What is Mental Accounting?

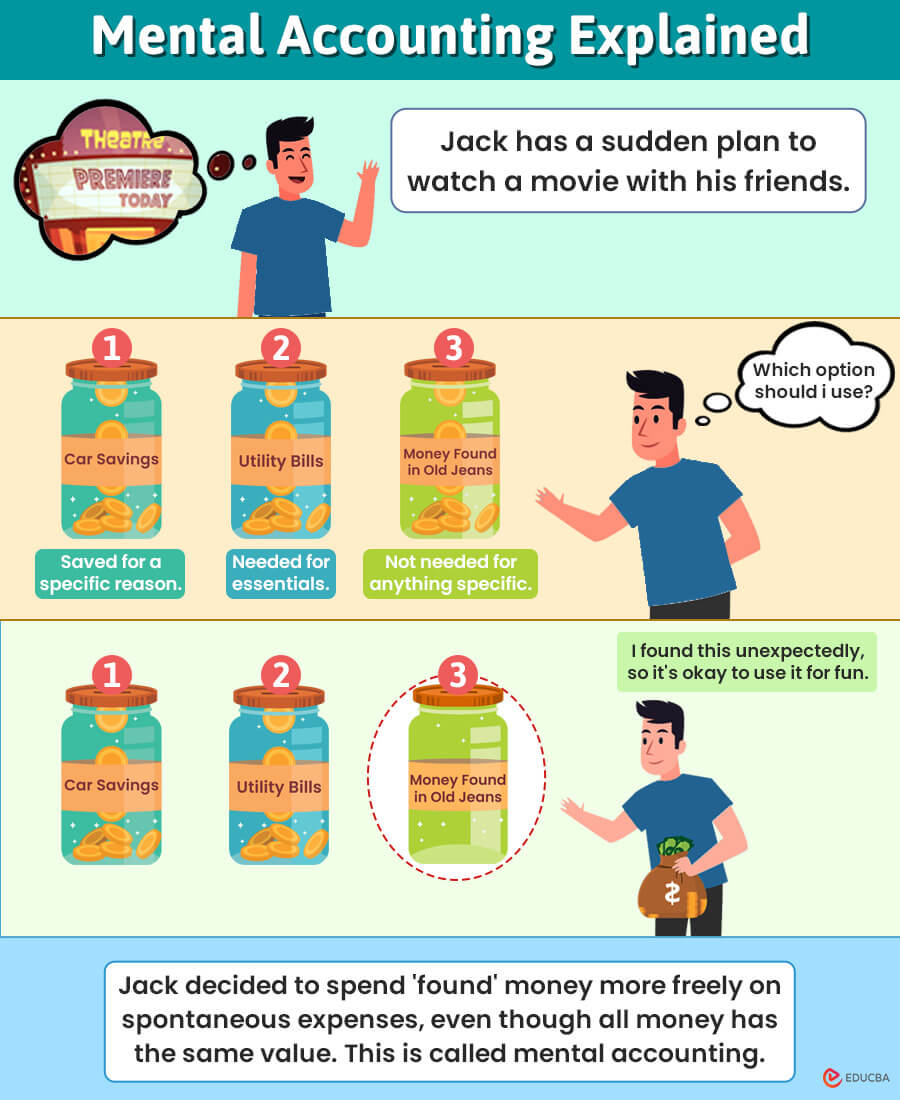

Which money would you spend on a spontaneous movie plan with friends?

- The money you have saved for your car.

- The money you have saved for your utility bills.

- The money you found in your old jeans.

