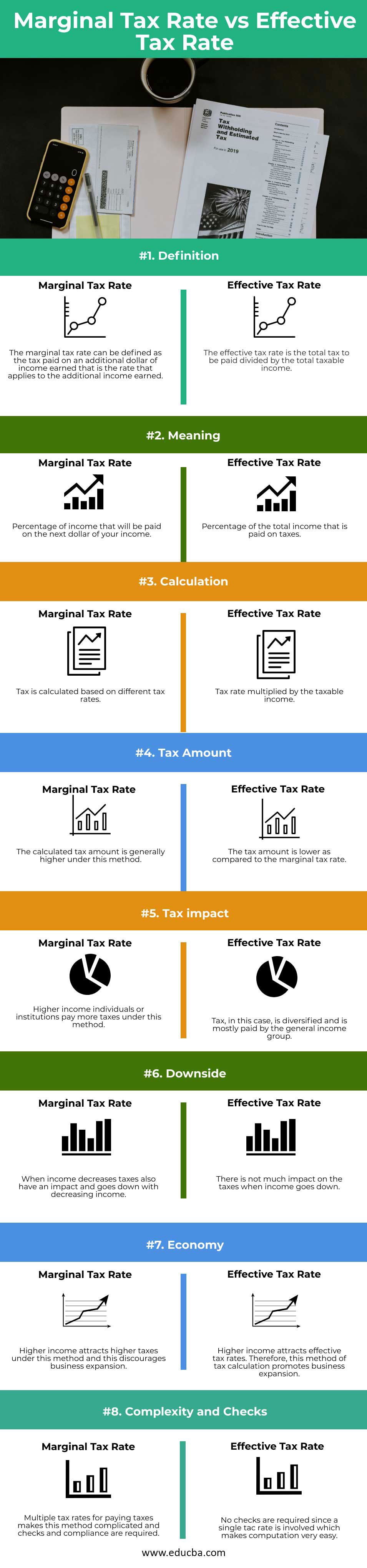

Head to Head Comparison Between Marginal vs Effective Tax Rate (Infographics)

Below are the top 8 differences between Marginal and Effective Tax Rate

Key Differences Between Marginal vs Effective Tax Rate

Let us discuss some of the major Difference Between Marginal vs Effective Tax Rate

- The government applies the marginal tax rate to determine the percentage of income you pay on the next dollar you earn, while they calculate the effective tax rate as the percentage of your total income that you pay in taxes.

- The marginal tax rate defines the tax an individual pays on each additional dollar earned as the rate applied to the additional income. The effective tax rate calculates the total tax to be paid by dividing it by the total taxable income.

- The computation of taxes under the marginal tax rate involves calculating based on multiple tax rates, which makes the process complex and requires additional compliance checks. On the other hand, the effective tax method simplifies computation by relying on a single rate, eliminating the need for additional compliance checks.

- Revenue collected by the government under the marginal tax system is higher than under the effective tax rate.

- The income decrease aligns with the marginal tax rate, resulting in a decrease, whereas the effective tax rate remains relatively unaffected by the decrease in income.

- Higher income attracts higher taxes under the marginal tax rate method, discouraging business expansion. On the other hand, higher income attracts effective tax rates. Therefore, this method of tax calculation promotes business expansion.

- Higher-income individuals or institutions pay more taxes under the marginal tax rate method, while the tax burden under an effective tax rate mostly falls on the general group level.

- Let us understand this by looking at a simple example and how these taxes will be calculated.

Marginal Tax Rate

Let us consider an individual, Mr. A, who is a citizen of the USA and has a total income of $50,000. Let’s assume that he will be taxed at 25%. So if Mr. A gets a raise next year and his income increases to $5800 next year, then $800 will be taxed at 25%.

Effective Tax Rate

Let us assume that Mr. A’s total tax is $5000 on his income of $50,000. His effective tax rate will be $50,000 / $5000 = 10%

Marginal vs Effective Tax Rate Comparison Table

Let’s discuss the top comparison between Marginal vs Effective Tax Rates:

| Basis for Comparison | Marginal Tax Rate | Effective Tax Rate |

| Definition | The marginal tax rate can be defined as the tax paid on an additional dollar of income earned; that is, the rate that applies to the additional income earned. | The effective tax rate divides the total tax to be paid by the total taxable income. |

| Meaning | You will pay a percentage of your income on the next dollar earned. | Tax payments constitute a percentage of the total income. |

| Calculation | Calculated based on different tax rates | Tax rate multiplied by the taxable income |

| Tax Amount | The calculated tax amount is generally higher under this method | The tax amount is lower as compared to the marginal tax rate |

| Tax impact | Higher-income individuals or institutions pay more taxes under this method | Tax, in this case, is diversified and is mostly paid by the general income group |

| Downside | When income decreases, taxes also have an impact and go down with decreasing income. | There is not much impact on the taxes when income goes down |

| Economy | Higher-income attracts higher taxes under this method, and this discourages business expansion | Higher income attracts effective tax rates. Therefore, this method of tax calculation promotes business expansion. |

| Complexity and Checks | Tax payments become complicated due to multiple tax rates, which necessitate checks and compliance. | Computation becomes very easy since a single tax rate eliminates the need for checks. |

Conclusion

It is important to know the differences between the marginal and effective tax rates to make good tax decisions. People may have said that their effective tax rate is ~30%. This is higher than what they pay because they mainly focus on the marginal tax rate. The marginal tax rate regime is followed by many countries worldwide since it is considered very logical as it taxes individuals or institutions based on income.

Recommended Articles

This has been a guide to Marginal vs Effective Tax Rate. Here, we have discussed the Marginal vs Effective Tax Rate key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –