Updated July 19, 2023

Introduction to Financial Statement Analysis

Financial Statement Analysis is analyzing the relationship between the items recorded in the Financial statement; the statements adapt the method of interpreting, assessing, and evaluating the results from the historical records and current records related to the company’s financial position. It also assists in focusing on particular investment decisions of the company.

Explanation

- The whole process of analyzing and evaluating the entries recorded in financial statements and then making economic decisions based on that can be termed financial statement analysis.

- It also helps the analyst learn about the company’s financial strengths and economic weaknesses by establishing a correlation between the strategic entries recorded in the balance sheet, income statement, or cash flow statements.

- From the finance manager’s perspective, financial statement analysis helps the manager assess the firm’s managerial effectiveness and operational efficiency.

- By determining the strength and weaknesses of the company, one can easily measure the creditworthiness of the company in terms of debt payback and leveraging operations.

- From the company’s perspective, the statements help categorize the types of assets owned by the company. This helps the company assess all types of assets it owns. It also gives a clear picture of the liabilities of the enterprise and the money it owes to all creditors.

- Other than all these things, the financial statement also helps to evaluate the cash in hand, which will help the company to make any provisions for future lending or borrowing.

- There are several objectives of Financial statement analysis, the primary one being to be transparent and provide essential information since this information acts as a primary source of input for making an informed decision and comparing the past and present performance of the company.

Objectives of Financial Statement Analysis

There are several objectives of the Financial statement analysis; let us discuss some of the major objectives below:

1. Know the Current Position of the Company

Financial statements are essential for the board and promoters of the company, as it helps them to compare and understand the trend of the company operations. The statements make it easy to compare past performance with current performance and also help to understand the projected vs actual growth of the company. Regular recording of all the company’s financial transactions is very useful for drawing a clear picture of the company’s performance; the management will come to know if the company is lagging behind and make an informed decision to stabilize the financial position of the company.

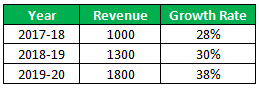

Let us understand this with an example: suppose the company planned to double its revenue by 3 years in 2017. So, financial statements from the past 3 years will help the board learn if the objective has been met; the figure to look out for here is Revenue, as shown below.

Here, we can see that revenue is increasing by an average of 30% every year; however, by the end of 3 year, the revenue increased from 1000 to 1800, which is an 80% rise. So, this does not meet the company target of 100% growth.

2. Eliminating Discrepancies

The main purpose of financial statements is to record every transaction in the statements and make sure they depict a very accurate picture of the company’s financial position. So, recording of day to day transactions related to expenses, income, sales, or purchases becomes very important, based on which the company can decide the areas of improvement and make efficient decisions to avoid any discrepancies.

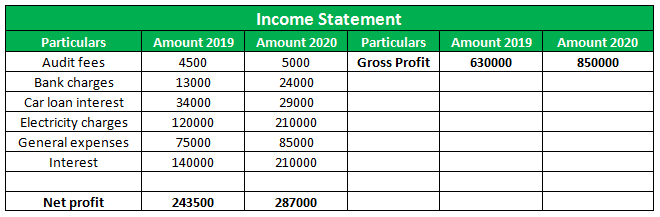

For instance, while comparing the profits of the company for the past two years, below is the data:

Here, we can see that the profits have increased for the company, but there has been an excess in some of the expenses. We can compare the ratio of increase in Gross profits and Net profit. The increase in Gross profits is around 35%, whereas the Net profits have only increased by 18%. So, recording every detail in the statement will help them avoid any discrepancies in the future.

3. Future Decision Making

For a futuristic approach to the decisions making, quarterly reports come into play, where statements like sales book, purchase orders, and manufacturing a/c will have some concrete numbers for the managers to make an effective decision. This helps to have information at your disposal for efficient decision-making, and with exposure to reliable information, the decision will be an informed one to set futuristic goals.

Example: If the company is operating at consistent levels of increase in sales and operating margin, while suddenly it sees a dip in operating margin for the current year. This may be due to increased raw material prices, reduced sales prices, or increased direct expenses like electricity or wages. So, looking at the quarterly report, the management can change the future strategy to maintain the sales and operating margin ratio.

4. Reduce the Chances of Fraud

This may not be the primary objective of the Financial statement, but its advantages are not to be neglected. Often, we come across some or the other scams companies fall prey to, and the amount and money laundering are being slipped under the rug, avoiding being recorded in the financial statements. However, if there is a stringent practice to record every transaction in the statement, the employee will be aware of the ongoing transactions in the company.

Conclusion

Financial Statement Analysis is a powerful tool company use for decision-making and recording every detail in the statements. If used effectively, this analysis can lead to the effective practice of operation and build goodwill in the market.

Recommended Articles

This is a guide to the Objectives of Financial Statement Analysis. Here we also discuss the introduction and several objectives of the financial statement analysis, along with examples. You may also have a look at the following articles to learn more –