What are Open Market Operations?

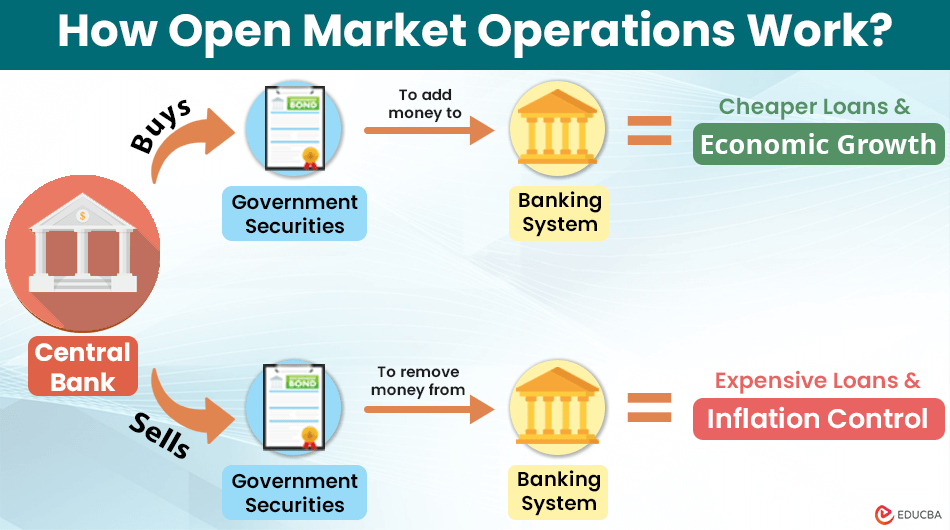

Open market operations (OMOs) include two activities by the central banks: purchasing and selling government securities (like treasury bills, bonds, or notes). They do this to ensure economic stability and achieve monetary policy goals by controlling the money supply in the economy.

- When central banks buy securities, they add money to the banking system, making loans more accessible and stimulating economic growth.

- Conversely, when they sell securities, they remove money from the banking system, making it hard for the public to get loans. This, in turn, helps control inflation.

Table of Contents

How Do OMOs Work?

Scenario #1: Boosting the Economy

Imagine the central bank wants to stimulate the economy.

In this case,

- It will buy government bonds from commercial banks.

- When it buys these bonds, it deposits money into the commercial banks’ accounts.

- It increases the banks’ cash reserves, allowing them to lend more money to businesses and consumers.

- More lending means cheaper borrowing costs, increased spending, and overall economic growth.

Scenario #2: Controlling Inflation

On the other hand, if the central bank wants to slow down the economy to prevent inflation,

- It sells government bonds.

- Commercial banks buy these bonds, and the money used to purchase them goes to the central bank.

- This transaction reduces the banks’ cash reserves, limiting their ability to lend money.

- With less money available for loans, spending decreases, and economic activity slows down, helping to control inflation.

Types

We can divide open market operations into two main types: permanent operations and temporary operations. Each type serves a different purpose and is used in varying economic conditions to achieve specific monetary policy goals.

#1. Permanent Open Market Operations

In permanent OMOs, central banks buy or sell government securities to permanently adjust the level of reserves in the banking system.

Purpose:

- To adjust the money supply and influence economic activity in the long term.

How it works:

- Buying Securities: If the central bank buys $100 million of government bonds from a commercial bank, the bank gets $100 million in cash reserves. This increase in reserves enables the bank to lend more, boosting economic activity.

- Selling Securities: If the central bank sells $50 million of government bonds to a commercial bank, the bank’s cash reserves decrease by $50 million. This reduction limits the bank’s lending ability, helping to control inflation if the economy is overheating.

#2. Temporary Open Market Operations

In temporary OMOs, central banks engage in short-term transactions, such as repurchase agreements (repos) and reverse repurchase agreements (reverse repos), to temporarily adjust the money supply.

1. Repurchase Agreements (Repos)

Purpose:

- To add short-term liquidity into the banking system.

How it works:

- The central bank buys securities (like bonds) from commercial banks, which agree to buy them back later. It is a way for the central bank to control the amount of money in the economy.

- Example: The central bank buys $50 million worth of government bonds from a commercial bank with an agreement to sell them back in two weeks. It gives the bank short-term cash, which it can use to meet its immediate funding needs.

2. Reverse Repurchase Agreements (Reverse Repos)

Purpose:

- To temporarily reduce the money supply.

How it works:

- The central bank sells securities to commercial banks with an agreement to buy them back at a later date.

- Example: The central bank sells $50 million worth of government bonds to a commercial bank, agreeing to buy them back in two weeks. It temporarily reduces the bank’s cash reserves, helping to control inflation by limiting lending in the short term.

