What are Non-Tariff Barriers?

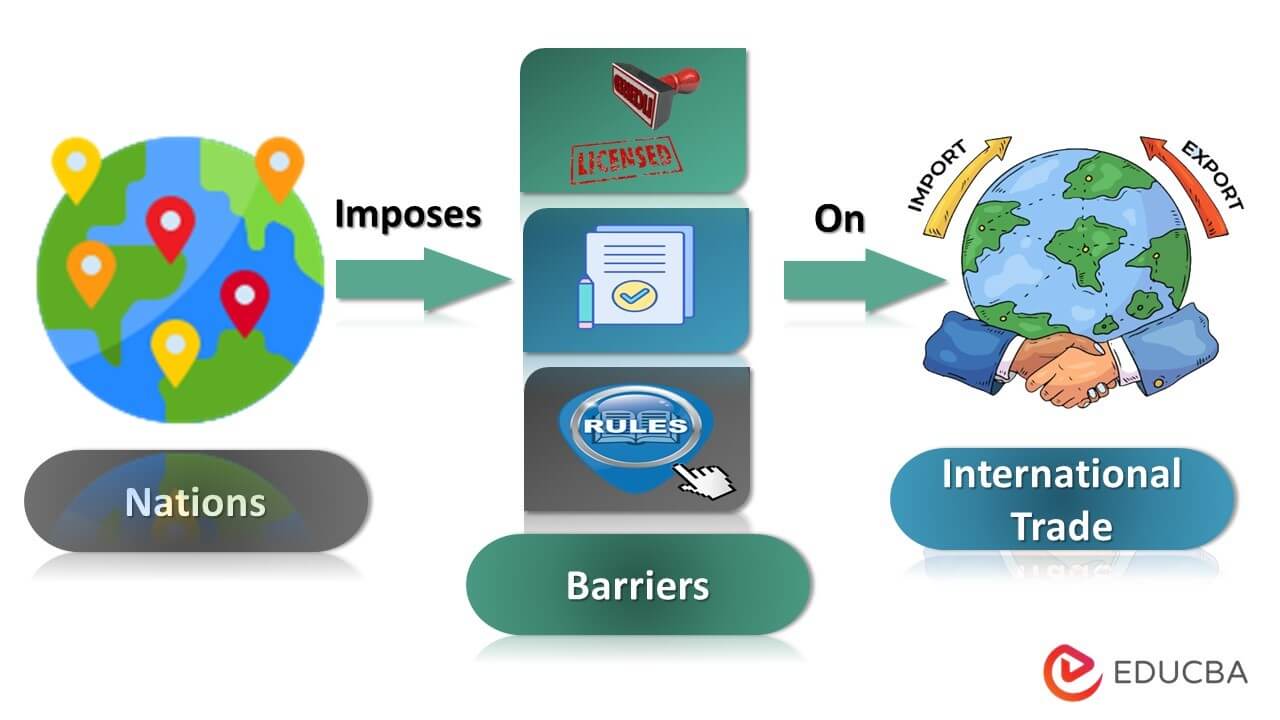

Non-tariff barriers are trade limitations other than customs tariffs, such as quotas, licenses, rules, and embargoes that limit the import or export of goods.

For example, In December 2017, the USA adopted non-tariff barriers against North Korea. The primary purpose behind such restrictions was to put economic pressure to slow down its nuclear arms and military exercises.

Protecting the national interest is the main reason for regulating world trade. Therefore, developed countries impose tariff restrictions to protect their economic strategy and maintain the trade standard they conduct with other countries.

Key Highlights

- Non-tariff barriers are the restrictions imposed on international trade, which do not include tax or any other duty.

- Countries conduct trading limitations when they want to slow down the import and export of goods with other countries and focus on their economic level.

- Examples include quotas, licenses, rules, embargoes, and other trade rules.

- Developed countries apply customs duties to protect their regional industries against other countries.

- Governments commonly use these exercises, including quantity limitations, administrative rules, foreign exchange restrictions, and consular credentials.

How do Non-Tariff Barriers Work?

The availability of goods and services influences a nation’s political authorities to decide when to impose non-tariff barriers. International trade barriers include non-tariff and tariff barriers, which also apply to the global economy. It limits the import and export of goods, which may affect many countries’ businesses and cause economic loss. Often countries use alternative tariffs to the standard one to release countries from paying heavy tariffs on imported goods.

