Updated October 31, 2023

Difference Between Mutual Fund vs Exchange Traded Fund

A mutual fund is a professionally managed investment vehicle created by pooling money from several investors for investment in a wide range of securities like stocks, bonds, money market instruments, and other assets. Through this vehicle, small or individual investors can access the securities or asset markets while reducing risk through cheaper and faster diversification, economies of scale, and the expertise of professional money managers. Now, we will discuss the Mutual Fund vs Exchange Traded Fund.

To understand diversification benefits, assume that one of the stocks in the mutual fund portfolio is doing poorly while another is doing very well. The risk is mitigated as losses from one stock can be nullified/reduced by gains in another. Thus, you will be better off investing in a mutual fund than investing in one stock or a few stocks of the fund portfolio.

An average mutual fund holds hundreds of securities. Hence, investors reap benefits from capital gains of different securities through their proportionate share, which would not be possible for individual investment in each of these securities owing to funding constraints. The fund management company sells mutual fund units to buyers.

Exchange-traded funds (ETFs) are an extension of mutual funds traded on the stock exchange, just like company shares, giving the investor the flexibility to sell short or buy on margin during the trading hours in a day. Buyers can purchase ETF shares through a brokerage.

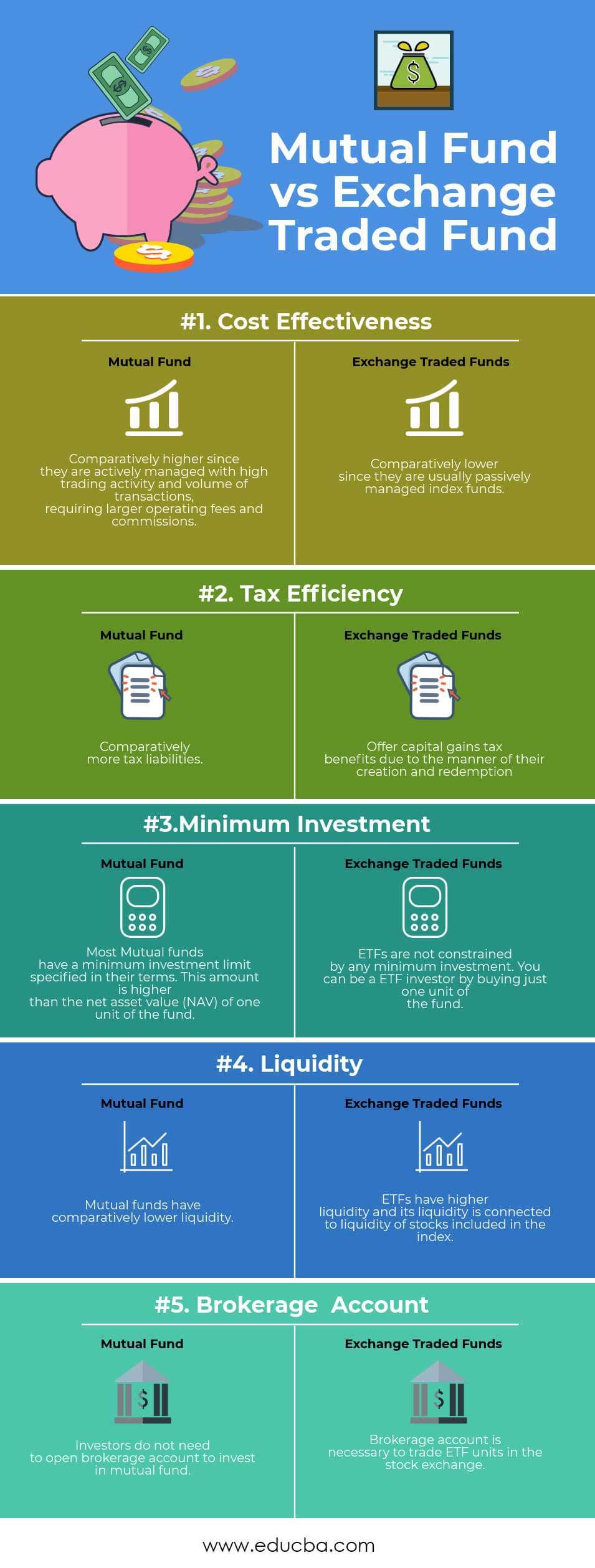

Head To Head Comparison Between Mutual Fund vs Exchange Traded Fund (Infographics)

Below are the top 5 differences between Mutual Funds and exchange-traded funds:

The Key Difference Between Mutual Funds vs Exchange Traded Fund

Both Mutual Funds and Exchange Traded Fund are popular choices in the market; let us discuss some of the major differences :

- ETFs trade on a public stock exchange, unlike mutual funds. Hence, like shares of public companies, ETF shares can be transferred, bought, or sold among investors.

