Updated July 24, 2023

Operating Leverage Formula (Table of Contents)

What is the Operating Leverage Formula?

The term “Operating Leverage” refers to the ratio that shows how much a company benefits in terms of operating profit from the mix of fixed and variable costs in its overall cost structure.

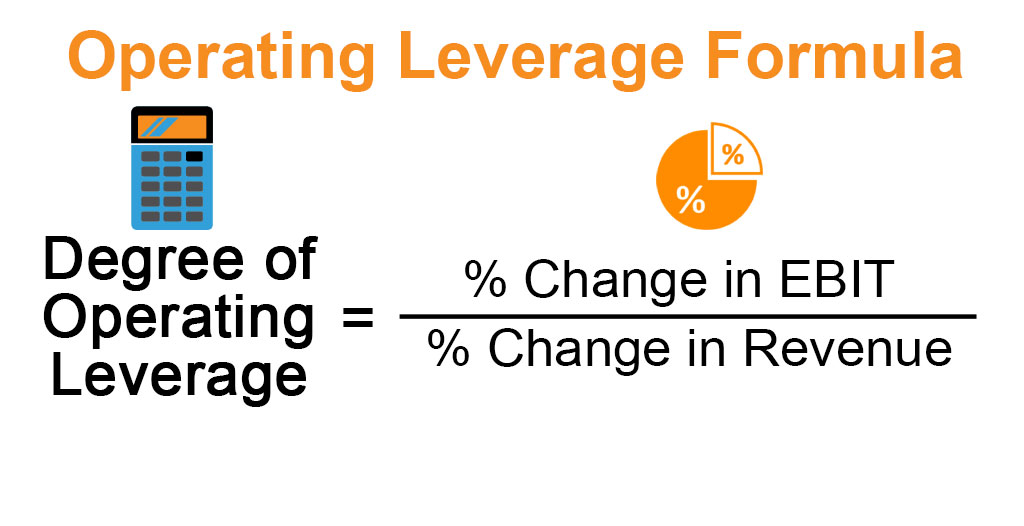

In other words, the ratio measures how much a company’s operating profit increases with the increase in its revenue, primarily due to better absorption of the fixed cost component. The formula for operating leverage, a.k.a. degree of operating leverage, can be expressed by dividing the % change in operating profit (EBIT) by the % change in revenue. The mathematical representation of the formula is as below:

Formula

Example of Operating Leverage Formula (With Excel Template)

Let’s take an example to understand the calculation of the Operating Leverage Formula in a better manner.

Operating Leverage Formula – Example #1

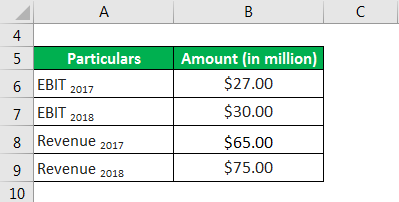

Let us take the simple example of a tech company named Mango Inc. In 2018, the company reported $75.0 million vis-à-vis revenue of $65.0 in 2017. The company’s EBIT also increased to $30.0 million in 2018 vis-à-vis $27.0 million in 2017. Calculate Mango Inc.’s degree of operating leverage based on the given information.

Solution:

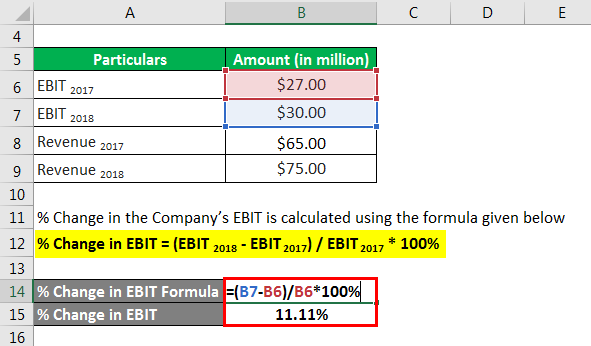

The formula to calculate the % Change in the Company’s EBIT is as below:

% Change in EBIT = (EBIT 2018 – EBIT 2017) / EBIT 2017 * 100%

- % Change in EBIT = ($30.0 million – $27.0 million) / $27.0 million * 100%

- % Change in EBIT = 11.11%

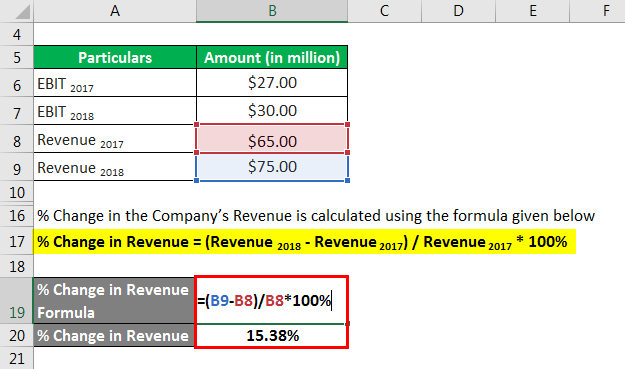

The formula to calculate the % Change in the Company’s Revenue is as below:

% Change in Revenue = (Revenue 2018 – Revenue 2017) / Revenue 2017 * 100%

- % Change in Revenue = ($75.0 million – $65.0 million) / $65.0 million * 100%

- % Change in Revenue = 15.38%

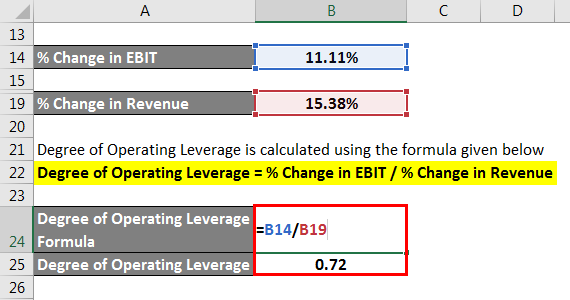

The formula to calculate the degree of Operating Leverage is as below:

Degree of Operating Leverage = % Change in EBIT / % Change in Revenue

- Degree of Operating Leverage = 11.11% / 15.38%

- Degree of Operating Leverage = 0.72x

Therefore, based on the given information, it can be seen that Mango Inc.’s degree of operating leverage is 0.72x.

Operating Leverage Formula – Example #2

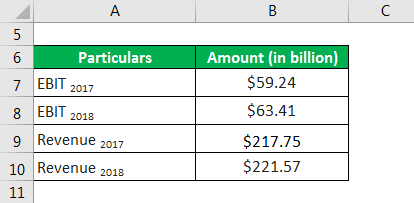

Let us now take the example of Samsung Electronics Co. Ltd. in order to illustrate the concept of operating leverage for a real-life company. According to its annual report for the year 2018, Samsung achieved revenue of $221.57 billion in 2018 vis-à-vis revenue of $217.75 billion in 2017, while it achieved an operating income of $63.39 billion in 2018 vis-à-vis that of $59.24 billion in 2017. Based on the given information, calculate the operating leverage of Samsung Electronics Co. Ltd.

Solution:

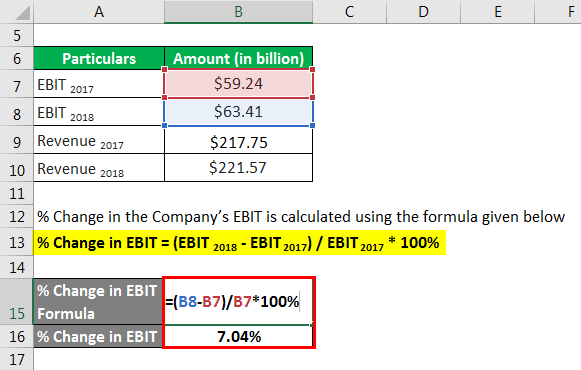

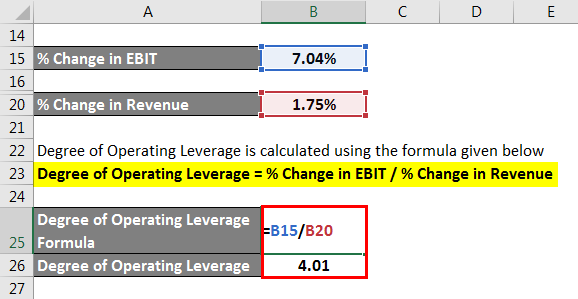

The formula to calculate the % Change in the Company’s EBIT is as below:

