Updated November 27, 2023

Markup Price Formula (Table of Contents)

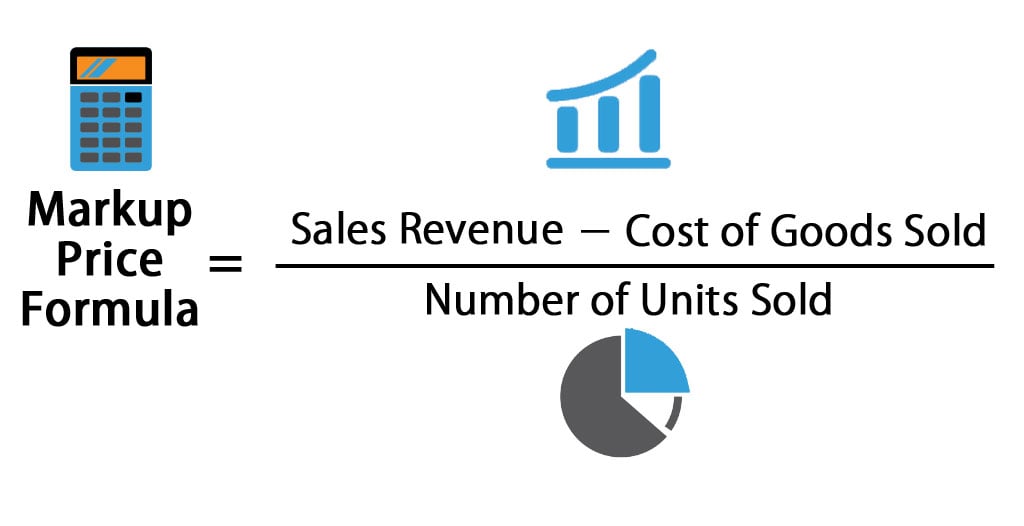

Markup Price Formula

The seller defines the markup price as the additional price or profit garnered above the total cost of a good or service.

Here’s the Markup Price formula –

Examples of Markup Price Formula

Let’s take an example to find out the Markup Price for a company: –

Example #1

Let’s take the example of company X, whose overall sales revenue is $20000. The cost of goods sold by the company is $10000. The number of units sold by the company is 1000.

The markup Price for company X is calculated using the formula below

- Markup Price = (Sales Revenue – Cost of Goods Sold) / Number of Units Sold

- Markup Price = ($20000 – $10000) / 1000

- Markup Price = $10000 / 1000

- Markup Price = $10 for each unit

Example #2

Let us take an example of the company Apple, whose overall sales revenue is $500 million. The cost of goods sold is $100 million. The number of units sold is 10 million.

Markup Price for company Apple is calculated using the below formula

- Markup Price = (Sales Revenue – Cost of Goods Sold) / Number of Units Sold

- Markup Price = ( $500 million – $100 million ) / 10 million

- Markup Price = $400 million / 10 million

- Markup Price = $40 million

Example #3

Let us take an example of the company Crompton Greaves, whose overall sales revenue is $50 million. The cost of goods sold is $20 million. The number of units sold is 5 million.

Markup Price for company Crompton Greaves is calculated using the formula below.

- Markup Price = (Sales Revenue – Cost of Goods Sold) / Number of Units Sold

- Markup Price = ( $50 million – $20 million ) / 5 million

- Markup Price = $30 million / 5 million

- Markup Price =$6 million

Explanation of Markup Price Formula

The seller defines the markup price as the additional price or profit garnered above the total cost of a good or service. They also define it as the difference between the Average Selling Price per unit and the Average Cost Price per unit.

Companies generally use the markup price to determine the price they should charge the consumer to turn their business into a profit.

Significance and Use of Markup Price Formula

Markup price is one of the important metrics companies and businesses use to figure out their pricing strategy. The ultimate objective of any business is making a profit; hence, markup price should be as such so that the cost of goods sold and operating expenses are taken care of so that the overall company turns a profit. The firms have to figure out the extent of a price that can be stretched, which consumers will buy, and there will not be any drop in sales. Hence, that should be the extent of markup which would make the business profitable. The higher selling price the firm can charge indicates greater consumer confidence, even if it charges a higher price. Markup price is essential for a company that starts its operations because it helps estimate cash flows.

Markup price is different than the Gross Profit Margin. Companies generally use markup prices to choose a selling price so that it covers its production costs and turns a profit. At the same time, the Gross Profit Margin is used, mostly by investors, to determine a firm’s profitability. Another way of differentiating them is that markup is a cost multiplier while margin is a percentage of the selling price. Markup is a function of cost, while the gross margin is a function of sales. Markup is defined from the buyer’s perspective, while Gross Profit Margin is defined from the seller’s perspective.

One can figure out the difference between Gross Profit Margin and Markup price from the following: –

- To achieve a Gross Profit Margin of 10%, the Markup Price Percentage by the company should be 11.1%

- To achieve a Gross Profit Margin of 20%, the Markup Price Percentage by the company should be 25%

- To achieve a Gross Profit Margin of 30%, the Markup Price Percentage by the company should be 42.9%

- To achieve a Gross Profit Margin of 40%, the Markup Price Percentage by the company should be 80%

- To achieve a Gross Profit Margin of 50%, the Markup Price Percentage by the company should be 100%

Markup Price Calculator

You can use the following Markup Price Calculator

| Sales Revenue | |

| Costs of Goods Sold | |

| Number of Units Sold | |

| Markup Price = | |

| Markup Price = |

|

|

Markup Price Formula in Excel (With Excel Template)

Here we will do the same example of the Markup Price formula in Excel. It is very easy and simple. You need to provide the three inputs i.e Sales Revenue, Cost of Goods Sold, and Number of Units Sold

You can easily calculate the Markup Price using the Formula in the template provided.

Conclusion

Markup price is the additional price that the company charges the consumer over and above the cost price to turn a profit for its business. It can also be defined as the difference between the Average Selling Price per unit and the Average Cost price per unit. Markup price is different than gross margin as markup price is from the buyer’s perspective while Gross Profit Margin is from the seller’s perspective.

Recommended Articles

This has been a guide to a Markup Price formula. Here, we discuss its uses along with practical examples. We also provide you with a Markup Price Calculator with a downloadable Excel template. You may also look at the following articles to learn more –