Updated July 3, 2023

What Are Non-Performing Assets (NPA)?

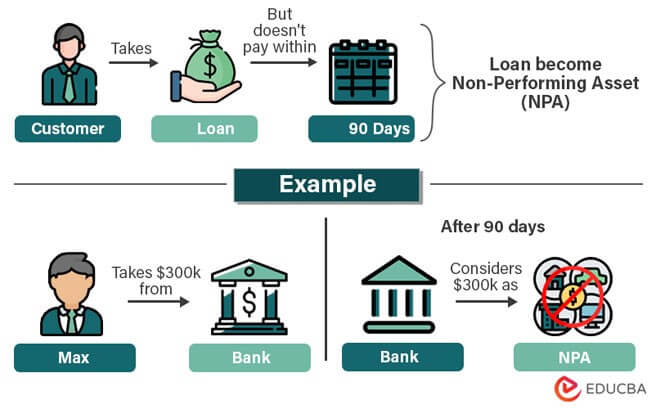

When customers take an advance or a loan from banks or financial organizations, they must repay the amount within 90 days. However, if the customer fails to repay the loan or advance within the timeframe, it becomes non-performing assets (NPA) for the bank.

As loans are the primary source of income for banks, it creates a poor financial picture when they start losing money instead of making it.

Many global banks have recently faced significant issues due to these assets. Mainly, the COVID-19 pandemic led to a rise in loan defaults and delayed repayments. For instance, in 2020, Wells Fargo reported a $2.4 billion increase in non-performing loans, contributing to the bank’s net income decline. Simbank’s, one of India’s leading privatIndia’sr banks HDFC Bank reported an increase in its gross NPAs from 0.81% in September 2020 to 0.84% in December 2020.

Top Countries With Highest NPAs

The following table shows the NPA percentage of the first 10 countries in descending order (2021).

|

Sr. No. |

Country |

NPA (%) |

| 1 | San Marino | 58.96 |

| 2 | Eq. Guinea | 55.08 |

| 3 | Portugal | 35.44 |

| 4 | Ukraine | 31.72 |

| 5 | Chad | 26 |

| 6 | Republic Of Congo | 16.85 |

| 7 | Ghana | 15.12 |

| 8 | Angola | 15 |

| 9 | Dominica | 14.39 |

| 10 | Cameroon | 14.07 |

(Source: The Global Economy)

How Does NPA Work?

Given is the stepwise process of how non-performing assets (NPA) occur:

Step 1: Individuals or firms take loans from banks or financial institutions to fulfill financial necessities or goals.

Step 2: The borrower may be unable to repay the loan within the 90 days due to various reasons. For example, business failure, layoff, and other financial crises.

Step 3: Banks and financial institutions record those NPAs (failed loan repayments) on their balance sheets.

Step 4: After a certain period (usually 90 days), the bank can sell the loan’s collateral (likloan’suse or car) to get some of their money back. Otherwise, they can write off the loan as a loss.

Step 5: Sometimes, banks partner with third-party agencies that either specialize in recovering the debt or buy bad debts from the bank at a discounted price.

Examples of Non-Performing Assets (NPA)

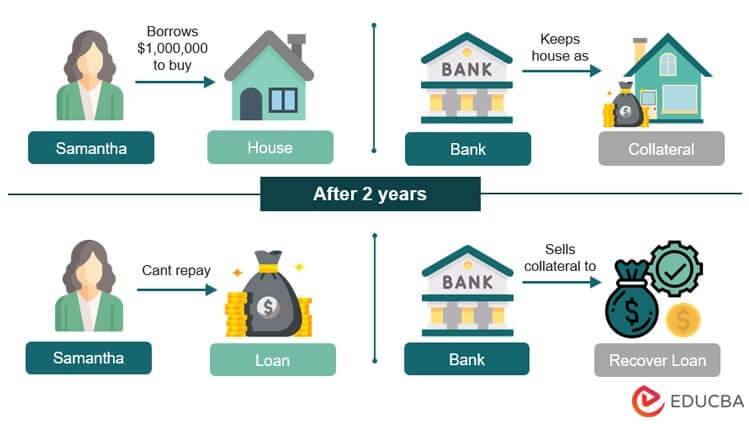

1. House Loan

Samantha borrows a sum of $1,000,000 from the National Corporation Bank to purchase a house. She mortgages the home as collateral for the loan. Samantha has to repay the loan in 30 years with a monthly installment of $3000. Samantha could pay the installments for 2 years, but after that, she stopped paying the installments due to financial issues.

The bank starts sending recovery emails to Samantha, but after the stipulated time, the bank realizes she will not pay any further installments. As a result, they mark the loan as a Non-Performing asset. Moreover, as they had the house as a mortgage, the National Corporation bank sold the house to recover the loan amount.

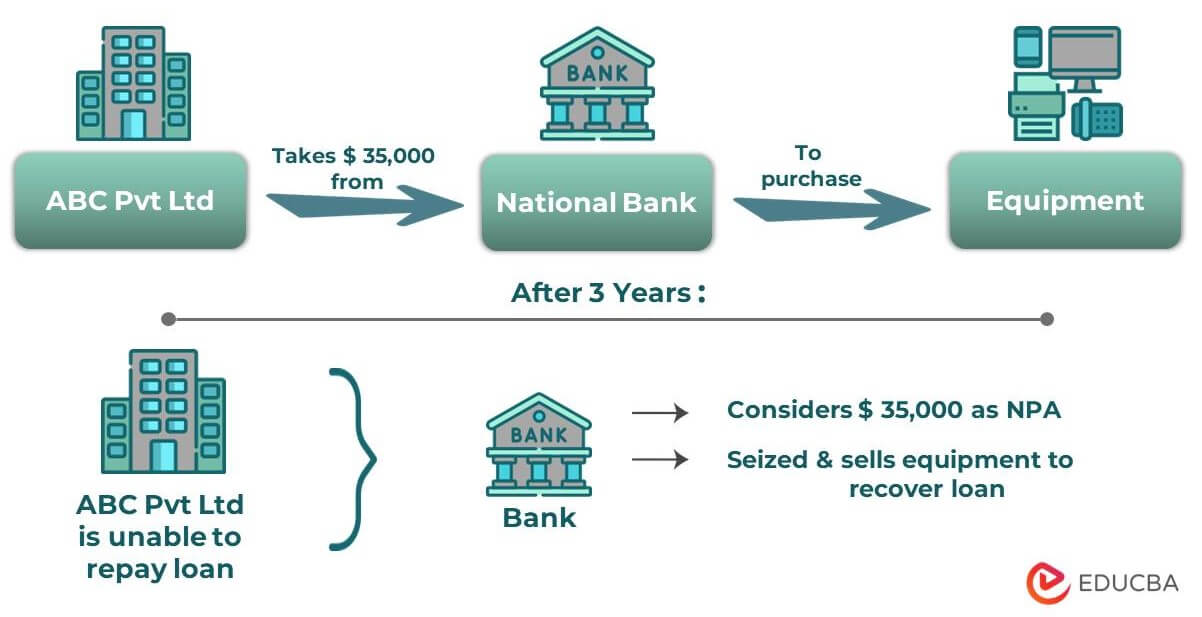

2. Loan for Equipment

ABC Pvt. Ltd. borrowed $35,000 from a national bank to buy new equipment for their warehouse. They were required to repay the loan amount and interest through monthly installments over 5 years. However, after making payments for 3 years, the company suffered losses due to internal corruption. It failed to pay the installments, causing the loan to become a non-performing asset. Consequently, the bank seized the equipment and sold it in the market to recover the loan amount and avoid losses.

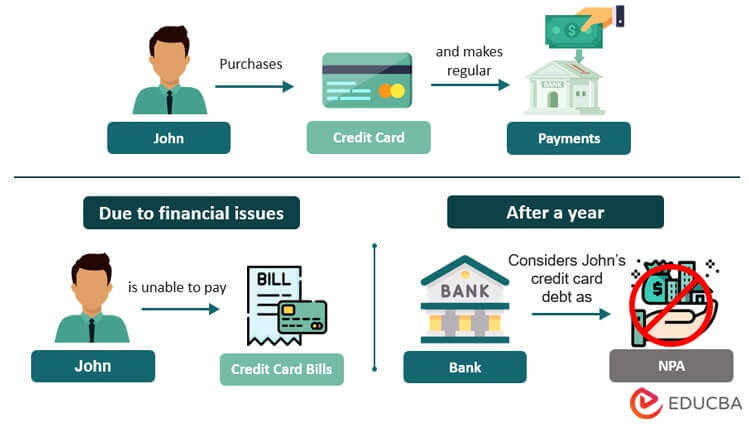

3. Credit Card Debt

John purchases a new credit card with a maximum limit of $10,000. He regularly uses the card and makes timely payments for a few months. However, after some time, due to financial difficulties, he begins to miss the payment deadlines. Eventually, John stops paying his credit card bills, and his credit card debt becomes a non-performing asset for the bank. As a result, the bank can take legal action against John to recover the unpaid debt.

