Updated November 24, 2023

Difference Between Merger vs Amalgamation

Inorganic growth has become a major part of the business looking to become industry leaders, and companies are nowadays acquiring smaller fish or taking control of a new line of business to enter the market and earn some big fat returns. Companies frequently use the terms “merger” and “amalgamation” in the world of takeovers to grow the business and fetch returns in the market. In this Merger vs Amalgamation article, we will try and understand the key differences between Merger and Amalgamation in detail.

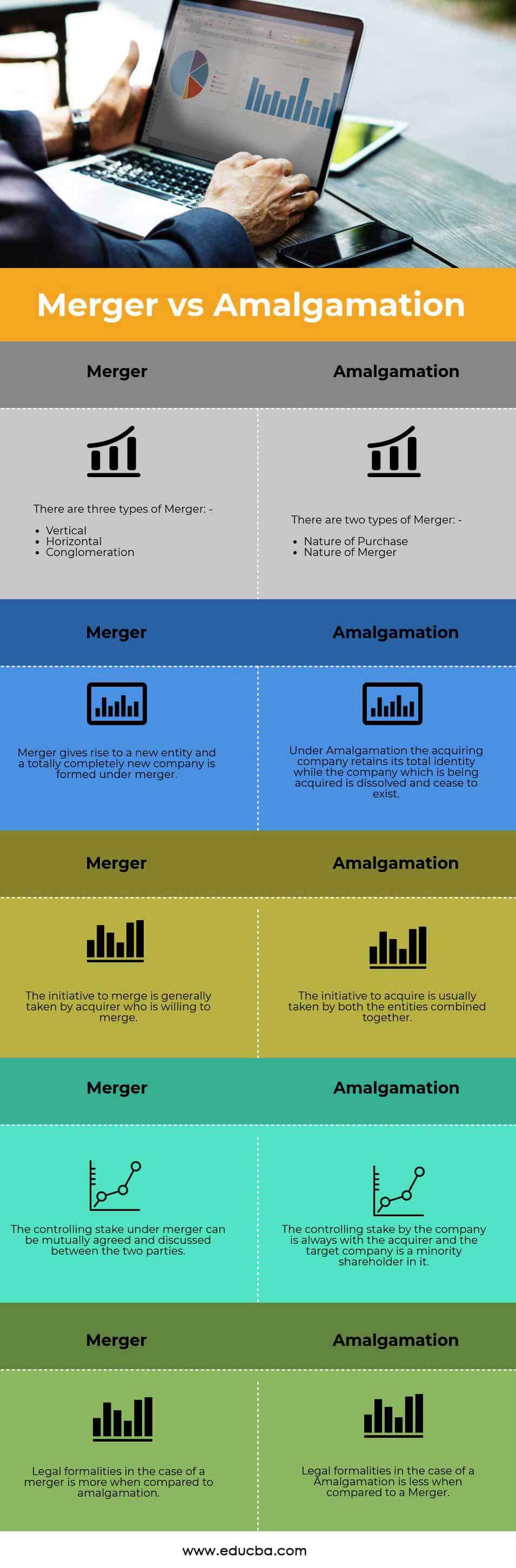

Head To Head Comparison Between Merger vs Amalgamation (Infographics)

Below is the top 5 difference between Merger vs Amalgamation

Key Differences Between Merger vs Amalgamation

Both Mergers vs Amalgamation are popular choices in the market; let us discuss some of the major differences:

- A merger happens when two companies or more companies with a similar line of business operations merge to get synergies out of business, enter a different geography, or start a new service line. On the other hand, Amalgamation usually happens when a larger business entity with bigger operations in the market acquires smaller companies with much less revenue and operations.

- A merger can be horizontal, vertical, or conglomerate. A horizontal merger takes place to reduce the existing competition in the market, which eliminates companies of a similar nature. A vertical merger is when a company providing raw materials and other things to the business gets acquired, also known as backward integration. Forward integration happens when a company that is a vendor to the business gets acquired. A conglomerate merger is entered into to diversify the business.

- On the contrary, amalgamation can be like a merger or like purchase. When amalgamation happens like a purchase, when the shareholder acquires the acquirer company takeover, all the shareholding of the acquired company and company ceases to exist. This means the shareholders of the transferor entity no longer have a proportionate share in the combined equity of the parties to the amalgamation, where when amalgamation happens, like a merger, both entities’ assets and liabilities of the companies are combined.

- Amalgamation is less frequent in events when compared with mergers. Amalgamation creates some powerful companies around the globe. Arcelor, the world’s largest steel company, was created through an amalgamation. On the other hand, mergers also kill competition in an industry, and before merging entities, the companies need to get approval from the merger control in India.

- The merger transforms merging entities into non-existent entities and establishes a new company with a revised shareholding pattern, a fresh name, and renewed goals. On the other hand, under amalgamation, the acquiring company retains all its powers and rights of the shareholding, and the company which has been acquired is dissolved.

- Examples of Merger and Amalgamation

- Merger = “Centurion Bank of Punjab” is merging with “HDFC Bank”

- Amalgamation = Nirma and core health care

Merger vs Amalgamation Comparison Table

Below is the 5 topmost comparison between Merger vs Amalgamation

|

Merger |

Amalgamation |

There are three types of Mergers: –

|

There are two types of Amalgamation: –

|

| The merger creates a new entity, forming a completely new company. | The acquiring company preserves its complete identity while dissolving and causing the acquired company to cease to exist. |

| The initiative to merge is generally taken by an acquirer willing to merge. | Both entities usually take the initiative to acquire together. |

| The two parties can mutually agree and discuss the controlling stake under a merger. | The company’s controlling stake is always with the acquirer, and the target company is a minority shareholder in it. |

| Legal formalities in the case of a merger are more when compared to amalgamation. | When comparing an amalgamation to a merger, there are fewer legal formalities in the case of an amalgamation. |

Conclusion

The industry’s mergers and amalgamation sources of inorganic growth make it an effective tool for achieving rapid business growth. Companies today should formulate strategies and policies on who to acquire and how to enter new markets cleverly. The company should align mergers and amalgamations with its long-term goals. Before buying out distressed assets, one should conduct a careful analysis.

Recommended Articles

This has been a guide to the top difference between Merger vs Amalgamation. We also discuss the Merger vs Amalgamation key differences with infographics and a comparison table. You may also have a look at the following articles to learn more.