Updated October 31, 2023

Difference Between Nominal GDP vs Real GDP

The Gross Domestic Product (GDP) of a country is the monetary value of all goods and services produced within the country during a specified time period. Countries usually track GDP quarterly and annually and include value additions through all private and public consumption, private inventories, government investments, outlays, paid-in construction costs, and net foreign trade (exports fewer imports). GDP is a good economic indicator that helps gauge a country’s standard of living. Due to its uniformity in measurement, GDP helps compare productivity across countries and time for trend analysis. Now, we will discuss the difference between Nominal GDP vs Real GDP.

Since GDP is a monetary value, it is subject to price changes in the economy during the time period used for GDP measurement. Inflation refers to the increase in the price of goods and services over a period of time. In contrast, deflation or negative price change may be witnessed during economic recessions. If you do not adjust for price changes in GDP, you would not be able to analyze whether an increase in GDP during the period has been due to expansion in production, escalation of prices, or both; hence, growth comparison across countries or time would be a futile exercise.

Inflation is a negative force for all economic participants since it decreases the purchasing power of both consumers and investors. For example, suppose an investor receives 5% from his investment while inflation during the same period is 5%. In that case, the real interest rate on the investor’s investment will be zero, signifying no real gains from the investment.

Nominal GDP is calculated at the current market price, while real GDP adjusts for price changes due to inflation/deflation. For example, if real GDP rises 2% during a year and the inflation rate is 1%, nominal GDP would be 2%+1%=3% for that year. A large difference between nominal GDP and real GDP signifies a significant inflationary or deflationary situation in the country.

The calculation of real GDP is not as simple as the example above. Economists usually use a GDP price deflator, which adjusts for this price change. GDP deflator measures the price change in goods and services from the base year used for comparison. Real GDP is derived by dividing nominal GDP by the GDP deflator. For example, if the price of an economy’s goods and services has increased by 1% compared to the base year, the deflator would be 1.01.

India’s GDP at current prices, or Nominal GDP, for 2017-18 was Rs 167.73 lakh crore, while GDP at 2011-12 constant prices, or Real GDP, during the same period was Rs 130.11 lakh crore. To compute real GDP, 2011-12 was taken as the base year, and calculation was done by multiplying the quantities of goods/services produced during 2017-18 with the prices of those goods/services prevalent in 2011-12. While the yearly nominal GDP growth rate was 10%, it included inflation during the fiscal year 2017-18. Real GDP growth of 6.7% in the 2017-18 fiscal year represents the quantitative growth of economic goods/services over 2016-17. Let us look at the Nominal GDP vs Real GDP with infographics and key differences.

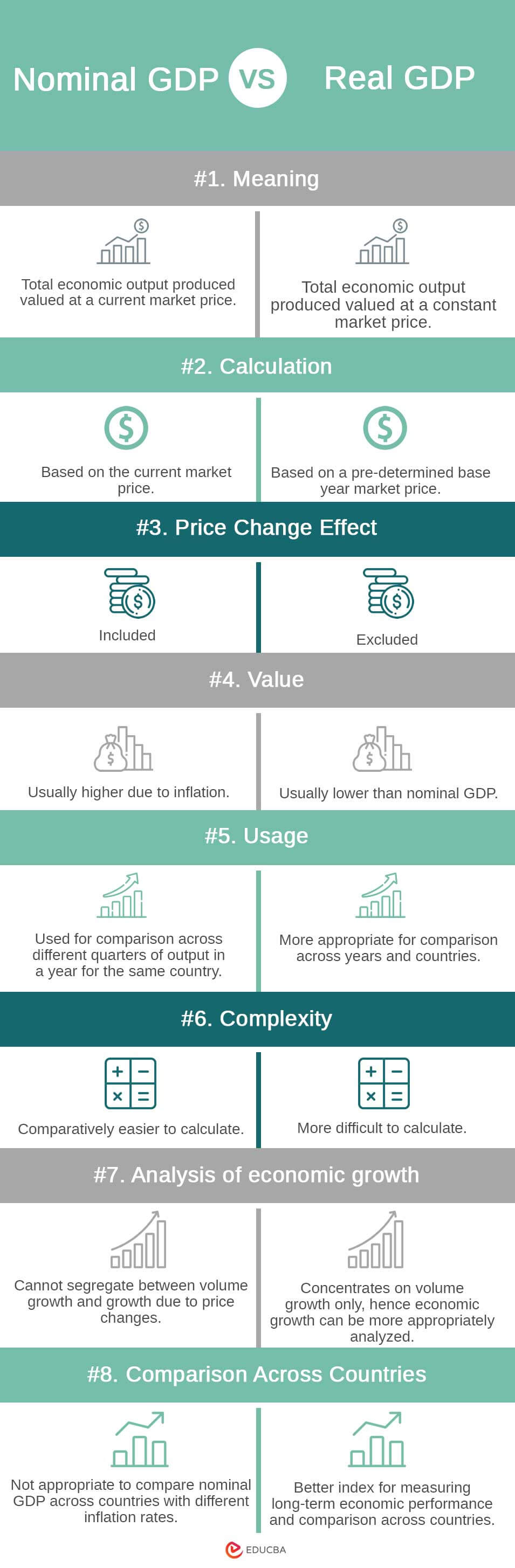

Head To Head Comparison Between Nominal GDP vs Real GDP (Infographics)

Below is the top 8 difference between Nominal GDP vs Real GDP

Key Differences Between Nominal GDP vs Real GDP

Both Nominal GDP vs Real GDP are popular choices in the market; let us discuss some of the major Differences Between Nominal GDP vs Real GDP:

- Nominal GDP represents the current market price value of economic output produced during the specified time period within a country, while real GDP represents the total economic output produced during the time period within the country valued at a pre-determined base market price.

- Nominal GDP does not take inflation/deflation of the country during the specified time period into consideration, while real GDP adjusts for price changes in the country during the specified time period.

- It is easier to calculate, while real GDP is much more complex since it requires analysis of the base year market price of the current year’s economic output to determine the value.

- Nominal GDP is more appropriate for comparisons across different quarters of a year, while real GDP is more appropriate for comparisons of economic performance across years and countries.

- The economic growth of a country cannot be easily analyzed through nominal GDP, while assessment of economic growth is significantly and comparatively easier through real GDP; hence, real GDP growth is more popular among economists and analysts.

Nominal GDP vs Real GDP Comparison Table

Below is the topmost comparison between Nominal GDP vs Real GDP

| The Basis of Comparison | Nominal GDP | Real GDP |

| Meaning | Total economic output produced valued at a current market price | Total economic output produced valued at a constant market price |

| Calculation | Based on the current market price | Based on a pre-determined base year market price |

| Price change effect | Included | Excluded |

| Value | Usually higher due to inflation | Usually lower than nominal GDP |

| Usage | Used for comparison across different quarters of output in a year for the same country | More appropriate for comparison across years and countries |

| Complexity | Comparatively easier to calculate | More difficult to calculate |

| Analysis of economic growth | Cannot segregate between volume growth and growth due to price changes | Concentrates on volume growth only; hence, economic growth can be more appropriately analyzed |

| Comparison across countries | Not appropriate to compare nominal GDP across countries with different inflation rates | Better index for measuring long-term economic performance and comparison across countries |

Final Thoughts

An increasing nominal GDP may reflect the rise in inflation against growth in a country’s economic output. This defeats the purpose behind GDP calculation when that is used to gauge the economic growth of a country and compare it with previous years or with other countries with different inflationary behavior. Hence, real GDP attracts more attention from economists and analysts. The monetary authority of a country bases its decisions on money supply after a detailed analysis of the real GDP figures. In contrast, fiscal authority is influenced by this figure when it decides on the budget and government finance.

While the focus is more on real GDP when analyzing/comparing the economic growth of a country, the nominal GDP also has several applications where real GDP cannot be used. For example, when comparing economic variables like fiscal deficit, country debt level, current account balance, etc., across countries or time, they are usually computed as a percentage of GDP, specifically nominal GDP. We do not usually adjust these variables for inflation; hence, nominal GDP maintains consistency between the numerator and denominator.

Recommended Articles

This has been a guide to Nominal GDP vs Real GDP. Here, we also discuss the key differences between Nominal GDP vs Real GDP with infographics and the comparison table. You may also have a look at the following articles to learn more –