Examples

#1: China

Until recently, China mandated that all avocados from nations like Kenya must be frozen to a temperature of –30°C and peeled before shipping. After a dangerous pest risk analysis identified by the country’s plant health inspection, China applied such norms.

#2: Africa

According to the African Continental Free Trade Area, businesses must deal with set guidelines. Such as 55 different country standards, test certificates, and national inspection processes. As a result, the rate of international trade slows down.

Types

Quantity Limitations

- Countries want to lower the frequency of overseas trade conduct limitations for specific items.

- The authorities will not authorize any deal that exceeds the defined quantity limit or cost.

- The applicable quotas might be permanent, seasonal, or temporary.

- For example, the USA imported $60.70 Billion in electronic products from China in 2021. The USA can conduct quantity limitations against China if the product quantity increases its agreed limits.

Foreign Exchange Restrictions

- Under this system, the importer must ensure that appropriate foreign exchange is available for import goods.

- A letter of credit or advance payment requires approval from the country’s exchange control authorities before the contract with the supplier is signed.

- For example, the British government applied foreign exchange restrictions in 1939 to prevent their currency outflow.

Technical and Administrative Regulations

- Administrative limits govern imports and technological restrictions, such as adherence to particular paperwork procedures.

- These policies significantly hamper the free flow of trade.

- For example, importing pharmaceutical products requires an origin certificate.

Preferred Arrangement

- The member countries negotiate and agree on a preferential tariff rate to continue trading.

- These charges are significantly cheaper than usual tariff rates and apply solely to the small group’s members.

- For example, in an agreement between the investors and the company, they favor the GATT (General Agreements on Tariffs and Trade).

Embargo

- Embargoes are when a specific country or several countries restrict the import of particular goods from another country.

- Countries apply such restrictions to save their political or economic goals.

- For example, the United States enforces an embargo and restricts supplying airplanes and replacement parts to Iranian

Advantages & Disadvantages of Non-Tariff Barriers

|

Advantages |

Disadvantages |

| The domestic market offers more jobs, and as a result, it has multiple effects on the economy. | The government can not generate extra income, as tax can not impose such tariffs. |

| Domestic industries become capable of competing with international sectors. | Limits the free market causing insufficient resources in the global market. |

| It maintains a trade balance by limiting the import of certain products with the upper limit. | It has the potential to spark trade wars as they guide unfair trading. |

Final Thoughts

Non-tariff barriers are primarily defensive actions adopted by governments and authorities in the form of laws, rules, and policies. These actions help to impose conditions on trade to defend the interests of domestic industry. When items from other countries fail to fulfill demand, citizens must buy domestic goods. Thus, it stimulates the national economy, resulting in increased job possibilities. Furthermore, these limits serve to maintain the trade balance.

Frequently Asked Questions (FAQs)

Q1. What are non-tariff barriers?

Answer: A non-tariff measures barrier is a trade restriction that governments impose to achieve their economic and political objectives, such as quotas, embargos, or penalties. Countries typically use non-tariff obstacles (rather than standard tariffs) in international commerce. Non-tariff obstacles like quotas, prohibitions, fines, and levies are non-tariff barriers.

Q2. What are examples of non-tariff barriers?

Answer: General or product-specific quotas, import bans, complex/discriminatory rules of origin, Phyto-sanitary conditions, and Unjustified Sanitary are some examples of non-tariff barriers. Exporting countries impose quality conditions and protocols on products from the Importing country.

Q3. Differentiate between tariff and non-tariff barriers.

Answer: Tariff barriers can take the shape of sales costs, whereas non-tariff barriers can take the form of rules, restrictions, requirements, formalities, etc. Tariff barriers enhance government income by protecting domestic industries and increasing their revenue. In comparison, non-tariff barriers restrict the import and export of goods.

Q4. What are the four types of trade barriers?

Answer: The four main trade barriers many countries use are quotas, licenses, subsidies, and standardization. The allocations are the restrictions on product quantity or monetary worth, while a claim is an administrative authorized certificate. Moreover, subsidies are payments from the government to organizations to protect citizens’ jobs. Finally, standardization ensures that all the goods are as per the set guidelines.

Recommended Articles

This EDUCBA article is a glimpse of non-tariff barriers. To learn more about it, EDUCBA would refer to these recommended articles.