Can You Obtain EIN Without LLC?

Many aspiring entrepreneurs wonder, “Can you obtain EIN without LLC?” The answer may surprise you! An Employer Identification Number (EIN), or Federal Tax Identification Number, is essential for various business operations. You do not need an LLC to get one.

This blog post will explore how to obtain an EIN without an LLC and discuss alternative options.

Understanding the EIN and Its Importance

An EIN, or Employer Identification Number, serves as a Federal Tax Identification Number issued by the IRS. It plays a crucial role for various entities, including businesses, non-profits, and even individuals, as it identifies a business for tax purposes.

An EIN application process is essential whether you have established a formal business entity or operate as a sole proprietorship. This number not only streamlines tax filing but also allows businesses to open bank accounts, hire employees, and apply for necessary licenses.

Furthermore, many entrepreneurs ask, Can You Get An Ein Without An LLC?

Yes, it is perfectly legal to obtain EIN without LLC or any formal business structure. Whether you are just starting or need to manage finances more effectively, understanding the importance of an EIN is vital for any business endeavor. For additional resources, you might explore sites like ein-itin.com for more insights.

EIN Application Process Explained

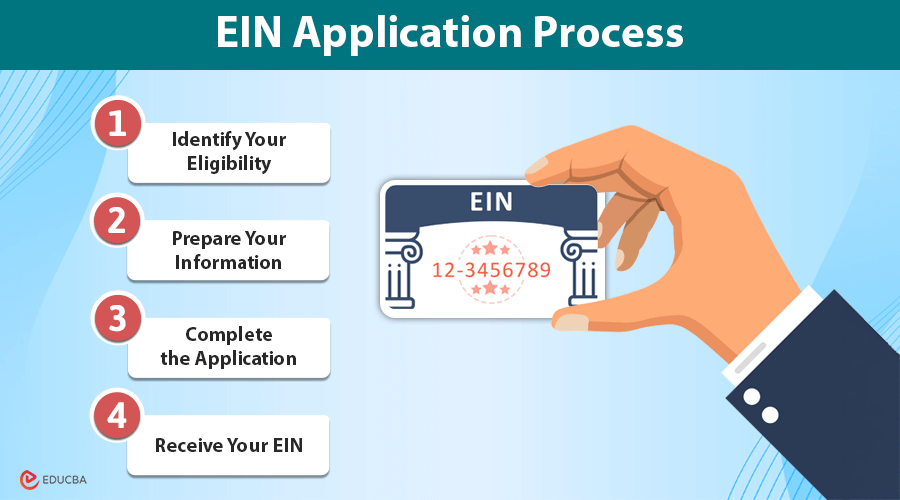

Applying for an EIN is precise and can be done in a few easy steps. Here is a step-by-step guide to applying for an EIN:

Step 1: Identify Your Eligibility

Before starting the application, determine if you need an EIN. If eligible, you can apply as a sole proprietor or another business type.

Step 2: Prepare Your Information

Gather the necessary information, including your name, address, and the type of entity for which you are applying. If you are seeking to obtain EIN for a sole proprietorship, make sure to have your SSN handy.

Step 3: Complete the Application

You can complete the EIN application without LLC online at the IRS website or through ein-itin.com. The online process is quick, with most applications being processed immediately.

Step 4: Receive Your EIN

If your application is approved, you will get your EIN right away. This will enable you to file taxes and open a business bank account without delay.

Alternatives to LLC

When considering obtaining an EIN without forming an LLC, it is essential to explore other business structures that may better suit your needs. One popular alternative is the sole proprietorship. As a sole proprietor, you can run your business without registering it as a separate legal entity, making it a popular choice for many entrepreneurs.

Benefits of Sole Proprietorship

A sole proprietorship allows you to obtain an EIN without the complexities associated with an LLC. The EIN application process for sole proprietors is straightforward, enabling you to focus on running your business rather than managing paperwork. Not needing an LLC significantly reduces your initial setup time and costs.

Other Options Beyond LLC

Other business structures include partnerships and corporations, in addition to sole proprietorships. While these options often require more formal registration, they provide benefits such as shared responsibilities and limited liability protection.

Ultimately, the right choice depends on your business goals and risk tolerance. Understanding your EIN needs is the first step toward a successful venture. For more information and expert advice, visit ein-itin.com.

Recommended Articles

We hope this guide on how to obtain EIN without LLC has clarified the process. Check out these recommended articles for more tips on business setup and tax essentials.