Updated July 26, 2023

Operating Ratio Formula (Table of Contents)

What is the Operating Ratio Formula?

The term “operating ratio” refers to the efficiency ratio that assesses how well a company can manage the different operating expenses while conducting the business in a normal economic set-up. The ratio is also known as an expenses-to-sales ratio.

The formula for an operating ratio can be derived by dividing the sum of the cost of goods sold (a.k.a. cost of sales) of the company and it’s operating expenses by its total revenue. Mathematically, it is represented as,

Examples of Operating Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of Operating Ratio Formula in a better manner.

Operating Ratio Formula – Example #1

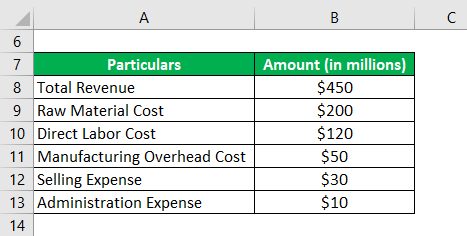

Let us take the example of a company named ADG Ltd which is engaged in the business of manufacturing electronic parts for Tier I auto parts supplier. During 2018, the company clocked a total revenue of $450 million. The cost incurred includes the raw material cost of $200 million, the direct labor cost of $120 million, the manufacturing overhead cost of $50 million, the selling expense of $30 million and the administrative expense of $10 million. Calculate the operating ratio of ADG Ltd based on the given information.

Solution:

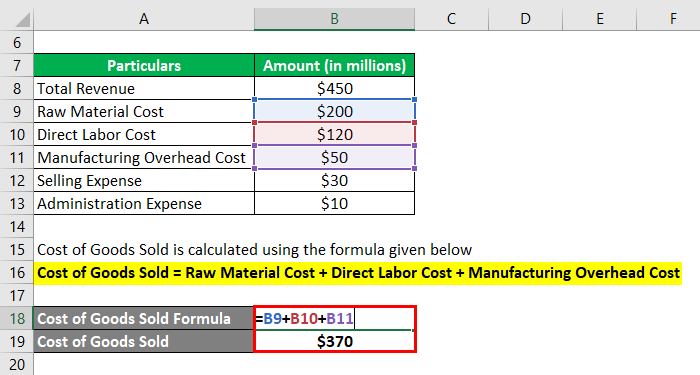

Cost of Goods Sold is calculated using the formula given below

Cost of Goods Sold = Raw Material Cost + Direct Labor Cost + Manufacturing Overhead Cost

- Cost of Goods Sold = $200 million + $120 million + $50 million

- Cost of Goods Sold = $370 million

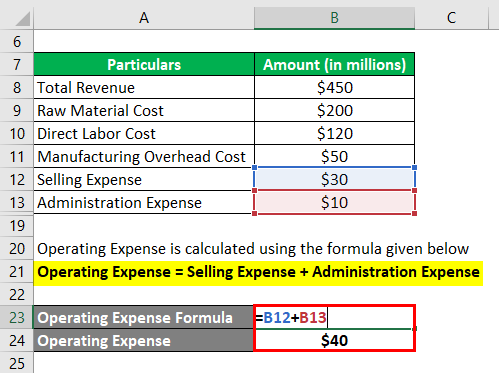

Operating Expense is calculated using the formula given below

Operating Expense = Selling Expense + Administration Expense

- Operating Expense = $30 million + $10 million

- Operating Expense = $40 million

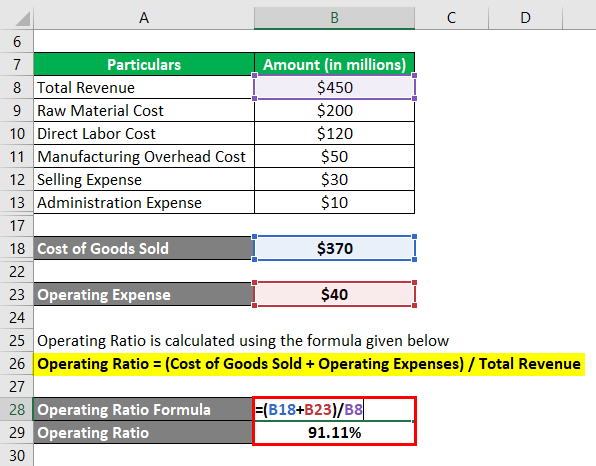

Operating Ratio is calculated using the formula given below

Operating Ratio = (Cost of Goods Sold + Operating Expenses) / Total Revenue

- Operating Ratio = ($370 million + $40 million) / $450 million

- Operating Ratio = 91.11%

Therefore, the operating ratio of ADG Ltd for the year 2018 stood at 91.11%.

Operating Ratio Formula – Example #2

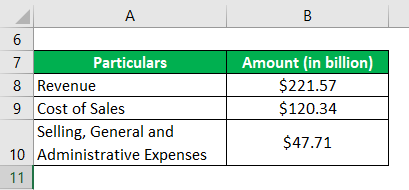

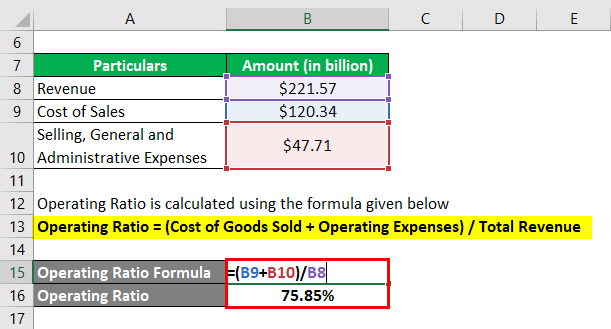

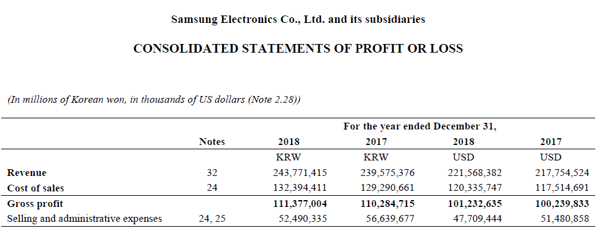

Let us take the example of Samsung Electronics Co. Ltd. and calculate its operating ratio for the year 2018. During 2018, the company and its subsidiaries registered total revenue of $221.57 billion, while the cost of sales and selling & administrative expenses incurred by the company during the year stood at $120.34 billion and $47.71 billion respectively. Calculate the operating ratio of Samsung Electronics Co. Ltd. for the year 2018 based on the given information.

Solution:

Operating Ratio is calculated using the formula given below

Operating Ratio = (Cost of Goods Sold + Operating Expenses) / Total Revenue

- Operating Ratio = ($120.34 billion + $47.71 billion) / $221.57 billion

- Operating Ratio = 75.85%

Therefore, the operating ratio of Samsung Electronics Co. Ltd. for the year 2018 stood at 75.85%.

Source Link: Samsung Balance Sheet

Operating Ratio Formula – Example #3

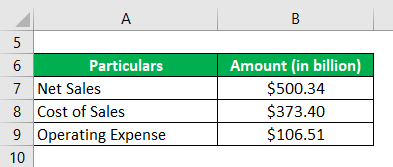

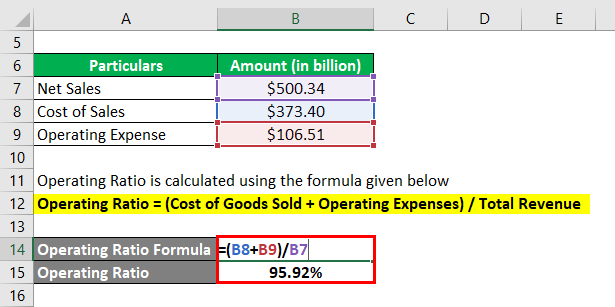

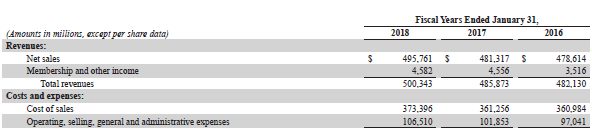

Let us take the example of Walmart Inc. According to its annual report, the company generated net sales of $500.34 billion during 2018. Calculate the operating ratio of Walmart Inc. if the cost of sales and operating expenses incurred during the period are $373.40 billion and $106.51 billion respectively.

Solution:

Operating Ratio is calculated using the formula given below

Operating Ratio = (Cost of Goods Sold + Operating Expenses) / Total Revenue

- Operating Ratio = ($373.40 billion + $106.51 billion) / $500.34 billion

- Operating Ratio = 95.92%

Therefore, Walmart Inc. operating ratio for the year 2018 stood at 95.92%.

Source: Walmart Annual Reports (Investor Relations)

Explanation

The formula for an operating ratio can be derived by using the following steps:

Step 1: Firstly, determine the cost of goods sold by the company. It is the summation of all direct and indirect costs that can be assigned to the job orders, and it primarily comprises raw material cost, direct labor cost and manufacturing overhead cost. These cost fields are easily available in the income statement.

Cost of Goods Sold = Raw Material Cost + Direct Labor Cost + Manufacturing Overhead Cost

Step 2: Next, determine the operating expenses of the company that primarily includes all indirect costs of production that can’t be assigned to the job orders. Examples of operating expenses are selling & distribution expenses, office & administration expenses, etc. which are seen as separate line items in the income statement.

Operating Expenses = Selling & Distribution Expenses + Office & Administration Expenses

Step 3: Next, find out the total revenue of the company and it is easily available as the first line item in the income statement of a company.

Step 4: Finally, the formula for an operating ratio can be derived by dividing a sum of the cost of goods sold (step 1) of the company and it’s operating expenses (step 2) by its total revenue (step 3) as shown below.

Operating Ratio = (Cost of Goods Sold + Operating Expenses) / Total Revenue

Relevance and Uses of Operating Ratio Formula

It is important to understand the concept of operating ratio because it is used to evaluate the ability of the company’s management to generate sales while controlling its operating expenses in the process. A lower value of the ratio indicates better efficiency of the company management in generating dollar against the operating expenses which means higher profit margin or higher return for the investors. On the other hand, a higher value is unfavorable as it means lower profitability and hence lower return.

Operating Ratio Formula Calculator

You can use the following Operating Ratio Calculator

| Cost of Goods Sold | |

| Operating Expenses | |

| Total Revenue | |

| Operating Ratio | |

| Operating Ratio = |

|

|

Recommended Articles

This is a guide to Operating Ratio Formula. Here we discussed how to calculate Operating Ratio along with practical examples. We also provide an Operating Ratio calculator with a downloadable excel template. You may also look at the following articles to learn more –