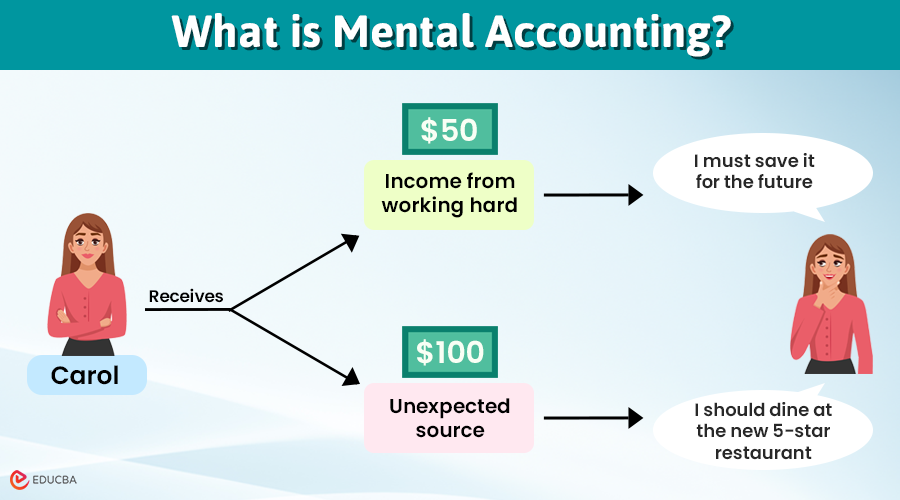

Most of us will choose the third option because we mentally feel that we were not saving this money for a specific purpose, we found it unexpectedly, and we can spend it on an impromptu movie plan without guilt.

Here, instead of recognizing that the money in all three options has the same value, we assign a slightly lower value to the money found in the jeans. It is because we think that since we found it unexpectedly, we can simply spend it for spontaneous expenses. This is what we call mental accounting.

Mental accounting describes how people categorize money depending on where it came from or its intended purpose. They divide their income and spending into different mental accounts, such as a wealth account, a budget account, and a leisure account.

Table of Contents

- What is Mental Accounting?

- Explanation

- Why do we fall for this bias?

- Examples

- How it affects our investing decisions?

- How marketers use it to make profits?

- How to avoid it?

- Advantages and Disadvantages

Mental Accounting Explained

Nobel Prize-winning economist Richard Thaler introduced the concept of mental accounting in 1999 in his paper “Mental Accounting Matters.”

This theory shows that people often make illogical financial decisions that contradict basic economic concepts because of how they assign different values to money. It suggests that individuals do not view money as fungible (interchangeable) and instead allocate their spending to specific budgets. In other words, people are more inclined to spend recklessly with unexpected money since it was not part of their financial plan.

Here are the steps that show how mental accounting works:

- Categorization and Segregation of Funds: According to Richard Thaler’s theory, mental accounting causes individuals to categorize their funds based on sources (salary, bonuses, tax refunds) and purposes (such as savings, bills, and leisure).

- Behavioral Segregation: People treat money differently based on these categories, often disregarding the principle of fungibility (where all money is considered equal).

- Decision-making Based on Categories: These mental categories influence spending and saving decisions, impacting financial choices. People frequently ignore the fungibility rule while handling windfall situations (money earned through lottery, bonuses, tax refunds).

- Financial Impact of Segregated Spending: This behavior can lead to suboptimal financial outcomes, such as increased debt or missed investment opportunities.

Why Do We Fall For Mental Accounting Bias?

When we receive money, we categorize it mentally depending on how we got it and what we can use it for. So when we get unexpected money, windfall gains (lottery winnings, gifts, bonuses, inheritance), or a good deal (same product, lower price), we mentally account this money as an extra amount we have that we don’t need to save or spend wisely. So we try to use it or spend it on anything spontaneous or unnecessary that we think will bring us happiness.

Factors contributing to mental accounting bias include:

- Situation: If we have already spent money on something we don’t need right now, instead of returning it or not spending it in the first place, we think of it as an investment. When we eventually use the item in the future (which could be rare), we feel like we got it for free since we already spent the money on it.

- Place: We are willing to spend more at a five-star hotel for the same item we can get cheaper elsewhere because we believe we are paying for the experience.

- Virtual Spending: Spending money that isn’t tangible (like using credit cards or bank apps) feels like spending fake money. This perception makes purchases feel easier since we don’t see the money physically leaving our accounts.

