What is Minority Interest?

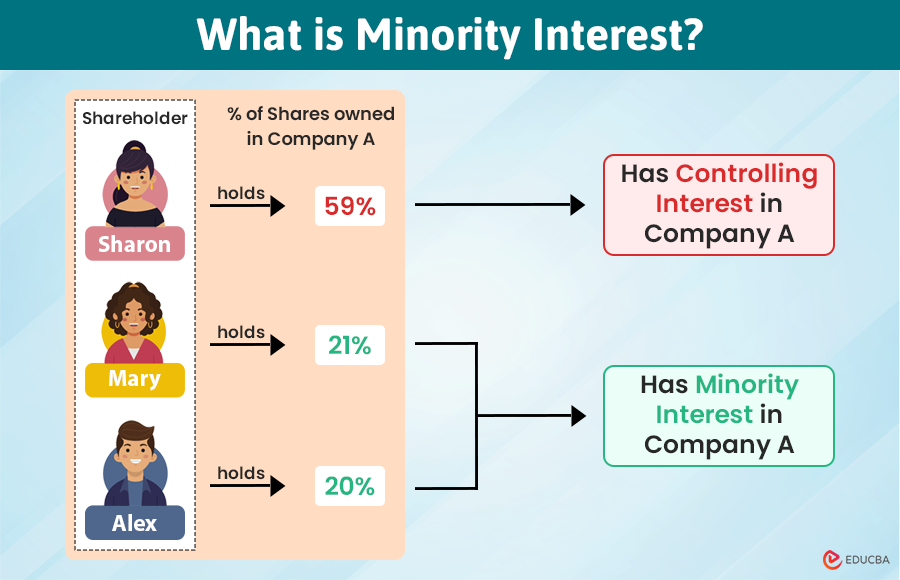

The term “minority interest” refers to the ownership of the shareholders who own less than 50% shares of the enterprise. Although the term is also used for a smaller partnership interest in a firm, it is predominantly used for stock ownership in a company. The minority shareholders of a company can either be individual investors or another organization.

Explanation

It means that a combination of companies, firms, and investors own a stake in another company, and the aggregate ownership is less than 50% of the total shares in terms of voting rights. In other words, minority shareholders don’t have the power to control a company through votes, which means they have minimal influence on the overall decision-making. Typically, ownership lies in the range of 20% to 30%. In addition, M.I. usually has certain rights, including participation in sales and some audit rights.

How to Calculate Minority Interest?

The M.I of a company can calculate in the following steps:

- Firstly, determine the book value of the consolidated company as it appears on its balance sheet.

- Next, determine the percentage of company shares owned by the minority shareholders.

- Next, multiply the book value by the percentage owned by the minority shareholders. Record the value of M.I. in the balance sheet under the equity section once its dollar value has been calculated.

- Next, the net income attributable to the M.I. owners can calculate by multiplying the net income by the percentage owned by the minority shareholders. Record the income statement’s net income attributable to M.I. as a separate non-operating line item.

Examples of Minority Interest

Following are examples of M.I given below:

Example #1

Let us take the example of XYZ Inc., which has recently acquired a majority stake of 80% in SD.Inc. At the same time, the existing shareholders of SDF Inc. retained the remaining number of shares in the company, which is worth $100 million now. Determine the value of M.I. in the company.

Solution:

Given, Majority shareholder interest = 80%

Book value = $100 million

Minority Shareholder Interest calculates as

- Minority Shareholder Interest = 1 – 80%

- Minority Shareholder Interest = 20%

The value of M.I in the company can calculate as shown below,

Minority Interest = Book Value * Minority Shareholder Interest

- M.I = $100 million * 20%

- M.I = $20 million

Therefore, the value of M.I. in the consolidated financials of XYZ Inc. is $20 million.

Example #2

Take the example of ABC Inc., which owns an 85% stake in LMN Inc., a company worth $500 million. First, determine the value of net income attributable to M.I. if ABC Inc. recognized a net income of $40 million during the year.

Solution:

Given, Majority shareholder interest = 85%

Net income = $40 million

Now, M.I can calculate as shown below,

Minority Shareholder Interest = 1 – Majority Shareholder Interest

- Minority Shareholder Interest = 1 – 85%

- Minority Shareholder Interest = 15%

Now, Net Income Attributable to M.I can calculate as shown below,

Net Income Attributable to Minority Interest = Net Income * Minority Shareholder Interest

- Net Income Attributable to M.I = $40 million * 15%

- Net Income Attributable to M.I = $6 million

Therefore, the net income attributable to an M.I. in the consolidated financials of ABC Inc. for the year is $6 million.

Types of Minority Interest

There are two types of Minority Interests:

- Passive M.I

- Active M.I

Passive: Here, the minority shareholders own less than 20% shares in the company and have no material influence on the company’s decision-making.

Active: Here, the minority shareholders own shares in the range of 20% to 49% and can influence the company’s decision-making materially.

Valuation

The following three methods can be used to value companies to estimate the value of M.I accurately:

- Constant growth

- Numerical growth

- Model subsidiaries separately

Constant Growth: In this method, it is considered that the growth in the performance of the company will hardly change and remain stable through the forecasted period.

Numerical Growth: In this method, the analyst arrives at the forecasted growth number by analyzing historical trends using moving averages, time series, and regression analysis. This method does not apply to companies with dynamic growth.

Model Subsidiaries Separately: In this method, each subsidiary is evaluated based on its own financials, and then the M.I. in each of the subsidiaries is added up to ascertain M.I. at the consolidated level. This method offers more flexibility, and the results are much more accurate. However, it involves too much cost and time, so that it won’t be feasible in many cases.

Balance Sheet

During the financial crisis of 2008-09, Financial Accounting Standards Board (FASB) came up with a change on how to classify M.I. in the balance sheet. Post this change, companies had to include the M.I. in the equity section instead of the liabilities section, which was the old practice before 2008. The old school of thought was that minority interest represented the financial liability owed to the minority shareholders and should be reported under the liabilities section.

Passive vs Active

Some of the major differences between passive minority interest and active minority interest are:

- In passive M.I., the aggregate stake of the minority shareholders is less than 20%. On the other hand, in active M.I., the aggregate stake of the minority shareholders is in the range of 20% and 49%.

- In passive M.I., the minority shareholders don’t have much influence on the company. On the other hand, in active M.I., the shareholders enjoy special voting rights to influence decision-making in the company.

Recommended Articles

This is a guide to Minority interests. Here we also discuss the introduction and how to calculate minority interest. Along with examples and types. You may also have a look at the following articles to learn more –