Online Financial Planning: Why India Needs It?

The Indian financial landscape is rapidly evolving, with technology revolutionizing how individuals manage their money. Online financial planning has become necessary, enabling people to navigate complex decisions like volatile markets and long-term goals effortlessly. Accessible from anywhere, it bridges gaps across India’s diverse regions, ensuring expert financial guidance. Streamlined, technology-driven solutions are now replacing traditional investing methods. Partnering with an online financial planner is no longer a luxury but a crucial step toward securing a stable financial future.

What is an Online Financial Planner?

Online financial planning in India simplifies managing personal finances through technology-driven guidance. Qualified professionals and robo-advisors offer tailored budgeting, saving, investing, and retirement planning advice. Robo-advisors, using algorithms, create diversified portfolios based on your risk profile, offering cost-effective solutions for beginners. However, while they provide convenience and automation, they may lack the personalized insights and detailed analysis that an experienced financial advisor can deliver, ensuring a more comprehensive approach to achieving financial goals.

How Online Financial Planning Works?

Online financial planning in India operates through digital platforms, offering personalized financial advice and tools for investment tracking, budgeting, and goal planning, ensuring client convenience.

#1. Data Collection and Analysis

Financial planners gather your data through questionnaires or linked accounts, analyze your income, expenses, and goals, and evaluate your financial health using standard models for improvement areas.

#2. Goal Setting and Planning

Define financial goals like retirement or buying a house. Advisors help you create a tailored roadmap to achieve your objectives using budgets, savings plans, or investment tactics.

#3. Investment Management

Advisors recommend diversified portfolios, balancing bonds, stocks, or mutual funds according to your risk tolerance and goals. Some platforms offer automated account management for efficient investment handling.

#4. Online Monitoring and Reviewing

Financial planners continuously monitor progress, review portfolios, and adjust strategies. They provide market updates and guide adaptations to ensure your plans remain effective.

#5. Communication and Support

Platforms offer communication via email, phone, or videoconferencing. They also provide tools like financial calculators and educational resources to empower informed financial decision-making.

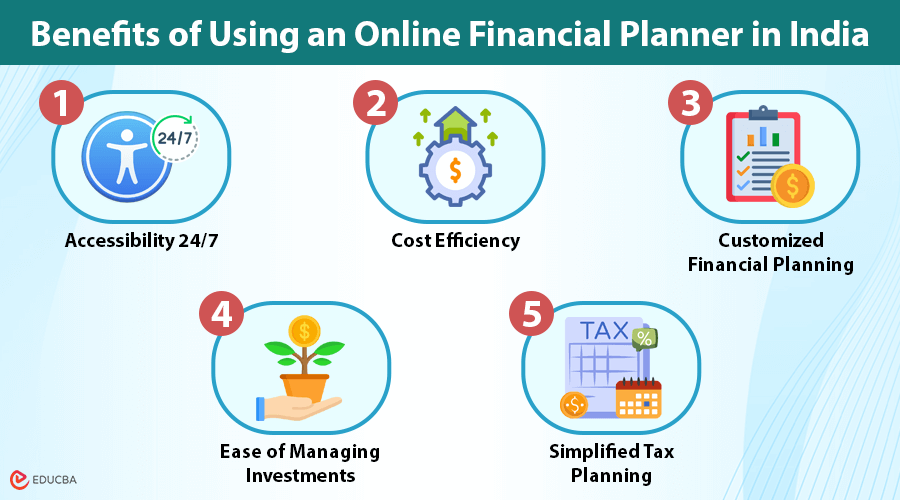

Benefits of Using an Online Financial Planner in India

Engaging an online financial planner for the right online financial planning in India provides convenience, personalized strategies, cost-effectiveness, and many more benefits:

- Accessibility 24/7: You can connect with your advisor anytime, anywhere, and no longer have to be constrained by traditional office hours. This is beneficial for busy schedules and frequent travelers.

- Cost efficiency: Online financial planners in India’s services are often much cheaper than those of financial advisory firms with a local office in India. This allows for professional financial advice to a larger number of people.

- Customized Financial Planning: The best financial advisor in India knows that every individual is different. They will take the time to understand your specific financial goals, assess your risk tolerance, and consider your investment preferences to develop a customized plan tailored to your needs.

- Ease of Managing Investments: Online portals make investment management very convenient with simple tools and interfaces. It allows easy portfolio tracking, making changes, and monitoring progress toward goals.

- Simplified Tax Planning: Many online financial planners in India offer tax optimization strategies and tools to help you reduce your liabilities and maximize returns.

Challenges of Relying on an Online Financial Planner

Although online financial planning has its own merits, one should also know of some of the potential pitfalls:

- Lack of Personal Touch: While technology provides communication, a few people prefer face-to-face contact and the personal bond between them and old-time advisors.

