What is Net Sales?

Net sales, also known as net revenue, is the money a business earns from its sales of goods or services after deducting returns, discounts, and allowances. For example, if a store generates $10,000 in sales, offers a discount of $1,000, and has $500 in returns, its net sales for that period would be $8,500 ( $10,000 – $1,000 – $500).

It is listed on the income statement as the top-line revenue figure and is used to calculate financial metrics like gross profit margin, operating income, and net income. These metrics provide insight into a company’s financial performance and are critical for investors, creditors, and other stakeholders in assessing the company’s overall health and profitability.

How Does Net Sales Work?

A business’s total sales work is as follows:

Step #1 Production

The production unit manufactures the products and initiates the services.

Example: A clothing manufacturer produces 1,000 shirts in a month.

Step #2 Sales

The sales unit sells the products and services to the consumers and earns revenue.

Example: The manufacturer sells all 1,000 shirts for $20 each, earning a total revenue of $20,000.

Step #3 Discounts and Returns

To keep up with the market, they offer customers discounts and pay refunds for returned items.

Example: Some customers return 50 shirts due to sizing issues, and the manufacturer offers a 10% discount on the remaining 950 shirts for a promotion.

Step #4 Deduct the Factors

They deduct the discounts and refunds from the total revenue they have earned from sales.

Example: The total value of returned shirts is $1,000 (50 x $20), and the discount offered is $190 (10% of $19,000). So the total deductions are $1,190 ($1,000 + $190).

Step #5 Determine the Total Sales

The resultant amount after all the deductions is the business’s net sales.

Example: The net sales of the business are $18,810 ($20,000 – $1,190).

Formula

- Gross Sales refer to the total revenue generated from goods or services.

- Returns & Allowances are the refunds given to customers for goods or services returned.

- Discounts & Commissions are the offers that customers receive from the sellers.

How to Calculate Net Sales?

Step #1 Gather Data

- It includes the total sales made, returns and refunds, discounts and allowances, and other deductions.

- Consider Company ABC sells 2000 products for $30 each, pays an overall refund of $3,000 on returned items, and offers a total discount worth $900.

Step #2 Calculate the Gross Sales

- It is the product of the price of each article and the number of articles sold.

- Company ABC’s gross sales = ($30 x 2000) = $60,000

Step #3 Subtract Returns and Refunds

- Subtract all returns and refunds from the gross sales.

- Subtracting the refund amount from ABC’s gross sales, we get ($60,000-$3000)= $57,000

Step #4 Subtract Discounts and Allowances

- Subtract all discounts or allowances offered to customers on their orders from the updated gross sales amount.

- Subtracting the discounts Company ABC offered to its customers from the updated gross sales, we get ($57,000-$900)= $56,100

Step #5 Calculate Net Sales

- It is the money a business has earned from sales after subtracting the returns, refunds, discounts, and allowances.

- The total sales of Company ABC is $56,100.

Examples

#1 Cloth Merchant

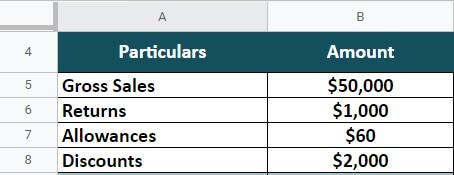

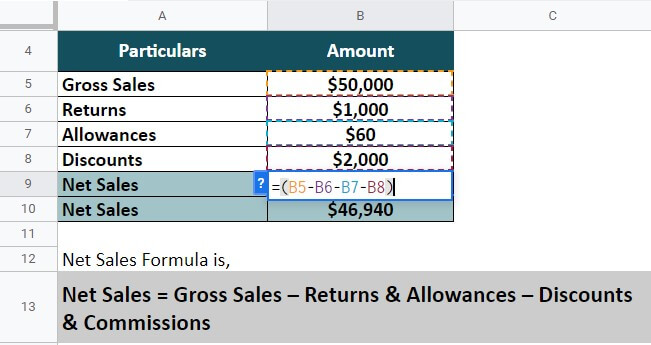

A cloth merchant sold $50,000 worth of clothes last year. Customers returned clothes worth $1,000 due to size issues and color preferences. Twelve customers who made a purchase value of $500 received a total allowance of $60. After detecting some defects, four clothes had a total discount of $2000. Calculate the company’s annual net revenue.

