Overview of Mistakes in Discounted Cash Flow

Do we hear about stocks and companies daily on television and in the newspapers? And during your finance courses, weren’t you told to read newspapers daily? And what was the daily news that you read? It was always about various companies and how their stocks went high or low. Did you read about company-related news that led the stock prices to move up and down—scared of investing in shares already? No, you don’t have to. Warren Buffet did not spend his entire life being scared and sitting in one corner of Wall Street. Everyone knows where he is now!!!

So now, let’s get started on this topic.

It would be best if you had a little idea of how financial ratios and multiples provide a quick and easy way for investors to determine the general value of a stock and compare them between companies. But have you ever thought about how we estimate the absolute value of any company? That’s when the discounted cash flow (DCF) valuation method comes in handy.

The discounted cash flow approach helps in determining stock prices differently and robustly. DCF models help in estimating what the entire company is worth. Comparing the stock’s intrinsic value (derived from the DCF valuation approach) with the stock’s current market price allows apples-to-apples comparison. For example, if you estimate a stock worth $50 based on a DCF model, and it is currently trading at $80, you must know that it’s overvalued!!!

DCF analysis is a crucial valuation method at an analyst’s disposal. Analysts in many big investment banks use this valuation method for the company. They use DCF to determine a company’s current value according to its estimated future cash flows.

But now we come to the main point.

What if you need to perform the DCF analysis in the right way? Yes, you are in a problem then. What is there are Mistakes in Discounted Cash Flow? What if your assumptions are incorrect, and you come at an altogether different intrinsic stock price and buy that stock? Yes, you can be doomed.

After a few months, you are sipping your tea and reading your favorite financial newspaper, and you see something you never even dreamt of in your wildest dreams. Yes, the stock and company you invested in are at their all-time low. You lost your money. Now, you wish that you had done some proper analysis and assumptions. Assume that you have not made Mistakes in Discounted Cash Flow.

Mistakes in Discounted Cash Flow

So, let’s analyze some common DCF errors and learn how not to commit the same!!! The common mistakes are as follows.

1. Inappropriate Forecast Horizon!!!

Consider that you are valuing an FMCG-based company, but you consider the projections for only two years. Is it the right approach? Not!!! The DCF analysis requires considering a time frame of at least five years. But this does not mean that you think the time frame of 50 years would be wrong. Imagine the interest rates, economic factors, and inflation after 50 years, and we do not have some financial superpower to predict the same.

John Maynard Keynes rightly said,

“I’d rather be vaguely right than precisely wrong”.

His message applies here. Consider a proper explicit period that is not too short or long.

2. Cost of Capital

Many DCF models are built on the non-sensible cost of capital. This is one of the significant mistakes in Discounted Cash Flow. Here are the reasons why. Most companies use either debt or equity to finance their operations. The cost of debt for large companies is usually transparent, as they have to make contractual obligations through coupon payments. Estimating the cost of equity is more challenging because, unlike debt’s explicit cost, the cost of equity is implicit. The cost of equity is usually higher than that of debt because equity’s claim is junior. And no simple method exists to estimate the most accurate cost of equity.

The most common and used approach for estimating the cost of equity is the capital asset pricing model (CAPM). According to CAPM, the company’s cost of equity is equal to the risk-free rate plus the product of the equity risk premium and beta. Government-issued bonds generally provide a good representation of the risk-free rate. However, estimating the equity risk premium and beta proves much more challenging.

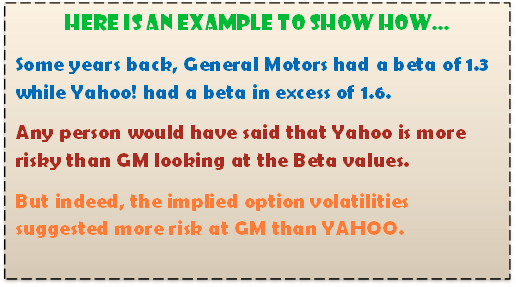

Let’s start with the beta for now. Beta reflects the sensitivity of a stock’s price movement relative to the broader market. A beta of 1 suggests that the stock aligns with the market. A beta below 1 means that the stock moves less than the market. While a beta above 1 implies that the stock moves more significantly than the market. Although it sounds wonderful in theory, beta fails practically and empirically. Ideally, we want forward-looking betas, which are difficult to estimate reliably. Beta’s empirical failure shows how beta does poorly in explaining returns.

The equity risk premium is the second important input into the CAPM that can cause errors. As with the beta, equity risk premium is a forward-looking estimate. Relying on past equity risk premium values may not give a reasonable sense of the return outlook. In addition, research also suggests that the equity risk premium is possibly non-stationary; thus, using past average values can be very misleading.

