What is the New Tax Regime?

On July 23, 2024, India’s finance minister, Nirmala Sitharaman, proposed changes in the new tax regime in the 2024 budget, which we will understand in this article.

When it comes to income tax, individuals fall into three categories according to their age:

- Residents and NRI under the age of 60

- Senior resident citizens of ages between 60 and 80

- Super senior resident citizens above the age of 80

Each category has different income tax slabs.

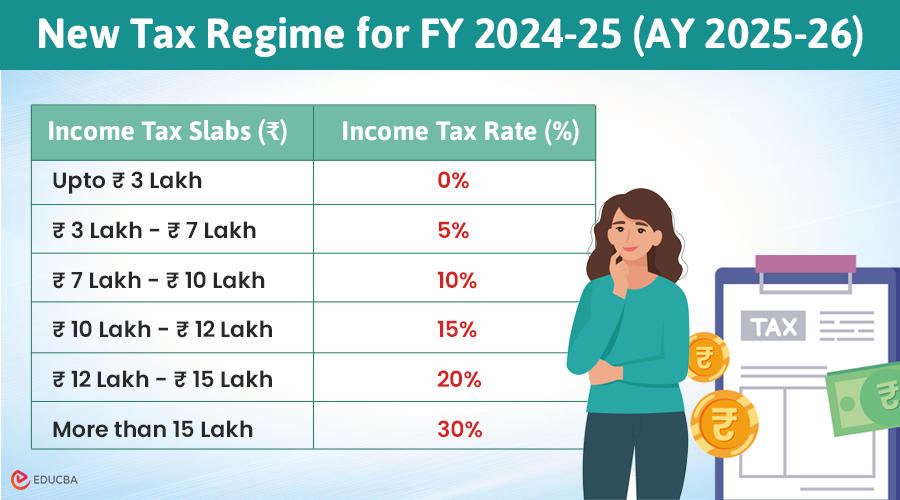

New Tax Regime for FY 2024-25 (AY 2025-26)

Below are the proposed income tax slabs under the new tax regime for FY 2024-25 (AY 2025-26):

Note: You can choose between the old and new tax regimes. If you don’t, the new regime will apply by default.

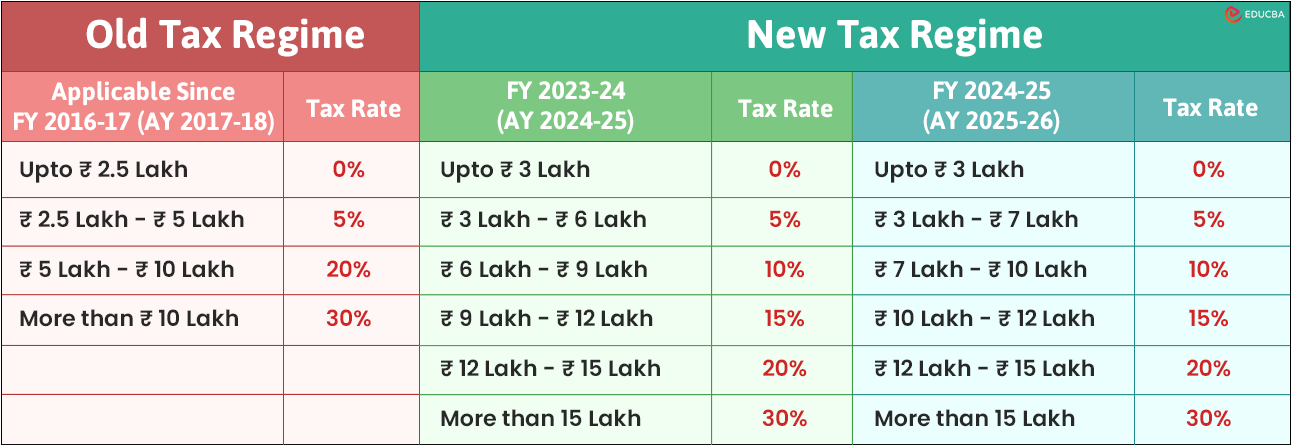

Comparison of Old and New Tax Regimes

The given snapshot comparing the old and new tax regimes will clear up any confusion about your tax rates for filing your ITR.

FY: Financial Year – The year in which you earn income.

AY: Assessment Year – The year in which you report earnings and pay taxes on your income.

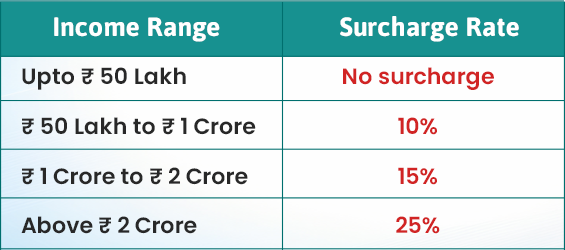

Additional Charges Under the New Tax Regime for FY 2024-25

- Health & Education Cess: 4% of the total tax amount.

- Surcharge Rates:

Note: In the 2023 budget, the surcharge on income above ₹5 Crore was reduced from 37% to 25%.

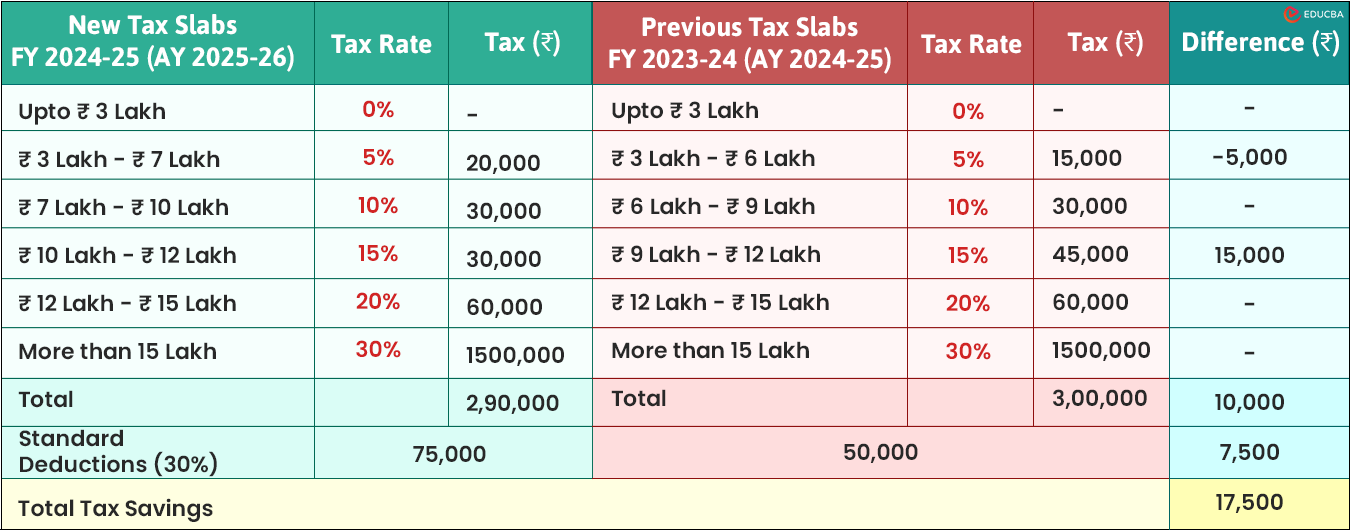

How the New Tax Regime Helps Salaried Employees Save Up to ₹17,500 in Taxes?

Finance Minister Nirmala Sitharaman said in her budget speech that a salaried employee can save up to ₹17,500 in income tax in the new tax regime.

Let us understand how you can save ₹17,500:

Note: Here is the calculation for 7,500:

The standard deduction in the new regime: 75,000 – 50,000 = 25,000

Tax on 25,000 at 30% (according to the tax bracket) = 7,500

A taxpayer earning ₹15,00,000 can save ₹17,500 with the new tax regime when considering changes in tax rates and the additional standard deduction.

Common Deductions under New Tax Rate Regime

Allowed:

Taxpayers choosing the new tax regime (FY 2024-25) will have to forgo several deductions and exemptions available under the old tax regime. The key deductions and exemptions allowed are:

- Investment in a government-approved pension scheme (section 80CCD(2)).

- Conveyance allowance for traveling to work.

- Depreciation on assets (excluding extra depreciation) under Section 32.

- Deduction for hiring new employees (section 80JJAA).

- Allowance for travel related to work or job transfers.

- Transport allowance for people with disabilities.

Not Allowed:

The key deductions and exemptions not permitted under the new tax regime include:

- Leave Travel Allowance (LTA)

- Conveyance Allowance

- House Rent Allowance (HRA)

- Relocation Allowance

- Children’s Education Allowance

- Professional Tax

- Daily Expenses Incurred in the Course of Employment

- Helper Allowance

- Deductions under Chapter VI-A (e.g., Sections 80C, 80D, 80E)

- Standard Deduction on Salary

- Interest on Housing Loan (Section 24)

- Other Special Allowances (Section 10(14))

By opting for the new tax regime, taxpayers will benefit from lower tax rates but will need to forgo these specific deductions and exemptions.

Income Tax Slabs Under Old Tax Regime

Suppose you are still using the old regime for your tax calculations and want to continue to use the same regime. You do not have to worry. As per the Budget 2024, there are no changes in the old tax regime. The slabs applicable to an individual under the old tax regime depend on the age.

Here are the income tax slabs for individuals under 60, senior citizens (60 and above but below 80), and super senior citizens (80 and above).

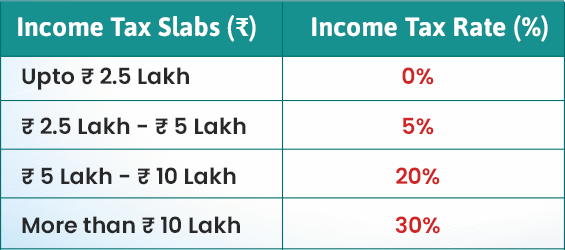

A. Individuals (below 60 years):

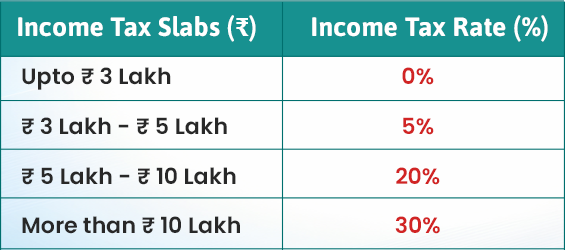

B. Senior Citizens (ages between 60-80):

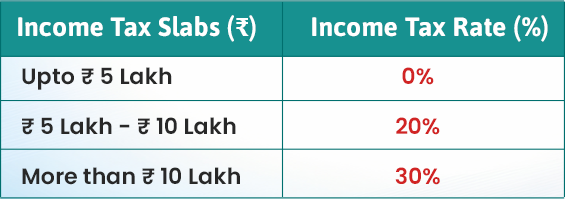

C. Super Senior Citizens (above 80 years):

Key Highlights of the Union Budget 2024

The Union Budget 2024 focuses on key areas such as employment, skilling, MSMEs (Micro, Small, and Medium Enterprises), and the middle class. Here are some important updates:

- Revised Tax Slab Rates: The new tax slab rates allow salaried employees to save up to ₹17,500 annually in taxes.

- Increased Standard Deduction: The standard deduction for salaried employees is now ₹75,000 and not ₹50,000.

- Higher Deduction for Family Pensions: The pension deduction has been raised from ₹15,000 to ₹25,000.

- Boost to National Pension System (NPS): The deduction limit for employers’ contributions to the NPS is up from 10% to 14%.

- NPS Vatsalya Plan: This new plan allows parents and guardians to contribute to NPS for minors. Once the minor reaches adulthood, they can convert the plan into a regular NPS account.

Things to Remember in New, Old Tax Regimes

Key points regarding the cess and surcharge under the new and old tax regimes:

1. Cess:

- A 4% cess applies to the income tax amount under both the new and old tax regimes.

2. Surcharge:

- Applicable on incomes exceeding Rs 50 lakh in both tax regimes.

- The surcharge rates differ between the old and new tax regimes for incomes exceeding Rs 50 lakh.

- The surcharge rates are lower in the new tax regime than in the old one.

Recommended Articles

We hope you understand the new tax regime easily with this guide. Here are other blogs on taxes that you must read.