Updated July 27, 2023

Net Sales Formula (Table of Contents)

What is Net Sales Formula?

The term “net sales” refers to a company’s revenue after making several deductions, such as returns, discounts, and allowances from the gross sales.

Gross sales are the total sales before any deductions are made. The formula for net sales can be derived by deducting sales returns, discounts, and allowances from the product of total units sold and sales price per unit. Mathematically, it is represented as,

or

Examples of Net Sales Formula (With Excel Template)

Let’s take an example to understand the calculation of Net Sales in a better manner.

Net Sales Formula – Example #1

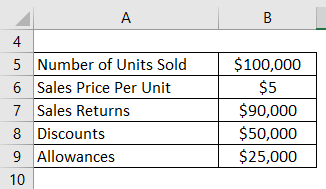

Let us take the example of a company that sold 100,000 units during the year, each unit worth $5. Calculate the company’s net sales if sales returns are worth $90,000, discounts are $50,000, and sales allowances are $25,000.

Solution:

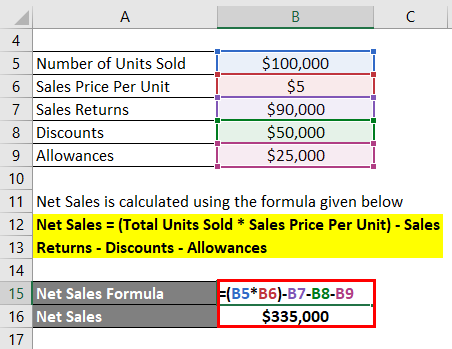

Net Sales is calculated using the formula given below

Net Sales = (Total Units Sold * Sales Price Per Unit) – Sales Returns – Discounts – Allowances

- Net Sales = ($100,000 * $5) – $90,000 – $50,000 – $25,000

- Net Sales = $335,000

Therefore, the company booked net sales of $335,000 during the year.

Net Sales Formula – Example #2

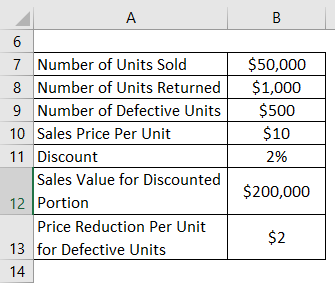

Let us take the example of a lamp manufacturing company that sold $50,000 lamps last year with each lamp sold at $10 per unit. Now, there were some deductions as mentioned below:

- $1,000 lamps were returned by the customers as they changed their mind after the purchase

- A discount of 2% was offered to customers worth sales of $200,000 due to early payment

- $500 lamps were found to have some defects and such their prices were reduced by $2 per unit

Based on the given information, Calculate the net sales of the company during the year.

Solution:

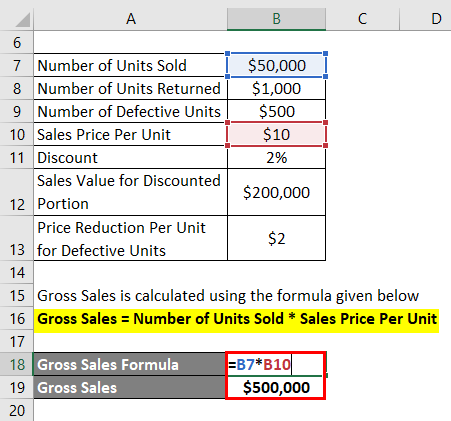

Gross Sales is calculated using the formula given below

Gross Sales = Number of Units Sold * Sales Price Per Unit

- Gross Sales = 50,000 * $10

- Gross Sales = $500,000

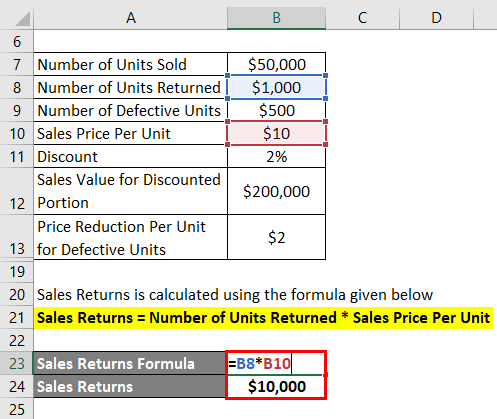

Sales Returns is calculated using the formula given below

Sales Returns = Number of Units Returned * Sales Price Per Unit

- Sales Returns = $1,000 * $10

- Sales Returns = $10,000

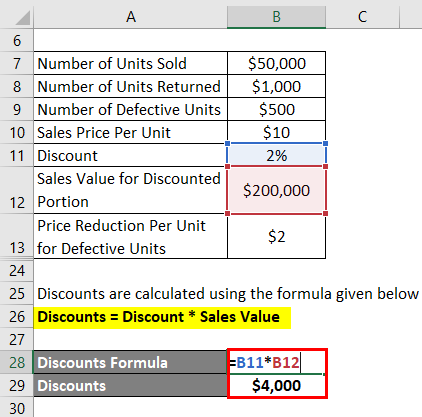

Discounts are calculated using the formula given below

Discounts = Discount * Sales Value

- Discounts = 2% * $200,000

- Discounts = $4,000

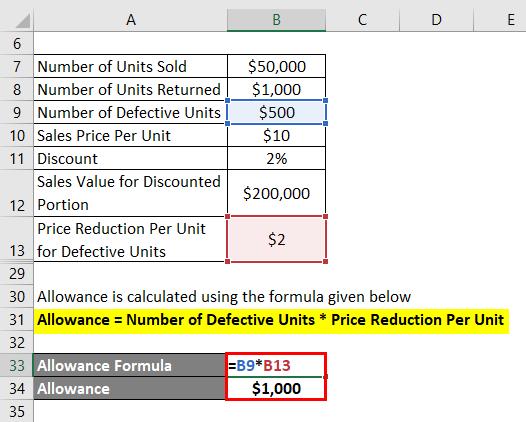

Allowance is calculated using the formula given below

Allowance = Number of Defective Units * Price Reduction Per Unit

- Allowance = $500 * $2

- Allowance = $1,000

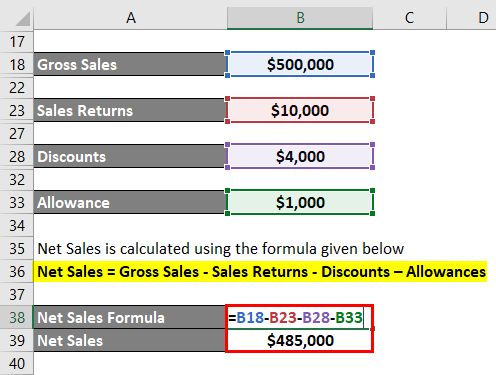

Net Sales is calculated using the formula given below

Net Sales = Gross Sales – Sales Returns – Discounts – Allowances

- Net Sales = $500,000 – $10,000 – $4,000 – $1,000

- Net Sales = $485,000

Therefore, the company booked net sales of $485,000 during the year.

Explanation

The formula for net sales can be derived by using the following steps:

Step 1: Firstly, determine the total number of units sold of the product under consideration during a certain period of time, which can be daily, monthly, quarterly or annually.

Step 2: Next, determine the sales price per unit of the product.

Step 3: Next, calculate the gross sales by multiplying the number of units sold (step 1) and the sales price per unit (step 2) as shown below.

Gross Sales = Total Units Sold * Sales Price Per Unit

Step 4: Next, determine the sales return which includes the value of the products returned by the customers for various reasons like business return policy, product quality, etc. The customers receive a refund for the returned product.

Step 5: Next, determine the value of discounts which includes the deduction offered to the customers on their invoices due to early or timely payments. These discounts intended for lower account receivables and faster recovery.

Step 6: Next, determine the value of allowances which refers to the price reductions offered to the customers in case of some defect or damage in the product.

Step 7: Finally, the formula for net sales can be derived by deducting sales returns (step 4), discounts (step 5) and allowances (step 6) from the gross sales (step 3) as shown below.

or

Relevance and Uses of Net Sales Formula

The concept of net sales is a very important one as it is, if not the first line item, one of the first few the income statement that sets the tone of the statement. In fact, in case an income statement has a single line item that is labeled simply as “sales,” then it is safe to assume that the line item refers to the net sales. In most cases, the amount of total revenues booked by a company in its income statement is usually the net sales figure, which is the value arrived at after the deductions of all forms of sales. It is advisable to report gross sales as a separate line item itself, followed by all the deduction and then the net sales. Apparently, non-reporting of the deductions can prevent the readers of the financial statements or other stakeholders from drawing meaningful insights about the sales transactions.

Net Sales Formula Calculator

You can use the following Net Sales Formula Calculator

| Total Units Sold | |

| Sales Price Per Unit | |

| Sales Returns | |

| Discounts | |

| Allowances | |

| Net Sales | |

| Net Sales = | (Total Units Sold x Sales Price Per Unit) - Sales Returns - Discounts - Allowances |

| = | (0 x 0) - 0 - 0 - 0 = 0 |

Recommended Articles

This is a guide to Net Sales Formula. Here we discuss how to calculate Net Sales along with practical examples. We also provide a Net Sales calculator with a downloadable excel template. You may also look at the following articles to learn more –