Updated July 13, 2023

Definition of Multi-Step Income Statement

The multi-step income statement provides a similar result as to what a single-step income statement provides, with the only difference that it uses multiples stages or steps to compute the net income, i.e. in this method, multiple subtractions are made to arrive at the net income figure where basically the operating revenue and expenses are separated from the non-operating revenues, expenses, gains and losses.

Explanation

As discussed above, the multi-step income statement is like a single-step income statement, but the difference lies in the representation part. In a multi-step income statement, the calculation is broken down into several parts to arrive at the net income figure at the bottom line. The gross profit is too separately calculated and shown in such an income statement. Here, we separate operating expenses and operating revenues from non-operating expenses and non-operating revenues separately in different steps. A multi-step income statement will use multiple equations to determine the final net income figure. A multi-step income statement will use three formulas to determine the final net income figure. We will discuss the formula for the same in the following topic of this article.

The Formula of Multi-Step Income Statement

As stated in the above discussion, the formulas used to arrive at the net income figure in the multi-step income statement approach are as follows:

- Calculation of gross profit

We subtract the cost of goods sold from the net sales to arrive at the gross profit number.

- Calculation of Operating Income

Here the operating expense gets subtracted from the gross profit, which helps us arrive at the value of operating income

- Calculation of final Net Income

Here the operating income obtained is added to the non-operating expense, revenue, gains, and losses, where the final resultant is the net income for the period.

How to Prepare Multi-Step Income Statement?

The preparation multi-step income statement requires the following steps:

- Selection of reporting period: The selection of the income statement is very important based on the timeline where we decide if we need to prepare it monthly, quarterly, or annually. Public traded firms are required to prepare financial statements on a quarterly and annual basis.

- Creation of document header: The statement header will bear the company’s name and help the user identify it as an income statement along with the period or the timeline based on which it was made.

- Addition of operating revenues: The first part is the addition of all the operating revenues, which means the revenue generated by the company by selling its products or services

- The next step involves adding the operating expenses, which include all expenses related to the cost of goods sold, salaries, advertising, office rent, and supplies, to arrive at the operating expense.

- Calculation of gross profit: To arrive at the gross profit number, the cost of goods sold is deducted from the net sales.

- To calculate operating income, we subtract the earlier calculated operating expense from the gross profit, resulting in net operating income or income from operations.

- Addition of non-operating revenue and expenses: Below is the calculation showing our operating activities; we need to create another section of the non-operating part where all the non-operating expenses, revenues, gains, and losses are added to arrive at a final result.

- Calculation of Net Income: The final task is to add our operating income to the non-operating items. The result is the bottom line of our net income statement for the period.

Example of Multi-Step Income Statement

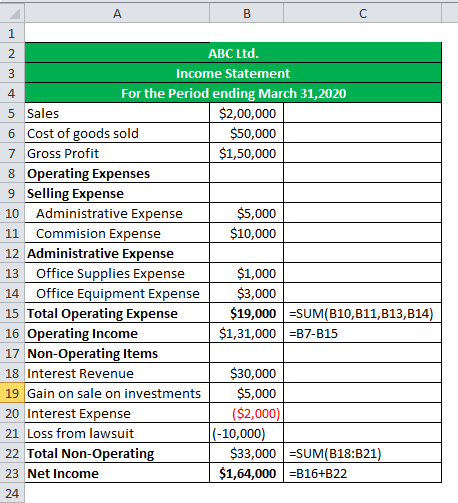

An example of the multi-step income statement is attached as an Excel file where we start with the sales turnover of $200,000 and arrive at a gross profit of $150,000 by deducting the cost of gold sold off the value of $50,000. The total operating expense of the business stands at $19,000, and thus to arrive at the operating income, we deduct the operating expense from the gross profit to arrive at a value of $131,000. The total non-operating values are added, bringing us to an estimated $33,000. Finally, to arrive at the net income, we add the operating and non-operating income to arrive at the value of $164,000.

| ABC Ltd. | |

| Income Statement | |

| For the period ending March 31, 2020 | |

| Sales | $2,00,000 |

| Cost of goods sold | $50,000 |

| Gross Profit | $1,50,000 |

| Operating Expenses | |

| Selling Expense | |

| Administrative Expense | $5,000 |

| Commission Expense | $10,000 |

| Administrative Expense | |

| Office Supplies Expense | $1,000 |

| Office Equipment Expense | $3,000 |

| Total Operating Expense | $19,000 |

| Operating Income | $1,31,000 |

| Non-Operating Items | |

| Interest Revenue | $30,000 |

| Gain on sale on investments | $5,000 |

| Interest Expense | ($2,000) |

| Loss from lawsuit | (-10,000) |

| Total Non-Operating | $33,000 |

| Net Income | $1,64,000 |

Components of Multi-Step Income Statement

The components of a multi-step income statement are as follows:

- Operating Head – Gross Profit: This is the first section of the income statement and is obtained by deducting the cost of goods sold from net sales. It represents how much profit the company earns in producing or selling its goods and services.

- Operating Head: Selling & Administrative Expense: These are captured in the income statement’s second phase. Selling expenses are the cost incurred to sell the product to customers and include advertising expenses. Admin expenses are indirect expenses related to selling goods and services, including salary and rental expenses. Adding both gives the operating expense and when we deduct the same from the gross profit, we arrive at the operating income.

- Non-Operating Head: The last part includes the non-operating expenses, revenues, gains, and losses, which, when added to the operating income, gives us the resultant as the net income for the period.

Uses of Multi-Step Income Statement

The use of a multi-step income statement is as follows:

- When we want to understand the in-depth analysis of the financial performance of the business.

- Potential investors and creditors may ask for such statements to get a detailed insight into the gross profit and operating income.

- For some public-traded corporations, it is a must to declare the breakups to get a detailed insight into their performance.

Advantages of Multi-Step Income Statement

Some of the advantages are given below:

- It provides detailed insight into the breaks involved in calculating net income.

- It shows the gross profit and the gross profit calculation part.

- One can get a break up of the operating and non-operating components of the business.

- An itemized breakdown of all expenses and revenues.

- One can calculate the gross profit margin of the company.

Disadvantages of Multi-Step Income Statement

Some of the disadvantages are given below:

- It makes the preparation of the income statement a bit lengthier and time-consuming.

- It might confuse the user about so many breaks and subtotals to arrive at the final number or the bottom line.

Conclusion

As discussed above, we saw how multi-step income statements are useful for investors and creditors to get a detailed insight into a company’s financial performance and its pros and cons. The attached example also helped us understand the different components used in such a statement.

Recommended Articles

This is a guide to a Multi-Step Income Statement. We also discuss the definition, how to prepare a multi-step income statement, and the advantages and disadvantages. You may also have a look at the following articles to learn more –