Difference Between Mortgage Banker vs Broker

Mortgage Banker vs Broker in this, a mortgage banker can be defined as a direct lender who is technically employed in the department that takes care of the loan at a bank, financial institution, or credit union. A mortgage banker is the one who lends money to the borrower for the applied loan amount. A mortgage banker works with the loan and Realtors applicants to execute the process of mortgage that starts with the evaluation of the property, assembling all the financial information of the loan applicant and advising him of the best suitable options, and ends with assigning him the loan.

On the other hand, a mortgage broker can be defined as a mediator between the lender and the borrower who works for a percentage of commission on the overall qualified loan amount and works with not just one but multiple lending institutions. A mortgage broker’s job is to work with a borrower and accordingly evaluate his needs and then suggest to him the best options from multiple lending institutions.

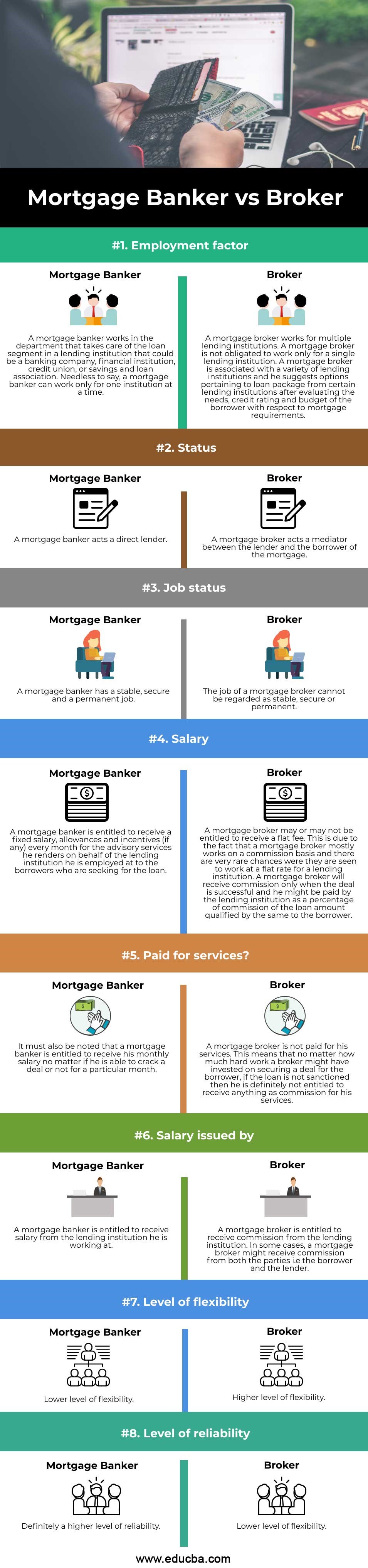

Head To Head Comparison Between Mortgage Banker vs Broker(Infographics)

Below are the Top 8 comparisons between Mortgage Banker vs Broker:

Key Differences Between Mortgage Banker vs Broker

The key differences between a mortgage broker and a banker are provided and discussed as follows:

- A mortgage banker is a sort of a direct lender, whereas a mortgage broker cannot be regarded as a direct lender as he acts as a mediator between the lending and the borrowing parties.

- A mortgage broker is not entitled to receive a fixed salary, unlike a mortgage banker. A mortgage banker can claim a percentage of commission on the loan institution’s sanctioned loan amount to the borrower even when they use free mortgage internet leads to find clients.

- A mortgage banker works for a bank, financial institution, or credit union. A mortgage banker works with numerous lending institutions.

- Being employed with a lending institution makes a mortgage banker highly reliable compared to a mortgage broker since the latter works independently to secure the best loan package on behalf of the borrowers.

- The level of flexibility offered by a mortgage banker is lower as compared to the level of flexibility offered by a mortgage broker.

Mortgage Banker vs Broker Comparison Table

Given below are the Major difference between Mortgage Banker vs Broker:

| Basis of Comparison | Mortgage Banker | Broker |

| Employment factor | A mortgage banker works in the department that takes care of the loan segment in a lending institution that could be a banking company, financial institution, credit union, or savings and loan association. Needless to say, a mortgage banker can work only for one institution at a time. | A mortgage broker works for multiple lending institutions. A mortgage broker is not obligated to work only for a single lending institution. A mortgage broker is associated with a variety of lending institutions, and he suggests options pertaining to loan package from certain lending institutions after evaluating the needs, credit rating and budget of the borrower with respect to mortgage requirements. |

| Status | A mortgage banker acts as a direct lender. | A mortgage broker acts as a mediator between the lender and the borrower of the mortgage. |

| Job-Status | A mortgage banker has a stable, secure, and permanent job. | The job of a mortgage broker cannot be regarded as stable, secure, or permanent. |

| Salary | A mortgage banker is entitled to receive a fixed salary, allowances, and incentives (if any) every month for the advisory services he renders on behalf of the lending institution he is employed at to the borrowers who are seeking the loan. | A mortgage broker may or may not be entitled to receive a flat fee. This is due to the fact that a mortgage broker mostly works on a commission basis, and there are very rare chances where they are seen to work at a flat rate for a lending institution. A mortgage broker will receive commission only when the deal is successful, and the lending institution might pay him as a percentage of commission of the loan amount qualified by the same to the borrower. |

| Paid for Services? | It must also be noted that a mortgage banker is entitled to receive his monthly salary no matter if he is able to crack a deal or not for a particular month. | A mortgage broker is not paid for his services. This means that no matter how much hard work a broker might have invested in securing a deal for the borrower if the loan is not sanctioned, then he is definitely not entitled to receive anything as a commission for his services. |

| Salary issued by | A mortgage banker is entitled to receive a salary from the lending institution he is working at. | A mortgage broker is entitled to receive a commission from the lending institution. In some cases, a mortgage broker might receive a commission from both the parties, i.e. the borrower and the lender. |

| Level of Flexibility | The lower level of flexibility. | A higher level of flexibility. |

| Level of Reliability | Definitely a higher level of reliability. | The lower level of flexibility. |

Conclusion

A mortgage banker can help in the procurement of a bank loan and so can a mortgage broker. However, the difference between a mortgage banker and a broker could be the fact that the former works for banking or such other lending institution, whereas the latter does not work with a single institution. The benefits of using a mortgage broker include having access to a wider range of lenders and loan products, which can result in more competitive rates and terms tailored to the borrower’s specific needs.

A mortgage broker is free to work with any lending institution, whereas the same is not applicable in the case of a mortgage banker. Another significant distinction between a mortgage banker and a mortgage broker could be the fact that the former acts as a direct lender, whereas the latter acts as a mediator between the former and the loan applicant (borrower).

A mortgage banker is entitled to receive a salary and other incentives (if any) from the banking institution he is currently employed in. On the other hand, a mortgage broker is entitled to receive a commission for his services, which are generally settled by offering a percentage of the loan amount passed. Sometimes, they might also work on a flat commission amount instead of a percentage of the loan amount.

Recommended Articles

This is a guide to the Mortgage Banker vs Broker. Here we discuss the difference between Mortgage Banker vs Broker, along with key differences, infographics, & a comparison table. You can also go through our other related articles to learn more–