Updated July 4, 2023

Definition

Monetary policy is the process by which a country’s central bank, such as the Federal Reserve, controls the money supply in an economy. The Fed Reserve Bank of the United States carries out a monetary policy under a twin purpose to maximize employment while containing inflation.

Key Highlights

- The economic policy discipline controls monetary factors to maintain price stability and economic growth.

- A central bank can use it to decrease inflation, increase employment, or slow down a booming economy to avoid a recession.

- The two main goals of monetary policies are to maintain economic stability and to keep prices from rising too fast.

- A country’s monetary policies depend on many factors, including government spending and tax rates, trade balances with other countries, and global demands for products and services.

- Monetary policy impacts the value of your money by changing the amount of money in circulation and how quickly it circulates through the economy. This can influence prices, interest rates, and employment levels, affecting your finances.

What is Monetary Policy

- The central bank (sometimes called the Federal Reserve) makes a set of decisions about how much money should be in circulation and what interest rates should be. This set of decisions is known as monetary policy.

- Monetary policy aims to help the economy grow while keeping inflation stable. There are many different tools at the central bank’s disposal to achieve these goals, but they all have consequences. This blog post will explore some of these tools and their impacts on different parts of the economy and people.

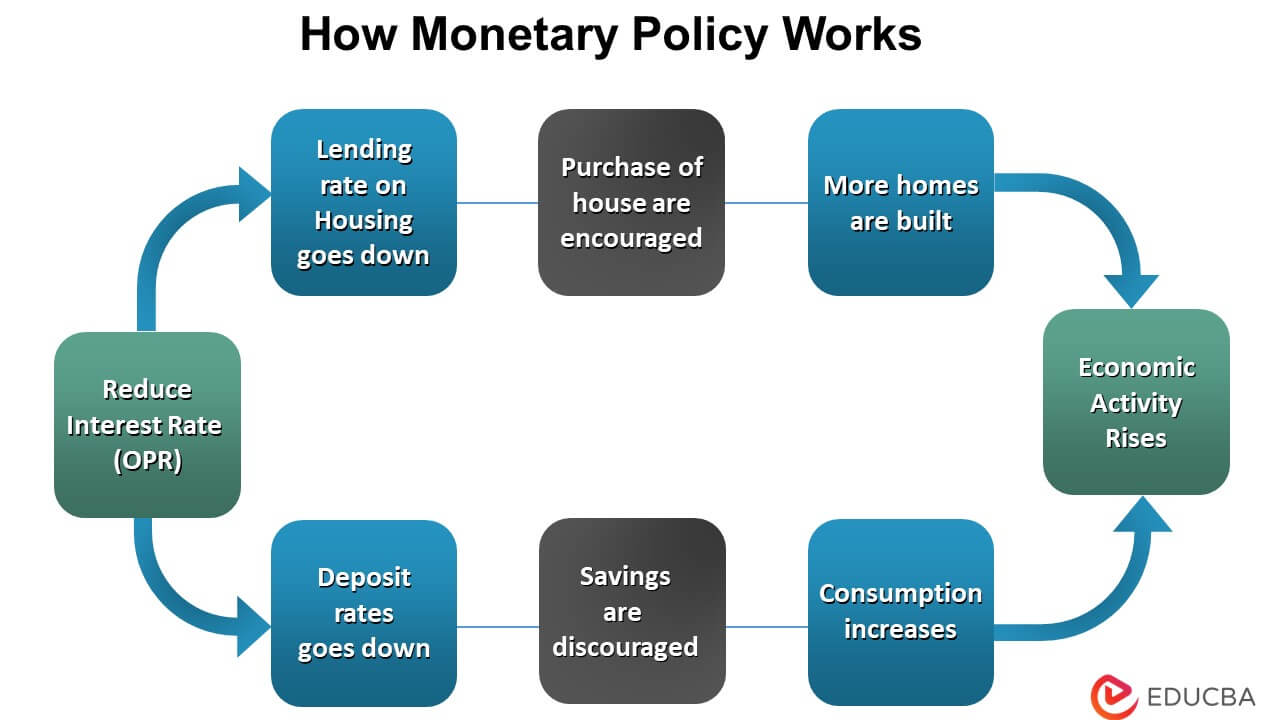

How Does Monetary Policy Work?

- Central banks, such as the Federal Reserve, control monetary policy.

- They use various tools to maintain economic stability and ensure inflation stays low (around 2%).

- Tools include adjusting interest rates, changing the amount of money in circulation, and buying or selling bonds.

