Updated July 10, 2023

What is a Negative Yield Bond?

The term “negative yield bond” refers to those in which the investors receive less money at maturity than its original purchase price. In the case of a negative yield bond, the custodians of the money receive payment as the issuers. In other words, the investors pay the bond issuers a net amount instead of earning a return on the investment.

Explanation

It is a debt instrument that pays the investors a lower maturity amount than its purchase price. Trusted institutions, such as governments or central banks, usually issue such bonds. The investors agree to pay a net amount to the borrowers to keep their money with them.

How Does a Negative Yield Bond Work?

Generally, investors purchase investment security at a price less than its par value. Then its value gradually increases to reach its par value by the time it matures. But in the case of a negative yield bond, it is the other way around as the investors buy at a price higher than its par value, which eventually falls back to its par value at maturity. In other words, the negative yield erodes the bond value, and the coupons (if any) are inadequate to compensate for the lost value.

Example of Negative Yield Bond

Examples of negative yield bonds are:

Example

Let us use a zero-coupon bond to illustrate the concept of negative yield. The $1,000 par value bond will mature in another four years, and David purchased it at $1,050 today.

Now, we can observe that the purchaser bought the bond at a premium, as they paid a purchase price of $1,050, which exceeds the bond’s par value of $1,000 to be received at maturity. However, it is a zero-coupon bond, meaning David won’t receive any coupons during the next four years. Therefore, if David holds the bond until its maturity, he will lose $50 (= $1,050 -$1,000), a deterioration of the bond value, an example of a negative-yielding bond.

Types

Generally, negative yield bonds can be classified into major categories:

- Fixed-Rate Bonds: These are sold at a negative YTM, so the investors will lose some of the invested money if held until maturity.

- Floating Rate Bonds: In such cases, the bonds’ yield is linked to a benchmark index, such as EURIBOR or LIBOR; hence, the negative yields may be momentary.

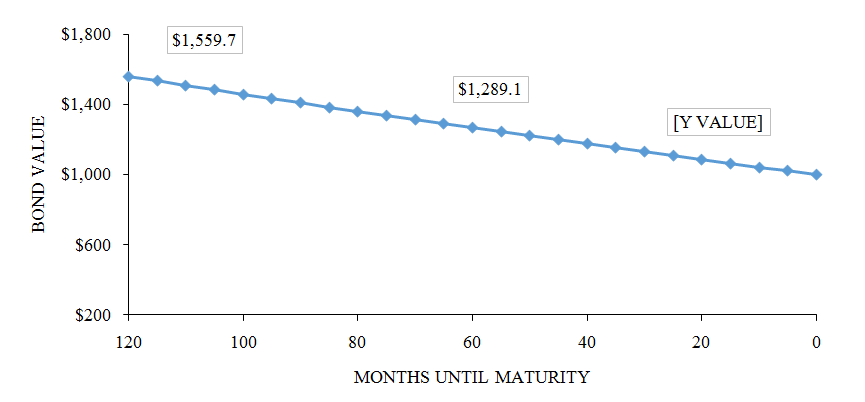

Negative Yield Bond Graph

The above graph shows that the bond’s value falls and reaches the par value as the time until maturity decreases or the maturity date comes up. A typical negative yield bond exhibits behavior where investors purchase it at a price higher than its par value and subsequently decline to reach the par value upon reaching maturity.

Why Buy a Negative Yield Bond?

Despite negative returns, negative-yield bonds are popular among investors for the following reasons:

- Many hedge funds and investment firms must buy government bonds to meet certain asset allocation requirements to build a diversified investment portfolio. The objective is to reduce the risk of losses from other asset classes, such as equity investments. Therefore, investment firms must buy these bonds irrespective of their yield.

- In a deflationary economy, the investors might initially hold their investments at a slightly negative return, eventually purchasing more goods and services with their savings when prices significantly decrease.

- Investors might also be attracted to negative yield bonds if their expected loss is lower than other investment avenues. In addition, many investors prefer buying these bonds during economic uncertainties as they are considered safe-haven investments.

- Many investors purchase foreign negative yield bonds as they expect the gain from the currency exchange rate to offset the losses incurred due to negative yields.

Strategies of Negative Yield Bond

There are two major strategies to manage negative yield bonds. They are:

- Active Investment: Active portfolio managers can lessen the adverse impacts of negative yield by taking advantage of the lower base and tactically adding new securities to outperform the broader market.

- Diversification: Investors can boost their investment return through portfolio diversification, which can be achieved by investing in bonds across different markets, industries, tenors, etc. It helps the investors offset the adverse impacts of negative yield at an aggregated level.

Future of Negative Yield Bond

Negative yield is a popular and largely acceptable trend across the global bond markets. In the past couple of years, global growth has experienced a slowdown compared to previous periods, and central banks have been setting their policy rates well below the levels observed before the financial crisis. In fact, despite the debate surrounding negative interest rates, many central banks, such as the Swiss National Bank (-0.75%) and Bank of Japan (-0.10%), have adapted to them and set their policy rates below zero.[Source: Global-rates] The impact of negative yield bonds issued by the government spill over to other fixed-income securities, and hence the size of the negative yield bond market has been growing. As of 28th August 2019, the size of the sub-zero yield bond market peaked to reach $17 trillion, which later fell back to $11 billion by the end of the calendar year. [Source: Bloomberg]

Advantages

Some of the major advantages are as follows:

- As a monetary policy, a negative interest rate stimulates the economy by encouraging people to invest in other business opportunities rather than saving them in the banks.

- This asset class can generate excess or positive returns in a lower market return (or lower risk-free rate) environment.

- In a falling market, they consider safe-havens.

Recommended Articles

This is a guide to Negative Yield bonds. We also discuss the introduction and example of negative yield bonds and their advantages and strategies. You may also have a look at the following articles to learn more –