Definition of Operating Income

Operating Income represents the income remaining after deducting the expenses associated with the business’s operations and the cost of goods sold incurred in producing the revenues.

Explanation

It is the Income from a business after the cost of revenues and operating expenses like selling, general and administrative expenses, research, and development expenses are deducted from the revenues. It is also known as earnings before interest and taxes or EBIT.

Formula for Operating Income

To calculate the operating Income, start from revenue, deduct the cost of revenue, deduct the cost of operations, and obtain operating Income.

Operating Income = Total Revenues – Cost of Goods Sold – Operating Expenses

Or

Operating Income = Gross Profit – Operating Expenses

Where,

Gross Profit is Total Revenues – Cost of Goods Sold

Or

Operating Income = Net Income + Income Taxes + Net Interest Expenses

Examples of Operating Income

Different examples are mentioned below:

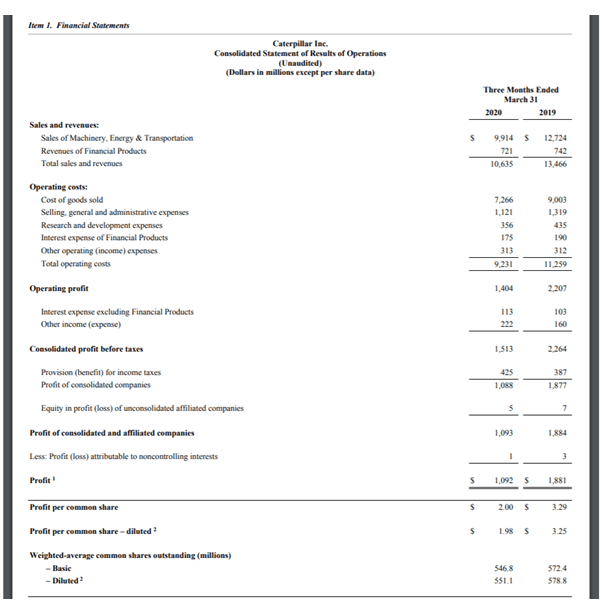

Look at this Statement of Income of Caterpillar Inc.

How is the Operating Income Deduced?

The accountant started from the Sales and revenues, which consisted of some segment revenues. He then deducted the operating costs such as COGS, SG&A, R&D expenses, and Other operating expenses.

An exception is the deduction of interest expense of Financial Products. As a general rule, interest expenses are not operating costs, but Caterpillar Inc. has business related to Financial Products, which treats those interest expenses as operating incomes.

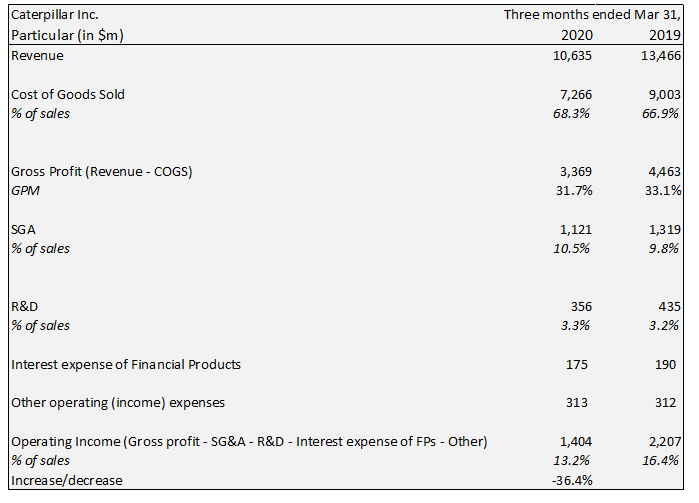

Let us calculate the operating incomes with the above-mentioned formula and check if we are correct in our approach.

Operating Income has decreased 36.4% in the current quarter over the previous year’s quarter. At the same time, the operating margin has also reduced from 16.4% to 13.2%.

