Updated July 29, 2023

Net Realizable Value Formula (Table of Contents)

- Net Realizable Value Formula

- Examples of Net Realizable Value Formula (With Excel Template)

- Net Realizable Value Formula Calculator

Net Realizable Value Formula

Net realizable value (NRV) is the value of an asset which can be realized when that asset is sold. It is also termed as cash Realizable value since it is the cash amount which one gets for the asset.

All the related cost like disposal cost, transportation cost etc. should be subtracted while calculating a net realizable value. NRV is basically used for inventory valuation in both GAAP (Generally Accepted Accounting Principal) and in IFRS (International Financial Reporting Standards) so that inventory is properly stated in the balance sheet. So during inventory valuation, NRV is the price cap for the asset if we use a market method of accounting. In that method, inventory is valued at either historical cost or market value, whichever is lower. If we are not able to determine the market value, NRV can be used as a proxy for that.

The formula for Net Realizable Value –

Following are the steps which can be used to find net realizable value:

- First of all, we need to determine the expected selling price or the market value of inventory.

- Next step is to determine all the cost associated with the sale of an asset. It can be preparation cost, testing, transportation, etc. Find all those costs.

- Subtract all the cost from the selling price to come at the net realizable value.

Examples of Net Realizable Value Formula (With Excel Template)

Let’s take an example to understand the calculation of Net Realizable Value in a better manner.

Net Realizable Value Formula – Example #1

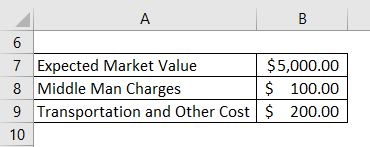

Let say that there is company X which makes automobile spare parts. Now X has a number of machines which it uses to produce the items. One of those machine X wants to sell since it is not much use. Company X is expecting that if they sell that machine today, they will get $5000 for that. But they have to go through a middle man which will charge $100 as it cost. Also, the company has to bear all the paperwork and transportation cost which is another $200.

Solution:

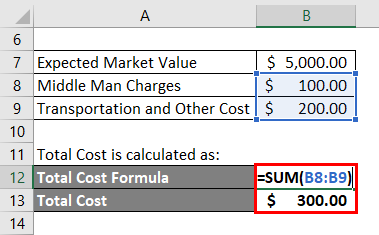

Total Cost is calculated as:

- Total Cost = $100 + $200

- Total Cost = $300

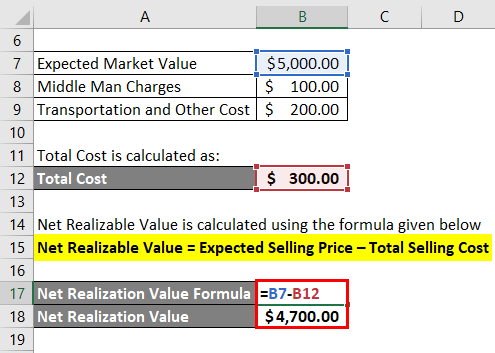

Net Realizable Value is calculated using the formula given below

Net Realizable Value = Expected Selling Price – Total Selling Cost

- Net Realizable Value = $5,000 – $300

- Net Realizable Value = $4,700

Net Realizable Value Formula – Example #2

Now let see a more detailed example to see how we report inventory using net realizable value formula.

Let continue with the above example. We have calculated the net realizable value of the machine is $4700. Let’s say the carrying cost of this machine in the balance sheet is $4000. Since the carrying value of the machine is lower than the NRV, we will keep on reporting the machine at its carrying value.

Now let’s say after 2 years, the demand for that machine decline because of which the expected market price also decreases and now it has dropped to $4100 but the cost is the same at $4000.

So

- Net Realizable Value = $4,100 – $300

- Net Realizable Value = $3,800

Since NRV has dropped from $4700 to $3800 and this new value is less than the carrying cost of the machine, a company has to report the machine at the NPV also book loss in its financials. The loss amount will the differential amount between carrying cost and NRV i.e. $4000 – $3800 = $200

Explanation

Net realizable value, as discussed above can be calculated by deducting the selling cost from the expected market price of the asset and plays a key role in inventory valuation. Every business has to keep a close on its inventory and periodically access its value. The reason for that is there are several negative impacts like damage of inventory, obsolescence, spoilage etc. which can affect the inventory value in a negative way. So it is better for a business to write off those assets once for all rather than carrying those assets which can increase the losses in the future.

Inventories, in general, cannot be revalued upward once written down. There is a certain exception to that as well. If once the asset is written down and new assessment states that the net realizable value has increased from the previous amount, the previous write down can be reversed but that can only be done up to the upper limit of previous write down.

Relevance and Uses of Net Realizable Value Formula

NRV is the total amount which a company can expect while selling its assets. It is used by businesses to value their inventory and it uses a conservative approach while valuing the inventory. Analysts, who are analyzing companies financial can also check if the company is valuing its assets following proper accounting method. NRV helps businesses to assess the correct value of inventory and see if there is any negative impact on valuation. NRV is a very conservative approach to accounting. This approach expects the businesses to value their inventory at a conservative value and avoid overstating it.

Net Realizable Value Formula Calculator

You can use the following Net Realizable Value Calculator

| Expected Selling Price | |

| Total Selling Cost | |

| Net Realizable Value Formula | |

| Net Realizable Value Formula = | Expected Selling Price – Total Selling Cost |

| = | 0 – 0 |

| = | 0 |

Recommended Articles

This has been a guide to Net Realizable Value formula. Here we discuss how to calculate Net Realizable Value along with practical examples. We also provide a Net Realizable Value calculator with downloadable excel template. You may also look at the following articles to learn more –