Updated July 18, 2023

Difference Between NOPAT vs Net Income

NOPAT stands for Net Operating Profit after Tax and is an important yardstick to measure the operating efficiency of the business net of taxes. NOPAT measures the efficiency of the business without taking into consideration the use of debt borrowing as it doesn’t adjust interest charges. On the contrary net income is a popular profitability measure that is used to measure the overall performance of a business entity and it takes into consideration all expenses include interest charges and all. Both serve a different purpose and can be used in conjunction as well depending upon the purpose and scope of analysis involved.

What is NOPAT and What is Net Income?

NOPAT: NOPAT finds its utility in multiple cases. It is an ideal measuring yardstick when the capital structure is not taken into consideration and tax benefits of debt components are to be ignored.

The formula for NOPAT is as follows:

As can be observed it is focused purely on operating income and as such help in a more simplistic comparison across the different business without getting impacted by the capital structure.

Also, NOPAT is used often to compute economic value added (eva) through which businesses measure economic profit against the accounting profit.

The formula to compute EVA using NOPAT is shown below:

Net Income: Net Income focus on determining the income earned by the business and is a measure of overall profitability. it is well understood across different stakeholders and it considers all expenses including interest expenses on account of debt in the capital structure.

The formula for Net Income is as follows:

Alternatively, the simple formula can be:

It is pertinent to note here that if a business has a negative net income (net loss), it may have a positive nopat, however, if a business has a negative operating profit i.e. negative nopat it will surely have a negative net income.

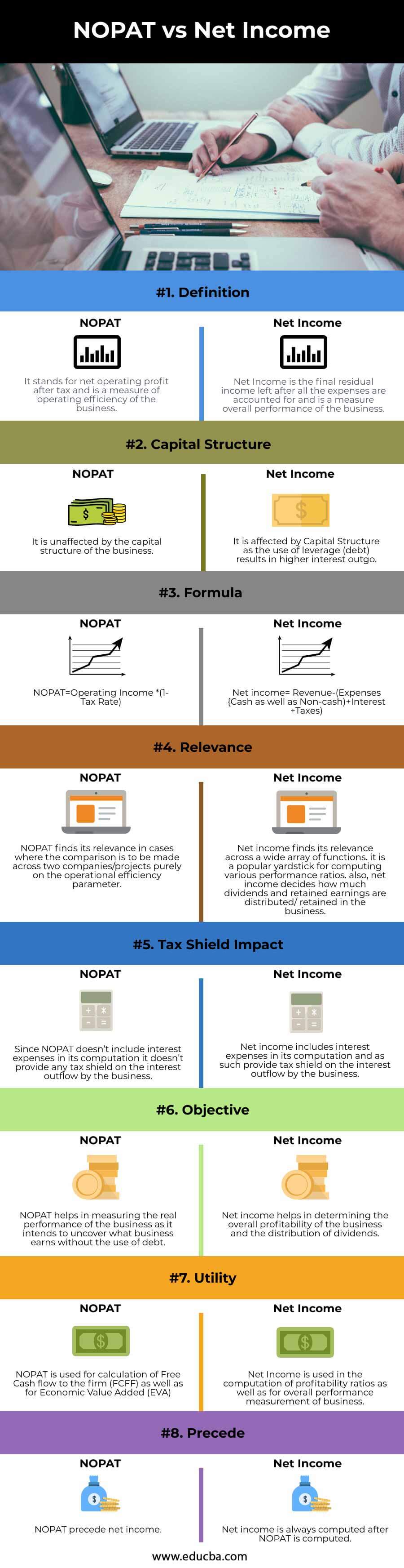

Head To Head Comparison Between NOPAT vs Net Income (Infographics)

Below are the top 8 differences between NOPAT vs Net Income:

Key Differences Between NOPAT vs Net Income

Both NOPAT and net income evolve from the income statement of a business; however, there are certain key differences between the two as enumerated below:

| Basis | NOPAT | Net Income |

| Definition | It stands for net operating profit after tax and is a measure of operating efficiency of the business. | Net Income is the final residual income left after all the expenses are accounted for and is a measure overall performance of the business. |

| Capital Structure | It is unaffected by the capital structure of the business | It is affected by Capital Structure as the use of leverage (debt) results in higher interest outgo. |

| Formula | NOPAT=Operating Income *(1-Tax Rate) | Net income= Revenue-(Expenses {Cash as well as Non-cash)+Interest +Taxes) |

| Relevance | NOPAT finds its relevance in cases where the comparison is to be made across two companies/projects purely on the operational efficiency parameter. | Net income finds its relevance across a wide array of functions. it is a popular yardstick for computing various performance ratios. also, net income decides how much dividends and retained earnings are distributed/ retained in the business. |

| Tax Shield Impact | Since NOPAT doesn’t include interest expenses in its computation it doesn’t provide any tax shield on the interest outflow by the business. | Net income includes interest expenses in its computation and as such provides tax shield on the interest outflow by the business. |

| Objective | NOPAT helps in measuring the real performance of the business as it intends to uncover what the business earns without the use of debt. | Net income helps in determining the overall profitability of the business and the distribution of dividends. |

| Utility | NOPAT is used for calculation of Free Cash flow to the firm (FCFF) as well as for Economic Value Added (EVA) | Net Income is used in the computation of profitability ratios as well as for the overall performance measurement of business. |

| Precede | NOPAT precede net income | Net income is always computed after NOPAT is computed. |

Example of NOPAT and Net Income

PQR International reported the following information for the year ended 2019:

| Net Revenues | $100000 |

| Cost of goods sold | $40000 |

| Selling and Distribution expenses | $20000 |

| Interest Expenses | $10000 |

| Tax Rate | 25% |

| Preference Dividend paid | $5000 |

Based on the above let’s compute NOPAT and Net Income for the business:

- NOPAT = ($100000 – $40000 – $20000 – $5000) * (1 – 0.25)

- NOPAT = ($35000) * 0.75

- NOPAT = $26250

- Net Income = ($100000 – $40000 – $20000 – $5000 – $10000) * (1 – 0.25)

- Net Income = $18750

Thus we can observe that Interest expenses resulted in tax shield for the business leading to Net Income of $18750 which otherwise would have been $16250 ($26250 – $10000).

NOPAT vs Net Income Comparison Table

Let us look at the comparison table of NOPAT vs Net Income.

| NOPAT | Net Income |

| It describes earnings before interest but after taxes. | It describes net earnings after all expenses are taken care of including interest expenses. |

| It is the starting point in the calculation of free cash flow which is used in undertaking financial modeling for the business. | Net Income considers items like depreciation, changes in working capital which are important from a business continuity perspective. |

| NOPAT comprises of operating income and doesn’t include any one-off items. | Net Profit comprises even one-off items as well which may not recur in the future. |

Conclusion

NOPAT and Net Income are two important metrics that help in measuring the operating efficiency and overall performance of business respectively. These numbers are found the same in the case of those businesses where there is no debt borrowing and no interest charges and interest income to report and such business will be indifferent in case of both. However, most of the business makes use of financial leverage, and as such these numbers vary within a business.

An important question that usually surfaces when one has to choose between the two is which measure to use. In this case, when the question relates to making investment decisions in a business, NOPAT is a more powerful measure as it provides the absolute performance of the business without getting impacted by the use of financial leverage, interest income, etc.

Recommended Articles

This is a guide to NOPAT vs Net Income. Here we also discuss the NOPAT vs net income key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –