Updated February 7, 2023

Difference Between Market Order vs Limit Order

The following article provides an outline for Market Order vs Limit Order. In layman’s terms, an order simply means an instruction for a particular action. Here, we are going to refer to capital market transactions. While executing a transaction, a contingency may arise regarding a perfect time to execute a particular order. This can be avoided by identifying and placing any particular type of order to give effect to the desired result.

Order: Requirements

An order, whether placed by a buyer or a seller, essentially requires the following details:

- Price

- Quantity (Lot size)

- Name / Ticker of the stock

Market Order

This is the most basic type, where the buyer (or seller) quotes a particular price for a particular stock, and the order will be executed at that instance. This is a real-time order, where the buyer (or seller) can identify a moment when the markets reach a desired level, and it is the right time to enter into a transaction. The transaction gets executed the moment that the party enters the requirement.

For example:

John places a market order to buy 1500 stocks of ABC Corporation at $10.00.

In this case, John places his order to purchase the stock when the market reaches $10.00 for ABC Corp. However, like John, there may be many other participants who would have placed their orders at that instance. Hence by the time, John’s order gets finally executed, the price may have gone up to $10.10 or down to $9.90. A practical problem may arise when the lot size does not match the quoted price, meaning the seller(s) may sell a smaller lot (say only 1000 stocks). Hence only 1000 stocks could be purchased at $10.00, and the rest had to be traded at the best available price after that.

Limit Order

This order type has been specially designed to limit losses. With this, a buyer sets a limit to the price of the stock, whereby the order gets executed only if the spot price in the market is equal to or lower than that set price. This ensures that the buyer will not lose if prices do not reach that limit based on his trading analysis of the correct price. Similarly, a seller can set a limit too, and the order gets executed only if the prices reach that limit or higher.

For Example:

John had bought 1500 stocks of ABC Corporation @$10.00 each. Markets are volatile, and prices keep on fluctuating. The current spot price is $10.50, and John has a bearish market view, so he wishes to sell them off. Hence, John gives instructions for a limit order, with a transaction to be executed at no less than $9.80.

In this case, the order will be executed for potential buyers bidding for $9.80 or more for ABC Corp. Thus, John can make a profit if stocks are sold at $10.00 or more and, consequently, limit his losses to $9.80 per stock.

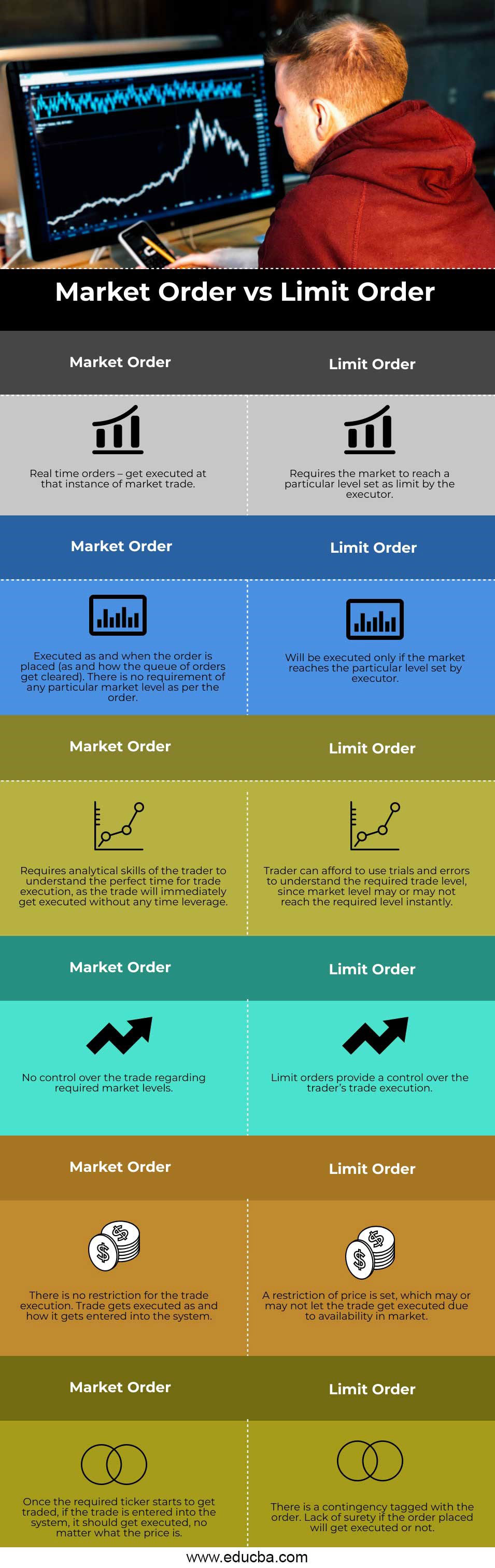

Head-to-Head Comparison Between Market Order vs Limit Order (Infographics)

Below are the top 6 differences between Market Order vs Limit Order:

Key Differences Between Market Order vs Limit Order

Let us discuss some of the significant differences between Market Order and Limit Order:

- Both the market and limit orders intend to execute a transaction in the markets, with differences in their execution structure. While a limit order does have the functionality of setting a limit over price, it may be used as a market order by entering the current market price.

- Unlimited risks are involved with market orders, as the trader needs to trade at the existing market levels. The risk gets enhanced when the trade gets queued up and executed at the best available price, which may be away from the required price.

- The risk gets reduced upon trading with a limit order, as a limit can be set below (or above), and the trade is not executed.

- Thus, both types of orders have their own merits and demerits attached. It required an in-depth understanding of which works better for a particular trade.

Market Order vs Limit Oder Comparison Table

Let us discuss the top comparison table between Market Order vs Limit Order:

| Market Order | Limit Order |

| Real-time orders – get executed at that instance of market trade. | Requires the market to reach a particular level set as a limit by the executor. |

| Executed as and when the order is placed (as and how the queue of orders get cleared). There is no requirement of any particular market level as per the order. | It will be executed only if the market reaches a particular level set by the executor. |

| The trader requires analytical skills to understand the perfect time for trade execution, as the trade will immediately get executed without any time leverage. | A trader can afford to use trials and errors to understand the required trade level since the market level may or may not reach the required level instantly. |

| No control over the trade regarding required market levels. | Limit orders provide control over the trader’s trade execution. |

| There is no restriction for trade execution. Trade gets executed as and how it gets entered into the system. | A restriction on the price is set, which may or may not let the trade get executed due to availability in the market. |

| Once the required ticker starts to get traded, if the trade is entered into the system, it should get executed, no matter what the price is. | There is a contingency tagged with the order. Lack of surety if the order placed will get executed or not. |

Conclusion

The market order is the default method practiced for trading, with different variants like a limit order, stop-loss order, peg orders, etc. A market order can be risky if there is a lack of analysis. A limit order is less risky, intending to limit the party’s losses. Nevertheless, it cannot be denied that any trade in the marketplace needs solid analytical understanding, and be it any order, it takes good analysis to determine the price to trade at.

Recommended Articles

This is a guide to Market Order vs Limit Order. Here we have discussed the Market Order vs Limit Order key differences with infographics and a comparison table. You can also go through our other suggested articles to learn more –