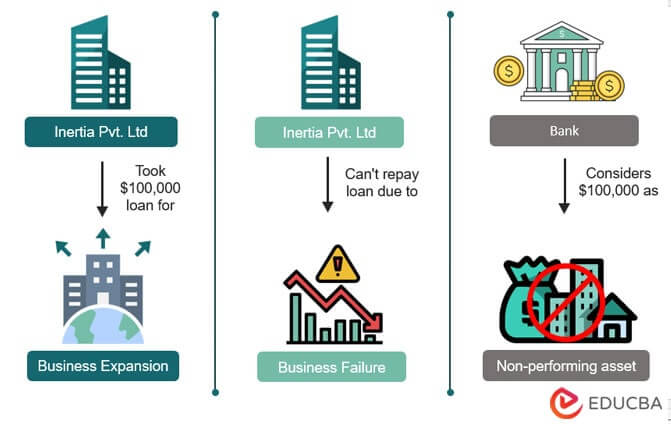

4. Business Loan

Inertia Pvt. Ltd. took a loan of $100,000 from a bank to expand its business operations. They had to repay the loan in 7 years with a monthly installment of $2000. However, due to a downturn in the economy and the industry, the business could not generate sufficient revenue to repay the loan.

Moreover, the bank tried to recover the payments for a year, but the company failed to make any payments. Eventually, the bank declared the loan an NPA and sold the collateral assets, such as machinery and equipment, to recover the loan amount.

Classifications of Performing and Non-Performing Assets (NPA)

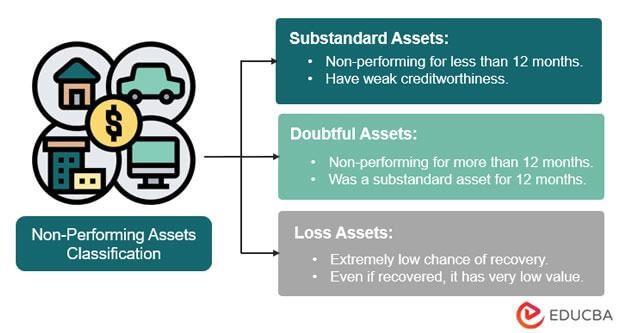

1. Substandard Assets: These assets stay non-performing for over 12 months. As these NPAs have weak creditworthiness, it becomes difficult for banks or financial organizations to settle the debt leading to a loss.

2. Doubtful Assets: These assets have remained non-performing for over 12 months. They have a specified non-payment period and generally remain unpaid.

3. Loss Assets: These assets have a very low chance of recovery. Additionally, even if the bank recovers the loan amount, it won’t profit from the value it collects. Thus, auditwon’tnd banks identify these loans as losses.

Causes of Non-Performing Assets (NPA)

- Error in Records: If there are inconsistencies in banking documentation, it can cause the organization to make errors in tracking loans and assets.

- Ineffective Screening: If the lender doesn’t examine the borrower’s financial position bedoesn’tving the loanborrower’sces of loan default increase substantially.

- Internal and External Issues: Problems with technology, labor, and external economic setbacks, such as a recession, infrastructure issues, or price hikes, can cause a rise in NPAs.

- Depression: In times of economic depression, it gets difficult for borrowers to earn money to pay off the debt, leading to increased assets.

- Weak Recovery Channel: If the lender has an ineffective system for loan recovery, borrowers are more likely to default.

- Willful Defaulter: This occurs when a borrower fraudulently (purposely) does not repay the debt, even though they are financially capable.

Types

Fixed Maturity Loans

The most common NPA is a personal loan with a fixed maturity date. Banks usually issue personal loans without collateral, so they have to write off this loan as a bad debt on the balance sheet.

Mortgaged Loans

Home loans with longer maturities, ranging from 25 to 30 years, pose a higher risk of default. However, as the lenders always collect collateral in such cases, if the loan turns sour, the bank sells the collateral to recover the amount.

