Updated July 21, 2023

Introduction to Market Maker

Market maker are financial intermediaries who are either ready to take up the buy or the sell position in a market transaction and therefore act as a counterparty by positing both buy and sell quotes and by building up the inventory of the securities to fulfill the requirements or act as the connecting point between buyers and sellers thereby providing liquidity to the traders.

Explanation of Market Maker

These market makers are governed mainly by the security regulators such as the SEC in the US or the SEBI in India. Therefore they have to follow the regulators’ guidelines and act within them. They limit the amount of inventory they can hold without affecting the market’s integrity; therefore, when a large trade has to be executed, several market makers must come together to fulfill the same.

They are required to provide liquidity in the market so that the trades can be executed at an optimal transaction cost, and the markets can function seamlessly. If market makers are not available, then the number of transactions can be affected, and overall investing can get reduced. It is similar to having a network of retail outlets for the products to be sold so that the buyers and sellers can reach out to their nearest shop to acquire goods and services.

Role of Market Maker

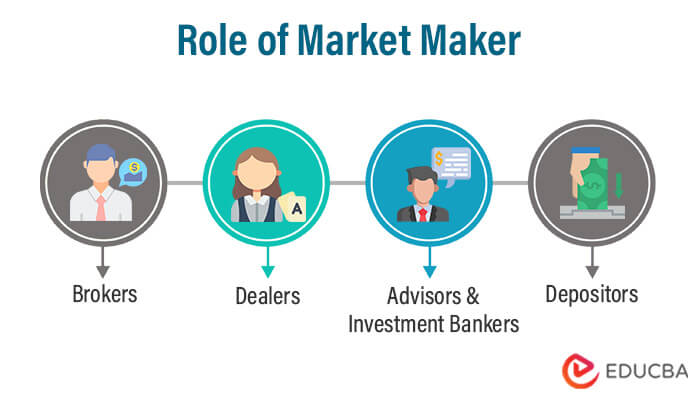

Depending upon the portfolio of the products and services provided, the market makers may play different roles in the market:

- Brokers: They act as financial intermediaries who connect buyers to sellers. They don’t trade themselves; they only provide a platform wherein the buyers can post a buy intention, a seller can post a sell intention, and the broker helps them meet and execute the trades for them. The most crucial role here for the broker is to get his client the best possible execution; for the same, they charge a fee or a commission from the client.

- Dealers: They act as the counterparty to the transaction. The buyers buy from the dealers, and dealers fulfill the order from their inventory while the sellers sell to dealers, and the dealer builds up inventory. For them, the main role is to satisfy the trader’s demand. The dealer profits from the bid-ask spread from the ‘’buy low sell high phenomena.

- Advisors & Investment Bankers: These can be market participants who provide services to M&A or IPO clients, for example, underwriters, securitizers, etc. They help in the issue of securities of a company or in striking an M&A deal.

- Depositors: In the case of securities such as the ADRs or GDRs, the issuer and the investor come in contact through a depository participant who helps the issuers in raising capital from the markets where they are not listed directly and helps investors in gaining exposure to such securities

One of the critical roles that the market makers play is providing liquidity in the market and helping execute large trades. Most times, they act on behalf of institutional investors who need large blocks of investment, and therefore they would want the best execution for the same; however, it is not the case that the retail investors can’t get help from them, provided their fees are within reach of smaller investors.

Examples of Market Maker

Below are a few market makers companies along with their four-letter market maker codes for the NASDAQ in the US

- GSCO: Goldman Sachs & Co

- MLCO: Merrill Lynch<

- FBCO: Credit Suisse Securities LLC

- DBAB:Deutsche Bank Securities

- MSCO: Morgan Stanley & Co. Inc.

- JPHQ: JP Morgan Securities, Inc.

GSCO specializes in equity, fixed income, currency, and commodity domains as a market maker, to give an example. As part of this process, they take orders from clients and provide investment research, market information, analysis, and other related products.

How do Market Makers Make Money?

Two of the essential sources of market-making are the follows:

- Bid-ask Spread: This is one of the primary sources of profit for dealers. A bid is a price they buy the securities at, and an ask is a price they sell them for. The difference between the two prices is known as the spread, which is the dealer’s profit before accounting for his expenses.

- Commission or Fee: For brokers, advisors, and investment bankers, one of the most important sources is the fee or the commission they take from their clients for their services. These are fixed fees; therefore, they are often not linked with performance in the client’s interest because otherwise, they may create a conflict of interest rather than incentivize.

There can be other customized arrangements for income between the client and the market makers within the acceptable guidelines of the regulators.

How do Market Makers Impact Liquidity?

- Counterparty: It is not always possible that the security buyer may find a seller, and due to this timing difference, there can be great illiquidity in the market. The market maker, such as the dealer, builds up the inventory and acts as a counterparty, thus removing the effect of this difference in timing.

- Block Trading: Market makers build up inventory and can execute large trades for institutional investors individually or in groups. These make investing possible for large investors without impacting the price in the market in a regular course.

Advantages and Disadvantages

Below are mentioned the advantages and disadvantages:

Advantages

Following are the advantages given below:

- Investor Confidence: The presence of market makers brink investor confidence because that implies that the securities are worth investing in. Market makers have the expertise of analyzing securities from an angle that smaller investors can’t; their activities act as a barometer for the securities in the market.

- Security Availability: Depositors make available securities unavailable to investors, making investing in such securities easier and safer because they act as custodians and help the investor get the desired exposures.

- Seamless Markets: By bringing liquidity and volume to the market, the market makers help inefficient functioning of the markets.

Disadvantages

Following are the disadvantages are given below:

- Conflict of Interest: Most times, the market makers function as brokers and dealers; this leads to a conflict of interest because as a broker, they are supposed to get the clients the best execution, while as dealers, they become the counterparties and therefore trade for profit. Creating such a divide within the organization is difficult; therefore, investors must be cautious.

- Impact Market Integrity: Market makers deal in a large number of securities and therefore have the power to influence the price in the market. Therefore, their actions might impact the integrity of capital markets. Their actions may attract herding behavior in the investors, and consequently, such practices might not be suitable for the health of the market and investing.

- Insider Trading: Market makers have a lot of information that is not publicly available, and therefore there is always a possibility that some individuals might indulge in insider trading and therefore make unfair profits which can lead to severe regulatory actions and innocent investors get affected for no fault of theirs.

Conclusion

Therefore we know that there are different types of market makers who fulfill different roles in the financial markets, from acting as intermediaries to the counterparty to advisors and so on. They help create liquidity, availability, and volume in the market and make it run efficiently and seamlessly. They earn from fees or spread.

However, every coin has the other side too. They have greater information availability and the power to affect the markets. Therefore they have a great responsibility to maintain market integrity and act in the best interest of their clients by overcoming various kinds of conflicts of interest.

Recommended Articles

This is a guide to Market Maker. Here we also discuss the introduction to Market Maker and how these makers impact liquidity with advantages and disadvantages. You may also have a look at the following articles to learn more –