- Investors directly purchase mutual fund units from the funds at a fixed NAV value during the day’s trading hours. You can buy and sell ETF shares anytime during trading hours, and the market decides the price based on demand-supply dynamics at any time. Hence, the price of ETF units keeps changing throughout the trading hours, thus providing real-time pricing and greater control of the price of your trade.

- Due to their manner of creation and redemption, ETFs incur capital gains taxes only when the investor sells the fund. In contrast, mutual funds incur capital gains tax every time they trade the shares. Hence, the tax liability is higher for mutual funds compared to ETFs.

- The transaction cost for buying or selling mutual fund units is zero. However, ETFs have a transaction cost involved as a bid-ask spread, just like other exchange-traded shares.

- Most Mutual funds have an investment lock-in period of a minimum of 90 days and impose a penalty if the investor wants to liquidate his holdings before the lock-in period. Since ETFs are exchange-traded, investors can trade their units with other investors at the prevailing market price during trading hours. There is no minimum holding period.

- Traders can short-sell or buy ETF units on margin, similar to public company shares. ETFs can thus be used for hedging, equitizing cash, or arbitrage.

- Unlike ETFs, Mutual funds will provide you with the opportunity to preset automatic investments and withdrawals as per your preferences.

- Most mutual fund managers have the independence to choose their investments and actively manage their portfolios to beat the index they track. Professionals passively manage most ETFs, which are primarily index funds. They aim to match the movements and returns of the tracked index by maintaining a portfolio similar to that of the index.

Mutual Fund vs Exchange Traded Fund Comparison Table

Here is an active voice comparison table between Mutual Funds and Exchange Traded Funds:

| The Basis of Comparison | Mutual Fund | Exchange-Traded Funds |

| Cost-effectiveness | The operating fees and commissions for actively managed ETFs are comparatively higher due to their high trading activity and volume of transactions, which require larger fees and commissions. | Comparatively lower since they are usually passively managed index funds |

| Tax Efficiency | Comparatively, more tax liabilities | Offer capital gains tax benefits due to the manner of their creation and redemption. |

| Minimum investment | Most Mutual funds have a minimum investment limit specified in their terms. This amount is higher than the net asset value (NAV) of one unit of the fund. | Any minimum investment does not constrain ETFs. You can be an ETF investor by buying just one fund unit. |

| Liquidity | Mutual funds have comparatively lower liquidity | ETFs have higher liquidity, which is connected to the liquidity of stocks included in the index. |

| Brokerage account | Investors do not need to open a brokerage account to invest in a mutual fund. | A brokerage account is necessary to trade ETF units in the stock exchange |

Conclusion

Mutual Fund vs Exchange Traded Fund provides similar investment opportunities to small investors constrained by funds and expertise from individually investing in a large diversified portfolio of assets, including stock, bonds, commodities, etc. Both Mutual Fund vs Exchange exchange-traded fund investment vehicles offer high diversification benefits in the form of better returns at a lower cost. Both Mutual Funds vs Exchange Traded Funds offer a wide variety of investment options, and based on your preference, you can invest broadly, like in a market fund, or narrowly, like in a sector fund. Professional portfolio managers administer both these investment vehicles, providing their expertise and saving you time and effort.

However, ETFs provide several benefits over mutual funds, like a lower minimum investment, more control over price, lower capital gains tax benefit, trading simplicity, lower commission and management fees involvement, and cleaner transferability options while switching from one investment firm to another. On top of that, ETFs provide higher investment flexibility as they come with several innovations in their trading strategy, like style ETFs, inverse ETFs, country ETFs, etc., offering a greater opportunity to attain their specific financial goals.

Still, the question remains whether ETFs are better than Mutual funds or vice-versa. This largely depends on the preference of the investor. If the investor prefers a lower minimum investment, he will opt for an ETF. If he wants repeated automatic transactions, he should go for mutual funds. He should go for an ETF if he wants control over the pricing. He should opt for a mutual fund if he does not want the hassles of opening and maintaining a brokerage account. If he is looking for an index fund with a lower risk, an ETF could be a more suitable investment.

Recommended Articles

This has guided the top difference between Mutual funds vs Exchange Traded Funds. Here, we discuss the Mutual Fund vs Exchange Traded Fund key differences with infographics and a comparison table. You may also have a look at the following articles –