Credit Card Defaults

Credit card defaults, or overdrafts, usually occur after the holder hasn’t paid the amount in 90 days. The institution generally assesshasn’tit can recover the money within that period. However, once the asset turns non-performing, retrieving credit card defaults is challenging due to the absence of collateral.

Agricultural Loans

Most farmers take loans to grow crops during the harvesting period. However, if the cultivation is not as expected, the farmers fail to repay the loan. Thus, after a stipulated period, the lender marks it as NPA.

Where to Record Non-Performing Assets (NPA) on Financial Statements?

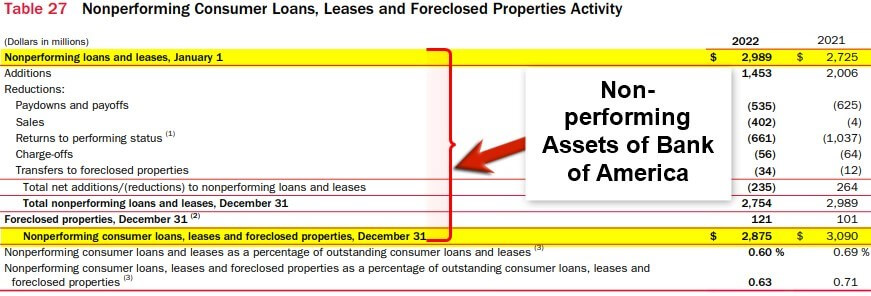

Banks and businesses record their NPAs on the consolidated balance sheets of their annual reports. The following image shows the non-performing assets of Bank of America for 2021 and 2022.

(Source: Bank of America Annual Report 2022)

Net and Gross Non-Performing Assets (NPA)

Gross Non-Performing Assets:

Gross Non-Performing Assets (GNPA) is the total value of all non-performing assets a bank or a business holds. It includes substandard, doubtful, and loss assets. Banks and companies use this measure to assess their asset quality and financial stability.

Net Non-Performing Assets:

The Net Non-Performing Assets (NNPA) refer to gross non-performing assets minus the provisions made by a bank or a business.

Provisions help cover potential losses from assets that are non-performing. Thus, NNPA is a more accurate measure of asset quality as it considers the provisions. A higher NNPA indicates that a bank or business has a larger exposure to non-performing assets (NPA), potentially impacting financial stability.

Provisions for NPA

Banks keep aside a separate fund from their profits to cope with unexpected losses from non-performing assets (NPA) in the future. It efficiently saves the bank from bad debts and helps to maintain a healthy financial record.

- Total provisions are the amount a bank keeps aside from its profits to cope with future bad debts.

- Gross NPA refers to all the loans customers have not paid back within 90 days.

This ratio determines the financial health of the bank or the organization. A higher PCR ratio indicates the organization has enough spare funds to cope with the losses.

In the balance sheets of banks or financial organizations, we find the provision coverage as Contingent Provisions against Standard Assets in Section 5, under Other Liabilities and Provisions Others.

The provisions are different for different categories of NPA. The following table shows the categories and their respective provisions.

|

Sr. No. |

Types of NPA | Period as NPA |

Provisions |

| 1. | Standard Assets | – | Agricultural Loans: 0.25%

Unsecured Loans: 2% All other Loans: 0.4% |

| 2. | Substandard Assets | Up to 1 year | Secured Advances: 15%

Unsecured Advances: 25% |

| 3. | Doubtful Assets | ||

| 3. a. | 2nd Year | Secured Advances: 25%

Unsecured Advances: 100% |

|

| 3. b. | 3rd and 4th Year | Secured Advances: 40%

Unsecured Advances: 100% |

|

| 3. c. | 5th Year Onwards | Secured Advances: 100%

Unsecured Advances: 100% |

|

| 4. | Loss Assets | Secured Advances: 100%

Unsecured Advances: 100% |

NPA Ratio Calculation

NPA Ratio determines the loans and advances of a bank or a financial institution that are unrecoverable from the borrowers. We determine this ratio by dividing a bank’s or financial organization’s total non-performing assets (NPA) by the loans it has lent to its bank’sers.