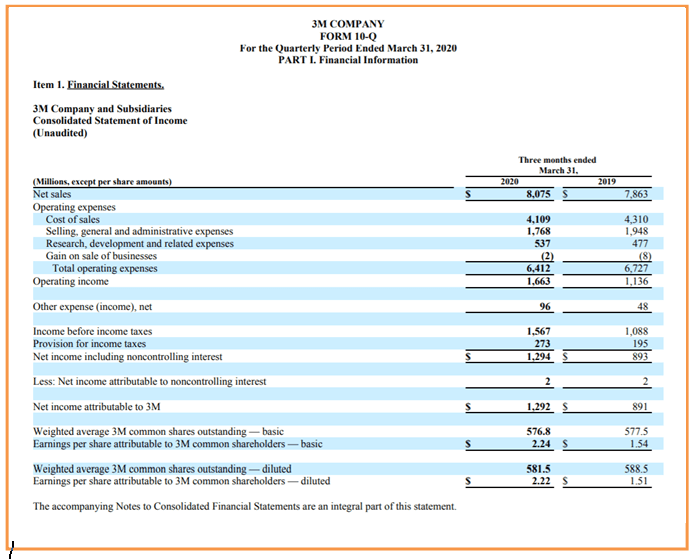

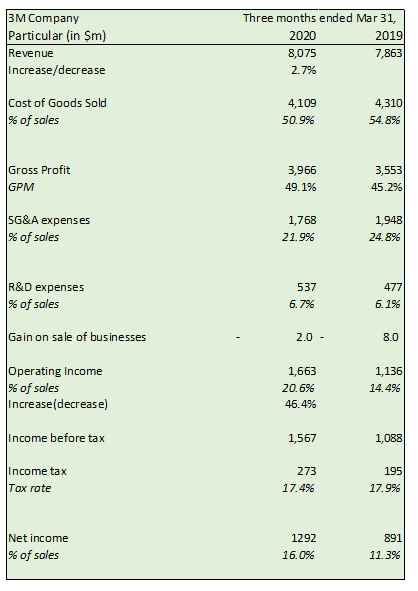

Take into consideration the Statement of Income of 3M Company.

If we calculate the operating Income (=Revenue – COGS – SG&A – R&D – Gain on sale), we get the following:

A significant item is included here, i.e., Gain on sale of the business. Though the number is as small as $2mn in 2020 and $8mn in 2019, it has been included in calculating the operating Income.

Operating incomes are $1,663mn and $1,136 for the first quarter of 2020 and 2019, respectively. This is an increase of 46.4%. Similarly, the operating margin has increased to 20.6% from 14.4%.

Further line items are calculated to show how operating incomes lead to other things in a Statement of Income.

What is Included in Operating Income?

It comprises all the Income a business has earned after subtracting operating expenses and cost of goods sold from the Sales revenues. Thus, it includes the following:

- Financial costs

- Investments in subsidiaries, etc

- Interest income

- Gain or loss on sale of business

- Income tax expenses

- Minority interests

- Other extraordinary gains or losses

It is important to note that operating income encompasses nearly all of a business’s income after deducting the expenses directly associated with its operations.

Importance

It is essential from the business perspective because it tells us about the business’s operating efficiency. It includes direct and indirect costs related to the company. Direct costs such as those that impact revenue generation like the cost of goods sold, manufacturing expenses, labor expenses and wages, power, and utility costs, etc. Indirect costs are also related to business operations but do not impact the operations as much as direct costs. Such indirect costs are commissions, staff salaries, administrative expenses, non-essential expenses, bills, and expenditures unrelated to revenue generation.

The company measures operating margin, which is the division of operating incomes by revenues, to understand whether it increases or decreases yearly. Similarly, the company can measure it as an absolute value each passing year. In a comparative analysis, the company plots operating incomes and margins against the importance of other similar businesses to determine if there are any deviations from the industry average, etc.

Benefits

- It provides a picture of how well the business manages its operating expenses and manufacturing expenses

- It gives way to earnings before tax and earnings after tax, thus giving clarity on whether the business can pay interests and taxes and still hold profits

- It can provoke companies to take meaningful insights and improve efficiencies at the core of business performance

Disadvantages

- It is not an accurate representation of profits if the business has high manufacturing costs as the competing space, and the point of concern would be to cut off those manufacturing costs to outdo the market competition

- It can vary widely as businesses and industries differ, thus rendering it irrelevant to compare operating incomes for different companies.

- It does not consider the cash paid to stockholders and debtholders as it is deducted afterward. For instance, if a business has an operating income of $100mn while another company has $150mn in operating Incomes, it can not be figured out whether the claimants to free cash flow are at an advantage over the business with higher operating incomes.

Conclusion

It only considers the Income from a business’s ongoing operations. Any income generated by a business or part of a company that has been sold is mentioned in the ‘Income from discontinued operations. It can be helpful for investors as it gives insights into the business’ operating efficiency. Excluding the effect of taxes and exceptional gains or losses also benefits the analysis.

It is a good measure of success if the business consistently outperforms in delivering this number. However, subtracting expenses after operating incomes can trouble or upset the business’s net profits, so it cannot be the sole measure of reliance.

Recommended Articles

This is a guide to Operating Income. Here we also discuss the definition, what is included in operating expenses, importance, and advantage. You may also have a look at the following articles to learn more –