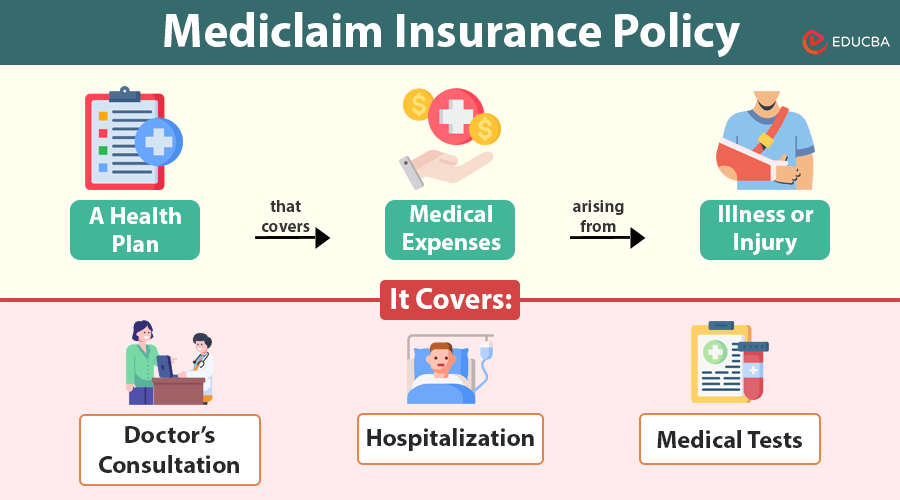

What is a Mediclaim Insurance Policy?

A mediclaim insurance policy is a health plan that covers medical expenses arising from illness or injury. This policy covers the costs if you need a doctor’s consultation, hospitalization, or medical tests.

A mediclaim policy acts as a financial shield, ensuring you do not have to spend all your savings on medical bills. One of its biggest advantages is that it allows you to receive hospital treatment without paying upfront, offering peace of mind during unexpected health crises.

How Does it Work?

A mediclaim insurance policy works by covering your medical expenses when you need treatment. Here is how it functions:

- Policy Coverage: This includes hospitalization expenses due to accidents, surgeries, or critical illnesses within the policy period.

- Premium Payments: To avail of the benefits, you must pay regular insurance premiums.

- Renewal Terms: To continue enjoying the coverage, renew your policy periodically.

- Claim Settlement Options:

- Cashless Hospitalization: The insurer directly settles the hospital bills.

- Reimbursement Settlement: You pay the hospital bills first, and the insurer reimburses you later.

Mediclaim Insurance Policy vs. Health Insurance

Many people confuse mediclaim insurance policy with health insurance, but they are different in key ways:

| Aspect | Mediclaim Insurance Policy | Health Insurance |

| Coverage | Covers hospitalization expenses only | Covers hospitalization & other medical costs |

| Inclusion | Covers expenses due to accidents, surgery, and chronic illness | Includes pre- & post-hospitalization, ambulance charges, daycare treatments, home treatment, etc. |

| Sum Insured | Limited coverage based on the plan | Higher coverage, even up to crores |

| Flexibility | Less flexible | Highly customizable with add-ons like maternity, disability, and critical illness coverage |

Types of Mediclaim Insurance Policies

There are different types of mediclaim insurance policies, each designed to meet specific needs:

- Individual Mediclaim: Covers only the policyholder’s hospitalization expenses.

- Family Floater Plan: Covers the policyholder, spouse, children, and parents under a single plan.

- Senior Citizen Plan: Designed for people above 60, covering age-related medical expenses.

- Critical Illness Plan: Pays for treatment of serious illnesses like cancer, kidney failure, and heart disease.

- Personal Accident Policy: Provides coverage for disability or accidental death.

Key Features of a Mediclaim Insurance Policy

While different policies have different terms, most mediclaim insurance policies share these standard features:

- Financial Security: Protects you from medical expenses that could drain your savings.

- Wide Policy Options: Available as individual and family plans at affordable premiums.

- Cashless Hospitalization: No need for upfront payments; the insurer settles hospital bills directly.

- Tax Benefits: You can get a tax benefit on premiums under Section 80D of the Income Tax Act.

How to Choose the Right Mediclaim Insurance Policy?

To select the best medical insurance policy, consider these factors:

- Adequate Coverage: Ensure the policy covers a sufficient amount to handle medical emergencies.

- Check Policy Terms: Read the fine print to understand clauses like co-payment, exclusions, and sub-limits.

- Look for Add-ons: Some policies offer additional benefits like maternity or critical illness coverage.

- Long-Term Plans: Opt for a long-term plan to avoid yearly renewals.

- Network Hospitals: Select a policy that covers many cashless hospitals.

Best Insurance Company for Mediclaim Policy

Star Health Insurance stands out as a great choice among the various insurers. Here is why:

- Extensive Hospital Network: Over 14,000 hospitals across India offer cashless treatment.

- Fast Claim Settlement: Most cashless claims are settled within two hours.

- Comprehensive Coverage: Covers multiple medical expenses beyond hospitalization.

- Customizable Plans: Offers policies tailored to different age groups and family needs.

- Wellness Benefits: Includes programs that promote a healthy lifestyle and offer premium discounts.

Final Thoughts

Health emergencies can sometimes arise, and rising medical costs make having a mediclaim insurance policy crucial. This policy acts as a financial shield, allowing you to get the best medical care without financial stress.

A good policy ensures that your savings remain intact while giving you access to quality healthcare. Whether you are young, old, or have dependents, investing in the right insurance plan ensures you are always prepared.

In the long run, it saves money, provides security, and guarantees peace of mind—making it a wise choice for everyone.

Recommended Articles

We hope this guide on mediclaim insurance policies has been helpful. Check out these recommended articles for more insights on health insurance, financial planning, and medical expense management.