Real-World Examples

1. Reserve Bank of India’s Open Market Operations (September 2023)

The Reserve Bank of India (RBI) used OMOs to manage liquidity in the financial system during September 2023. The RBI sold government securities totaling Rs.8,385 crore. It included:

- Rs 1,720 crore on September 15

- Rs 815 crore on September 21

- Rs 775 crore on September 25.

Purpose:

- The RBI aimed to manage the banking system’s liquidity. It wanted to ensure that the money supply matched the economy’s needs.

Impact:

- Bond Market Dynamics: Selling these securities led to lower bond prices and higher bond yields.

- Interest Rate Influence: This action influenced interest rates, affecting borrowing costs for businesses and consumers.

- Monetary Policy: The RBI’s OMO sales during liquidity fluctuations showed its commitment to its monetary policy goals.

- Financial Stability: By managing liquidity, the RBI aimed to stabilize financial markets.

2. Federal Reserve’s Open Market Operations in Response to the COVID-19 Pandemic (March 2020)

In March 2020, the COVID-19 pandemic caused major economic disruptions, market volatility, and liquidity shortages. The Federal Reserve (Fed) undertook significant OMOs to stabilize financial markets and support the economy.

Actions Taken:

- The Fed announced the purchase of $700 billion in Treasury securities and mortgage-backed securities (MBS).

- It expanded these purchases, committing to buy “in amounts needed” to support market functioning.

- The Fed also conducted large-scale repo operations to ensure money market liquidity.

Purpose:

- The Fed aimed to restore market functioning, ensure liquidity, and support credit flow to households and businesses.

Impact:

- Market Stability: The Fed’s actions stabilized financial markets, reducing volatility and restoring investor confidence.

- Liquidity: By enhancing banking system liquidity, the Fed ensured that credit continued to flow, preventing a deeper economic collapse.

- Interest Rates: The Fed’s large-scale securities purchases kept interest rates low, supporting borrowing and spending.

- Economic Support: These measures mitigated the pandemic’s economic impact, supporting a faster recovery as lockdowns eased and economic activity resumed.

Advantages and Disadvantages

| Advantages | Disadvantages |

| They allow central banks to quickly adjust to economic changes by buying or selling government securities. | Getting the timing and execution of OMOs wrong can be risky, potentially causing market instability or even worsening the situation. |

| They help control interest rates more precisely, boosting economic activity or normalizing inflation as needed. | During really tough economic times, like when interest rates are already low, OMOs might not have much impact, making them less useful. |

| They help keep the financial markets stable and liquid without heavy-handed interventions. | They can sometimes cause unintended consequences, such as pushing up the prices of certain assets too much, which can create financial bubbles. |

| Unlike other methods, they don’t directly interfere with markets’ operations, which helps maintain investor confidence. | Too much intervention can sometimes confuse markets, leading to unpredictable outcomes and market distortions. |

Final Thoughts

Overall, open market operations are a versatile and effective tool for central banks to adjust the money supply and interest rates in the economy. They are important for achieving key monetary policy objectives, such as controlling inflation, promoting economic growth, and maintaining financial stability. They help central banks achieve their economic goals by precisely managing liquidity in the financial system.

Frequently Asked Questions (FAQs)

Q1. What is the most common usage of open market activities?

Answer: The main purpose of open market activities is to control the money in the economy. For this, the central bank buys or sells government bonds.

When the central bank buys bonds, it puts more money into the economy, which can help boost spending and growth. When it sells bonds, it takes money out of the economy, which can help reduce inflation.

Q2. Which two forms of open market operations are there?

Answer: There are two types of open market operations: contractionary and expansionary. Contractionary operations decrease the money supply (e.g., the central bank sells government bonds), while expansionary operations increase it (e.g., the central bank buys government bonds).

Q3. What is the impact of Open Market Operations on the economy?

Answer: OMOs affect interest rates, inflation, and economic growth by changing the amount of money in circulation and the cost of borrowing. Here’s how:

- Interest Rates: Buying bonds lowers rates, and selling bonds raises rates.

- Inflation: Increasing the money supply can raise inflation, and decreasing the money supply can lower inflation.

- Economic Growth: Lower rates stimulate growth, and higher rates slow it down.

Q4. Can Open Market Operations affect exchange rates?

Answer: Yes, OMOs can indirectly affect exchange rates by altering interest rates. Changes in interest rates influence investor confidence and capital flows, which then impact the demand for a currency and its exchange rate.

Recommended Articles

We hope this guide on open market operations has clarified their role in the financial market. For similar guides, visit the below recommendations.