Top Books to Learn to Make Money

Earning money takes a lot of work, and thus, money making books teach us the money making money skill that depends on many variables. Even today, a large population does not know how to generate income, manage money, or achieve financial success. Although no magic can instantly make you wealthy, knowledge does assist. The list of books we have provided below will give the readers a clear understanding of money making. These are essential reads for anyone wanting to be debt-free or advance their financial status.

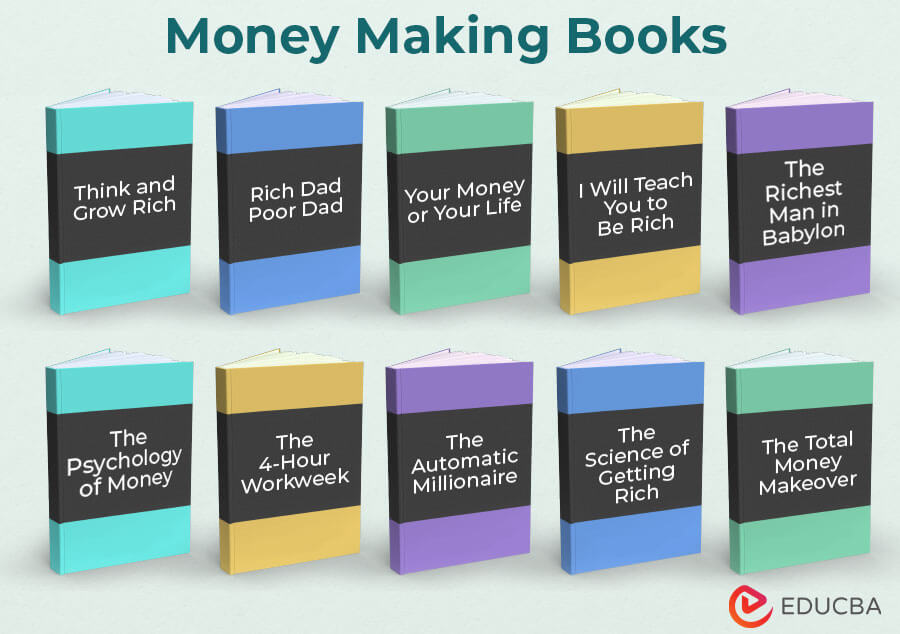

These 10 best money making books will help you build the fortune you deserve.

| # | Book | Author | Original Publishing Date | Rating |

| 1. | Think and Grow Rich | Napoleon Hill | 1937 | Amazon: 4.4 Goodreads: 4.18 |

| 2. | Rich Dad, Poor Dad | Robert T. Kiyosaki | 1997 | Amazon: 4.6

Goodreads: 4.12 |

| 3. | Your Money or Your Life | Vicki Robin, Joe Dominguez | 1992 | Amazon: 4.5

Goodreads: 4.00 |

| 4. | I Will Teach You to Be Rich | Ramit Sethi | 2009 | Amazon: 4.3

Goodreads: 4.16 |

| 5. | The Richest Man in Babylon | George Clason, Frederick Van Rensselaer | 2002 | Amazon: 4.7

Goodreads: 4.14 |

| 6. | The Psychology of Money | Morgan Housel | 2020 | Amazon: 4.6

Goodreads: 4.36 |

| 7. | The 4-Hour Workweek | Timothy Ferriss | 2007 | Amazon: 4.4

Goodreads: 3.92 |

| 8. | The Automatic Millionaire | David Bach | 2003 | Amazon: 4.6

Goodreads: 3.94 |

| 9. | The Science of Getting Rich | Wallace D Wattles | 1910 | Amazon: 4.6

Goodreads: 4.14 |

| 10. | The Total Money Makeover | Dave Ramsey | 2003 | Amazon: 4.7

Goodreads: 4.23 |

Let us now review each of the money making books to help you pick the one that best suits your needs.

Book #1: Think and Grow Rich

Author: Napoleon Hill

Get this book here.

Review:

The book suggests that the reader can succeed and become wealthy by adhering to recommended financial management rules. Hill refers to these principles as the “13 Steps to Wealth,” which include adopting a positive mindset, setting concrete goals, developing a plan to achieve those goals, taking action, and having complete confidence in one’s abilities.

Key Point:

- The book helps the reader to develop the motivation to succeed financially.

- It enables the reader to cultivate a positive self-perception and cheerful outlook and remove uncertainty and anxiety.

- It helps to develop a good judgment of unfavorable opinions and not let them interfere with the decision-making process.

Book #2: Rich Dad, Poor Dad

Author: Robert Kiyosaki

Get the Book here.

Review:

The book Rich Dad, Poor Dad is a book that tells the story of how Robert, the author, had two fathers growing up. One, his biological father, and another, his best friend’s wealthy father. It explores how each of his father’s views on money and investment affected Robert. The book dispels the myth that earning a high wage is mandatory for financial success. It clarifies the difference between working for money and having your money work for you.

Key Points:

- Readers understand the difference between a rich person and a poor mindset.

- The author advises paying oneself first. He discusses the most prevailing emotions of fear and greed throughout the book.

- The book clarifies how individuals frequently mix up assets and liabilities.

- The book encourages people to become financially educated and learn to see financial opportunities in all situations.

Book #3: Your Money or Your Life

Authors: Vicki Robin, Joe Dominguez

Get this book here.

