Updated July 24, 2023

Multiplier Formula (Table of Contents)

What is the Multiplier Formula?

The term “multiplier” refers to the relationship between output and its underlying factor such that any change in the underlying factor results in a greater degree of change in the output.

Although there are several types of a multiplier, in this article, we will discuss two major types of multipliers –

- Deposit Multiplier

- Fiscal Multiplier

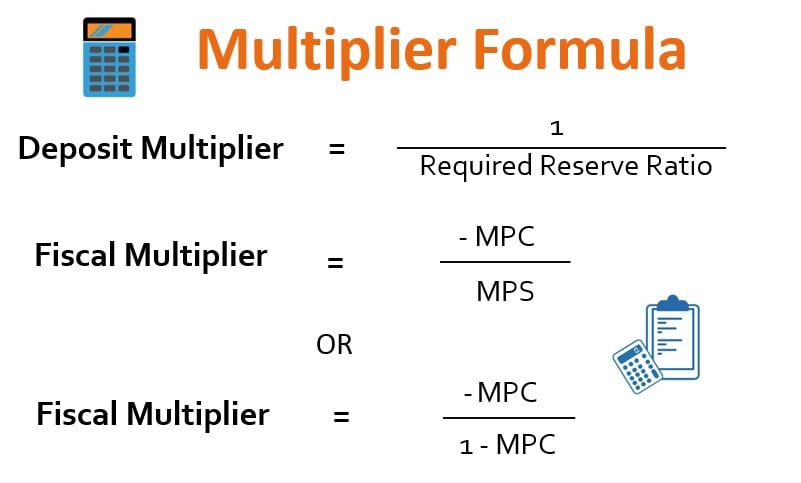

The deposit multiplier represents the relationship between the fractional reserve banking system and the resultant credit creation. Basically, banks are mandated to maintain a certain amount of the public deposits as reserves in order to cover any potential instance of bank run. The money retained by the bank as a proportion of the total deposits is known as the “Required reserve ratio”, and the formula for deposit multiplier is expressed as the reciprocal of the required reserve ratio. Mathematically, it is represented as,

On the other hand, the Fiscal multiplier describes the relationship between the economic output or Gross Domestic Product (GDP) of a nation and its tax regulation. In other words, it can be used to assess the impact of tax policy changes on aggregate national income. The fiscal multiplier formula is expressed by dividing the negative marginal propensity to consume (MPC) by marginal propensity to save (MPS). Mathematically, it is represented as,

Where,

MPS: (1 – MPC) and therefore,

Example of Multiplier Formula (With Excel Template)

Let’s take an example to understand the calculation of Multiplier in a better manner.

Multiplier Formula – Example #1

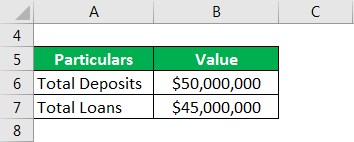

Let us take the example of a bank to illustrate the computation of the deposit multiplier. During 2018, the bank received total deposits of $50 million, and it extended a loan worth $45 million. Calculate the bank’s deposit multiplier and the subsequent total money supply in the economy due to the same.

Solution:

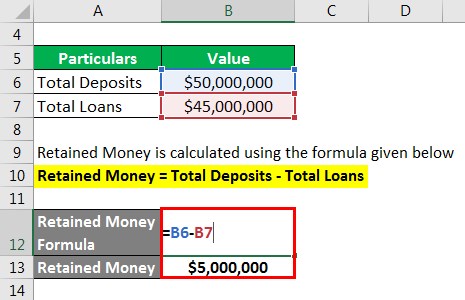

Retained Money is calculated using the formula given below

Retained Money = Total Deposits – Total Loans

- Retained Money = $50 million – $45 million

- Retained Money = $5 million

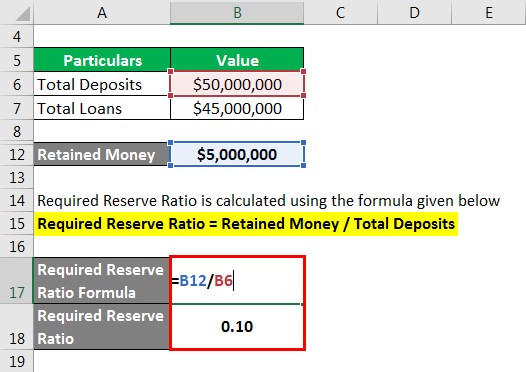

Required Reserve Ratio is calculated using the formula given below

Required Reserve Ratio = Retained Money / Total Deposits

- Required Reserve Ratio = $5 million / $50 million

- Required Reserve Ratio = 0.10

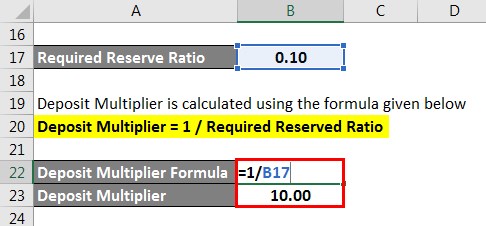

Deposit Multiplier is calculated using the formula given below

Deposit Multiplier = 1 / Required Reserved Ratio

- Deposit Multiplier = 1 / 10%

- Deposit Multiplier = 10.0x

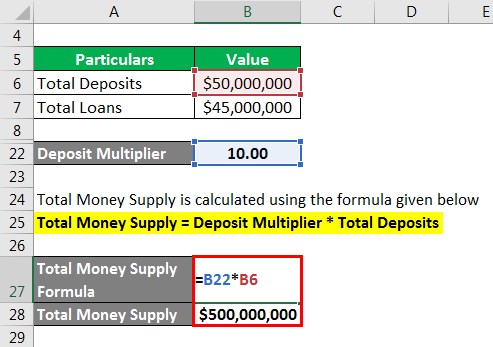

Total Money Supply is calculated using the formula given below

Total Money Supply = Deposit Multiplier * Total Deposits

- Total Money Supply = 10.0x * $50 million

- Total Money Supply = $500 million

Therefore, the bank’s deposit multiplier during the year 2018 stood at 10.0x, resulting in a money supply of $500 million in the economy.

