Updated July 26, 2023

Money Multiplier Formula (Table of Contents)

What is the Money Multiplier Formula?

The term “money multiplier” refers to the phenomenon of credit creation due to the fractional reserve banking system under which a bank must hold a certain amount of the deposits in its reserves to meet any potential withdrawal demand.

So, it means that a bank has to hold a fraction of all the deposits as reserves, while it can extend the remaining as loans to create more money in the economy. The mandatory reserve maintained by the bank divided by the total deposits received by the bank is known as the required reserve ratio. The formula for the money multiplier is simple, and it can be derived by dividing one by the required reserve ratio. Mathematically, it is represented as,

Examples of Money Multiplier Formula (With Excel Template)

Let’s take an example to understand the calculation of the Money Multiplier in a better manner.

Money Multiplier Formula – Example #1

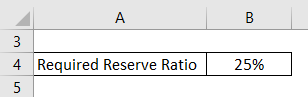

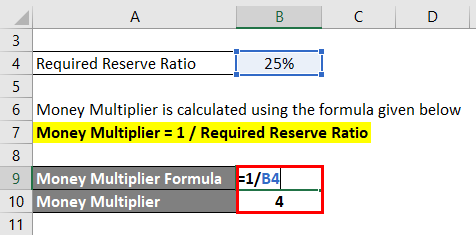

Let us take a simple example of a bank with a required reserve ratio of 25%. Calculate the money multiplier of the economy.

Solution:

The formula to calculate Money Multiplier is as below:

Money Multiplier = 1 / Required Reserve Ratio

- Money Multiplier = 1 / 25%

- Money Multiplier = 4

Therefore, the money multiplier of the economy is 4.

Money Multiplier Formula – Example #2

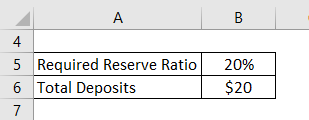

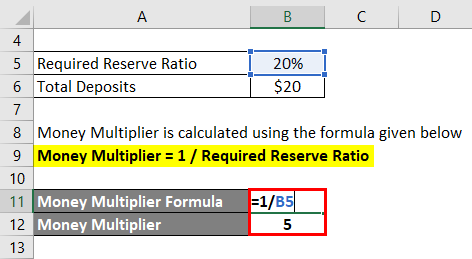

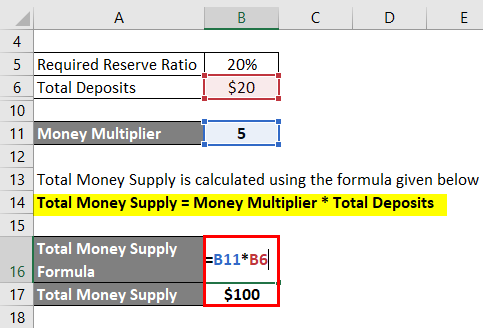

Let us take the example of a country where the central bank has mandated commercial banks to maintain a reserve equivalent to 20% of their deposits. Calculate the money multiplier and the total money supply in the economy if the total deposits are $20 million.

Solution:

Money Multiplier = 1 / Required Reserve Ratio

- Money Multiplier = 1 / 20%

- Money Multiplier = 5

The formula to calculate Total Money Supply is as below:

Total Money Supply = Money Multiplier * Total Deposits

- Total Money Supply = 5 * $20 million

- Total Money Supply = $100 million

Therefore, the money multiplier is 5, while the total money supply in the economy is $100 million.

Money Multiplier Formula – Example #3

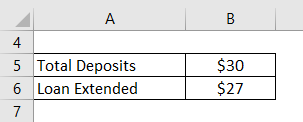

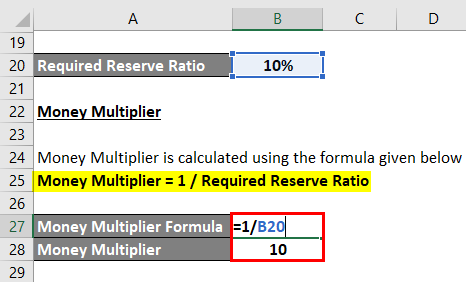

Let us take another example of a bank SDF Bank Ltd to understand the money multiplier concept. Last year, the bank collected total deposits worth $30 million, out of which the bank extended $27 million in the form of different types of loans. Based on the given information, Calculate the following:

- Money Maintained in Reserve

- Required Reserved Ratio

- Money Multiplier

- Total Money Supply in the Economy

Solution:

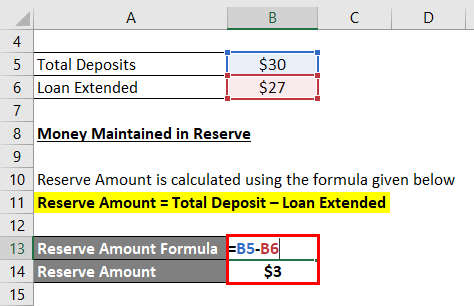

The formula to calculate Reserve Amount is as below:

Reserve Amount = Total Deposit – Loan Extended

- Reserve Amount = $30 million – $27 million

- Reserve Amount = $3 million

Therefore, the money maintained in the reserve is $3 million.

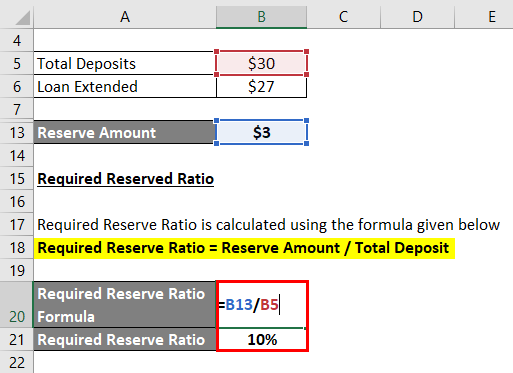

The formula to calculate Required Reserve Ratio is as below:

Required Reserve Ratio = Reserve Amount / Total Deposit

- Required Reserve Ratio = $3 million / $30 million

- Required Reserve Ratio = 10%

Therefore, the Required Reserved Ratio is 10%.

Money Multiplier = 1 / Required Reserve Ratio

- Money Multiplier = 1 / 10%

- Money Multiplier = 10

Therefore, the Money Multiplier of the Economy is 10.

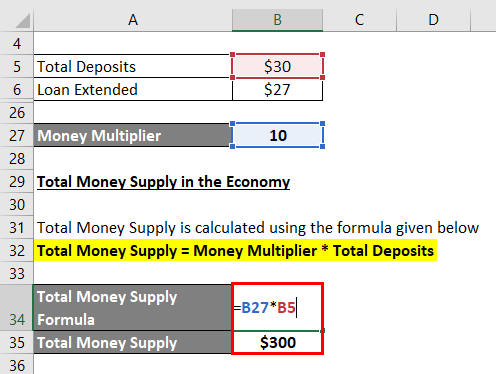

Total Money Supply = Money Multiplier * Total Deposits

- Total Money Supply = 10 * $30 million

- Total Money Supply = $300 million

Therefore, the total money supply in the economy due to SDF Bank Ltd is $300 million.

Explanation

The formula for the money multiplier can be determined by using the following steps:

Step 1: Firstly, determine the number of deposits received by the bank in the form of the current account, savings account, recurring account, fixed deposit, etc.

Step 2: Next, determine the number of loans extended to the borrowers. It is the aggregate of all the types of lending, such as term loans, short-term loans, overdraft facilities, etc.

Step 3: Next, calculate the number of deposits maintained in reserve by deducting the total amount of loans extended (step 2) from the total amount of deposits received (step 1), as shown below.

Reserve Amount = Total Deposit – Loan Extended

Step 4: Next, calculate the required reserve ratio by dividing the fraction of deposits maintained in the reserve (step 3) by the total amount of deposits received (step 1) by the bank, as shown below.

Required Reserve Ratio = Reserve Amount / Total Deposit

Step 5: Finally, the formula for the money multiplier can be calculated by dividing one by the required reserve ratio (step 4), as shown below.

Money Multiplier = 1 / Required Reserve Ratio

Relevance and Use of Money Multiplier Formula

From the perspective of banking economics, the money multiplier is a very important concept as it is a key element of the fractional banking system that controls the money supply in an economy. The money multiplier defines the money the banking system generates with each dollar of reserves. Theoretically, the higher the reserve requirement, the lower the amount of money the banking system can use to extend loans resulting in lesser money in circulation. As such, the money multiplier is inversely proportional to the reserve ratio.

Money Multiplier Formula Calculator

You can use the following Money Multiplier Formula Calculator

| Required Reserve Ratio | |

| Money Multiplier | |

| Money Multiplier | = |

|

|

Recommended Articles

This is a guide to Money Multiplier Formula. Here we discuss how to calculate Money Multiplier Formula along with practical examples. We also provide a Money Multiplier calculator with a downloadable Excel template. You may also look at the following articles to learn more –