For example, the total loans that the international Noble Bank gave in 2022 amount to $400,000. Moreover, its total NPA value for 2022 is $600,000. Therefore, the NPA ratio of the bank will be,

NPA ratio = $600,000 /$400,000 = 3/2 = 3:2

Impact on the Economy

NPAs can negatively impact the economy of a country. When an institution’s NPA is higher than the average market rate, it can increase the chances of default and institution’sratings from rating agencies. It can cause investors to sell stocks and lose confidence in the institution. The banks may also have difficulty providing new loans due to unsettled old loans, which can reduce their profitability and capital sufficiency. This loss of public faith can lead to the bank focusing on risk management over profitability, increasing the chances of bankruptcy.

As a result, the bank may offer higher interest rates on loans, and regulators will monitor their activities closely. If the bank cannot recover its NPAs, it can default and lose billions of dollars, significantly impacting the overall economy.

Management of Non-Performing Assets (NPA)

Banks and financial institutions can use the following government strategies to manage and recover these assets:

- Insolvency and Bankruptcy Code:

It is a framework that allows banks to resolve insolvency issues by amending the corresponding laws. Thus, preventing any monetary distress to the bank or organization.

- The SARFAESI (Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest) Act:

The act states that banks have the power to recover their loan balances from borrowers without the need for any legal intervention.

- Asset Reconstruction:

Asset Reconstruction Companies buy any unpaid debts (NPAs) that debtors like banks have. It allows banks to maintain clean balance sheets and focus on day-to-day operations.

- Debt Recovery Tribunals:

Banks and institutions can approach debt recovery tribunals to get a final judgment on customer loan amount recovery.

Role of Regulatory Bodies

| Regulatory Body | Goal |

| Basel Committee | It is a Switzerland-based, 45-member supervision system covering 28 jurisdictions. It sets global standards to ensure banks focus on financial safety and cooperates on supervisory matters. |

| Committee on Payments and Market Infrastructures | It sets international standards for safe and efficient financial transactions to promote and maintain financial stability. |

| Financial Stability Board | It monitors the global financial sector (including non-member countries) and recommends appropriate policies by spotting liquidity imbalances. |

| Group of Twenty | With the European Union, and 19 other countries, like Indonesia, India, Germany, Japan, etc., it deals with global financial issues. |

| International Association of Deposit Insurers | It shares its expertise in deposit insurance with the global community to allow members worldwide to make wise decisions. |

| International Association of Insurance Supervisors | It supervises and sets international standards for the global insurance sector to benefit policyholders and insurance companies. |

| Joint Forum | This forum consists of representatives worldwide who look after the regulatory activities of the banking, securities, and investment sectors. |

Significance

NPA is an important indicator that helps understand a bank’s or a financial institution’s performance. Thus, credit rating agencies, research companies, and regulatory bodies consider it anbank’stial parameter dinstitution’sal assessments. NPA accounting also helps lenders determine the assets that are not performing well and needs consideration. Moreover, the data allows the Board of Directors to organize crucial meetings and make effective business decisions.

Frequently Asked Questions (FAQs)

Q1. What are non-performing assets (NPA) as per RBI?

Answer: According to the RBI, any loan overdue for more than ninety days at a stretch falls under the non-performing assets (NPA) category. It refers to any asset that does not make a profit for the bank.

For example, Max takes a loan of $50,000 from ABC National Bank of the US to start a company. He promises to pay back the loan in installments over four years. However, his business faces a loss after a year, and he cannot repay the loan. Therefore, ABC national bank considers the loan a non-performing asset.

Q2. What are the new rules for non-performing assets (NPA)?

Answer: Following are the new rules for NPA according to the circular of 2022:

- When any debt or loan is overdue for less than or equal to twelve months, we consider it a substandard NPA (Non-performing asset).

- Suspicious NPA belongs to the category of substandard NPA and remains unchanged for 12 months or less.

- When banks or financial organizations incur losses due to their NPAs, we consider them a loss of assets.

Q3. What is the time limit for non-performing assets (NPA)?

Answer: The time limit for NPA is 90 days or three months. After this stipulated period, the debts or loans become overdue and thus bring no profit to the lending organization.

Q4. What are a bank or business’s non-performing assets (NPA)?

Answer: Any unresolved debts or unpaid loans and leases that remain unchanged for 90 days are the non-performing assets of a bank or a business. Banks further classify them as substandard, doubtful, or lost assets. A financially stable organization has a lower NPA to total asset ratio, as a higher NPA indicates the economy is going toward recession.

Recommended Articles

This is a guide to Non-Performing Assets. Here we also discuss how Nonperforming Assets work along with their impact and benefits. You may also have a look at the following articles to learn more –