Given,

Solution,

Therefore, the net revenue of the cloth merchant last year amounted to $46,940.

#2 Toy Manufacturer

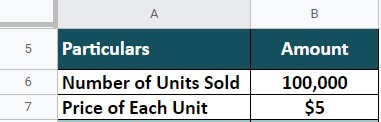

A toy manufacturing business sold 100,000 units for $5 each year. If the company has sales returns worth $90,000, and discounts worth $50,000, calculate the company’s net revenue.

Solution:

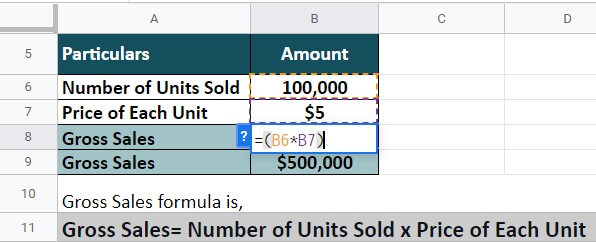

Step #1 Calculate Gross Sales.

Given,

Solution:

Gross Sales = No. Of. Units * Price Per Unit

= 100,000 * $5 = $500,000

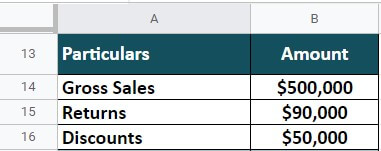

Step #2 Calculate Net Sales.

Now, we deduct the returns and discounts from the gross sales.

Given,

Solution:

Net Sales = Gross Sales – Returns – Discounts

=$500,000 – $90,000 – $50,000 = $360,000

Therefore, the net revenue of the toy manufacturing company is $360,000.

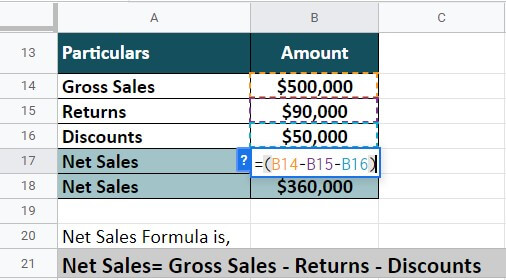

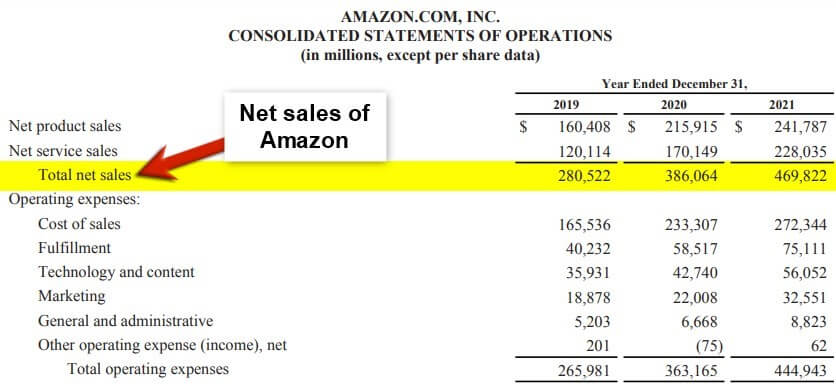

Net Sales on Financial Statements

A company’s net sales are present on the company’s consolidated income statement. Businesses can calculate it by adding the net product sales and net service sales figures. In addition to the net total sales figure, the annual report may also include a list of company sales sources. This list can give investors and other stakeholders a better understanding of the company’s revenue streams and the markets it operates in.

