Updated November 23, 2023

Meaning

Net pay is the amount an employee receives as their final paycheck after the employer deducts all mandatory and voluntary deductions from their gross pay. It is also called take-home pay or net salary.

For example, if an employee earns $1,000 monthly and has a deduction of $200, then the net salary or pay will be $800 ($1,000-$200).

In simple terms, it represents the amount deposited into an employee’s bank account or received as a paycheck. This take-home pay is crucial for financial planning, expenses, and budgeting.

Table of Contents

Key Highlights

- An amount an employer issues to an employee after subtracting all deductions from their gross pay is net pay.

- The formula to calculate is Gross pay – Total deductions (Mandatory + Voluntary)

- Its calculation depends on an hourly wage or a fixed salary.

- It is essential in planning a budget for expenses, savings, and investments.

Types

The take-home pay calculation depends on an hourly or fixed salary.

1. Salary

These are employees who get a fixed salary for working a specified period. Salaried employees are exempt from certain Fair Labor Standards Act (FLSA) regulations due to their job roles and salaries. They may receive overtime as part of performance bonuses or other rewards, as per company policies.

2. Hourly Wage

Hourly employees earn pay depending on their work hours and hourly wage. They fall under the non-exempt category of the Fair Labor Standards Act (FLSA). In the US, the federal minimum wage is $7.5 per hour, and employees are also entitled to overtime payment if they work more than 40 hours in a workweek.

Formula

Calculate the formula as follows:

Where,

- Gross wages = It is the total amount an employee earns before any deductions.

- Total Deductions = It includes both mandatory deductions (required by law), such as taxes, and voluntary (optional) deductions, like health insurance premiums.

Deductions

The following are the deductions affecting an employee’s net salary:

Mandatory deductions: These are compulsory deductions required by law, which are as follows:

- Federal income taxes

- State income taxes

- National Insurance Contributions (NIC)

- Wage garnishments

Voluntary deductions: These deductions are those employees choose to subtract from their pay to cover services like:

- Healthcare premiums

- Retirement savings plan

- Health savings account (HSA) contributions

- Union dues

How to Calculate it?

The following are the steps to calculate net salary or pay:

Step #1: Calculating Gross Pay:

- For hourly employees: Multiply the pay/rate per hour by the number of working hours within a pay period and add overtime amount if required.

- For salaried employees: Divide the yearly or annual salary by the number of pay periods in a year. For example, if an employee receives their pay monthly, the pay period will be 12.

Step #2: Include all mandatory and voluntary deductions as directed by governing bodies to calculate the total deduction.

Step #3: Find net pay by subtracting the total deductions from gross pay.

Excel Examples

Let’s understand how to calculate net salary or pay with the help of the following examples.

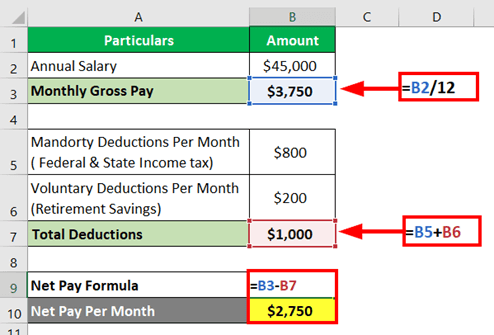

Example #1

Suppose David, a software developer, has just joined a renowned company, and his annual salary is $50,000. During his onboarding, the employer mentioned his mandatory deductions (Federal and State Income Tax) are $800 monthly, and voluntary deductions (Retirement Savings) are $200 monthly. Now, let’s calculate David’s monthly net salary or pay.

Solution:

Step #1: If David gets paid monthly, divide the annual salary by 12 to find the monthly or gross pay.

Monthly Gross Pay = Annual Salary / Number of Months

= $45,000 / 12 = $3,750

Step #2: Let’s calculate total deductions with the help of the following formula.

Total Deductions = Mandatory Deductions + Voluntary Deductions

= $800 + $200 = $1,000

Step #3: Calculate Net Pay

Net Pay = Monthly Gross Pay – Total Deductions

= $3,750 – $1,000 = $2,750

Thus, David’s net salary or pay would be $2,750 per month.

