Updated July 31, 2023

Net Debt Formula (Table of Contents)

Net Debt Formula

The term “Net debt” refers to a liquidity metric that is useful in assessing the potential of a company to pay all of its debts in case they are immediately due.

The formula for net debt is computed by adding all types of short term debts and long term debts and then deducting the cash & cash equivalents. Mathematically, it is represented as,

Examples of Net Debt Formula (With Excel Template)

Let’s take an example to understand the calculation of Net Debt formula in a better manner.

Example #1

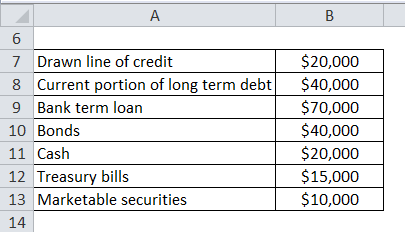

Let us take the example of company ABC Ltd that has reported a drawn line of credit of $20,000 and a current portion of the long term debt of $40,000. The long term liabilities of the company include a bank term loan of $70,000 and bonds worth $40,000. On the other hand, the current assets of the company consist of $20,000 in cash, $15,000 worth Treasury bills, and $10,000 in marketable securities.

Solution:

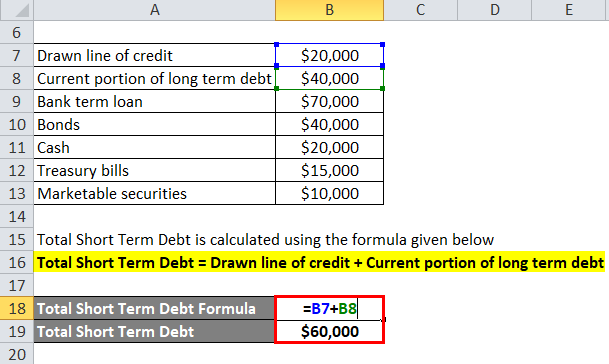

Total Short Term Debt is calculated using the formula given below

Total Short Term Debt = Drawn line of credit + Current portion of long term debt

- Total Short Term Debt = $20,000 + $40,000