Mental Accounting Examples

1. Basic Example (Girl Math Concept)

Suppose Betty wants a pair of shoes that cost $100, but she thinks it’s expensive. The shopkeeper offers her a deal: if she buys two pairs, she gets a 20% discount.

Now, two pairs cost $160 ($80+$80) instead of $200 ($100+$100). Betty thinks she’s paying $80 per pair instead of $100, which seems more reasonable. She thinks she’s saving $40 by buying two pairs and convinces herself it’s a great deal. However, instead of spending $100 on one pair, she spends $160 on two pairs, $60 more than she planned.

Thus, as per the concept of ‘Girl Math’, Betty justified her purchase with creative reasoning instead of practical economic thinking.

2. Numerical Example (Tax Refund)

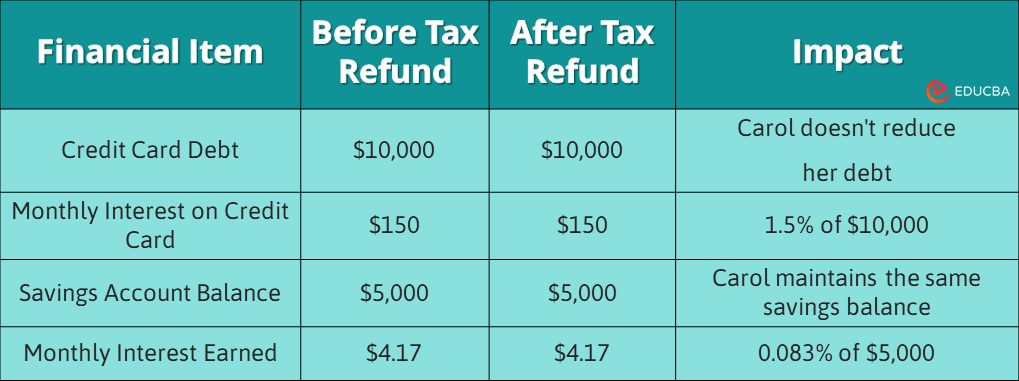

Carol earns $5,000 a month after taxes. She has $10,000 in credit card debt (with an 18% annual interest rate) and $5,000 in a savings account (which earns 1% interest). She expects a $2,000 tax refund, but instead of using it to pay off her debt, she chooses to spend it on a vacation. Here’s what happens financially:

A) Scenario 1 (When Carol spends the tax refund on vacation):

- Her credit card debt remains at $10,000.

- She continues paying $150 monthly in interest.

- Her savings account balance stays at $5,000, earning her $4.17 monthly in interest.

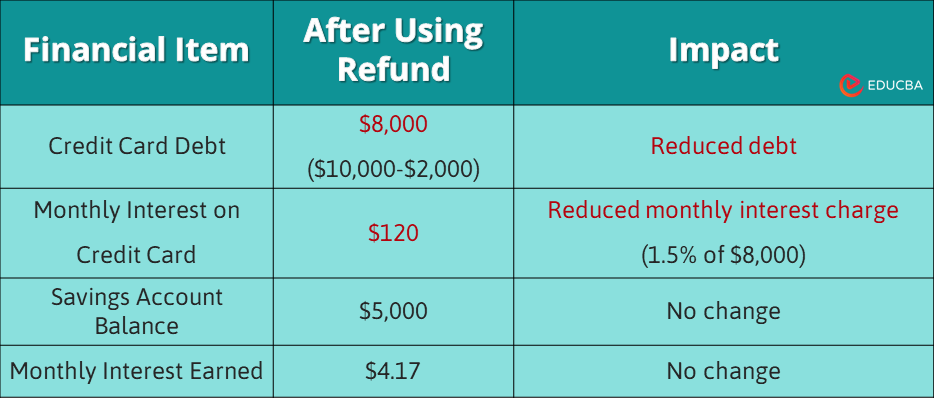

B) Scenario 2 (If Carol uses the tax refund to pay down her debt):

- Her debt would decrease to $8,000.