% Change in EBIT = (EBIT 2018 – EBIT 2017) / EBIT 2017 * 100%

- % Change in EBIT = ($63.39 billion – $59.24 billion) / $59.24 billion * 100%

- % Change in EBIT = 7.04%

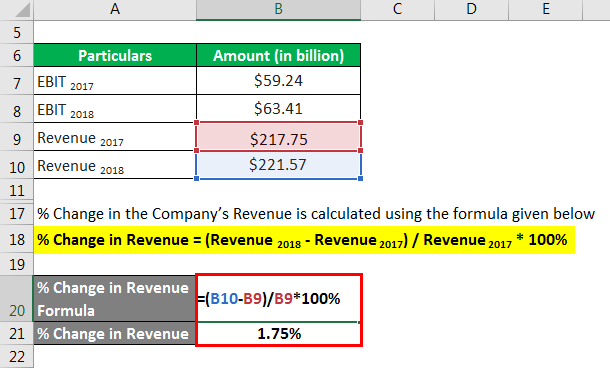

The formula to calculate the % Change in the Company’s Revenue is as below:

% Change in Revenue = (Revenue 2018 – Revenue 2017) / Revenue 2017 * 100%

- % Change in Revenue = ($221.57 billion – $217.75 billion) / $217.75 billion * 100%

- % Change in Revenue = 1.75%

The formula to calculate the degree of Operating Leverage is as below:

Degree of Operating Leverage = % Change in EBIT / % Change in Revenue

- Degree of Operating Leverage = 7.00% / 1.75%

- Degree of Operating Leverage = 4.01x

Therefore, the company’s degree of operating leverage can be calculated as 4.01x based on the given information.

Source Link: Samsung. Balance Sheet

Explanation

The formula for Operating Leverage can be calculated by using the following steps:

Step 1: First, determine the company’s operating profit for the current (EBITx) and the preceding period (EBITx-1). In most companies, operating income is available as a separate line item in any company’s income statement.

Step 2: Calculate the % change in EBIT by dividing the difference between EBITx and EBITx-1 by EBITx-1, as shown below.

% Change in EBIT = (EBITx – EBITx-1) / EBITx-1 * 100%

Step 3: Next, figure out the company’s revenue during the current (Revenuex) and the previous period (Revenuex-1). It is usually available as the first line item in any company’s income statement.

Step 4: Next, calculate the % change in revenue, dividing the difference between Revenuex and Revenuex-1 by Revenuex-1 as shown below.

% Change in Revenue = (Revenuex – Revenuex-1) / Revenuex-1 * 100%

Step 5: Finally, the formula for operating leverage can be derived by dividing the % change in EBIT (step 2) by the % change in revenue (step 4) as below.

Degree of Operating Leverage = % Change in EBIT / % Change in Revenue

Relevance and Use of Operating Leverage

The concept of operating leverage is very important as it helps in assessing much a company can benefit from the increase in revenue. Based on the expected benefit, a company can schedule its production or sales plan for a period. A company with a higher proportion of fixed cost in its overall cost structure is said to have higher operating leverage. Typically, a company with a higher value of operating leverage is expected to have an increase in profitability with an increase in revenue, as higher revenue allows better absorption of fixed costs. On the other hand, a company with a lower value of operating leverage experiences nominal to no change in its profitability with an increase in revenue.

However, it is important to note that a company with high operating leverage is exposed to the risk of financial losses in case of a significant decline in revenue, as a large portion of the cost structure is fixed in nature. As such, high operating leverage can be a double-edged sword.

Operating Leverage Formula Calculator

You can use the following Operating Leverage Formula Calculator

| % Change in EBIT | |

| % Change in Revenue | |

| Degree of Operating Leverage | |

| Degree of Operating Leverage = |

|

|

Recommended Articles

This is a guide to Operating Leverage Formula. Here we discuss calculating the Operating Leverage Formula and practical examples. We also provide an Operating Leverage calculator with a downloadable Excel template. You may also look at the following articles to learn more –