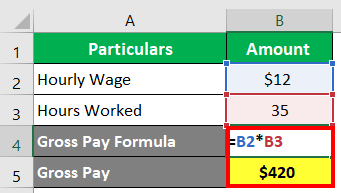

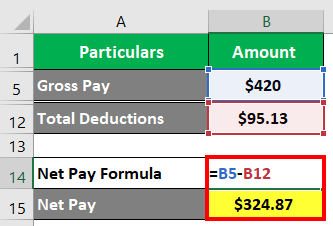

Example #2

Daisy works 35 hours weekly at $12 per hour in a retail store. Let’s assume her deductions include federal income tax (10% of gross pay), social security (6.2% of gross pay), and Medicare (1.45% of gross pay). Let’s find her weekly take-home pay.

Solution:

Step #1: Calculate gross pay using the following formula.

Gross Pay = Hourly Wage × Hours Worked

Gross Pay = $12 × 35 hours = $420

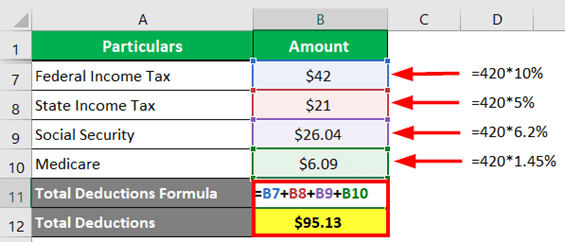

Step #2: Let’s calculate total deductions by multiplying total gross pay with tax rate

- Federal Income Tax (10%) = $420 × 0.10 = $42

- State Income Tax (5%) = $420 × 0.05 = $21

- Social Security (6.2%) = $420× 0.062 = $26.04

- Medicare (1.45%) = $420 × 0.0145 = $6.09

So, Total Deductions= Federal Income Tax + State Income Tax + Social Security + Medicare

= $42 + $21 + $26.04 + $6.09 = $95.13

Step #3: We will now find the take-home pay with the formula below.

Net Pay = Total Gross Pay – Total Deductions

= $420 – $95.13 = $324.87

Therefore, Daisy’s net salary would be $324.87 per week.

Net Pay Vs. Gross Pay

Here is the difference between net pay and gross pay.

| Particulars | Net Pay | Gross Pay |

| Definition | The amount an employee receives after all deductions. | The amount an employee earns before any deductions. |

| Taxes | It’s inclusive of all taxes. | It’s exclusive of all taxes. |

| Formula | Gross Pay-Total Deductions | Basic pay + HRA + Other Allowances |

| Scope | Useful in personal planning and investments. | Useful for business profitability analysis. |

| Value | It is less than gross pay but equal if there are no deductions. | It is always greater than net pay but equal if no deductions exist. |

| Impact on cash flow | It indicates the real amount available for spending. | It might not directly represent the actual cash received. |

Calculator

The following is the calculator you can use to calculate your net salary.

| Gross Pay | |

| Total Deductions | |

| Net Pay Formula = | |

| Net Pay Formula = | Gross Pay - Total Deductions |

| = | 0 - 0 = 0 |

Final Thoughts

Net pay is essential in accurately planning a budget for expenses, savings, and investments. It significantly affects loan eligibility, which is an indication of an individual’s financial responsibility. Employers are responsible for ensuring that employees understand their net salary and are aware of any changes in deductions or contributions to their payroll.

Frequently Asked Questions (FAQs)

Q1. What is the importance of net pay?

Answer: The net pay is important for the following reasons.

- Real Income: It provides employees clarity on the amount they will receive per pay cycle.

- Financial Planning & Budgeting: It enables budgeting, investments, and savings strategies that align with future goals.

- Loan Approvals: It helps lenders determine an individual’s capacity to repay loans and credit facilities. A higher net salary can increase the chances of loan approval.

- Flexibility: It allows businesses to customize payment frequencies (weekly or biweekly) to manage cash flow and meet financial commitments effectively.

Q2. Is net pay the same as CTC?

Answer. No, net pay refers to the amount an employee receives after all deductions from their gross pay. On the other hand, CTC (Cost to Company) is the total cost an employer spends when hiring an employee, including the employee’s salary, benefits, and other expenses. CTC is the total cost of the employee to the company and does not represent the amount the employee will receive in their paycheck.

Recommended Articles

We hope that this article on Net Pay was informative. To learn more, we suggest exploring the following articles.