Updated July 11, 2023

Definition of Other Expenses

Other expenses can be defined as those expenses which do not form part of the core business activities of the company in other words; they are the expenses that are not necessary for the company for carrying out its day-to-day business activities and are considered secondary expenses incurred for the secondary activities of the company.

Explanation

Other costs are just incidentals that are unrelated to the company’s operations in manufacturing, administration, or sales. Hence, they cannot be classified under the manufacturing, administrative, or selling heads of the expenses They are something that is incurred up and above the normal direct expenses incurred by the company which is called secondary activities, and also called secondary expenses incurred for the secondary activities of the company. For example, the loss from disposal of an asset or equipment, and interest expenses incurred by the company. All these exp. are not incurred by the company from its normal day to day activities and hence are abnormal or unusual exp.s.

These expenses do not form part of the financial statements for a long period of time as they have to be written off over a period of time

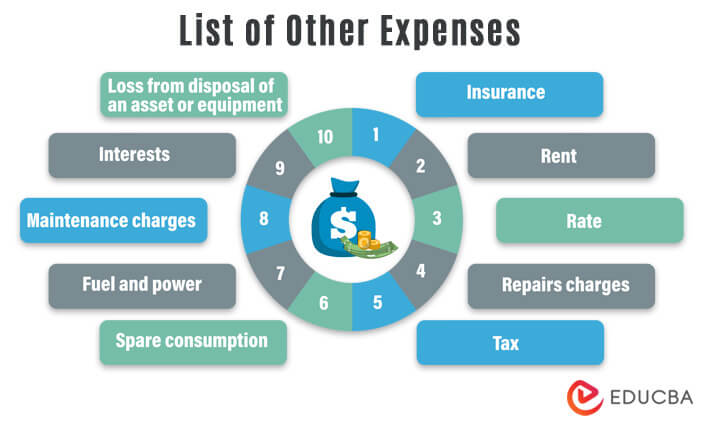

List of Other Expenses

- Insurance

- Rent

- Rate

- Repairs charges

- Tax

- Spare consumption

- Fuel and power

- Maintenance charges

- Interests

- Loss from disposal of an asset or equipment.

Other Expenses in Income Statement

It is the unusual exp. that is not incurred due to the company’s normal activities and hence is not directly related to the company’s regular operations. This exp. can be incurred due to the occurrence of any unusual activities of the company like unexpected disposal of any asset or equipment or interest paid by the company. However, they form part of the income statement of the company and are used for the calculation of the net income. Hence, there is a direct effect in the company’s income statement where such costs are to be subtracted from the net operating profit of the company to arrive at or calculate the net profit before income tax.

Other Expenses in Balance Sheet

Other Expenses directly forms part of the income statement but they do not appear directly on the balance sheet of the company. Rather, they appear indirectly on the company’s balance sheet. The amount leads to the decline in the retained earnings account of the balance sheet where the retained earnings account comes under the equity section of the company’s balance sheet. This is so because the net income amount in the equity account gets reduced by the other expense and thereby affecting the balance of the equity account in total.

Along with affecting the equity section, it also leads to a decline in the balance of either the asset side of the company or will increase the balance of the liability side of the company. With respect to the asset side, mainly there is an effect on the current asset heads like cash or bank account of the company as cash or bank gets reduced due to the incurring or there can be a decline in inventory if the same is written off. With respect to the liability side, it will mainly increase accrues expenses or accounts payable head of current liabilities.

Benefits

- There are many exp. which are incurred by the company and do not form part of any specific head of the company. So, it gives the company the way to allocate all those exp, which the company cannot classify in the normal other heads of the accounts.

- The net profit before taxes gets reduced by the amount of operating exp. incurred by the company. Hence the company will be liable to pay less tax as the amount of net income before taxes get reduced. Hence, just like all companies, it also gives tax benefits.

Importance

- It gives the opportunity to a company to allocate all those costs, which it cannot allocate to the normal heads of exp. Hence it gives clarity to the company in terms of proper classification of the expenses

- Also, the exp. like loss from disposal of the assets cannot be allocated to either direct manufacturing, administrative, or selling exp. of the company. They even cannot be reduced from the value of the assets of the company hence the company has a special head of exp. to give the place of allocation to such kinds of assets.

- Also, there are specific guidelines for the disclosure of this exp. in the financial statements. Hence, there is a proper presentation of the exp. in the financial statements of the company.

Conclusion

The classification of income and exp. are one of the important activities of the company. Hence every company should take the utmost care in the classification of expenses and incomes. As mentioned above, it should be studied thoroughly as to whether they can form part of the existing heads of expenses, and if not, then they should be classified under the head of Other Expenses. There are various requirements are mentioned in the guidelines regarding disclosure and presentation. All those guidelines should be thoroughly followed by the company in the preparation and presentation of its financial statements. Also, the proper classification of the expenses helps the company in getting the proper benefits in terms of savings to the company along with tax benefits. Hence further cost of the company is as much as important as normal business expenses of the company.

Recommended Articles

This is a guide to Other Expenses. Here we discuss the definition and list of expenses along with benefits and importance. You may also have a look at the following articles to learn more –