Multiplier Formula – Example #2

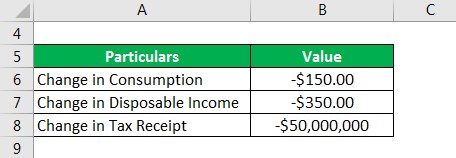

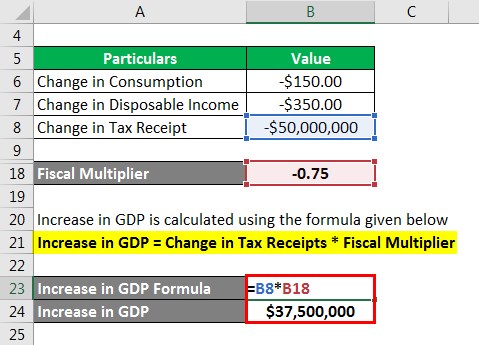

Let us now take the example of a nation where personal spending declined by $150 due to the increase in taxation that resulted in an average decline in disposable income of $350. Calculate the fiscal multiplier based on the given information. Also, Calculate the increase in GDP if the government reduces the tax receipts by $50 million.

Solution:

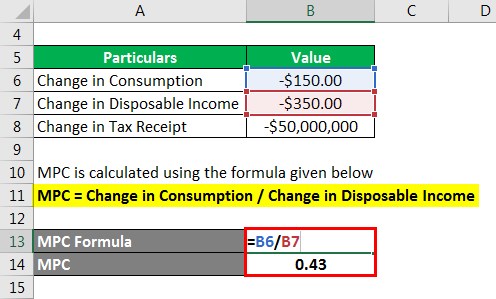

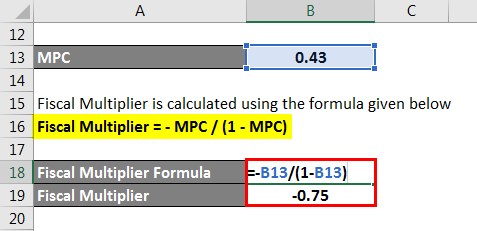

MPC is calculated using the formula given below

MPC = Change in Consumption / Change in Disposable Income

- MPC = (-$150) / (-$350)

- MPC = 0.43

Fiscal Multiplier is calculated using the formula given below

Fiscal Multiplier = – MPC / (1 – MPC)

- Fiscal Multiplier = – 0.43 / (1 – 0.43)

- Fiscal Multiplier = -0.75x

Increase in GDP is calculated using the formula given below

Increase in GDP = Change in Tax Receipts * Fiscal Multiplier

- Increase in GDP = (-$50 million) * (-0.75x)

- Increase in GDP = $37.50 million

Therefore, the nation’s fiscal multiplier is -0.75x, and the expected increase in GDP is $37.50 million.

Explanation

The formula for Multiplier can be calculated by using the following steps:

Step 1: Firstly, ascertain the value of money deposited at the bank, which can be in the form of a recurring account, savings account, current account, fixed deposit, etc.

Step 2: Next, ascertain the value of money lent by the bank in the form of loans. Such loans include both personal loans and corporate loans.

Step 3: Next, compute the value of money retained in reserve, which is the difference between total deposits received (step 1) and total loans extended (step 2).

Retained Money = Total Deposits – Total Loans

Step 4: Next, the required reserve ratio is computed by dividing the retained money (step 3) by the total deposits (step 1).

Required Reserve Ratio = Retained Money / Total Deposits

Step 5: Finally, the formula for deposit multiplier can be derived as reciprocal of the required reserve ratio (step 4) as shown below.

Deposit Multiplier = 1 / Required Reserve Ratio

The formula for fiscal multiplier can be derived by using the following steps:

Step 1: Firstly, determine the change in the disposable income level of the nation.

Step 2: Next, determine the change in consumption which is a proxy for personal spending.

Step 3: Next, compute MPC by dividing the change in consumption (step 2) by the change in disposable income (step 1).

MPC = Change in Consumption / Change in Disposable Income

Step 4: Finally, the fiscal multiplier formula can be derived as negative MPC (step 3) divided by one minus MPC as shown below.

Fiscal Multiplier = – MPC / (1 – MPC)

Relevance and Use of Multiplier Formula

The concept of deposit multiplier is important because it is useful in the assessment of the contribution of the banking system to the overall money supply in an economy. Typically, this metric estimates the amount of money generated by each dollar of bank reserve.

On the other hand, the fiscal multiplier concept is important for the determination of the impact of tax reforms on the national output. As such, it plays a pivotal role in any government’s decision-making process when it comes to tax policy. Theoretically, the increase in taxation may increase tax receipt, but it may negatively impact the overall national output due to reduced disposable income.

Multiplier Formula Calculator

You can use the following Multiplier Formula Calculator

| Required Reserve Ratio | |

| Deposit Multiplier | |

| Deposit Multiplier | = |

|

|

Recommended Articles

This is a guide to Multiplier Formula. Here we discuss how to calculate the Multiplier Formula along with practical examples. We also provide a Multiplier calculator with a downloadable excel template. You may also look at the following articles to learn more –