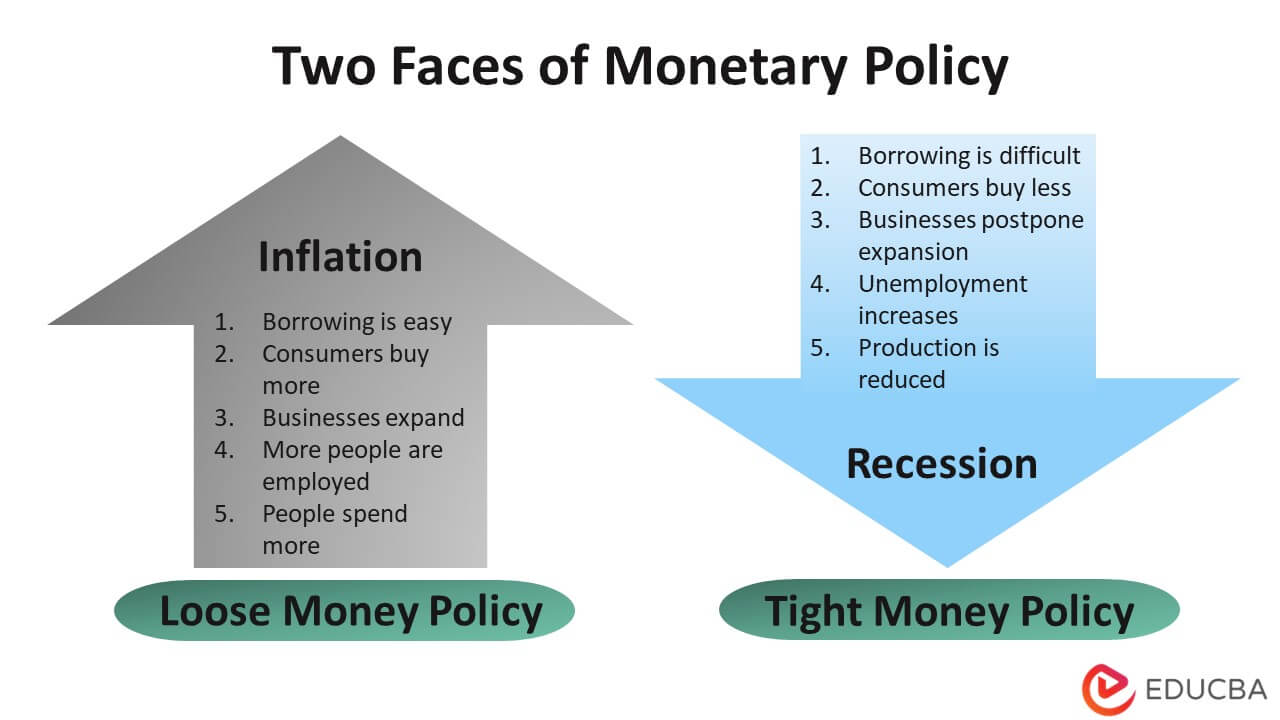

- For instance, if there is very high inflation, they may raise interest rates discouraging people from borrowing and encouraging them to save.

- If there is too little inflation, they may lower interest rates, encouraging people to borrow and spend.

- By lowering rates, they make it cheaper for businesses to borrow money and invest.

- As the demand for goods goes up, so does inflation.

- The central bank reduces inflation by raising rates by making it more expensive for consumers to buy things because prices increase when borrowing costs rise. The Federal Reserve Board in the US sets interest rates by voting at its regular meetings.

- The president appoints all governors of the Fed Board, but they must be confirmed by Congress first.

- Once appointed and confirmed by Congress, the chairperson of the Fed Board sets monetary policies based on their best judgment about stabilizing prices and employment to meet the dual mandate set out by Congress.