- Total Short Term Debt = $60,000

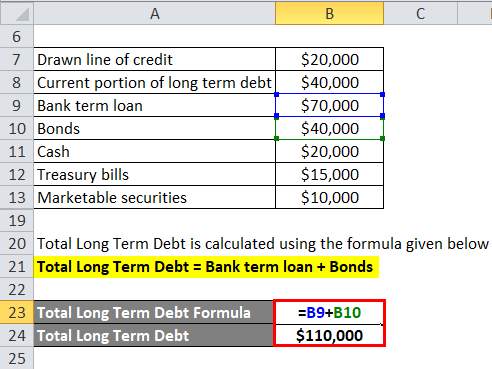

Total Long Term Debt is calculated using the formula given below

Total Long Term Debt = Bank term loan + Bonds

- Total Long Term Debt = $70,000 + $40,000

- Total Long Term Debt = $110,000

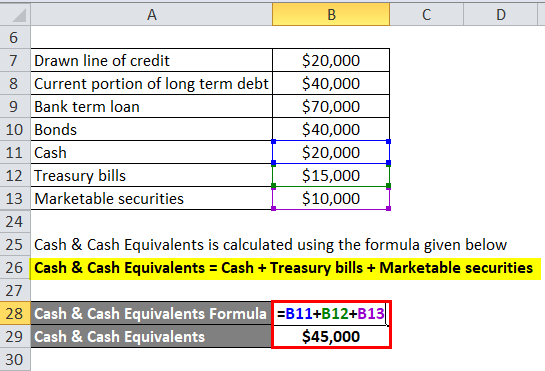

Cash & Cash Equivalents is calculated using the formula given below

Cash & Cash Equivalents = Cash + Treasury bills + Marketable securities

- Cash & Cash Equivalents = $20,000 + $15,000 + $10,000

- Cash & Cash Equivalents = $45,000

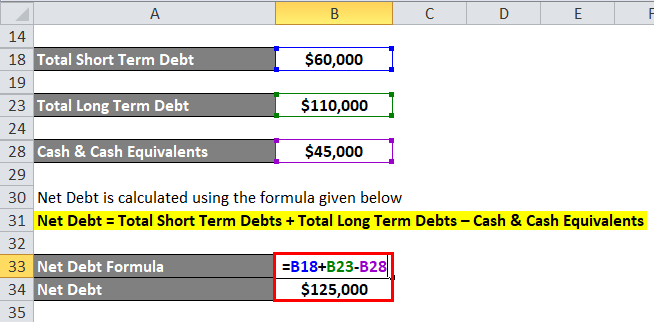

Net Debt is calculated using the formula given below

Net Debt = Total Short Term Debts + Total Long Term Debts – Cash & Cash Equivalents

- Net Debt = $60,000 + $110,000 – $45,000

- Net Debt = $125,000

Therefore, the company ABC Ltd has net debt value of $125,000.

Example #2

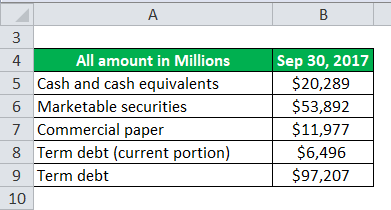

Let us take the example of Apple Inc. for which there is annual report as on September 30, 2017. As per the publicly released financial data, the information is available as follows:

Solution:

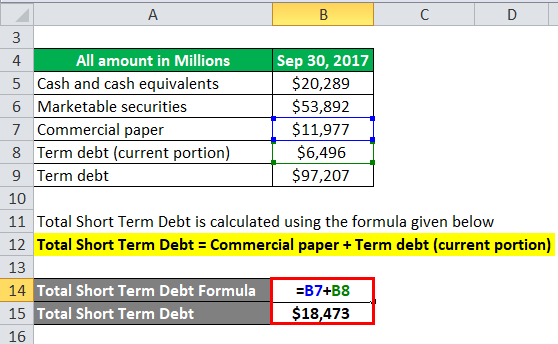

Total Short Term Debt is calculated using the formula given below

Total Short Term Debt = Commercial paper + Term debt (current portion)