Review:

Your Money or Your Life is a North Star in handling personal finance. Vicki Robin guides the reader to live a more meaningful and deliberate life and invest wisely. It helps to develop the right mindset to see the reader through to retirement while pruning out unnecessary habits.

Key Points:

- The reader learns to invest in index funds and manage hustles.

- The book teaches readers how to manage finances online and discusses challenging money-related topics.

- It assists in escaping debt and saving by adopting a positive mindset and forming new, financially-friendly habits.

- It also guides the readers to multiply their money with wise investments.

Book #4: I Will Teach You to Be Rich

Author: Ramit Sethi

Get this book here.

Review:

I Will Teach You to Be Rich: No Guilt. No Excuses. No BS is a Wall Street and New York Times bestseller. The author includes a six-week program to help the reader get out of debt, earn and save, and have a wealthy existence. The reader can save hundreds to thousands monthly by cultivating a few tactics.

Key Points:

- The book guides the reader to select the paying investments so that money grows and one does not need to cut down on things one loves.

- The reader learns to get out of debt by paying off loans very quickly.

- The author enables the reader to communicate effectively to set bank accounts without fees.

Book #5: The Richest Man in Babylon

Author: George S. Clason

Get this book here.

Review:

The book uses parables set in ancient Babylon to instruct readers on timeless financial principles. The book teaches the significance of spending responsibly, conserving money intelligently, and avoiding debt. It is a simple, understandable illustration of these concepts and is available to readers of all ages and educational backgrounds.

Key Points:

- The potency of compound interest is among the most vital lessons in this book.

- The significance of beginning to save early and consistently, as well as investing your money so that it might grow over time, is emphasized throughout the book.

- The book enables the reader to understand the value of taking charge of one’s financial future and becoming financially independent.

Book #6: The Psychology of Money

Author: Morgan Housel

Get this book here.

Review:

The book “The Psychology of Money” by Morgan Housel examines how money affects people’s behavior. Housel argues that people frequently think money is a strictly financial issue, but psychology and human nature are dominant factors, too. The author discusses a different aspect of money psychology in each of the book’s 20 concise chapters.

Key Points:

- Housel contends that one’s capacity to comprehend and regulate thoughts, feelings, and behaviors frequently determines success in money management.

- The reader learns the significance of refraining from behavioral problems like arrogance, fear, and greed.

- Housel guides the reader to stop worrying over daily financial details or paying attention to short-term stock market changes as they may hinder them.

Book #7: The 4-Hour WorkWeek

Author: Timothy Ferriss

Get this book here.

Review:

A thought-provoking book that questions conventional beliefs about work and lifestyle, “The 4-Hour Work Week” is entertaining and engaging. The book gives insightful advice on how to lead a more contented and effective life. However, all suggestions may not be suitable for every reader.

Key Points:

- There are alternative lifestyles besides the conventional 9 to 5 workweek.

- Ferriss advocates for a more flexible way of life that enables people to work fewer hours and spend more time relaxing.

- Delegating and outsourcing duties can free up time so that people can concentrate on priority tasks.

- In addition to outsourcing work to contractors or virtual assistants, Ferriss advises automating routine activities whenever possible.

Book #8: The Automatic Millionaire

Author: David Bach

Get the Book here.

Review:

This book is a practical guide that shows readers a straightforward method to achieve financial success. It focuses on the importance of automating finances to build wealth gradually and effortlessly. The author uses easy-to-follow steps to underscore how small changes in money management can lead to significant long-term gains.

Key Points:

- The book highlights the power of gaining wealth by setting up automatic contributions to savings, investments, and debt repayment.

- It also uses the concept of the “Latte Factor” to show how small daily expenses can add up over time and impact one’s financial future.

- The author discusses the role of homeownership in building wealth.

- It guides readers in setting up a secure retirement fund by harnessing the power of compound interest and consistent contributions.

Book # 9: The Science of Getting Rich

Author: Wallace D. Wattles

Get this book here.

Review:

Wallace Delois Wattles lived from 1860 to 1911 and, in his lifetime, came out of poverty-stricken conditions with a self-help attitude. The book addresses the fact that people need more money and guides them on how to make the money they need. The author emphasizes fine-tuning the mind for financial success.

Key Points:

- The author suggests proven scientific principles for a positive money management mindset.

- The reader learns to use their mind positively for favorable outcomes.

- The reader can also participate in the suggested step-by-step program to create more wealth.

Book #10: The Total Money Makeover

Author: Dave Ramsey

Get this book here.

Review:

Readers of “The Total Money Makeover” will receive a clear road map for reaching financial freedom with the help of this personal finance book. Debt is a big hurdle to financial independence. Ramsey supports the “Debt Snowball” approach, in which you prioritize paying off the lowest obligations before moving on to larger ones. The book is helpful for anyone wishing to take charge of their finances and secure their financial future, even though some readers may find Ramsey’s method too rigid or general.

Key Points:

- The author emphasizes that the foundation of successful money management is a budget.

- The book teaches us to keep tabs on expenditures and the best way to live within the means.

- It shows how to develop a six-month emergency fund that can prevent debt in case of the arrival of unexpected expenditures.

Recommended Books

We trust that this EDUCBA guide featuring the top 10 money making books was useful. For more insights, EDUCBA suggests these additional articles.