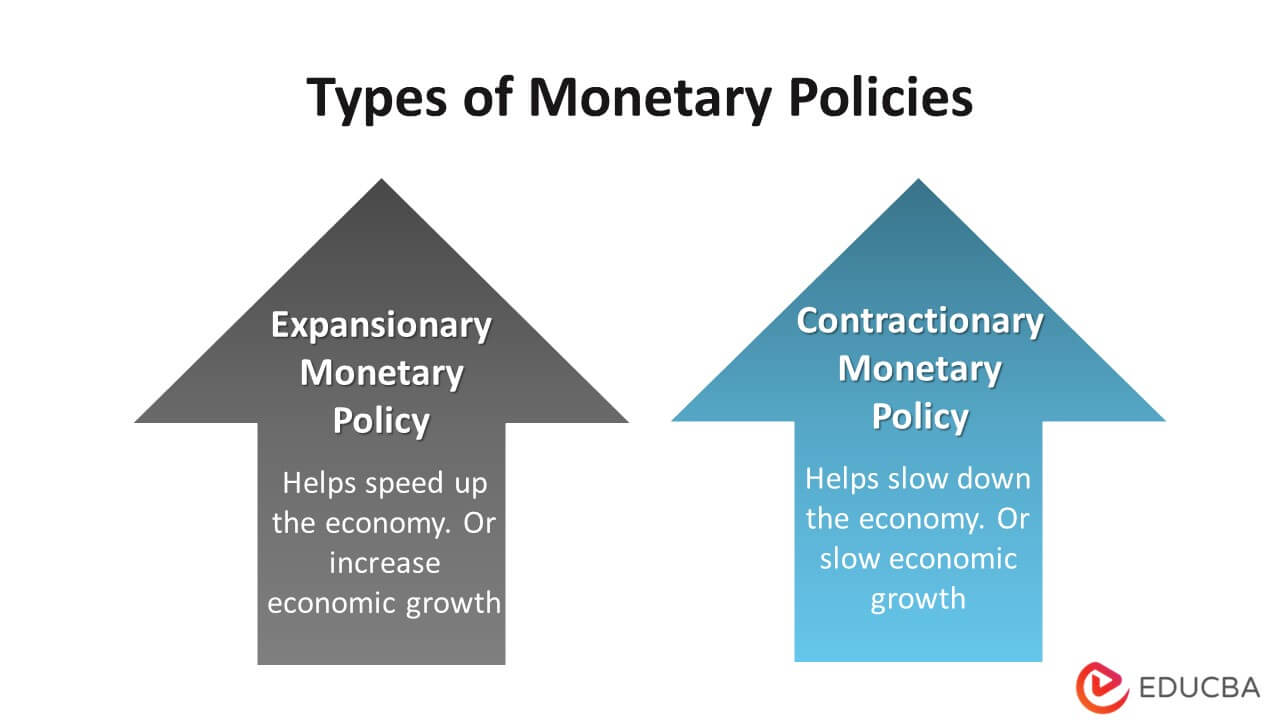

Types of Monetary Policy

Monetary policies are classified into two types based on their goals:

-

Expansionary Monetary Policy

- The government and central bank use expansionary monetary policy to counter an economic slowdown or recession by implementing low-interest rates and increasing government spending.

- It does not typically cause high inflation levels because lower demand levels from consumers, companies, and investors and slower productivity growth often accompany it.

- It entails increasing the amount of money in circulation to stimulate investment and, as a result, reduce unemployment and achieve economic growth. Its use usually results in inflation.

- The central bank can use expansionary monetary policies when there is a recession.

- Expansionary monetary policy involves lowering interest rates to stimulate economic growth and increase the money supply.

- The central bank injects cash into the system by buying government bonds or other securities from banks.

- If there are excess reserves in the banking system, these can also be used to pay for government bonds.

- When this happens, it pushes up bond prices, making them more attractive than before, so investors want to buy them because they offer better returns on their investment.

-

Restrictive Monetary Policy

- It aims to reduce the amount of money in circulation to reduce inflation.

- Restrictive monetary policies have the potential to slow economic growth, increase unemployment, and reduce investment.

- Central banks can use restrictive monetary policies to cool a hot economy.

- This policy involves raising interest rates, which reduces credit availability and slows spending and investment.

- However, this policy form also has negative consequences, like increasing unemployment and the risk of recession.

- The Federal Reserve implements a restrictive policy by keeping short-term interest rates near zero for seven years during the Great Recession. They eventually raised rates in December 2015 after economic growth reached its potential, with inflation under control.