For instance, Amazon’s annual report for 2021 lists the following sources of its sales:

- Online & Physical Stores

- Third-Party Sellers

- Subscriptions

- Advertising Services

- AWS

- Others

Example:

We find Amazon’s net sales in its Consolidated Statement of Operations given in its Annual report for 2021.

(Image Source: Amazon Annual Report 2021)

According to Amazon’s 2021 Annual Report, the company’s net product sales for the year were valued at $241,787 million, while their net service sales amounted to $228,035 million. These figures combine to produce Amazon’s total sales for 2021, which amounted to $469,822 million.

Factors Affecting Net Sales

- Pricing Strategy: Make sure the pricing is relevant to the market rates and has enough potential to draw customers in.

- Marketing: Marketing strategies ensure that a business reaches the right people with its message, both online and offline.

- Appropriateness: Offering the right products or services people seek can strongly impact sales.

- Customer Service: Customers need to feel valued and appreciated, so take the time to respond promptly to their queries and concerns.

- Quality: The business should ensure its product or service meets customer expectations.

Importance

- It determines the financial health and status of any corporate entity.

- Lesser difference between net and gross sales indicates a higher profit margin for a company.

- Businesses can meet their financial targets and stay within budget by tracking their sales.

- Companies can ensure making the most of their resources and maximize their profits by monitoring them.

- They can also make informed decisions about product pricing and marketing strategies.

- It is essential for companies with multiple revenue streams so they can evaluate their product performance.

Net Vs. Gross Sales

|

Particulars |

Net Sales |

Gross Sales |

| Calculation | It is the amount remaining after subtracting all expenses from the money earned. | It is the total amount of money earned before any expenses take place. |

| Amount | It is always less than the gross sales of a company. | It is devoid of deductions, and so is more than the net revenue.

|

| Importance | It is an indicator of how well a business is performing, evaluating the profitability of a company. | It is the difference between the total revenue and the total cost of the goods sold. |

| Formula | Gross Sales – Allowances – Discounts – Sales Returns | Number of units sold x Price of each unit |

Frequently Asked Questions (FAQs)

Q1. Do net sales include tax?

Answer: No, net sales do not include tax. Businesses deduct taxes from gross sales, the total income generated from operations, and sales. Total sales is the remaining amount after deductions for discounts, allowances, refunds, and taxes.

Q2. Are net sales the same as turnover?

Answer: Yes, net sales is another term used to describe a business’s turnover or total revenue. It represents the core income generated from the business’s operations and sales. For instance, if a company has gross sales of $50,000 and deductions of $10,000 for taxes, refunds, discounts, and allowances, its net revenue or turnover would be $40,000.

Q3. Are net sales the same as net income?

Answer: Net income and sales are two different entities of a business. Net sales is the money the company makes by selling its product or services. It is the net value after deducting the returns, allowances, and discounts from its gross sales.

On the other hand, net income is the profit the business incurs through its sales and non-sales operations. It is the company’s final profit after adding income from all sources and deducting all the expenses.

Q4. What is the difference between net sales and revenue?

Answer: Revenue is the total income a business earns from its sales and other operations, including investments, interest, and other sources. Net sales, on the other hand, is the revenue a business generates from its sales operations only after deductions for returns, allowances, and discounts.

For example, if a business has total revenue of $100,000, including $20,000 from investments and interest, and deductions of $30,000 for returns, allowances, and discounts, its net sales would be $70,000 ($100,000 Gross Sales – $10,000 Discounts – $20,000 Returns/Allowances), while its revenue would be $100,000 ($150,000 Gross Sales – $25,000 Discounts – $25,000 Returns/Allowances)

Recommended Articles

This was an EDUCBA guide to Net Sales. To learn more, please refer to EDUCBA’s Recommended Articles.