What Is a Money Order?

A money order is a secure way to send money to someone, like a prepaid check. You pay a specific amount upfront, and the issuer creates the money order for that exact amount. The recipient can cash or deposit the money order but cannot spend more than the written amount. It is a safe option when you do not want to send cash or when the recipient does not have a bank account.

Since a money order is prepaid, it offers more security than cash or personal cheques. The amount written on it is paid in full at the time of purchase, making it a safer option for sending or paying money.

How Does it Work?

- Purchase: To get it, you must first pay the full amount in cash, debit card, or credit card (depending on the institution issuing the order). There is usually a small fee for buying one.

- Fill Out the Details: When you purchase it, you fill in the recipient’s name and your information. This ensures that only the intended person can cash or deposit it.

- Sending or Using: After you get the it, you can mail it or deliver it in person. The recipient can cash it at a bank or any place that accepts money orders.

- Cash or Deposit: The recipient will cash or deposit the money order in their account. It is guaranteed to be paid, as the funds are already secured.

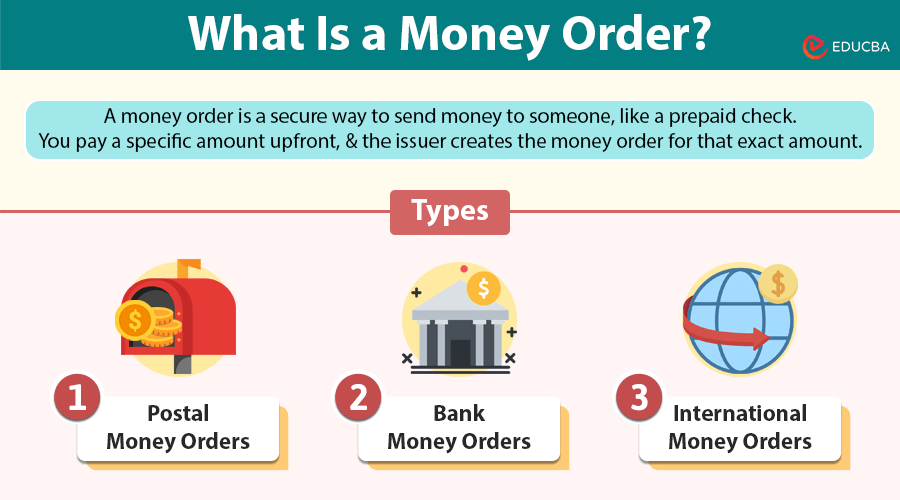

Types of Money Orders

- Postal Money Orders: National postal services (like the U.S. Postal Service) issue these, and you can use them nationwide or internationally. They are one of the most common types of money orders.

- Bank Money Orders: Banks or credit unions issue orders, and people widely accept them for various transactions, including paying bills or sending money.

- International Money Orders: You can use these to send money overseas. They are often available at postal offices or banks. When sending money internationally, you must be sure the money order is compatible with the country you are sending it to.

Advantages

- Security: Since money orders are prepaid, the funds are guaranteed. This makes sending money orders safer than sending cash by mail, as you can trace the money order if it gets lost or stolen.

- Widely Accepted: They are widely accepted by businesses, government agencies, and individuals, making them a convenient form of payment.

- No Bank Account Needed: It doesn’t require a bank account, making it perfect for those without access to traditional banking services.

- Good for Paying Bills: A lot of people use money orders to pay their bills, particularly if they do not have a credit card or bank account.

Disadvantages

- Fees: There is usually a fee associated with purchasing a money order. The fees typically vary from a few cents to a few dollars, depending on the issuer and the amount of the money order.

- Limited Amounts: Most money orders have a maximum limit. For example, in the U.S., the limit for a USPS money order is $1,000. If you need to send more, you must purchase multiple money orders.

- Inconvenience for Larger Amounts: If you need to send a large sum, buying multiple money orders or paying the fees for each order can be inconvenient.

- Not Always Free to Cash: The place where the recipient cashes the money order might charge a fee.

How to Buy a Money Order?

To buy a money order, follow these steps:

- Go to an Issuer: Find a financial institution, such as a bank, post office, or convenience store, that sells money orders.

- Pay the Amount: Pay the amount you want to send and the purchase fee. You can usually pay with cash, debit card, or credit card.

- Fill Out the Money Order: Write the recipient’s name and any other required details, like your name and address. Make sure the information is correct.

- Keep the Receipt: Always keep the receipt for your records, as it can help you track the money order in case it is lost or stolen.

How to Cash a Money Order?

To cash a money order, the recipient needs to follow these steps:

- Verify the Money Order: Make sure it is legitimate by checking the issuer’s logo and details. Fraudulent money orders are rare but do exist.

- Present the Money Order: The recipient can present the money order at a bank, post office, or a location that cashes money orders (like some grocery stores).

- Identification: The recipient might need to show identification, like a driver’s license, to prove they are the correct person to receive the money.

- Receive the Cash: If the issuer accepts the money order, the recipient can receive it or deposit it into their bank account.

Money Orders vs. Checks: Key Differences

| Aspect | Money Orders | Checks |

| Payment Source | Prepaid; the amount is paid upfront before issuance. | Draws money from your bank account, which may not have sufficient funds. |

| Fees | Typically has a purchase fee. | May not have a fee, but there could be charges for insufficient funds. |

| Security | More secure; guaranteed payment since it’s prepaid. | Less secure; can bounce if there are insufficient funds in the account. |

Common Uses for Money Orders

- Paying Bills: People use it to pay utility bills, rent, or any other bill that may not accept cheques or online payments.

- Sending Gifts: People use it to send gifts to family and friends, especially if they cannot access electronic payment systems.

- Purchasing Items: Some businesses prefer it for certain purchases, especially if they do not accept credit or debit cards.

- Sending Money Remotely: For individuals who do not have access to electronic transfers or bank accounts, money orders are an easy way to send funds.

Final Thoughts

Money orders are a safe, reliable, and simple way to send or receive payments without a bank account. They are a good alternative when other payment methods like cash, cheques, or bank transfers are not available or convenient. While fees are involved and some limitations, the security and ease of use make money orders a popular choice for many people. Knowing how money orders work and their benefits can help you make better decisions when using them for personal or business transactions.

Recommended Articles

We hope this guide helped you understand money orders and how they work. Check out these recommended articles for more insights on secure payment methods and financial tips.