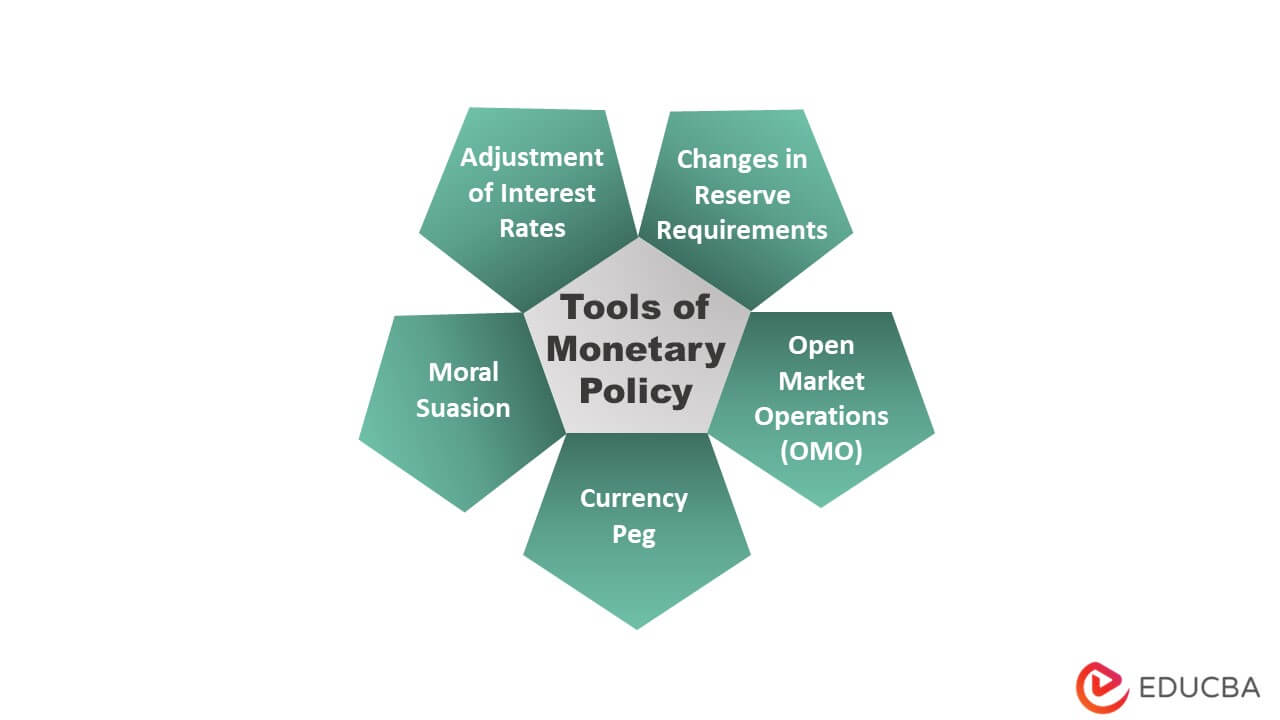

Tools of Monetary Policy

There are two main tools of monetary policies:

1. Open Market Operations

- With open market operations, a central bank buys or sells securities to change the money supply. A central bank can adjust its target interest rates, influencing short-term and long-term interest rates.

- Open market operations work through expansionary or contractionary monetary policies (expanding or contracting credit), while changing the discount rate only affects short-term interest rates.

- The Federal Reserve has control over open market operations as they affect changes in both short-term and long-term interest rates; the Fed doesn’t have direct control over the discount rate, so that tool indirectly affects those other rates.

- It’s important to note that the Fed may use both tools together when conducting Monetary policies.

- For example, if unemployment remains high, the Feds might try lowering the target rate while simultaneously buying up bonds from investors to increase liquidity and reduce their interest rates.

2. Discount Rate

- The discount rate is the interest rate charged by a central bank on loans to commercial banks.

- Lowering this rate will encourage banks to borrow more from the central bank rather than elsewhere at higher rates, increasing the money supply.

- Raising it makes borrowing more expensive and discourages banks from seeking loans.

- The central bank can influence short-term interest rates by changing the discount rate.

- The discount rate is how much the central bank charges commercial banks for loans, and it’s a key determinant of short-term interest rates because when commercial banks borrow from the central bank, they charge higher rates to their customers.

- Changing the rate at which a bank can borrow from the central bank affects the cost of money for all other borrowers in that market.

Objectives of Monetary Policy

- Countries use monetary policies to influence their economies by controlling the money supply and thus meeting their macroeconomic objectives of maintaining stable inflation, unemployment, and economic growth. Its primary goals are as follows:

- Control inflation by keeping the price level stable and at a low percentage. If inflation is very high, restrictive policies will be implemented, whereas expansionary monetary policies will be implemented if inflation is low or deflation is present.

- Reduce unemployment: Ensures that the number of unemployed people is minimal. Expansionary policies will be used to increase investment and hiring.

- Achieve economic growth: To ensure employment and well-being, the country’s economy must grow. Expansionary monetary policies will be employed to achieve this goal.