- Her monthly interest payment would drop to $120 from $150.

- Her savings account balance and interest earned would remain the same.

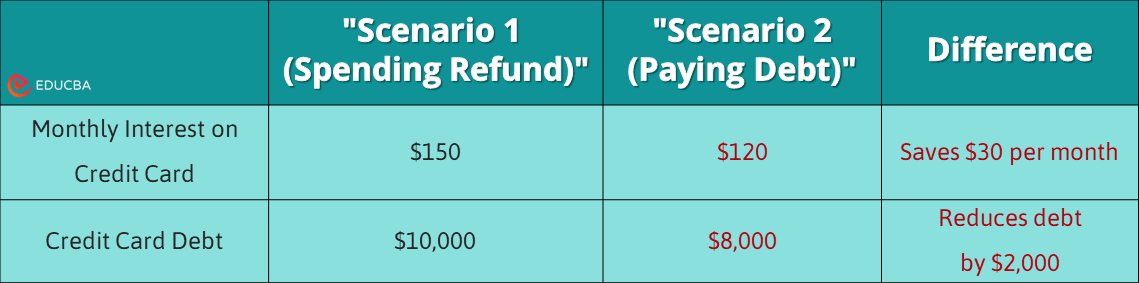

C) Comparison of Scenario 1 and 2:

- By spending the refund, Carol keeps paying $30 more in interest each month.

- Paying down debt would reduce her total debt by $2,000.

Thus, Carol’s decision to spend the tax refund rather than pay down her credit card debt results in higher monthly interest charges. This shows how mental accounting can affect financial decisions negatively.

Mental Accounting in Investing: How it Affects Our Investing Decisions?

Mental accounting in investing can cause us to make less smart investment choices because we sometimes don’t realize that all money is equally valuable, regardless of where we have invested it. People often separate their money into categories like “safe” and “extra,” which can trick us into thinking certain funds are more or less important than others.

Imagine you have $10,000 divided between two investment accounts:

- $5,000 for emergency fund

- $5,000 for your child’s college fund

You decide to invest the emergency fund in very safe options that guarantee a low return of 4% per year because you want it to be readily available. On the other hand, for the college fund, you choose higher-risk investments with an anticipated return of 15% annually because the goal is long-term.

If the college fund grows to $6,000 over time, you might be willing to take even more risks, seeing the gains as extra money. However, if the emergency fund only increases to $5,200, you might leave it in low-return assets, potentially missing out on higher returns.

Mental Accounting in Marketing: How Marketers Use it to Make Profits?

Marketers exploit mental accounting to boost sales through strategies like:

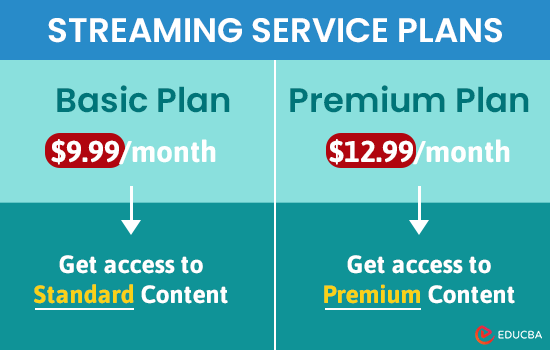

1. Tiered Pricing: Offering multiple product versions at different prices.

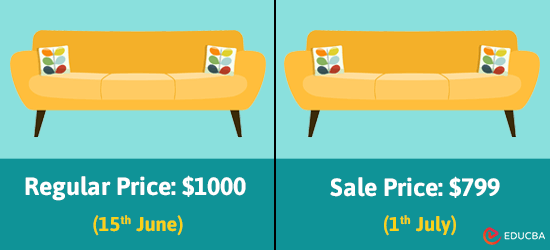

2. Price Anchoring: Starting with a high price to make later offers seem better.

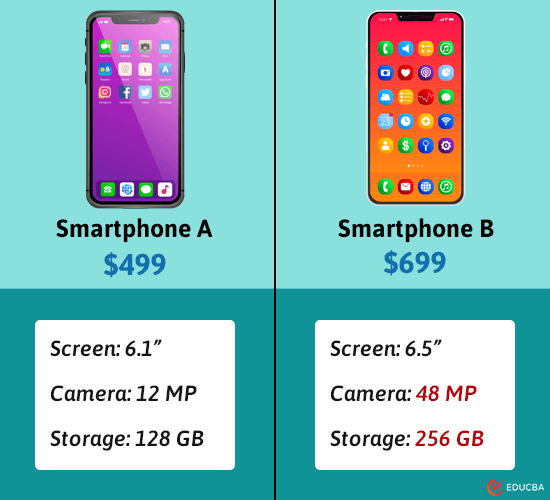

3. Product Comparison: Highlighting why pricier options are better.

4. Bundling: Selling packages at a lower overall price.

5. Bulk Discounts: Offering cheaper prices for larger purchases.

6. Complimentary Gifts: Adding value to encourage immediate purchases.

7. Gift Cards: Encourage future spending and loyalty.

8. Selling on Credit: Allowing buy-now, pay-later options.

9. EMI Plans: Breaking big purchases into smaller payments.

10. Attribute Selling: Emphasizing special features to justify higher prices.

How to Avoid the Mental Accounting Bias?

Here are some ways to overcome the mental accounting bias:

- Recognize that money is fungible, meaning every dollar should be valued equally.

- Create a budget to maximize the efficiency of your finances.

- Prioritize debt repayment when unexpected financial gains occur.

- Plan for windfall money by aligning it with specific goals, preventing its misuse on unnecessary purchases.

Advantages and Disadvantages of Mental Accounting

Advantages:

- Setting Investment Goals: Mental accounting helps people set specific investment goals. For instance, if someone sets aside money for their child’s education, they are less likely to spend it on other things. This promotes disciplined saving for future needs.

- Financial Planning: Mental accounting is useful for planning finances, especially when unexpected money comes in, like tax refunds or bonuses. By using these funds wisely—like saving part and spending part—people can avoid making sudden money decisions and improve their long-term financial security.

Disadvantages:

- Wasteful Spending: One downside is that people might spend money, viewing it as an extra amount for leisure rather than being careful with it.

- Sunk Cost Fallacy: Spending unwisely can result in irrational decisions to continue investing in projects or expenditures that may not yield optimal returns or benefits.

- Illogical Investment Decisions: It leads to financially unproductive or harmful behavior, such as maintaining a low-interest savings account while holding significant credit card debt.

Final Thoughts

Many people fall into the trap of mental accounting. Most individuals place subjective worth on money, often depending on where it comes from and how it will be utilized. While such a method may appear innocuous and quite acceptable, it might backfire against us, leaving us worse off financially. The answer to addressing mental accounting and avoiding it is recognizing money as interchangeable and avoiding labeling it.

Frequently Asked Questions (FAQs)

Q1. What are some common examples of mental accounting in daily life?

Answer: Here are some examples of mental accounting in daily life:

- Spending unexpected money on leisure instead of saving it.

- Saving money for vacations separately from regular savings.

- Spending more on credit cards because it feels like ‘extra’ money.

- Keeping savings in different accounts for different goals instead of one.

- Spending more when using coupons or discounts because it feels like saving money.

Q2. Is mental accounting necessarily a bad thing?

Answer: No, mental accounting can be beneficial in certain situations. For instance, having an emergency fund account that you will not touch for any other reason or mentally setting aside money in your bank account for your retirement are practical examples where mental accounting proves advantageous.

Q3. Is there a psychological aspect to mental accounting?

Answer: Yes, mental accounting is rooted in behavioral economics and psychology, highlighting how cognitive biases can impact financial decision-making.

Recommended Articles

We hope this article on ‘Mental Accounting’ was informative. For more unique accounting concepts, refer to the posts below.