Updated July 24, 2023

Difference Between Mortgage APR vs Interest Rate

The following article provides differences between Mortgage APR vs Interest Rate. The mortgage annual percentage rate is a charge required for the total loan amount and contains interest and all other expenses required for the loan procedure. An expense is mortgage broker fees, points, interest rates, and additional charges. On the other hand, the interest rate contains only interest charges on that loan amount. The annual percentage rate is calculated by the combination of interest rate and other expenses or fees required for the process.

The annual percentage rate is mostly higher than the nominal interest rate because it considers all other fees. The annual percentage rate takes only simple interest while calculating the final rate, but there is another term called annual percentage yield it takes to compound interest in calculating the rate; this is called the effective annual rate.

What is Mortgage Annual Percentage Rate?

The annual percentage rate is the annual rate required for the overall loan process. It contains interest rates and all expenses, including fees or additional costs, brokerage fees, etc. APR is expressed as a percentage and calculated yearly. It gives you a calculated amount you need to pay per period without compounding interest. The annual percentage rate is calculated by multiplying the simple interest rate by the number of periods in a year. It is a charge earned on an investment. APR is of two types one is fixed, and another is variable. Fixed APR is guaranteed not to change the whole life of the loan, but in variable APR, the interest rate may change during the life of the loan.

What is the Nominal Interest Rate?

The nominal interest rate is the only interest charge on loan and does not contain any other expense. It is the rate on the loan that has to pay by the borrower from where they take a loan, and it is also expressed as a percentage. If interest rates are reduced, people take more loans for their businesses or any other investment. And an increase in interest rates makes borrowers discourage investing. The interest rate can be calculated for less than one year or more than one year. The interest rate can vary widely. To calculate the yearly interest, you must multiply the annual percentage rate by 12.

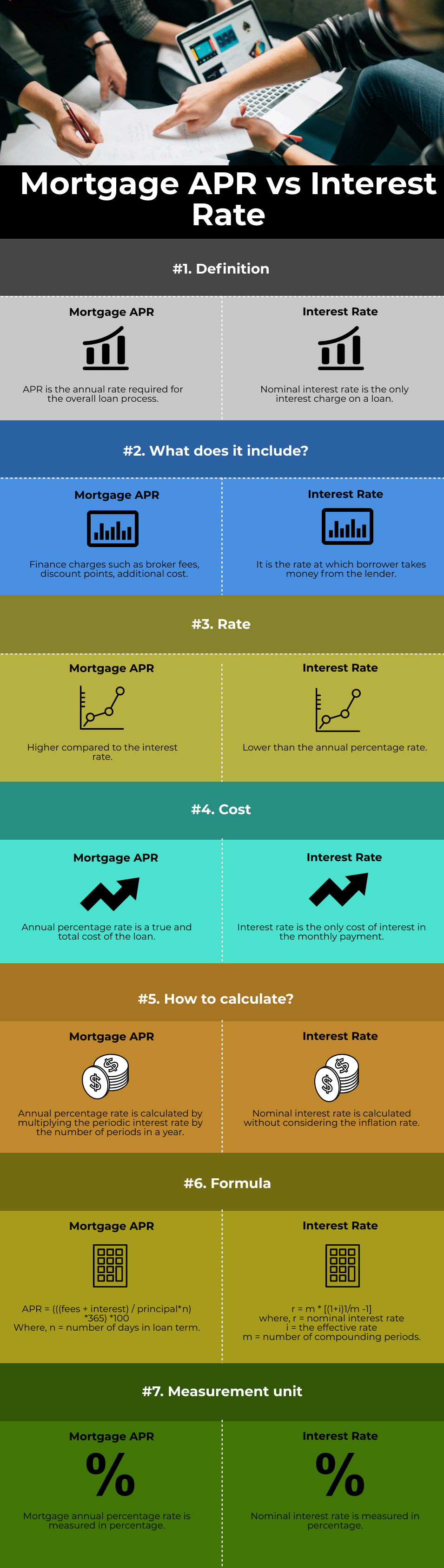

Head To Head Comparison between Mortgage APR vs Interest Rate (Infographics)

Below are the top 7 differences between Mortgage APR vs Interest Rate:

Key Differences Between Mortgage APR vs Interest Rate

Let us discuss some of the major key differences between Mortgage APR vs Interest Rate.

- The nominal interest rate gives you a monthly payment amount, whereas the mortgage annual percentage rate gives you a total estimate of the overall loan process’s cost.

- The mortgage annual percentage rate is a great term that shows you an amount for every monthly payment and the total cost of expenses, but the nominal interest rate shows only interest.

- For calculating the mortgage annual percentage rate, you require total, or additional fees, nominal interest rate, principal amount, and the number of days in the loan term. And the nominal interest rate is calculated without the inflation rate and does not consider any additional fees or other charges.

- Compared to the nominal interest rate, a mortgage’s annual percentage rate gives you a realistic value. The nominal interest rate does not provide an exact amount; it gives us a short-term view of the loan amount.

- The mortgage annual percentage rate always helps us to select what is more affordable from a long-term perspective.

- It is not necessary that if the annual percentage rate is low, then this is a better deal.

- APR may vary because all expenses may vary, such as brokerage is not the same everywhere. And the nominal interest rate is also not constant because the nominal interest rate is nothing but an addition of the real interest rate and inflation.

- The mortgage annual percentage rate is calculated using only a simple interest rate.

- The mortgage annual percentage rate is usually higher than the nominal interest rate because it considers all the expenses and additional fees.

Mortgage APR vs Interest Rate Comparison Table

Let’s discuss the top comparison between Mortgage APR vs Interest Rate:

|

Basis of Comparison |

Mortgage APR |

Interest Rate |

| Definition | APR is the annual rate required for the overall loan process. | The nominal interest rate is the only interest charge on a loan. |

| What does it Include? | Finance charges such as broker fees, discount points, additional cost. | It is the rate at which the borrower takes money from the lender. |

| Rate | Higher compared to the interest rate. | Lower than the annual percentage rate. |

| Cost | The annual percentage rate is the true and total cost of the loan. | The interest rate is the only cost of interest in the monthly payment. |

| How to Calculate? | The annual percentage rate is calculated by multiplying the periodic interest rate by the number of periods in a year. | The nominal interest rate is calculated without considering the inflation rate. |

| Formula | APR = (((fees + interest) / principal*n) *365) *100

Where, n = number of days in loan term. |

r = m * [(1+i)1/m -1]

where, r = nominal interest rate i = the effective rate m = number of compounding periods. |

| Measurement Unit | The mortgage annual percentage rate is measured in percentage. | The nominal interest rate is measured in percentages. |

Conclusion

We have gone through major differences between mortgage annual percentage rate and nominal interest rate. So which is better termed to get a clear idea and clear view while taking a loan? The mortgage annual percentage rate is better than the nominal interest rate because the annual percentage rate gives us a clear picture of the total cost required; thus, it calculates by adding all the additional fees and interest required for the loan. The mortgage annual percentage rate gives us a value-helpful in deciding for the long-term; it also shows that this will be affordable. But the annual percentage rate may vary because the fee structure is different everywhere and every time.

The value of the mortgage annual percentage rate is mostly higher than the nominal interest rate because of additional fees. The mortgage annual percentage rate is calculated by using a simple interest rate. The mortgage annual interest rate gives us an accurate amount, but the nominal interest rate doesn’t give it only shows a monthly payment. So to make the final decision, you must go through the mortgage and annual percentage rate.

Recommended Articles

This is a guide to the top difference between Mortgage APR vs Interest Rate. Here we also discuss the Mortgage APR vs Interest Rate key differences with infographics and a comparison table. You may also have a look at the following articles to learn more-