- Total Short Term Debt= $11,977 Millions + $6,496 Millions

- Total Short Term Debt = $18,473 Millions

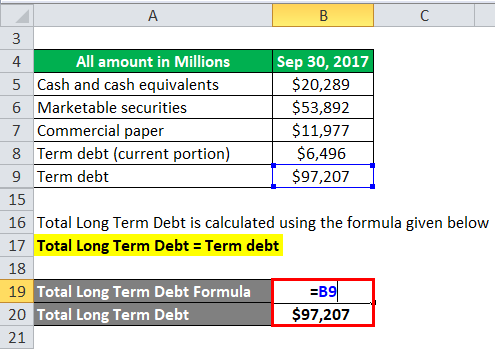

Total Long Term Debt is calculated using the formula given below

Total Long Term Debt = Term debt

- Total Long Term Debt = $97,207 Millions

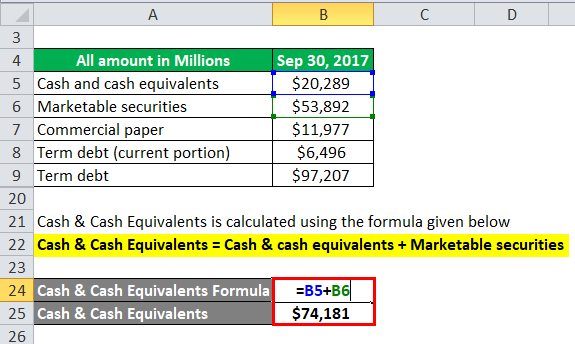

Cash & Cash Equivalents is calculated using the formula given below

Cash & Cash Equivalents = Cash & cash equivalents + Marketable securities

- Cash & Cash Equivalents = $20,289 + $53,892

- Cash & Cash Equivalents = $74,181 Millions

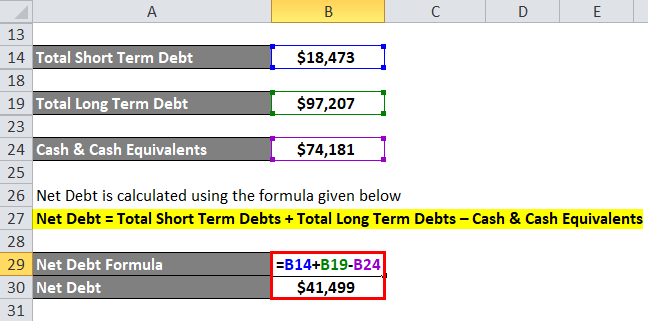

Net Debt is calculated using the formula given below.

Net Debt = Total Short Term Debts + Total Long Term Debts – Cash & Cash Equivalents

- Net Debt = $18,473 Millions + $97,207 Millions – $74,181 Millions

- Net Debt = $41,499 Millions

Therefore, the Apple Inc. had net debt of $41,499 Millions as on September 30, 2017.

Explanation

The formula for net debt can be simply calculated by using the following steps:

Step 1: Firstly, the short term debts have to be computed, which may include a current portion of a long term loan or a short term loan itself. Usually, such debts are due in less than a year.

Step 2: Next, the long term debts have to be computed, which may include term loan, cash credit, overdraft facilities etc. These type of debts are paid off either periodically or at the end of its tenure.

Step 3: Next, the cash & cash equivalents have to be computed, which may include cash at bank, treasury bills and other liquid investment.

Step 4: Finally, the formula for net debt is computed by adding all types of short term debts and long term debts and then deducting the cash & cash equivalents as shown below.

Net Debt = Total Short Term Debts + Total Long Term Debts – Cash & Cash Equivalents

Relevance and Uses

From the point of view of an investor, it is very important to understand the underlying concept of net debt formula because it helps in the measurement of the ability of a company to repay its debts in case they were all due immediately. In short, this metric determines the net amount of liabilities that exceed cash and cash equivalents. As such, the net debt formula enables investors and analysts to understand whether a company is overleveraged or underleveraged i.e. whether a company will be able to afford its debt repayment.

Further, investors and analysts also utilize the net debt formula to assess whether a company will be able to withstand hostile economic conditions because it helps them to predict a company’s ability to take on additional debt during such adverse times. A lower net debt value is indicative of the fact that the company is performing well financially. It should be noted that a company can have a lower net debt value despite a large debt because of comfortable cash & cash equivalents. It eventually denotes that the company has enough liquidity and as such it is financially sound and will be able to pay off its debt.

On the other hand, a higher net debt value can be indicative of the fact that the company may not be performing well enough or the company does not have sufficient liquidity to pay off its debt. Additionally, there are instances where the companies have almost no debt and as such, they have a negative net debt position which is indicative of the fact that the company holds enough cash & cash equivalents to pay off its short term debt and long term debt and it will still have excess cash remaining.

Net Debt Formula Calculator

You can use the following Net Debt Calculator.

| Total Short Term | |

| Total Long Term Debts | |

| Cash and Cash Equivalents | |

| Net Debt Formula | |

| Net Debt Formula = | Total Short Term + Total Long Term Debts - Cash and Cash Equivalents | |

| 0 + 0 - 0 = | 0 |

Recommended Articles

This has been a guide to Net Debt formula. Here we discuss How to Calculate Net Debt along with practical examples. We also provide Net Debt Calculator with downloadable excel template. You may also look at the following articles to learn more –