Updated July 18, 2023

What is Mixed Cost?

The term “mixed cost” refers to the type of cost that contains both fixed and variable component. Given the inherent nature of mixed cost, it is also popularly known as semi-variable cost. The sensitivity of mixed cost to changes in volume is usually midway between to of fixed cost and variable cost.

Explanation

Since a portion of the mixed cost is fixed in nature, it will be present even in the absence of any activity at all. Further, it also in partially variable in nature and so it is likely to increase as the activity level increases. The reason of the dual nature is the fact that mixed cost is a combination of fixed and variable costs. So, it is important to understand the mix of both the components to be able to predict a change in mixed cost at different levels of activity.

The Formula for Mixed Cost

The formula for mixed cost includes a fixed component along with a variable component. Mathematically, it can be expressed as a fixed cost plus the product of variable cost per unit and number of units, which is represented as,

Examples of Mixed Cost

Following are the examples are given below:

Example #1

Let us take the example of John who works as a sales representative in a medicine manufacturing company. Now, John’s compensation is a cost to the company and that too mixed in nature as it consists of fixed monthly take way and sales linked incentives. His fixed monthly take away is $5,000 and he earns another $1.5 per unit as a sales incentive. Determine the salary paid to John during the month of December 2019 if he could sell 2,000 units in that month.

Solution:

Given,

- Fixed Cost = $5,000

- Variable Cost per unit = $1.5

- No. of Units = 2,000

Mixed Cost is calculated using the formula given below:

Mixed Cost = Fixed Cost + Variable Cost per Unit * No. of Units

- Mixed Cost = $5,000 + $1.5 * 2,000

- Mixed Cost = $8,000

Therefore, the company paid John $8,000 during the month December 2019, wherein $5,000 is the fixed component and $3,000 is the variable component.

Example #2

Let us take the example of a car taken on lease by a company. The company has to pay a fixed lease rental of $1,000 every month and it further incurs a running cost of $0.8 per km travelled. Determine the expense incurred during a month in which the car travelled 800kms.

Given,

- Fixed Cost = $1,000

- Variable Cost per Unit = $0.8

- No. of Units = 800

Mixed Cost is calculated using the formula given below:

Mixed Cost = Fixed Cost + Variable Cost per Unit * No. of Units

- Mixed Cost = $1,000 + $0.8 * 800

- Mixed Cost = $1,640

Therefore, the company incurred total expense of $1,640 for the car during the given month, wherein $1,000 is the fixed component and $640 is the variable component.

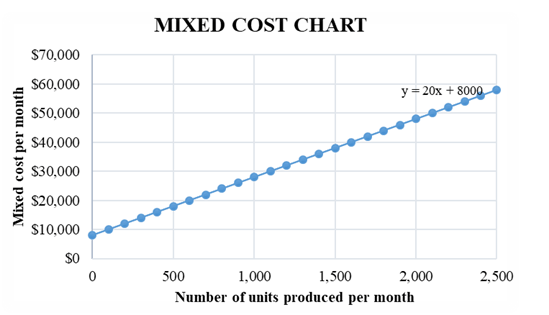

Mixed Cost Graph

The formula for mixed cost is analogous to the equation of a straight line- y = m * x + c, where c = fixed cost, m = variable cost and x = number of units. Let us now look at the graph for a mixed cost below.

From the above graph, it can be inferred that $8,000 is the fixed component as it is the mixed cost incurred at zero activity, i.e. where the line for total mixed cost intersects the Y-axis. Beyond that, the cost increases linearly with the increase in activity level. In this case, variable cost per unit is the slope of the line which is $20 per unit. Therefore, the equation for the mixed cost is,

Mixed Cost Analysis

The analysis of mixed cost primarily means identifying and bifurcating the fixed and variable components.

In case the graph shows a relatively linear relationship between mixed cost and activity level, then the high-low method can be used to estimate what portion of the mixed cost is fixed in nature and what portion is variable in nature. In this method, just two data points are required to determine the mix of fixed and variable costs.

On the other hand, if a linear relationship can’t be established then the least squares regression method is used. In this method, all of the available data points in the graph are being fitted into a regression line to determine the mix of the fixed and variable costs. It is considered to be more accurate than the high-low method.

Advantages of Mixed Cost

Some of the major advantages of a mixed cost are as follows:

- It offers the benefits of both fixed and variable costs. As such, while it increases with the increase in volume, the extent of increase is not as much as the variable cost due to the presence of a fixed cost component. So, it partially enjoys the benefit of economies of scale.

- Correct measurement of the mixed cost help companies to build proper budgeting and appropriate costing system.

- The mix of fixed and variable cost in the mixed cost can be tweaked to suite different business environments.

Disadvantages of Mixed Cost

Some of the major disadvantages of a mixed cost are as follows:

- The fixed cost component has to incurred even in the case of zero volume. As such, it results in cost burden in times of business downturn.

- At times the bifurcation of the mixed cost into fixed and variable component becomes difficult and time consuming for the company.

Conclusion

So, it can be seen that mixed cost changes with the change in the volume of sales or production similar to the variable cost, while just like the fixed cost it can’t even be eliminated entirely from the overall cost structure. So, it is important to maintain the optimal mix of mixed cost in the overall cost structure. Such costs are often associated with manufacturing companies.

Recommended Articles

This is a guide to Mixed Cost. Here we also discuss the definition and example of mixed cost along with advantages and disadvantages. You may also have a look at the following articles to learn more –