- Cybersecurity risks: Posting your financial information on an online website requires confidence in its safety, so a good platform should have stringent security mechanisms to prevent you from losing your details.

- Dependence on technology: Technical failures or internet outages can prevent access to your financial information and advisor. A backup plan, including alternative communication routes, is also necessary.

- Limited Scope of Advice: Online websites may limit the scope of financial advice. If your financial life is very complex, it might require specific expertise in areas that online sites cannot provide.

Current platforms provide essential services like retirement and tax planning, yet addressing FP&A concerns such as connecting real-time data for strategic decision-making can appear challenging. By overcoming issues like automating low-impact tasks and nurturing top talent, financial online platforms enhance value beyond traditional methods. Clear communication of actionable insights strengthens partnerships across businesses.

Online Financial Planner vs. Traditional Financial Advisor

Both online financial planning and traditional advisors assist in achieving financial goals. However, they differ in accessibility, personalized service, cost-effectiveness, and convenience, effectively catering to diverse client needs.

| Features | Online Financial Planner | Traditional Financial Advisor |

| Accessibility | 24/7 access, connect from anywhere | Limited to office hours and location |

| Cost | Generally more affordable | Typically higher fees |

| Personalization | Personalized plans based on algorithms and online questionnaires | Customized plans based on in-person interactions |

| Technology | Access to advanced tools, platforms, and resources | May have limited technology integration |

| Communication | Primarily through email, phone, or video conferencing | Primarily face-to-face meetings |

| Flexibility | Greater flexibility in scheduling and interaction | Less flexibility in scheduling |

| Transparency | Clear fee structures and online tracking tools | Fee structures may vary, less transparency |

How to Pick the Best Online Financial Planner in India?

When selecting an online financial planning advisor in India, prioritize research, check credentials, verify reviews, assess transparency, and ensure compliance with regulatory bodies. Always seek personalized recommendations for informed, reliable financial guidance.

- Verification of the credentials: You need to know if the chosen advisor holds a recognized certification, such as (CFA) Chartered Financial Analyst or Certified Financial Planner, and has experience in the Indian market.

- Fee assessment and transparency: This will ascertain the fee charged before. India’s best financial advisor shall be transparent in his/her charges and let one know his/her services in advance.

- Read reviews and testimonials: Check online reviews and testimonials from other clients to determine the advisor’s reputation and quality of service.

- Assess Features and Tools: Evaluate the platform’s features, including goal-setting tools, investment trackers, and financial calculators. Make sure that the platform offers tools that suit your needs.

- Security Measures: It should have a robust security measure to protect my personal and financial information. Look for encryption and other security features.

- Style of Communication: The advisor should consider communication style and be ready to listen. A good financial advisor in India will be a good communicator who can explain complex financial information in straightforward words.

- Look for Specialization: If you are planning for retirement or seeking a stock advisor in India to invest in the stock market, look for an online financial planner in India who specializes in those services.

Final Thoughts

The rise of online financial planning in India has revolutionized personal finance management. With the increasing complexity of financial markets, affordable and accessible advice has become crucial. Online platforms empower people to take control of their financial future, enabling them to achieve their goals with expert guidance. By leveraging technology’s convenience and the expertise of skilled planners, individuals can navigate India’s market more effectively, ensuring informed investment decisions and improved financial outcomes.

Frequently Asked Questions (FAQs)

Q.1. What kind of services do online financial planners offer?

Answer: Online financial planner India provides a wide range of services, such as:

- Financial planning: Develop an individualized plan that considers your goals and risk level.

- Investment management: Investing by offering recommendations and managing your portfolio.

- Retirement planning: Formulating strategies for safe retirement.

- Tax planning: Optimizing tax strategies in the most effective way to pay the least amount of liabilities.

- Estate planning: Planning distribution of assets.

- Debt management: Strategies to manage and minimize debt.

- Insurance planning: Suggesting insurance coverages.

Q.2. Are online financial planners reliable in India?

Answer: Some online financial planner India sites have been trusted and very productive. At the same time, while selecting the portal, a reliable platform, skilled advisors, and efficient security are required. Online financial planners should have credentials, clarity in their charge structure, and excellent client testimonials.

Q.3. How do online financial planners charge for their services?

Answer: Online financial planners usually charge fees in one of the following ways:

- Percentage of assets under management (AUM): A percentage of the total value of assets they manage for you.

- Fixed annual or monthly fee: They charge a fixed amount, no matter how big or small your portfolio.

- Commission-based: Earning commission on the financial products sold

- Performance-based: Charging fees that depend on the performance of the investments.

Recommended Articles

We hope this article on online financial planning has been helpful to you. Check out these recommended articles for more insights on choosing the right financial planning for managing money online.