3. Mismatch Between Assumed Investment and Earnings Growth

You must know how companies invest in the business via working capital, capital expenditure, acquisitions, R&D, etc. We take all these steps to achieve growth over an extended period. Also, by now, you can easily understand how “Return on investment” (ROI) helps determine the efficiency with which a company translates its investments into earnings growth. Since ROI is linked to investment and development, investors must carefully treat the relationship between investment and growth. DCF models sometimes underestimate the investment necessary to achieve an assumed growth rate. The source of this mistake is as follows. First, analysts looking at companies that have been highly acquisitive in the past consider the same growth rate now, even if the company is not as much into acquisitions as before. One can overcome this mistake by carefully considering the growth rate that is likely to come from today’s business.

4. Incorrect Consideration of Other Liabilities

One another mistake in discounted cash flow concerns other liabilities. We determine the Corporate value based on the present value of future cash flows. We add cash and other non-operating assets and subtract debt and other liabilities to arrive at shareholder value.

Some other liabilities, like employee stock options, are trickier and more challenging to analyze. Thus, most analysts do a very poor job analyzing these liabilities. At the same time, such other liabilities are most common in some sectors. For example, other post-retirement employee benefits plans are more common in manufacturing industries, while employee stock options occur most frequently in service industries. Hence, investors must properly categorize and recognize other liabilities in the sectors where they may significantly impact corporate value.

5. Scenario Changes

Sometimes, small changes in assumptions can also lead to significant changes in the value. Investors should also look to the value drivers like sales, margins, and investment needs as sources of variant sensitivity.

6. Double Counting

Always make sure that your model does not get into the mistake of double counting. Now, you must be wondering what exactly double counting is. So, let us understand it in simple terms. Double counting simply means that some values are taken twice, thus causing errors in the model. Considering the values twice can also change your intrinsic share price. Double counting can also take place in assessing the risk factor. Directly adjusting the cash flows in the model or discount rate are the two ways of considering the uncertainty of future cash flows. Hence if there are adjustments in both the above-mentioned methods, it can lead to double counting of the risk and thus lead to error.

7. Aggressive Terminal Growth Rate Assumptions

Think of it this way. Just for one day, consider that you are an insurance agent. You can get many customers, and you have overachieved your target. But how? You told your clients they would get a sure-shot 30 % return, which will increase cumulatively in the coming years. In this way, you could fool the clients, but can you fool yourself? You cannot guarantee your clients some dreamy figures of growth. Things do not work like that. You must consider all the factors affecting the growth rate and then promise your clients. The same is the case when you build your DCF model.

Generally, the long-term growth rate assumptions are often incorrect. We use these assumptions to determine the terminal value component of the DCF valuation. Remember that the long-term growth rate should not exceed the sum of inflation and real GDP growth. Terminal value contributes around 70-80% of the fair valuation; hence, we should be cautious while making terminal growth rate assumptions.

Generally, if a 1% higher terminal growth is assumed than usual, the share price valuation may jump by as much as 15-25%!

8. Incorrect Matching of Real and Nominal Cash Flows and Discount Rates

Let’s understand the difference between real and nominal here. Cash flows that incorporate the effects of inflation are on a nominal basis, whereas cash flows that exclude its effects are on a fundamental basis. Consider the impact of inflation on the discount rate when using actual cash flows. You may often encounter errors here if you don’t make adjustments.

9. Failure to Recognize “Typical” Market Conditions

Sometimes, income and operating statements for a particular project do not reflect normal operating patterns. Thus, ultimately, this will affect your DCF model and the intrinsic share price. In such a case, it is necessary to reconstruct the actual operating statements to reflect market conditions. Thus, to correctly measure market value, the projected operating or income statements must attempt to reflect actual market conditions.

10. Errors in Predicting the Tax Rate

The general mistake here is adopting a tax rate that does not reflect the long-term tax rate for the asset. Forecasts should be based on the expected effective tax rate applicable to the asset at that time to reflect anticipated future cash flows properly. Hence, you should devote some time to properly analyzing the corporate tax rate. It may sound like a short term, but properly analyzing the tax rate and then considering it in your model will bring your model closer to perfection.

Final Thoughts

So, now that you have learned about all the possible things that can go wrong in DCF calculations, you should be well-prepared while performing your model. While applying this model to the real world, you, as an investor or a student, must ensure that the models are economically sound and transparent. But in practice, sometimes only some DCF models can pass the tests. But now that you have gained some insights into “Mistakes in Discounted Cash Flow,” we hope your model will stand apart. This article on Mistakes in Discounted Cash Flow can act as a safety check to avoid paying too much for any stock. If you wish to hone your DCF skills, you may like to visit – Everything you need to Know about DCF.

All the very best.

Mistakes in Discounted Cash Flow Infographics

Learn the juice of this article in just a single minute: Infographics of Mistakes in Discounted Cash Flow.