Updated November 23, 2023

Net Income Formula (Table of Contents)

Net Income Formula

Net income is total earnings or profit. It is the net income or Revenue Company generates after paying the investor all expenses, interest, taxes, and dividends.

The net income is calculated from the income statement. Net income tells about the profit or losses of a company and also helps to find profitability and growth of the company. Investors and stakeholders analyze net income and its trend to make the decision of investment and decisions related to the growth and expansion of the company. Net income is revenue minus the cost of goods minus operating expense minus gain and losses minus other revenue expense plus income from the operations of a discounted component plus gain from disposal of a discounted component minus loss from a discounted component minus loss from disposal of a discounted component. The Formula for net income is as follows:-

In short, Net income is total revenue minus total expense, which can be written as:-

Where,

- Revenue: It is the actual amount the company earned over a period of time.

- Expense: It means what the company pays for operational expenses, employee salaries, taxes on income, interest, etc.

Examples

Now, let’s see an example to understand the net income formula.

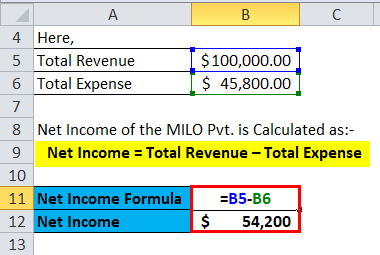

Net Income Formula – Example #1

Suppose a company named MILO Pvt. Ltd has a total revenue of $100,000 and a total expense of $45,800.

The net income of MILO Pvt. is Calculated using the below Formula-

- Net income = Total Revenue – Total Expense

- Net income = $100,000 – $45,800

- Net Income = $54,200

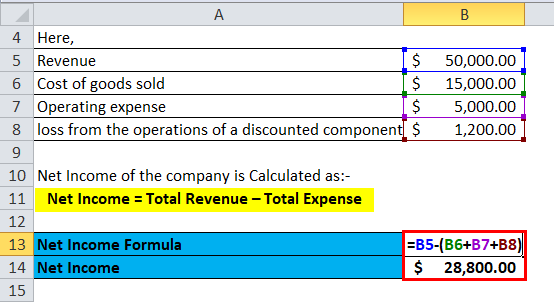

Net Income Formula – Example #2

A company has revenue of $50,000, a cost of goods sold is $15,000, an operating expense of $5,000, and a loss from the operations of a discounted component is $1,200.

The net income of the company is calculated using below Formula-

- Net income = Total Revenue – Total Expense

- Net Income = $50,000 – ($15,000 + $5,000 + $1,200)

- Net income = $50,000 – $21,200

- Net Income = $28,800

The net income is a simple formula that measures excess revenue above total expense. One can use the gross profit to calculate net income; gross profit is total revenue minus the cost of goods sold. All company revenue and expenses are included when calculating net income. Net income provides information about the ratio for financial and financial statement analyses. One can measure the company’s financial health and position through these analyses. Net income also tells stakeholders whether the company can pay a dividend. Net income helps measure and calculate earnings per share of the company’s profitability and allows the investor to decide on investment.

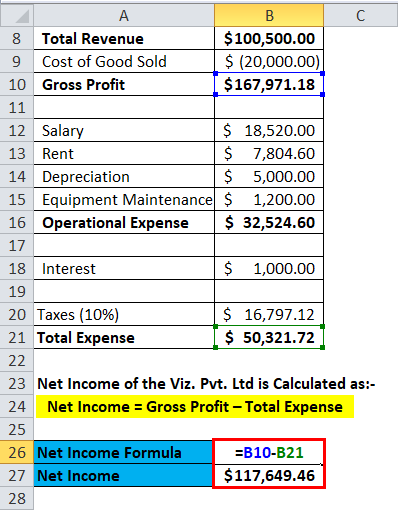

Net Income Formula – Example #3

Suppose a company named Viz. Pvt. Ltd has a below income statement for 2018; the company’s total revenue is $100,500, cost of goods sold is 20,000; this gives a gross profit of $167,971.18, a total expense of $50,321.72, which results in a net income.

| Income Statement | |

| [USD $ millions] | |

| 2018 | |

| Total Revenue | $100,500.00 |

| Cost of Goods Sold | $(20,000.00) |

| Gross Profit | $167,971.18 |

| Salary | $18,520.00 |

| Rent | $7,804.60 |

| Depreciation | $5,000.00 |

| Equipment Maintenance | $1,200.00 |

| Operational Expense | $32,524.60 |

| Interest | $1,000.00 |

| Taxes (10%) | $16,797.12 |

| Total Expense | $50,321.72 |

| Net Income | $117,649.46 |

Net Income of the Viz. Pvt. Ltd is Calculated using below Formula-

- Net income = Gross Profit – Total Expense

- Net Income = $167,971.18 – $50,321.72

- Net Income = $117,649.46

Net profit is used for financial measurement; net income varies from company to company and industry to industry and helps find the best investment company.

The net profit margin is the ratio of net income to net revenue. If the net profit margin is positive, that means the business is profitable, and if the profit margin is negative, that means the company is not profitable. The net profit margin tells us how the business is performing.

The net profit margin helps to find the profitability of the company.

Net Income Formula – Example #4

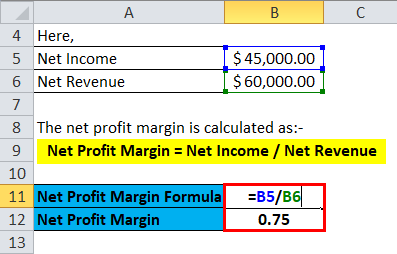

Let’s take an example to calculate the net profit margin.

Suppose a company has a net income of $45,000 and a net revenue of $60,000 in 2018.

The net profit margin is calculated as follows:-

- Net Profit Margin = Net Income / Net Revenue

- Net Profit Margin = $45,000 / $60,000

- Net Profit Margin = $0.75

So, the net profit margin of the company is $0.75.

The best tool for calculating net income is using accounting software, and the type of software depends on the size of the business, cost of software, amount of transactions, and type of business.

These tools help to track business transactions and the calculation of financial ratios.

Net Income Formula – Example #5

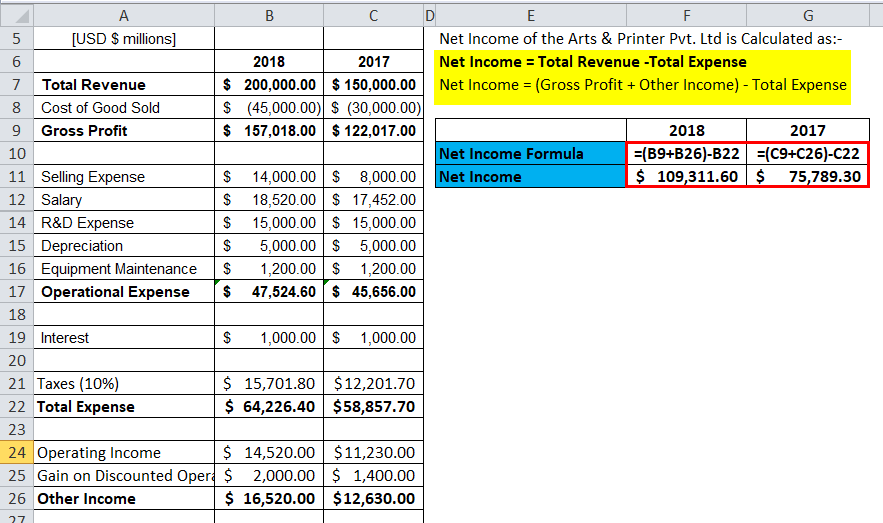

Let’s look at the income statement of a printing company named Arts & Printer Pvt. Ltd for the years 2018 and 2017.

| Income Statement | ||

| [USD $ millions] | ||

| 2018 | 2017 | |

| Total Revenue | $200,000.00 | $150,000.00 |

| Cost of Goods Sold | $(45,000.00) | $(30,000.00) |

| Gross Profit | $157,018.00 | $122,017.00 |

| Selling Expense | $14,000.00 | $8,000.00 |

| Salary | $18,520.00 | $17,452.00 |

| Rent | $7,804.60 | $7,004.00 |

| R&D Expense | $15,000.00 | $15,000.00 |

| Depreciation | $5,000.00 | $5,000.00 |

| Equipment Maintenance | $1,200.00 | $1,200.00 |

| Operational Expense | $47,524.60 | $45,656.00 |

| Interest | $1,000.00 | $1,000.00 |

| Taxes (10%) | $15,701.80 | $12,201.70 |

| Total Expense | $64,226.40 | $58,857.70 |

| Operating Income | $14,520.00 | $11,230.00 |

| Gain on Discounted Operations | $2,000.00 | $1,400.00 |

| Other Income | $16,520.00 | $12,630.00 |

| Net Income | $109,311.60 | $75,789.30 |

| Net Profit Margin | 0.55 | 0.51 |

Net Income of the Arts & Printer Pvt. Ltd for 2018 is Calculated as:-

- Net income = Total Revenue – Total Expense

- Net Income = (Gross Profit + Other Income) – Total Expense

- Net Income2018 = 157,018 + 16,520 – 64,226.40

- Net Income2018 = $109,311.60

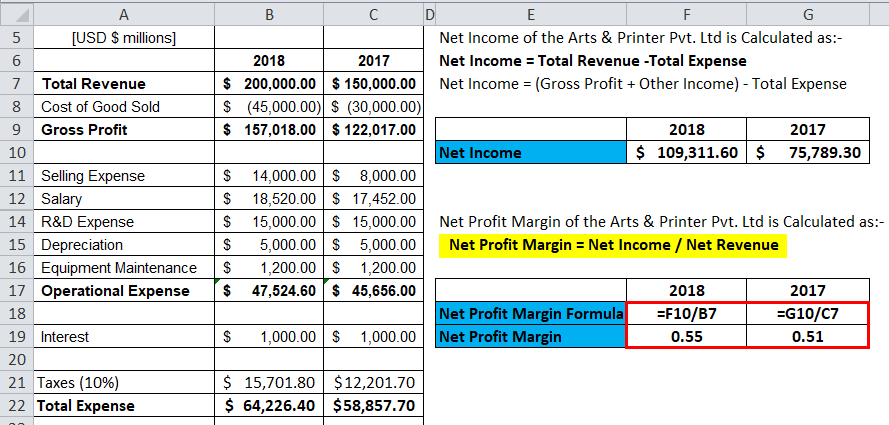

Net Profit Margin of the Arts & Printer Pvt. Ltd for 2018 is Calculated as:-

- Net Profit Margin = Net Income / Net Revenue

- Net Profit Margin2018 = 109,311.60 / 200,000

- Net Profit Margin2018 = 0.55

Net Income of the Arts & Printer Pvt. Ltd for 2017 is Calculated as:-

- Net income = Total Revenue – Total Expense

- Net Income = (Gross Profit + Other Income) – Total Expense

- Net Income2017 = 122,017 + 12,630 – 58,857.70

- Net Income2017 = $75,789.30

Net Profit Margin of the Arts & Printer Pvt. Ltd for 2017 is Calculated as:-

- Net Profit Margin = Net Income / Net Revenue

- Net Profit Margin2017 = 75789.30 / 150,000

- Net Profit Margin2017 = 0.51

Here, we can see that the company is growing in terms of profit and revenue from 2017 to 2018. The net profit margin is 55%. Higher profits are preferred then lower ones, but higher profit is not always favorable as the company reinvests its profit into a fixed asset, machinery, and pays a dividend, which may lead to loss to the company in the next year.

Significance and Use of Net Income Formula

Uses of the Net Income formula are as follows:-

- Earnings per Share

Net income helps to calculate earnings per share, which is net income minus the dividends on preferred stock and the same divided by the average outstanding Share. This indicates the company’s profitability.

- Profitability

Net income tells about the profitability of the company.

- Efficiency

Net income helps the investor calculate the efficiency of a company, which means it tells about how much revenue the company can generate. Investment in that company will generate profit or not.

So, from the above points, we can see the use of net income; apart from that, other ratios also help one to understand the company’s performance. Net income tells about the performance of the company. Net income does not measure the company’s cash earned over a period, as it shows non-cash expenses like depreciation and amortization. The net income formula may be unreliable as it just does the calculation, which may generate a fraudulent profit report by twisting accounting rules. This false presentation of net income is done to pay less income tax.

Net Income Formula Calculator

You can use the following Net Income Calculator

[wbcr_snippet]: PHP snippets error (not passed the snippet ID)Net Income Formula in Excel (With Excel Template)

Here, we will do the same example of the Net Income formula in Excel. It is very easy and simple. You need to provide two inputs, i.e., Total Revenue and Total Expense.

You can easily calculate the Net Income using the Formula in the template provided.

Net Income of the MILO Pvt. is Calculated as:-

The net income of the company is calculated as follows:-

Net Income of the Viz. Pvt. Ltd is Calculated as:-

The net profit margin is calculated as follows:-

Net Income of the Arts & Printer Pvt. Ltd for 2018 and 2017 is calculated as:-

A net profit margin of the Arts & Printer Pvt. Ltd for 2018 and 2017 is calculated as:-

Recommended Articles

This has been a guide to a Net Income formula. Here, we discuss its uses along with practical examples. We also provide a Net Income Calculator with a downloadable Excel template. You may also look at the following articles to learn more –