- Improve the balance of payments: Ensure that the country’s imports are not significantly higher than exports, as this could lead to an uncontrolled increase in debt and economic degrowth.

- Monetary policy objectives are unlikely to be met solely through monetary policy.

- To achieve them, fiscal policies coordinated with monetary policies will be required.

- Monetary policies have numerous limitations, and as a result, many economists oppose their use, claiming that they predict business cycles.

- Furthermore, monetary policy mechanisms frequently fail to achieve the desired outcomes while altering other variables.

- For example, increasing an economy’s money supply to achieve economic growth may only result in an increase in prices.

Real-world Examples of Monetary Policy

- Federal Reserve’s anti-inflationary recession under the direction of Paul Volcker in 1982.

- The most widely recognized successful implementation of monetary policy in the United States occurred in 1982.

- Shortly after taking office, Volcker increased the discount rate by 0.5 percent, kept an eye on the global credit crunch, and backed the growth of the IMF reserve fund. Additionally, he prioritized raising the money supply without causing inflation.

- Stagflation in the late 1970s:

- The late 1970s saw rising inflation and unemployment in the United States. Previously, Keynesian economic theory and the now-defunct Phillips curve considered stagflation, a phenomenon, impossible.

- Volcker was concerned in 1978 that the Federal Reserve would keep interest rates too low and raise them to 9%. Inflation, however, persisted.

- Great Recession of the 2000s:

- A more recent example of expansionary monetary policy was seen in the United States during the Great Recession in the late 2000s.

- As house prices fell and the economy slowed, the Federal Reserve reduced its discount rate from 5.25% in June 2007 to 0% by the end of 2008. With the economy still weak, it spent $3.7 trillion on government securities purchases from January 2009 to August 2014.

- Covid-19

- In 2020, nations suffered greatly from a lack of business activity due to a still underway pandemic, and most nations went into lockdown. The Fed started a quantitative easing program and declared it would buy $500 billion worth of Treasury bonds to stimulate the economy.

Monetary Policy vs. Fiscal Policy

| Monetary Policy | Fiscal Policy |

| Monetary policy is an economic policy established and directed by a central bank. | Fiscal policy is an economic policy established and directed by a national government. |

| The real economy is less affected by monetary policy, which is more of a blunt tool for adjusting the money supply to affect inflation and growth. | In fiscal policy, governments can increase their spending—often called stimulus spending—if they do not have enough economic activity. |

| Monetary policy aims to promote economic activity by incentivizing people and businesses to borrow and spend money. | Given that it can result in higher employment and income, fiscal policy typically impacts consumers more than monetary policy. |

| A central bank typically oversees monetary policy, which controls the amount of money in circulation, interest rates, and the total amount of money in circulation. | Taxation and spending are covered by fiscal policy, typically influenced by legislative action. |

| The central bank determines monetary policy, which can increase consumer spending by lowering borrowing costs for everything from credit cards to mortgages. | In fiscal policy, the government makes decisions about taxes and spending that affect individual taxpayers’ tax bills or give them jobs on government projects. |

FAQs

1. What is Monetary Policy?

Answer: Monetary policy, also known as monetary management, uses a country’s central bank and its instruments, such as interest rates and currency values, to influence the economy.

2. What are the examples of monetary policy operations and procedures?

Answer: Example 1: A fixed-interest-rate auction injects liquidity temporarily. Example 2: A variable interest rate auction injects liquidity temporarily.

3. What is the main objective of monetary policy?

Answer: The main objective of monetary policy is to achieve economic objectives, such as low inflation or high employment. It is a set of tools that the government can use to control the supply of money and credit in an economy. This is done to achieve economic objectives, such as low inflation or high employment.

4. Who controls monetary policy?

Answer: The Federal Reserve Board of Governors, a part of the US Federal Reserve System, decides the country’s monetary policy. Monetary policy is how the country’s central bank controls the supply and availability of money to help manage inflation and achieve economic goals.

5. How is a monetary policy implemented?

Answer: It uses monetary policy tools such as adjusting interest rates and altering reserve requirements. In addition, it also provides financial services to banks and consumers, oversees the banking system’s safety and soundness, regulates state-chartered banks that are not members of the Federal Reserve System (state banks), provides banking services to the US Treasury, sells bank notes abroad under an agreement with the Treasury Department and supplies currency at home when needed.

Recommended Articles

This article explains everything about Monetary Policy. To know more, read the following articles: